Report 3—Taxation of E-Commerce

At a GlanceReport 3—Taxation of E-Commerce

What we examined (see Focus of the audit)

The retail landscape in Canada is changing. More people are making purchases online. The increase in e-commerce creates challenges for assessing and collecting the goods and services tax (GST) and the harmonized sales tax (HST). This is particularly true for physical products and digital products and services—such as music and videos—that consumers in Canada purchase from foreign vendors.

This audit focused on whether, according to their respective roles and responsibilities, the Canada Revenue Agency, the Canada Border Services Agency, and the Department of Finance Canada ensured that the sales tax system for e-commerce was neutral (treated all vendors equally with regard to the GST/HST) and that the GST/HST tax base (everything that is taxable) was protected.

Why we did this audit

This audit is important because e-commerce is expanding rapidly. The Canadian sales tax system must keep pace with e-commerce and adapt to the challenges and opportunities it presents. The tax base must be protected so governments can fund vital public services, such as social programs. The Government of Canada must ensure that everyone who should remit sales taxes does so and that the taxes are collected fairly and effectively.

Overall message

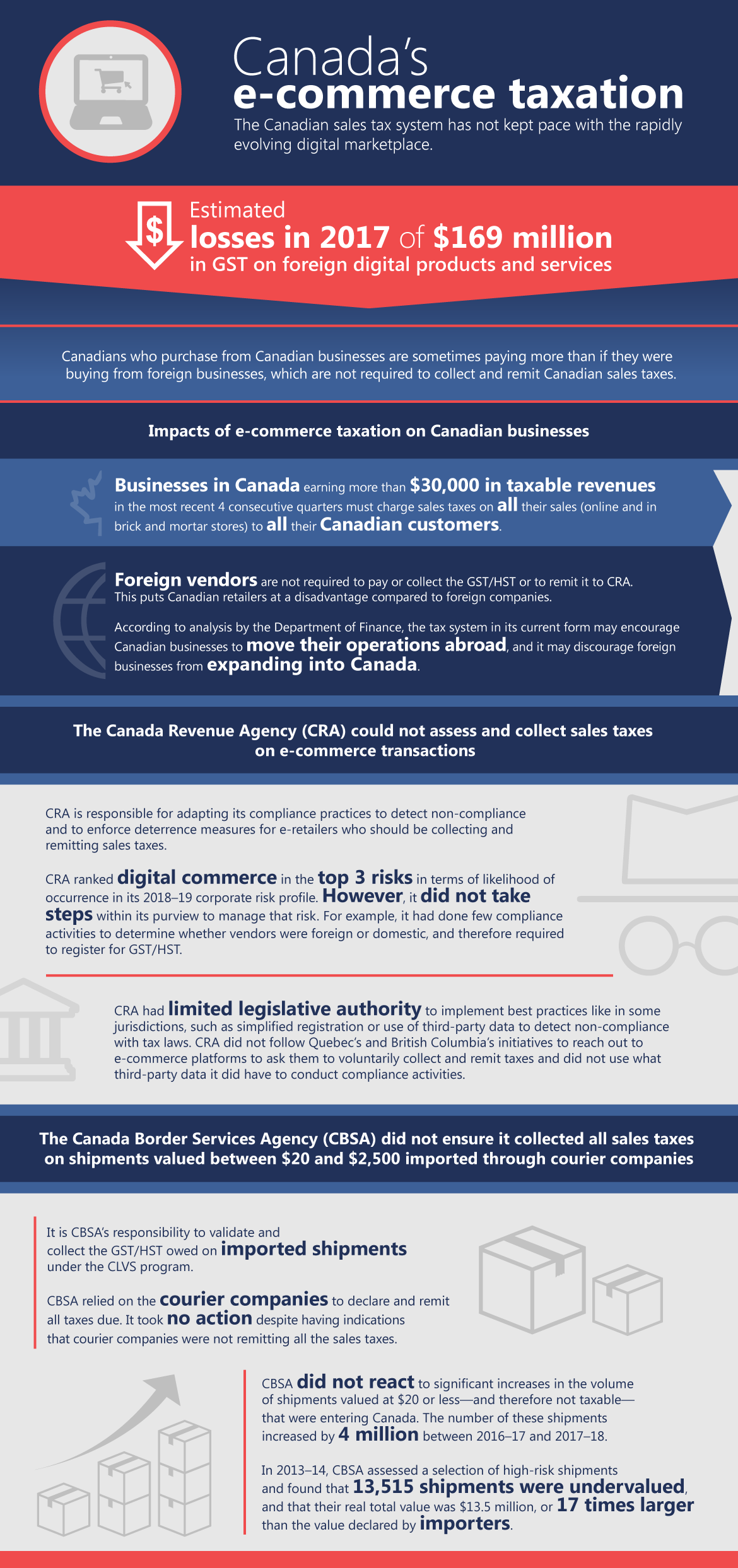

Overall, we found that the Canadian sales tax system did not keep pace with the rapidly evolving digital marketplace. On the basis of publicly available data, we estimated losses of $169 million in the GST on foreign digital products and services sold in Canada in 2017. In addition, the federal government could not assess and collect all sales taxes on e-commerce transactions.

We found that existing legislation, combined with the Canada Border Services Agency’s poor data management of low-value shipments imported into Canada by courier companies, placed Canadian businesses at an unfair disadvantage in relation to foreign vendors. According to the Department of Finance Canada, the situation could have encouraged domestic vendors to move their operations abroad and could have discouraged foreign investment in Canada.

The Canada Border Services Agency was aware that some courier companies were likely not remitting all sales taxes on low-value shipments into Canada. However, we found that the Agency did not step in, despite a significant increase in the volume of shipments declared as low value coming into the country.

In addition, we found that the Canada Revenue Agency undertook few activities to ensure that e-commerce vendors—including accommodation sharing vendors—registered for, collected, and remitted sales taxes when required. The Agency could not follow Quebec’s and British Columbia’s initiatives to reach out to prominent e-commerce platforms to ask them to voluntarily collect and remit the GST/HST on behalf of vendors on their platforms.

What we found about …

Canadian sales tax system

Compliance Activities

Entity Responses to Recommendations

The audited entities agree with our recommendations and have responded (see List of Recommendations).

Related information

| Report of the | Auditor General of Canada |

|---|---|

| Type of product | Performance audit |

| Topics | |

| Entities | |

| Completion date | 27 March 2019 |

| Tabling date | 7 May 2019 |

| Related audits |

|

For more information

Media Relations

Telephone: 1-888-761-5953

E-mail: infomedia@oag-bvg.gc.ca

Twitter: OAG_BVG