2016 Fall Reports of the Auditor General of Canada Report 2—Income Tax Objections—Canada Revenue Agency

2016 Fall Reports of the Auditor General of CanadaReport 2—Income Tax Objections—Canada Revenue Agency

Table of Contents

- Introduction

- Findings, Recommendations, and Responses

- Conclusion

- About the Audit

- List of Recommendations

- Appendix—Outcomes of objection decisions for the 2011–12 to 2015–16 fiscal years

- Exhibits:

- 2.1—Outstanding federal tax dollars in dispute (value at end of fiscal year)

- 2.2—The Agency’s inventory of outstanding income tax objections increased by 171 percent in the past 10 fiscal years

- 2.3—In the past five fiscal years, the Agency took months or years to resolve income tax objections

- 2.4—Almost two thirds of objections were allowed in full or in part

- 2.5—Most cases of overturned assessments resulted from additional information provided by the taxpayer

Introduction

Background

2.1 Canadian taxation is based on a system in which taxpayers prepare their own tax returns. This system is guided by fiscal laws, including the Income Tax Act. After taxpayers file their tax returns, the Canada Revenue Agency assesses the returns and may make changes to them. The Agency may also reassess them later for various reasons. For example, a reassessment may follow the Agency’s finding that employment income was not reported on the tax return, or a reassessment may result from a tax return audit. In addition, the Agency may issue determinations on such matters as a taxpayer’s eligibility for the disability tax credit. In this report, the term “assessment” may refer to an original assessment, a reassessment, or a determination, and the terms “tax return” and “taxpayer” may apply to an individual or a corporation.

2.2 Taxpayers who disagree with the Canada Revenue Agency’s assessment of their tax returns have multiple avenues to resolve their disputes. If they have additional or new information or would like further review of their assessments, they can contact the Agency by phone, in writing, or online. Taxpayers also have the right to file objections, which require impartial and timely review by the Agency.

2.3 The Canada Revenue Agency manages the objection process through its Appeals Branch. The Agency’s decisions on objections are based on impartial reviews of the particular facts and applicable laws. If taxpayers do not agree with the Agency’s decisions, they may appeal to the Tax Court of Canada, then to the Federal Court of Appeal, and finally, to the Supreme Court of Canada.

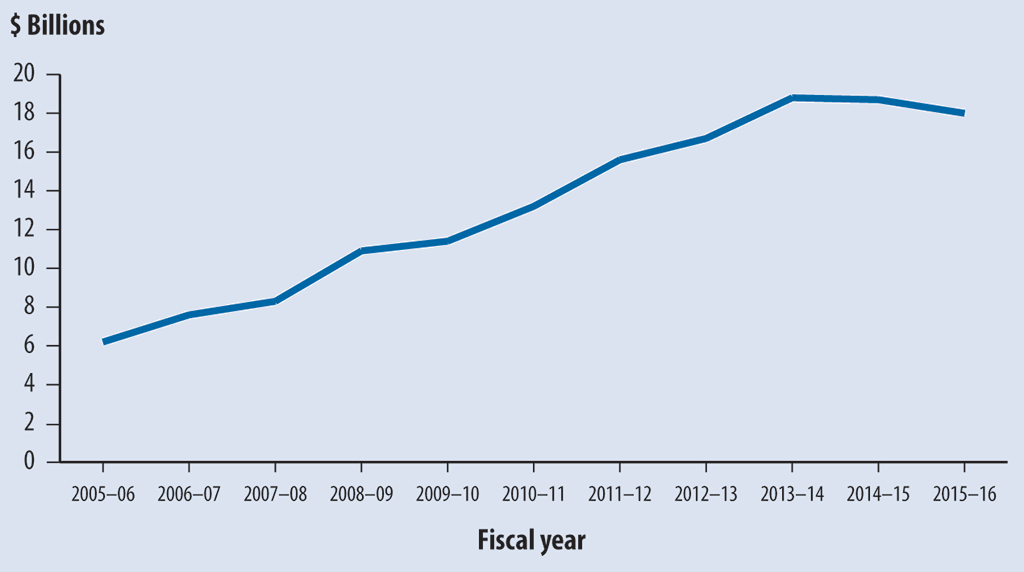

2.4 In the 2014 calendar year, the Agency processed roughly 29,640,000 income tax returns, with the related tax income totalling almost $235 billion. During that same calendar year, taxpayers filed 66,864 objections, for which the income tax amount in dispute totalled $4.8 billion. As of 31 March 2016, the Agency had an inventory of 171,744 objections outstanding for personal and corporate income taxes, which represented more than $18 billion of federal taxes (Exhibit 2.1).

