2019–20 Departmental Plan

Office of the Auditor General of Canada2019–20 Departmental Plan

ISSN 2371-7661

Table of Contents

- Message from the Office of the Auditor General of Canada

- Message from Auditor General Michael Ferguson (deceased February 2019)

- Planned results: What we want to achieve this year and beyond

- Spending and human resources

- Supplementary information

- Appendix A: Strategic framework of the Office of the Auditor General of Canada

- Appendix B: Performance measurement framework of the Office of the Auditor General of Canada

- Appendix C: Definitions

Errata

Subsequent to the tabling in Parliament of the Office of the Auditor General of Canada’s 2019–20 Departmental Plan, it was determined that some elements of the document of record required further clarification. Corrections have been made to both the Portable Document FormatPDF and HyperText Mark-up LanguageHTML versions of the document posted online to ensure complete and transparent information. Corrections include:

Section: Message from the Office of the Auditor General of Canada

A lead sentence has been added to the fourth paragraph to inform the reader of the passing of Auditor General Michael Ferguson prior to the tabling of the 2019–20 Departmental Plan.

Section: Message from the Auditor General

The title of this section has been amended to provide further context to the reader relating to the passing of Michael Ferguson: “Message from Auditor General Michael Ferguson (deceased February 2019).”

The coat-of-arms signature preceding the message has been removed to comply with the Government of Canada Federal Identity Program requirements.

Message from the Office of the Auditor General of Canada

We are pleased to present the Office of the Auditor General of Canada’s 2019–20 Departmental Plan, which describes the Office’s mandate, priorities, plans, and expected results.

As the legislative auditor of the federal government and Canada’s three territories, we provide Parliament and the northern legislatures with independent and objective assurance, advice, and information on government expenditures and the management of government programs.

Our mission is to contribute to a well-managed and accountable government for Canadians. Our vision is to be widely respected for the quality and impact of our work. Our strategic objectives ensure that we stay focused on that mission and vision, provide a framework for measuring our performance, and help us identify our priorities for the coming fiscal year.

As you may be aware, Michael Ferguson passed away in February 2019. Mike’s primary focus was to maximize the value that the Office delivers for parliamentarians, the federal government, and all Canadians. In his final message to Office staff he challenged us to focus on adding value in all that we do.

This past year has been a particularly difficult one for the Office culminating in the loss of our highly respected leader. We thank all of our employees for their hard work, dedication, and commitment to Mike’s vision and legacy. As we plan for the 2019–20 fiscal year and beyond, we look forward to providing the most value we can for Parliament and all Canadians.

[Original signed by]

Sylvain Ricard, Chartered Professional AccountantCPA, Chartered AccountantCA

Deputy Auditor General

[Original signed by]

Andrew Hayes

Deputy Auditor General

4 March 2019

Message from Auditor General Michael Ferguson (deceased February 2019)

When I arrived at the Office, my goal became to leave it in an even better place than I had found it. From day one, my priority has been to empower each and every one of you to do your best work, to take decisions, to understand and appreciate your value and contribution, and to derive a sense of accomplishment from the work we do.

I could never have hoped for a greater degree of engagement and commitment. I am very proud of the work that we have accomplished to date, both with all the audits we have reported and the changes we have made to the way we run the Office.

Recently, I started sharing with some of you my thoughts on how we add value for Canadians, because ultimately, we are here for them.

As I see it, the Office of the Auditor General of Canada (OAG) adds value at three levels―transactional, business, and organizational―with each of these building on the previous.

At the transactional level, I’m talking about the things we must do on an ongoing basis to meet minimum expectations, whether that is complying with legislation and government policies or meeting ethical or product quality standards. For example, in conducting our audits, we comply with professional standards to produce a quality audit report as efficiently as we can. Or in providing internal services such as compensation, we ensure that our employees are paid correctly and on time, in accordance with the terms of their employment contract, while protecting their personal information. These transactional things are necessary and add value. But for us at the OAG, transactional value is just the beginning.

Having checked the box of minimum expectations, we then work to add what I call business value. Value at this second level strives for such things as simplifying processes, increasing transparency and accessibility, and reducing risk. In all of our audits, it can include providing recommendations to management to help them improve the way they run their business or how they manage risk, or being responsive to entities’ needs for technical support and professional advice. Internally, in Human Resources Services for example, business value can include being available to provide employees with easy-to-apply advice when they need it. This middle level builds into the third―organizational value. This is the one that I consider to be the most inspirational.

Organizational value brings in what I would call individual and corporate values. The Office adds its highest value in areas such as personal growth and development, network building, reputational assurance, and social responsibility. In our performance audits, we ask “What is the end result that our audits are trying to influence?”, and we focus our work to help departments achieve this result. Internally, in people management, organizational value could involve supporting our employees’ need for personal and professional development by offering training and other opportunities for growth.