Exhibit 2.1—Outstanding federal tax dollars in dispute (value at end of fiscal year)

Source: Based on the Canada Revenue Agency’s data for all income tax objections in the 10-year period ending 31 March 2016

Exhibit 2.1—text version

This is a graphic showing the amount of federal tax dollars in dispute at the end of each fiscal year between 2005–06 and 2015–16.

At the end of the 2005–06 fiscal year, the amount of federal tax dollars in dispute was approximately $6 billion. This amount increased in each of the following fiscal years, reaching over $18 billion in 2013–14. Between the 2013–14 and the 2015–16 fiscal years, the amount stayed around $18 billion.

| Fiscal year | Value at year end |

|---|---|

| 2005–06 | $6,200,336,869 |

| 2006–07 | $7,604,617,219 |

| 2007–08 | $8,372,618,840 |

| 2008–09 | $10,925,033,641 |

| 2009–10 | $11,454,128,900 |

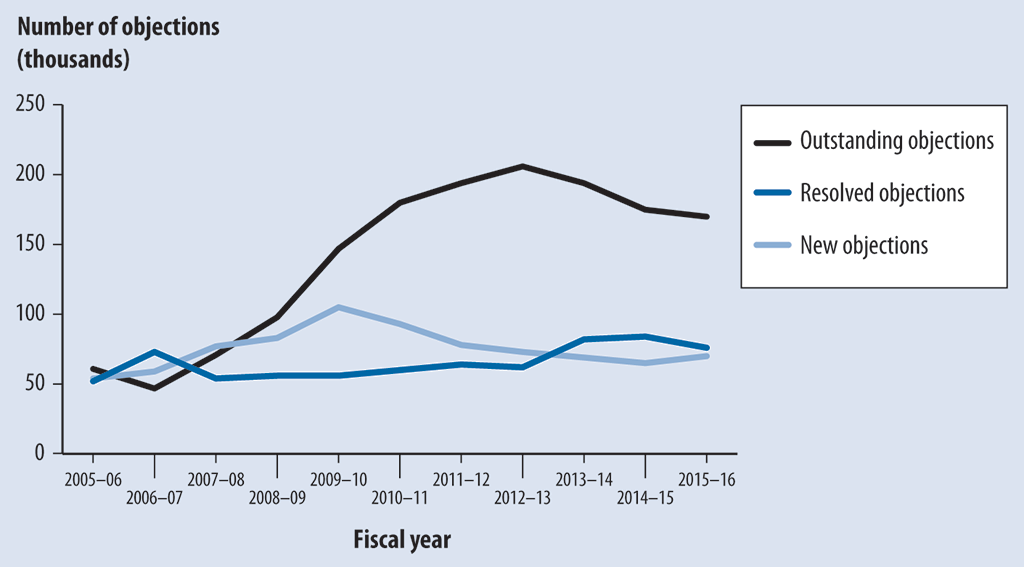

| 2010–11 | $13,226,363,386 |

| 2011–12 | $15,592,803,520 |

| 2012–13 | $16,705,490,870 |

| 2013–14 | $18,834,799,171 |

| 2014–15 | $18,672,892,524 |

| 2015–16 | $18,026,114,133 |

2.5 The Canada Revenue Agency is responsible for the application of laws and regulations related to income taxes. Its mandate is to administer tax, benefits, and related programs and to ensure that taxpayers comply with the Income Tax Act and related legislation on behalf of governments across Canada. The Agency has multiple branches, including the Appeals Branch, to help it fulfill its mandate.

2.6 Section 165(3) of the Income Tax Act states that on receiving an objection, “the Minister shall, with all due dispatch, reconsider the assessment and vacate, confirm or vary the assessment or reassess, and shall thereupon notify the taxpayer in writing of the Minister’s action.”

2.7 Taxpayers who are not satisfied with the Agency’s decisions on their objections can appeal to the courts. The Department of Justice Canada is responsible for defending the Agency’s assessments in the courts. When a court decision is in favour of the taxpayer, the Agency collaborates with the Department of Justice Canada. If the decision raises potential tax policy issues or has significant revenue implications, the Agency, in collaboration with the Department of Finance Canada, determines whether the court decision will be appealed. If applicable, the Agency indicates to the Department of Finance Canada whether legislative modifications should be considered. The Department of Finance Canada is responsible for proposing changes to the Income Tax Act.

Focus of the audit

2.8 This audit focused on whether the Canada Revenue Agency was efficiently managing income tax objections. To assess efficiency, we looked at the time the Agency took to provide taxpayers with decisions on their objections. We also examined the various stages in the objection process to identify where delays occurred. For income tax appeals, we examined how the Agency used and communicated information on court decisions.

2.9 This audit is important because taxpayers who are not satisfied with their income tax assessments have the right to impartial and timely reviews of their tax returns. Taxpayers and the Agency may incur significant costs in time and resources as a result of undue delays.

2.10 We did not examine the appeals process in the courts, the review of how performance associated with appeals to the courts was measured, or the validity of assessment decisions. We also did not examine notices of objection or appeals that involved the goods and services tax, the Canada Pension Plan, or Employment Insurance.

Tax avoidance group—Taxpayers who make similar efforts to reduce or eliminate taxes through transactions that contravene the specific provisions of the Income Tax Act, or through transactions that comply with the letter of the Act but violate the spirit and intent of the Act.

Source: Adapted from information on the Canada Revenue Agency’s website

2.11 During our audit, we looked at the objections to assessments of personal and corporate income tax returns that were resolved in the five-year period ending 31 March 2016. In some of these files, the Agency had identified potential tax avoidance groups.

2.12 The Agency classifies objections as either “group” files or “non-group” files. Group files contain objections to the same claims, or similar claims, that the Agency may consider to represent tax avoidance. For efficiency and consistency, the Agency does not typically process group files until a final decision is made on a lead case. If the taxpayer of the lead case appeals the Agency’s decision, a final decision may be delayed until the lead case is processed through the judicial system. This processing may take years, depending on court schedules, backlogs, and taxpayers’ actions. Over the period of five fiscal years ending 31 March 2016, the Agency resolved 366,905 objections, 223,739 of which were non-group files (61 percent).

2.13 Unless otherwise indicated, the analysis presented in this report is based on our review of non-group files. We focused on these files to avoid confusion and processing time distortions resulting from the Agency’s use of different processes to resolve these cases, including the lead case approach. A comparison of the results for group files and non-group files is included in the Appendix.

2.14 More details about the audit objective, scope, approach, and criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Processing objections and measuring results

Overall message

2.15 Overall, we found that the Canada Revenue Agency took too long to process income tax objections, which contributed to a backlog of the inventory of objections. We also found that it did not adequately measure its performance results. What the Agency reported as the time to process an objection was shorter than the length of time taxpayers actually waited. The Agency’s method of measuring performance omitted certain steps in the objection process; therefore, its reported performance results for the time it took to process objections were inaccurate.

2.16 These findings are important because under the Agency’s Taxpayer Bill of Rights, taxpayers have the right to a formal review and subsequent appeal. They also have the right to receive timely information. The longer it takes to process objections, the higher the cost to taxpayers. To avoid additional interest, taxpayers can pay the amount in dispute when they first file their objections or at any time when there is a balance outstanding. Otherwise, they must pay interest later if their objections are not allowed. Taxpayers may incur high costs, given that it can take months, or even years, for the Agency to make a decision.

2.17 The Agency needs to take all steps in its process into account to measure and report on the time required to process an objection. Without this information, taxpayers cannot determine how long they will have to wait for decisions on their objections, and the Agency cannot determine whether it is improving or getting worse in meeting its mandate for timely review of objections.