As the Office moves forward, we need to continuously challenge ourselves to add value at every level, every day. Particularly when resources are limited, we need to be striving to align our effort with the value that we add. We need to strive to deliver core audits and internal services as efficiently as possible, so that we can apply resources to adding business and organizational value for the legislative assemblies we report to and the citizens they serve, for the entities we audit, and for our own people. This is my challenge to all of you.

I want to leave you with one word: continuity. The core value elements I’ve set out above are the foundation that will ensure that the Office remains the successful and relevant organization it is today. It also means continuing to collaborate and work together. You can contribute to our work and our workplace with your ideas―do it today, and do it every day. I urge you to go beyond seeing the opportunities and act on them to make change happen―each and every one of you has been given the authority to step up, speak up, and take action. It is not about complicated processes, and it does not require complicated things to be done.

I have asked the Privy Council Office to begin the search for an interim Auditor General. I have appointed two deputy auditors general and six new assistant auditors general. Under their leadership, I wish you all great success in adding the most value you can for Parliament and for all Canadians. It has been an honour and a pleasure working with all of you.

Planned results: What we want to achieve this year and beyond

Through legislative auditing, the ultimate (or end) result that the Office seeks to influence is well-managed and accountable government for Canadians.

Our core responsibility: Legislative auditing

Description

Our audit reports provide objective, fact-based information and expert advice on government programs and activities. With our audits, we assist Parliament in its work on the authorization and oversight of government spending and operations. Our audits are also used by territorial legislatures, boards of Crown corporations, and audit committees to help oversee the management of government activities and hold them to account for the handling of public funds. Financial audits assess whether the annual financial statements of the Government of Canada, Crown corporations, and others are presented fairly, consistent with applicable accounting standards. Performance audits assess whether government organizations manage with due regard for economy, efficiency, and environmental impact, and measure their effectiveness. Special examinations assess whether Crown corporation systems and practices provide reasonable assurance that assets are safeguarded, resources are managed economically and efficiently, and operations are managed effectively.

Operating context

The operating context of the Office of the Auditor General of Canada is most affected by developments in the auditing and accounting professions, and by changes in government operations and technology.

Public Sector Accounting Standards and International Financial Reporting Standards are becoming increasingly complex in their application and require more time and effort to examine. However, in the 2019–20 fiscal year, we expect no significant changes to accounting and auditing standards that will affect our operations.

The size and nature of government continue to increase the volume and complexity of government transactions and the number of audits we are required to conduct each year. For example, in 2018, we were given a mandate to audit the new Trans Mountain Corporation. This new mandate does not provide funding for the Office to conduct this work. These and other changes in our operating context continue to put pressure on the Office’s resources and ability to deliver products of quality in a timely way.

Information technology is changing rapidly, affecting how the organizations we audit collect and use data. We are already seeing these effects in information technologyIT security, the use and storage of large amounts of data, and the use of artificial intelligence. Our approach to auditing must also evolve to adapt to these new technologies.

Planning highlights

In light of our operating context, the Office of the Auditor General of Canada continues to identify the following three strategic objectives as priority areas for the 2019–20 fiscal year:

- Be a financially well-managed organization accountable for the use of resources entrusted to it.

- Ensure effective, efficient, and accountable Office governance and management.

- Develop and maintain a skilled, engaged, and bilingual workforce.

Our finances

The Office continues to face a capacity shortage in many areas, including audit operations and support services. In fall 2018, we received about one third of the approximately $21 million we requested last year. We have allocated these funds to the highest-priority areas in the Office and have made a further submission to the Minister of Finance for the 2019 budget, to address our needs.

Our governance and management

We have been working to implement the plan we developed last year to reduce our IT security risk and the roadmap we prepared to maintain and update our IT systems generally.

In 2019–20, we will complete the replacement of our human resource management systems, begin to replace our audit management software, and finalize a detailed IT maintenance and operations plan. However, some IT systems that will be at the end of their supported lives in 2019–20 will not be replaced until 2021–22, and our IT security risk will not be reduced to an acceptable level until at least 2021. We will also not be able to invest in new technologies or audit approaches that are necessary to prepare the Office for the future.

Our people

Throughout the Office, employees are dealing with a lack of resources to deliver essential services or required products on time. To better match work plans with available resources, we reviewed our performance audit plans and eliminated five audits that had been planned for reporting in 2019–20. In our financial audit practice, we will continue to defer certain audit-related work that we should be addressing within the next fiscal year or two, and we will not fully resource two new mandates, because they are coming on stream more slowly than expected. In our support services, we will defer a number of projects.

Planned results

The Office has statutory responsibilities for the audit of the consolidated financial statements of the Government of Canada and each of the three territorial governments, and the financial statements of federal Crown corporations, territorial corporations, and other entities. These other entities include the United Nations Educational, Scientific and Cultural Organization (UNESCO), for which the Office has been appointed auditor from 2018 to 2023. In the 2019–20 fiscal year, we will conduct more than 89 financial audits and related assurance engagements.

We plan to report the findings of 19 federal and territorial performance audits in the 2019–20 fiscal year, including performance audits conducted by the Commissioner of the Environment and Sustainable Development. A list of these performance audits appears in the “Supplementary information” section of this report.

Over a 10-year period, the Office performs special examinations of more than 40 federal Crown corporations. In the 2019–20 fiscal year, we plan to complete examinations of 4 federal Crown corporations: Telefilm Canada, the Canadian Deposit Insurance Corporation, the National Gallery of Canada, and the National Arts Centre.

In accordance with Treasury Board’s Policy on Results, we report our results using a Departmental Results Framework. Exhibit 1 presents the Office’s departmental result, result indicators, targets, and actual results for the 2015–16, 2016–17, and 2017–18 fiscal years.

We have plans in place for 2019–20 for the indicators for which our targets were not met—namely, financial audit reports without qualifications or “other matters,” and special examination reports with no significant deficiencies.

We have been working with the two territorial corporations whose financial statements led to the financial statement qualifications target not being met. In the case of the Nunavut Housing Corporation, we are pleased to note that a clean audit opinion was issued for the 31 March 2018 year-end financial statements. Progress at addressing our concerns at the Qulliq Energy Corporation remains slower, and we plan to continue our work with the corporation in the 2019–20 fiscal year.

We have reported several significant deficiencies in our special examinations of Crown corporations in recent years. In 2018, we issued our first commentary report on these audits to draw Parliament’s attention to problems common to several corporations. We have issued recommendations to help the corporations address the deficiencies, and in 2019–20, we will explore initiatives on how to provide further support and encouragement to Crown corporations to put in place management practices that address these issues.

We monitor and report on our operations using a framework that is built around 11 strategic objectives that guide our audit work and the administration of the Office (see Appendix A). Our performance measurement framework, presented in Appendix B, establishes our indicators and targets for each of these objectives.

Once every 10 years, we request an international peer review of the design and implementation of the Office’s System of Quality Control. These reviews provide the Auditor General with opinions on whether our audits are conducted in accordance with professional standards and on whether our System of Quality Control is appropriately designed and effectively implemented. We expect to receive the report from our most recent peer review in fall 2019.

Exhibit 1—Planned and actual results

Departmental result: Well-managed and accountable government

| Departmental result indicators | Target | Date to achieve target | 2015–16 Actual results |

2016–17 Actual results |

2017–18 Actual results |

|---|---|---|---|---|---|

|

Percentage of audit reports on financial statements without qualifications or “other matters” raised. |

100% |

Ongoing |

Target not met |

Target not met |

Target not met |

|

Percentage of special examination reports with no significant deficiencies. |

100% |

Ongoing |

Target not met |

Target not met |

Target not met |

|

Percentage of performance audit reports to Parliament that are reviewed by parliamentary committees. |

At least 65% |

Ongoing |

Target not met |

Target met |

Target met |

|

Percentage of audit recommendations or opinions addressed by entities: For financial audits, percentage of qualifications and “other matters” addressed from one financial audit report to the next. |

100% |

Ongoing |

Target not met |

Target not met |

Target not met |

|

Percentage of audit recommendations or opinions addressed by entities: For performance audits, percentage of recommendations examined in our performance audit follow-up audits for which progress is assessed as satisfactory. |

At least 75% |

Ongoing |

No follow-up conducted |

Target not met |

No follow-up conducted |

|

Percentage of audit recommendations or opinions addressed by entities: For special examinations, percentage of significant deficiencies reported in our special examination reports that are addressed from one examination to the next. |

100% |

Ongoing |

Target met |

Target not metnote 4 |

Target met |

|

Percentage of audits that meet statutory deadlines, where applicable, or our planned reporting dates: |

|||||

|

100% |

Ongoing |

Target not met |

Target not met (95%)note 5 |

Target not met (98%)note 6 |

|

At least 80% |

Ongoing |

Target met |

Target met |

Target met |

Financial, human resources, and performance information for the Office of the Auditor General of Canada’s Program Inventory is available in the GC InfoBase.