2.18 As mentioned in the Introduction, filing an objection is one of several ways a taxpayer can resolve a disagreement about an income tax assessment without going through the courts. A taxpayer who is not satisfied with the Agency’s decision on the objection can use the appeals process. The Appeals Branch of the Canada Revenue Agency has a mandate to consider the taxpayer’s objection fairly and impartially, to agree or disagree with it, and to inform the taxpayer of its decision. Although the subject of income tax appeals to the courts was outside the scope of our audit, we did consider how the Agency used and shared information about court decisions.

2.19 Under the Income Tax Act, the Agency must review objections and notify the taxpayer of its decision in writing. Although the Act does not specify how long the Agency should take to resolve an objection, the Act does state that the Agency should do this “with all due dispatch.” The Agency’s Taxpayer Bill of Rights gives taxpayers the right to complete, accurate, clear, and timely information, but it does not define “timely.”

2.20 The Canada Revenue Agency Act requires the Agency to submit to the Minister of National Revenue an annual report on its operations, which must be tabled in Parliament. The report must measure the Agency’s performance against the objectives established in the Agency’s corporate business plan. These objectives include indicators and targets for the timely review of income tax objections. The term “indicator” refers to what is being measured—for example, the acknowledgement of a taxpayer’s objection within 30 days. The term “target” refers to the Agency’s objective in meeting that indicator—for example, to acknowledge the taxpayer’s objection within 30 days in 85 percent of instances.

Inefficiencies in the Canada Revenue Agency’s process caused delays in resolving objections

2.21 We found that the Canada Revenue Agency did not resolve income tax objections in a timely manner.

2.22 The Agency had limited capacity to reduce delays. In some cases, it was also dependent on external parties, such as when it was waiting for information from taxpayers. However, we found that some Agency processes themselves caused delays. We also found that the Agency did not communicate with taxpayers early enough in the objection process to obtain the required information from them, and that it did not provide estimates to taxpayers of how long it would take to make its decisions.

2.23 Our analysis supporting this finding presents what we examined and discusses

- communication of expected delays,

- management of growing inventory, and

- processing times and reasons for delay.

2.24 This finding matters because delays in the Agency’s objection process cause taxpayers to wait longer for decisions. Taxpayers need to know how long the objection process is likely to take because this information could affect their decision to object to an assessment. The Agency charges interest and penalties on taxes assessed, but not on taxes paid. A taxpayer who files an objection may pay all or part of the amount in dispute up front or may choose to wait for the Agency’s decision. If the objection is allowed, the taxpayer receives interest on the amount paid up front at a rate of one percent for corporations and three percent for individuals, and this interest is taxable income for the taxpayer. If the objection is not allowed, the taxpayer must pay interest of five percent on a disputed amount not paid in advance, and that interest expense is not tax deductible. These interest rates may change quarterly.

2.25 Furthermore, delays in processing objections cost the Agency time and money. The Agency reported that to resolve income tax objections, determinations, and appeals to the courts in the 2014–15 fiscal year, it employed the equivalent of 1,138 full-time employees and spent $148 million on salaries and all associated corporate costs.

2.26 Our recommendations in these areas of examination appear at paragraphs 2.31, 2.34, and 2.39.

2.27 What we examined. We examined whether the objection process led to timely resolutions of income tax objections.

Complexity—A basis for categorizing an objection according to the extent of research it requires for processing. Low-complexity objections require application of basic provisions of the law. Medium-complexity objections involve more intricate transactions and require application of more complex provisions of the law. High-complexity objections involve large files (for example, those related to international transactions or multinational corporations) and tax avoidance files.

Source: Adapted from the Canada Revenue Agency’s Summary of the Corporate Business Plan, 2015–2016 to 2017–2018

2.28 Communication of expected delays. When the Agency receives a notice of objection, it records data such as key dates and the complexity of the objection into an information system. The Agency then informs the taxpayer in writing that it has received the notice of objection, adds the file to the inventory of objections, and waits for an appeals officer to become available to review the file.