Spending and human resources

Planned spending

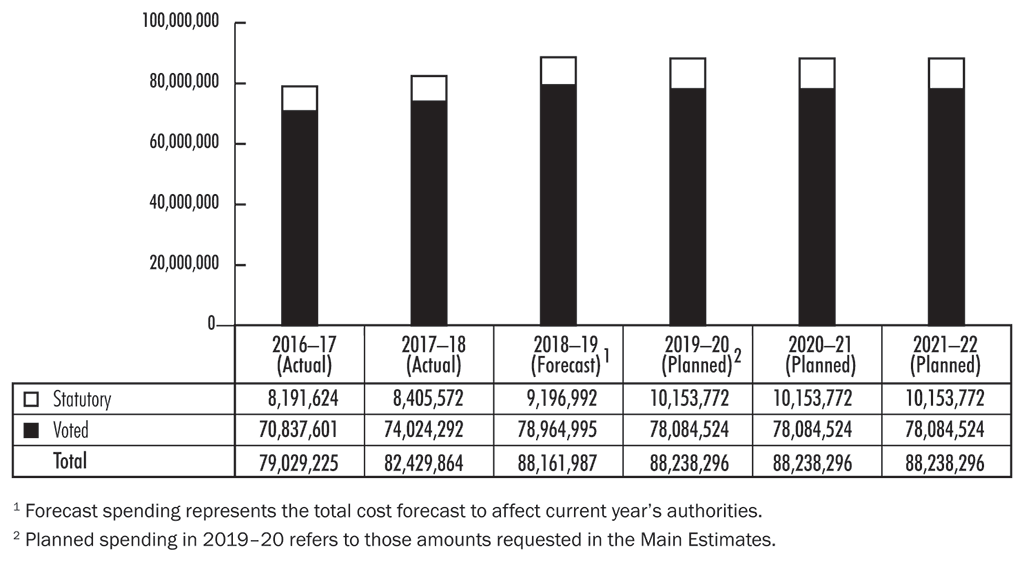

Exhibit 2 shows the Office’s spending trend for the 2016–17 to 2021–22 fiscal years. Planned spending in the 2019–20 through 2021–22 fiscal years does not include any additional funding requested in the Office’s funding proposal submitted to the Minister of Finance for the 2019 federal budget.

Exhibit 2—Departmental spending trend (in dollars)

Exhibit 2—text version

| 2016–17 (Actual) |

2017–18 (Actual) |

2018–19 (Forecast)note 1 |

2019–20 (Planned)note 2 |

2020–21 (Planned) |

2021–22 (Planned) |

|

|---|---|---|---|---|---|---|

| Statutory | 8,191,624 | 8,405,572 | 9,196,992 | 10,153,772 | 10,153,772 | 10,153,772 |

| Voted | 70,837,601 | 74,024,292 | 78,964,995 | 78,084,524 | 78,084,524 | 78,084,524 |

| Total | 79,029,225 | 82,429,864 | 88,161,987 | 88,238,296 | 88,238,296 | 88,238,296 |

Planned human resources

Exhibit 3 provides the Office’s human resources planning summary for the 2019–20 to 2021–22 fiscal years.

Exhibit 3—Human resources planning summary (full-time equivalents)

| Actual 2016–17 |

Actual 2017–18 |

Forecast 2018–19 |

Planned full-time equivalents | ||

|---|---|---|---|---|---|

| 2019–20 | 2020–21 | 2021–22 | |||

| 555 | 568 | 560 | 580 | 595 | 595 |

Estimates by vote

Information on the Office of the Auditor General of Canada’s organizational appropriations is available in the 2019–20 Main Estimates.

Future-oriented statement of operations

Exhibit 4 presents the future-oriented statement of operations of the Office. The forecast of financial information on expenses and revenues is prepared on an accrual accounting basis, to strengthen accountability and to improve transparency and financial management. The forecast and planned spending amounts presented in other sections of the Departmental Plan are prepared on an expenditure basis and, as a result, differ from the forecast and planned results presented below.

Exhibit 4—Future-oriented statement of operations for the year ending 31 March 2020 (in thousands of dollars)

| Financial information | 2018–19 Forecast results |

2019–20 Planned results |

|---|---|---|

| Financial audits of Crown corporations, territorial governments, and other organizations, and of the summary financial statements of the Government of Canada | 53,500 | 52,400 |

| Performance audits and studies | 29,600 | 32,700 |

| Special examinations of Crown corporations | 5,400 | 4,300 |

| Sustainable development monitoring activities and environmental petitions | 1,900 | 2,000 |

| Professional practices | 10,700 | 11,200 |

| Total cost of operations | 101,100 | 102,600 |

| Total revenues | (1,000) | (1,600) |

| Net cost of operations before government funding and transfers | 100,100 | 101,000 |

Note to the future-oriented statement of operations—Parliamentary authorities

The Office is financed by the Government of Canada through parliamentary authorities. Financial reporting of authorities provided to the Office differs from financial reporting according to generally accepted accounting principles because authorities are based mainly on cash flow requirements. Items recognized in the future-oriented statement of operations in one year may be funded through parliamentary authorities in prior, current, or future years. Accordingly, the Office has a different net cost of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in Exhibit 5.

Exhibit 5—Reconciliation of net costs of operations to authorities forecast (in thousands of dollars)

| 2018–19 Forecast results |

2019–20 Planned results |

|

|---|---|---|

| Net cost of operations before government funding and transfers | 100,100 | 101,000 |

| Adjustments for items recorded as part of net cost of operations but not funded from current year authorities: | ||

|

Services provided without charge by other government departments

|

(12,648) | (13,332) |

|

Amortization of tangible capital assets

|

(490) | (480) |

|

Total items recorded as part of net cost of operations but not funded from current year authorities

|

(13,138) | (13,812) |

| Adjustments for items not affecting net cost of operations but affecting authorities: | ||

|

Acquisition of capital assets

|

800 | 2,750 |

|

Decrease in liabilities not previously charged to authorities

|

400 | 350 |

|

Total items not affecting net cost of operations but affecting authorities

|

1,200 | 3,100 |

| Forecast spending (authorities forecast to be used) | 88,162 | 90,288 |

| Add: Forecast lapse (authorities forecast to be lapsed) | 2,500 | 3,000 |

| Authorities forecast (authorities forecast to be requested) | 90,662 | 93,288 |

| Main Estimates | ||

|

Vote 1: Program expenditures

|

69,028 | 78,084 |

|

Statutory amounts: Contributions to employee benefit plans

|

9,197 | 10,154 |

|

Total Main Estimates

|

78,225 | 88,238 |

| Supplemental operating authorities | 10,666 | 1,550 |

| Authorities carried forward from previous yearnote 1 | 1,771 | 3,500 |

| Authorities forecast (authorities forecast to be requested) | 90,662 | 93,288 |

Supplementary information

Corporate information

Organizational profile

Auditor General of Canada: Vacant

Main legislative authorities:

Auditor General Act, Revised Statutes of CanadaR.S.C. 1985, c. A-17

Financial Administration Act, R.S.C. 1985, c. F-11

Year established: 1878

Minister: The Honourable William F. Morneau, Privy CouncillorP.C., Member of ParliamentM.P., Minister of Financefootnote *

Raison d’être, mandate, and role

“Raison d’être, mandate and role: who we are and what we do” is available on the Office of the Auditor General of Canada’s website.

Reporting framework

The Office of the Auditor General of Canada’s Departmental Results Framework and Program Inventory of record for the 2019–20 fiscal year are shown in Exhibit 6.

Exhibit 6—Departmental Results Framework and Program Inventory

Core responsibility: Legislative auditing

|

Description Our audit reports provide objective, fact-based information and expert advice on government programs and activities. With our audits, we assist Parliament in its work on the authorization and oversight of government spending and operations. Our audits are also used by territorial legislatures, boards of Crown corporations, and audit committees to help oversee the management of government activities and hold them to account for the handling of public funds. Financial audits assess whether the annual financial statements of the Government of Canada, Crown corporations, and others are presented fairly, consistent with applicable accounting standards. Performance audits assess whether government organizations manage with due regard for economy, efficiency, and environmental impact, and measure their effectiveness. Special examinations assess whether Crown corporation systems and practices provide reasonable assurance that assets are safeguarded, resources are managed economically and efficiently, and operations are managed effectively. |

Result and indicators |

|

Well-managed and accountable government:

|

|

|

Program Inventory |

|

|

Supporting information on the Program Inventory

Supporting information on planned expenditures, human resources, and results related to the Office of the Auditor General of Canada’s Program Inventory is available in the GC InfoBase.

Supplementary information tables

The following supplementary information is available on the Office of the Auditor General of Canada’s website:

Planned reports for 2019–20

Reports to Parliament

Spring 2019: Reports of the Commissioner of the Environment and Sustainable Development

- Aquatic Invasive Species

- Protecting Fish From Mining Effluent

- Tax Subsidies for Fossil Fuels—Department of Finance Canada

- Non-Tax Subsidies for Fossil Fuels—Environment and Climate Change Canada

Spring 2019: Reports of the Auditor General of Canada

- Call Centres

- Equipping Royal Canadian Mounted PoliceRCMP Officers—Royal Canadian Mounted Police

- Taxation of E-Commerce

- In-Canada Asylum Seekers

- Oversight of Government of Canada Advertising

Fall 2019: Reports of the Commissioner of the Environment and Sustainable Development