2.29 The Agency sought to acknowledge in writing that it had received a taxpayer’s notice of objection 30 days from the date the taxpayer filed the notice. We found that the Agency usually adhered to this timeline. This acknowledgement was also used to communicate how long the taxpayer could expect to wait to be contacted by an appeals officer. In the 2015–16 fiscal year, this waiting period ranged from 3 months to a year for low- and medium-complexity files. For high-complexity files, the Agency did not inform taxpayers how long it would take for appeals officers to contact them and start working on the objections.

2.30 Although we found that the acknowledgement letter provided the taxpayer with an estimated waiting period for the first contact by an appeals officer, it did not provide an estimate of the waiting period to resolve the objection, and this information was not publicly available. The taxpayer remained unaware at the time of filing how long, on average, it could take the Agency to resolve the objection.

2.31 Recommendation. The Canada Revenue Agency should provide taxpayers with the time frames in which it expects to resolve their objections. Time frames should be based on objections’ level of complexity.

The Agency’s response. Agreed. The Canada Revenue Agency currently provides estimated time frames to contact the taxpayer and begin work on the objection through an acknowledgement letter. Within this fiscal year, this information will be improved to provide a more accurate estimate of time to receive a final response on the objection. Expected and actual time frames related to complexity will begin to be shared with the general public on the Agency’s website by the end of the 2016–17 fiscal year.

Also, by the end of the 2016–17 fiscal year, the Agency will clarify, on its external website, the steps to resolving taxpayer disputes, including the requirement to provide any relevant information.

2.32 Management of growing inventory. The Appeals Branch of the Canada Revenue Agency had experienced steady growth in the number of taxpayer objections. Agency officials told us that the growth was the result of both the taxpayers’ actions and the Agency’s own efforts to identify and reassess taxpayers who were not paying their fair share of income tax.

2.33 We found that the rate of growth in the number of new objections far outpaced the increase in resources the Agency dedicated to managing them. In the past 10 fiscal years, the inventory of outstanding income tax objections increased by 171 percent, from 63,384 to 171,744, while the number of employees dedicated to resolving these objections increased by 14 percent, from 998 to 1,138. We found that this large increase in the number of outstanding objections challenged the Agency’s ability to process the objections in a timely manner. The inventory decreased in the past three years. However, we found that in the 2015–16 fiscal year, the intake increased and the number of resolved objections decreased (Exhibit 2.2). These variations align with the actual number of employees tasked to resolve objections:

- 1,058 employees in the 2012–13 fiscal year,

- 1,275 employees in the 2013–14 fiscal year, and

- 1,138 employees in the 2014–15 fiscal year.

If this trend continues, inventory will increase again and challenge the Agency’s ability to resolve objections in a timely manner.

Exhibit 2.2—The Agency’s inventory of outstanding income tax objections increased by 171 percent in the past 10 fiscal years

Source: Based on the Canada Revenue Agency’s data for all income tax objections in the 10-year period ending 31 March 2016

Exhibit 2.2—text version

This is a graphic comparing the number of outstanding objections, resolved objections, and new objections between the 2005–06 and the 2015–16 fiscal years.

In the 2005–06 fiscal year, the number of outstanding objections was approximately 60,000. This number reached over 200,000 in the 2012–13 fiscal year. Between the 2013–14 and the 2015–16 fiscal years, it dropped to approximately 170,000.

In the 2005–06 fiscal year, the number of resolved objections was over 50,000. After a slight increase in 2006–07, this number remained approximately the same until 2013–14. In the 2013–14 fiscal year, the number of resolved objections increased to over 80,000 and remained approximately the same until the 2015–16 fiscal year.