- Review of the Federal Sustainable Development Strategy

- Departmental Progress in Implementing Sustainable Development Strategies

- Environmental Petitions Annual Report

Fall 2019: Reports of the Auditor General of Canada

- Maintaining a Healthy Federal Public Service

- Inventory Management

- Update on Results Measures

Spring 2020: Reports of the Auditor General of Canada

- Immigration Detention and Removal

- Student Financial Assistance

- Federal Support for Victims of Crime

Reports to northern legislative assemblies

Spring 2019: Reports of the Auditor General of Canada

- Kindergarten Through Grade 12 Education in Yukon

- Support for Inuit Employment—Nunavut

Fall 2019: Reports of the Auditor General of Canada

- Kindergarten to Grade 12 Education—Northwest Territoriesfootnote 1

Organizational contact information

Office of the Auditor General of Canada

240 Sparks Street

Ottawa, Ontario K1A 0G6

CANADA

Telephone: 613-995-3708 or 1-888-761-5953

Fax: 613-957-0474

Hearing impaired only telecommunications device for the deafTTY: 613-954-8042

Email: communications@oag-bvg.gc.ca

Website: www.oag-bvg.gc.ca

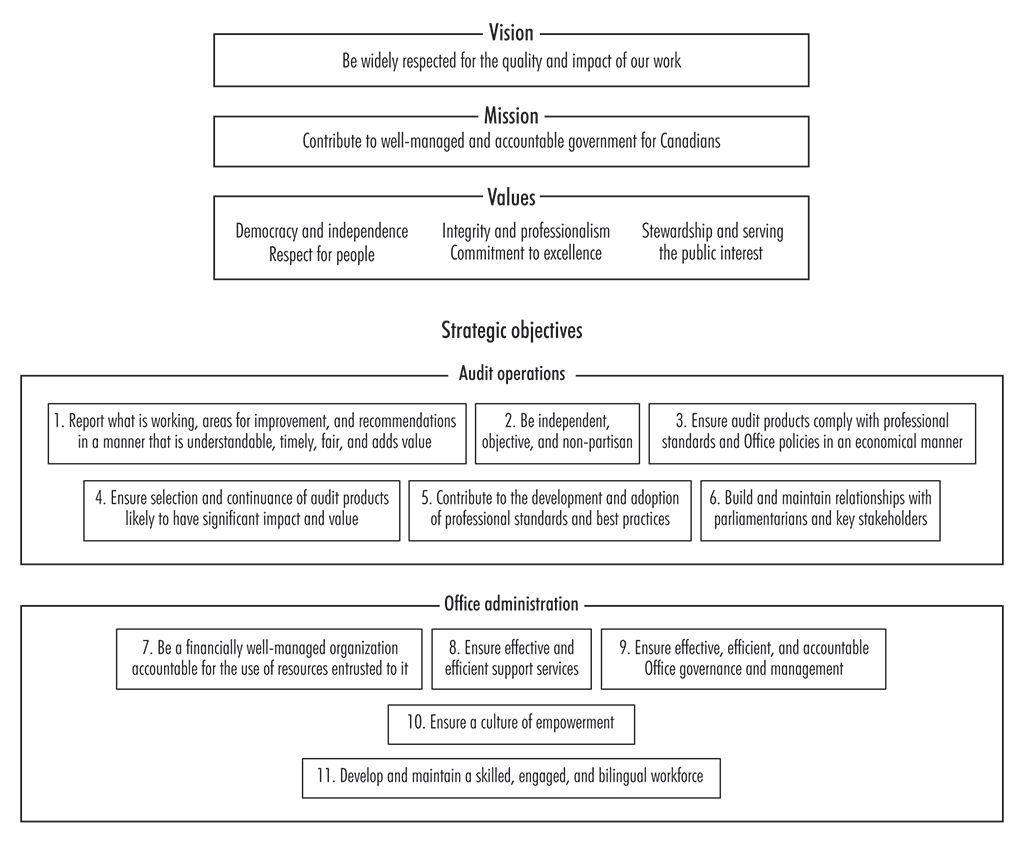

Appendix A: Strategic framework of the Office of the Auditor General of Canada

The Office of the Auditor General of Canada’s strategic framework identifies a number of client, operational, and people management objectives to help direct our work (Exhibit 7). We use this framework, together with our annual risk assessment, to establish our planning priorities and expected results.

Exhibit 7—Strategic framework of the Office of the Auditor General of Canada

Exhibit 7—text version

Vision

Be widely respected for the quality and impact of our work

Mission

Contribute to well-managed and accountable government for Canadians

Values

- Democracy and independence

- Respect for people

- Integrity and professionalism

- Commitment to excellence

- Stewardship and serving the public interest

Strategic Objectives

Audit operations

- Report what is working, areas for improvement, and recommendations in a manner that is understandable, timely, fair, and adds value

- Be independent, objective, and non-partisan

- Ensure audit products comply with professional standards and Office policies in an economical manner

- Ensure selection and continuance of audit products likely to have significant impact and value

- Contribute to the development and adoption of professional standards and best practices

- Build and maintain relationships with parliamentarians and key stakeholders

Office administration

- Be a financially well-managed organization accountable for the use of resources entrusted to it

- Ensure effective and efficient support services

- Ensure effective, efficient, and accountable Office governance and management

- Ensure a culture of empowerment

- Develop and maintain a skilled, engaged, and bilingual workforce

Appendix B: Performance measurement framework of the Office of the Auditor General of Canada

Exhibit 8—Audit operations

| Strategic objective | Performance indicators | 2019–20 Target |

2015–16 Actual results |

2016–17 Actual results |

2017–18 Actual results |

|---|---|---|---|---|---|

|

1. Report what is working, areas for improvement, and recommendations in a manner that is understandable, timely, fair, and adds value. |

Percentage of audit reports on financial statements without qualifications or “other matters” raised |

100% |

Target not met |

Target not met |

Target not met |

|

Percentage of special examination reports with no significant deficiencies |

100% |

Target not met |

Target not met |

Target not met |

|

|

Percentage of performance audit reports to Parliament that are reviewed by parliamentary committees |

At least 65% |

Target not met |

Target met |

Target met |

|

|

Percentage of audit recommendations or opinions addressed by entities: |

|||||

|

100% |

Target not met |

Target not met |

Target not met |

|

|

At least 75% |

No follow-up conducted |

Target not met |

No follow-up conducted |

|

|

100% |

Target met |

Target not metnote 4 |

Target met |

|

|

Percentage of users who find that our audits are understandable, timely, fair, and add value |

At least 90% |

Target met |

Target not met |

Target met |

|

|

Percentage of senior managers in the organizations we audit who find that our audits are understandable, timely, fair, and add value |

At least 80% |

Target met |

Target not met |

Target not met |

|

|

Percentage of audits that meet statutory deadlines, where applicable, or our planned reporting dates: |

|||||

|

100% |

Target not met |

Target not met |

Target not met |

|

|

At least 80% |

Target met |

Target met |

Target met |

|

|

2. Be independent, objective, and non-partisan. |

Number of founded complaints and allegations regarding failure to comply with professional standards, legal and regulatory requirements, or the Office’s System of Quality Control |

Zero |

Target met |

Target met |

Target met |

|

Percentage compliance with professional standards and Office policies for independence |

100% |

Target met |

Target met |

Target met |

|

|

Percentage of clients who find that we are independent, objective, and non-partisan |

At least 90% |

Target met |

Target met |

Target met |

|

|

Percentage of senior managers in the organizations we audit who find that we are independent, objective, and non-partisan |

At least 80% |

Target met |

Target met |

Target met |

|

|

3. Ensure audit products comply with professional standards and Office policies in an economical manner. |

Percentage of internal and external reviews that find engagement leaders complied with professional standards |

100% |

Target met |

Target met |

Target met |

|

Percentage of internal practice reviews that find the opinions and conclusions expressed in our audit reports to be appropriate and supported by the evidence |

100% |

Target met |

Target met |

Target met |

|

|

Percentage of external reviews that find our System of Quality Control to be suitably designed and operating effectively |

100% |

No datanote 7 |

No datanote 7 |

No datanote 7 |

|

|

Percentage of audits that are completed on budget |

At least 80% |

Target not met |

Target met |

Target not met |

|

|

4. Ensure selection and continuance of audit products likely to have significant impact and value. |

This strategic objective is about the long-term development of the Office’s mandate and products. Although there is no performance indicator that we measure and monitor annually, we review developments in the federal government and in the accounting and auditing professions to determine whether we need to make changes to our product and service offerings. In the 2017–18 fiscal year, we began to better integrate measures of end results into our performance audits and to prepare a follow-up report to Parliament on what progress federal organizations had made to improve end results in areas that we have audited. Through this new report, we expect to better communicate the results that the government delivers to Canadians in areas that we have audited. |

||||

|

5. Contribute to the development and adoption of professional standards and best practices. |

Percentage of commitments met to contribute to domestic and international professional standards bodies |

100% |

Target met |

Target met |

Target met |

|

6. Build and maintain relationships with parliamentarians and key stakeholders. |

Percentage of clients who find that auditors met relationship expectations |

At least 90% |

Target met |

Target met |

Target met |

|

Percentage of senior managers in the organizations we audit who find that auditors met relationship expectations |

At least 80% |

Target met |

Target met |

Target met |

|

Exhibit 9—Office administration

| Strategic objective | Performance indicators | 2019–20 Target |

2015–16 Actual results |

2016–17 Actual results |

2017–18 Actual results |

|---|---|---|---|---|---|

|

7. Be a financially well-managed organization accountable for the use of resources entrusted to it. |

Percentage compliance with financial management and reporting requirements |

100% |

Target not met |

Target not met |

Target not met |

|

8. Ensure effective and efficient support services. |

Percentage of internal service standards met (human resources, information technology, security, editorial services) |

100% |

Target not met |

Target not met |

Target not met |

|

Percentage of internal clients who find that support services are effective and efficient |

At least 85% |

Not available |

Not available |

Target not met |

|

|

9. Ensure effective, efficient, and accountable Office governance and management. |

Percentage of employees who find that the Office is well governed and managed |

At least 85% |

Target not met |

No data |

Target not met |

|

Audit Committee finds it is carrying out its oversight role effectively |

Annually |

Not applicablenote 4 |

Not applicablenote 4 |

Target met |

|

|

Adverse findings and decisions from courts, tribunals, or administrative decision makers |

None |

Not applicablenote 4 |

Not applicablenote 4 |

Target met |

|

|

Completion of the Office’s annual strategic priority projects |

All |

Not applicablenote 4 |

Target met |

Target not met |

|

|

10. Ensure a culture of empowerment. |

Percentage of employees who find that the Office ensures a culture of empowerment |

At least 80% |

Target met |

No data |

Target not met |

|

11. Develop and maintain a skilled, engaged, and bilingual workforce. |

Percentage of employees who complete mandatory training within the allotted time frame |

100% |

Not applicablenote 4 |

Target not met |

Target not met |

|

Percentage of employees who find that the Office develops and maintains an engaged workforce |

At least 85% |

Target met |

No data |

Target not met |

|

|

Percentage of employees who meet the language requirements of their positions: |

|||||

|

100% |

Target met |

Target met |

Target met |

|

|

100% |

Target not met |

Target not met |

Target not met |

|

|

100%note 5 |

Target not met |

Target met |

Target met |

|

|

Percentage of employees who find that the Office develops and maintains a bilingual workforce |

At least 90% |

Target not met |

No data |

Target met |

|

Appendix C: Definitions

appropriation (crédit): Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires): Operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

Core Responsibility (responsabilité essentielle): An enduring function or role performed by a department. The intentions of the department with respect to a Core Responsibility are reflected in one or more related Departmental Results that the department seeks to contribute to or influence.

Departmental Plan (plan ministériel): A report on the plans and expected performance of an appropriated department over a three-year period. Departmental Plans are tabled in Parliament each spring.

Departmental Result (résultat ministériel): Any change that the department seeks to influence. A Departmental Result is often outside departments’ immediate control, but it should be influenced by Program-level outcomes.

Departmental Result Indicator (indicateur de résultat ministériel): A factor or variable that provides a valid and reliable means to measure or describe progress on a Departmental Result.

Departmental Results Framework (cadre ministériel des résultats): The department’s Core Responsibilities, Departmental Results and Departmental Result Indicators.

Departmental Results Report (rapport sur les résultats ministériels): A report on the actual accomplishments against the plans, priorities and expected results set out in the corresponding Departmental Plan.

evaluation (évaluation): In the Government of Canada, the systematic and neutral collection and analysis of evidence to judge merit, worth or value. Evaluation informs decision making, improvements, innovation and accountability. Evaluations typically focus on programs, policies and priorities and examine questions related to relevance, effectiveness and efficiency. Depending on user needs, however, evaluations can also examine other units, themes and issues, including alternatives to existing interventions. Evaluations generally employ social science research methods.

experimentation (expérimentation): Activities that seek to explore, test and compare the effects and impacts of policies, interventions and approaches, to inform evidence-based decision-making, by learning what works and what does not.

financial audit (audit d’états financiers): Provides assurance that financial statements are presented fairly, in accordance with the applicable financial reporting framework.

full-time equivalent (équivalent temps plein): A measure of the extent to which an employee represents a full person-year charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

gender-based analysis plus (GBA+) (analyse comparative entre les sexes plus [ACS+]): An analytical process used to help identify the potential impacts of policies, Programs and services on diverse groups of women, men and gender-diverse people. The “plus” acknowledges that GBA goes beyond sex and gender differences. We all have multiple identity factors that intersect to make us who we are; GBA+ considers many other identity factors, such as race, ethnicity, religion, age, and mental or physical disability.

government-wide priorities (priorités pangouvernementales): For the purpose of the 2019–20 Departmental Plan, government-wide priorities refers to those high-level themes outlining the government’s agenda in the 2015 Speech from the Throne, namely: Growth for the Middle Class; Open and Transparent Government; A Clean Environment and a Strong Economy; Diversity is Canada’s Strength; and Security and Opportunity.

horizontal initiative (initiative horizontale): An initiative where two or more departments are given funding to pursue a shared outcome, often linked to a government priority.

non-budgetary expenditures (dépenses non budgétaires): Net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement): What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve, and how well lessons learned have been identified.

performance audit (audit de performance): An independent, objective, and systematic assessment of how well the government is managing its activities, responsibilities, and resources.

performance indicator (indicateur de rendement): A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, Program, policy or initiative respecting expected results.

Performance Information Profile (profil de l’information sur le rendement): The document that identifies the performance information for each Program from the Program Inventory.

performance reporting (production de rapports sur le rendement): The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

plan (plan): The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

planned spending (dépenses prévues): For Departmental Plans and Departmental Results Reports, planned spending refers to those amounts presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their Departmental Plans and Departmental Results Reports.

priority (priorité): A plan or project that an organization has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired Departmental Results.

Program (programme): Individual or groups of services, activities or combinations thereof that are managed together within the department and focus on a specific set of outputs, outcomes or service levels.

Program Inventory (répertoire des programmes): Identifies all of the department’s programs and describes how resources are organized to contribute to the department’s Core Responsibilities and Results.

results (résultat): An external consequence attributed, in part, to an organization, policy, Program or initiative. Results are not within the control of a single organization, policy, Program or initiative; instead they are within the area of the organization’s influence.

special examination (examen spécial): A form of performance audit that is conducted within Crown corporations. The scope of special examinations is set out in the Financial Administration Act. A special examination considers whether a Crown corporation’s systems and practices provide reasonable assurance that its assets are safeguarded and controlled, its resources are managed economically and efficiently, and its operations are carried out effectively.

statutory expenditures (dépenses législatives): Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

sunset program (programme temporisé): A time limited program that does not have an ongoing funding and policy authority. When the program is set to expire, a decision must be made whether to continue the program. In the case of a renewal, the decision specifies the scope, funding level and duration.

target (cible): A measurable performance or success level that an organization, Program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées): Expenditures that Parliament approves annually through an Appropriation Act. The Vote wording becomes the governing conditions under which these expenditures may be made.