In the 2005–06 fiscal year, the number of new objections was over 50,000. This number increased in the following fiscal years, reaching over 100,000 in 2009–10. Between the 2010–11 and the 2014–15 fiscal years, this number dropped to approximately 65,000. For the 2015–16 fiscal year, the number of new objections increased slightly to approximately 70,000.

| Fiscal year | Outstanding objections | Resolved objections | New objections |

|---|---|---|---|

| 2005–06 | 63,384 | 52,448 | 53,686 |

| 2006–07 | 49,331 | 73,174 | 59,031 |

| 2007–08 | 72,690 | 54,063 | 77,430 |

| 2008–09 | 100,327 | 55,703 | 83,347 |

| 2009–10 | 149,214 | 56,463 | 105,349 |

| 2010–11 | 182,090 | 60,155 | 93,039 |

| 2011–12 | 196,492 | 63,809 | 78,211 |

| 2012–13 | 208,385 | 61,599 | 73,492 |

| 2013–14 | 195,876 | 81,729 | 69,220 |

| 2014–15 | 177,215 | 83,945 | 65,284 |

| 2015–16 | 171,744 | 75,823 | 70,352 |

2.34 Recommendation. The Canada Revenue Agency should develop and implement an action plan with defined timelines and targets to reduce the inventory of outstanding objections to a reasonable level.

The Agency’s response. Agreed. The Canada Revenue Agency has identified some areas of delay within the objections process and will develop a strategy for reducing the backlog of unresolved objections that optimizes its processes and its available resources in order to respond to taxpayers in a more timely fashion.

This strategy will be finalized in early 2017. Work is ongoing and will leverage the additional information as it is identified through the process review that will be undertaken.

2.35 Processing times and reasons for delay. Agency officials told us that processing was often delayed because notices of objection sent by taxpayers were often missing information required to resolve the objection. For example, when the Agency received a notice of objection, the reason for the objection was not always clear, or evidence to support the objection was missing. If the taxpayer had provided a complete and accurate objection notice, the length of time required to process the objection would have been reduced.

2.36 In most cases, the appeals officer was the first to identify that information was missing and to request it from the taxpayer. However, most objections were not assigned to appeals officers until months after the Agency had received them, which caused delays in requesting the information. We found that in the five-year period ending 31 March 2016, the Agency did not assign an objection to an appeals officer until 150 days, on average, after the taxpayer had mailed the notice of objection. If the Agency had identified and requested the missing information from the taxpayer when it first received the notice of objection, the time required to process the objection might have been reduced.

2.37 When appeals officers require technical assistance, they may refer objections to other areas of the Agency. We found that appeals officers sometimes waited months, or years, before receiving responses to their referrals. We analyzed the objections resolved in the last five fiscal years and found that six percent of these objections needed to be referred elsewhere within the Agency. According to the Agency’s database, the appeals officers waited an average of 401 days to receive responses.

2.38 As mentioned in paragraph 2.28, the Agency categorizes files according to complexity. Over the past five fiscal years, the Agency took the following numbers of days, on average, to resolve objections from the time they were filed by the taxpayers:

- 143 days for low-complexity objections,

- 431 days for medium-complexity objections, and

- 896 days for high-complexity objections.

When we considered all resolved files, we found that approximately 79,000 objections, 76,000 of which were group files, took the Agency 5 or more years to resolve. These 79,000 objections represented about $3.8 billion of taxes in dispute. Moreover, 7,800 of these objections, 7,400 of which were group files, took the Agency 10 or more years to resolve. These 7,800 objections represented about $842 million of taxes in dispute. In our view, the Agency did not meet its mandate to provide a timely review of income tax objections.

2.39 Recommendation. The Canada Revenue Agency should conduct a complete review of the objection process to identify and implement modifications to improve the timely resolution of objections.

The Agency’s response. Agreed. Beginning in fall 2016, the Canada Revenue Agency will conduct a review of the objections process, taking into consideration ongoing planned enhancements and suggestions received from appeals officers in the 2015–16 fiscal year, to identify and resolve delays in the process, while taking into account its available resources.

In addition, beginning in the 2017–18 fiscal year, as part of the initial step when objections are received and screened, taxpayers will be contacted, when needed, to provide any missing information to ensure that the file is complete when assigned for resolution.

The Agency’s way of measuring timeliness was neither consistent nor complete and did not provide an accurate measure of the time it took to process an objection

2.40 We found that the Canada Revenue Agency did not report consistent and complete indicators and targets to measure the performance of the objection process.

2.41 We found that when measuring the length of time it took to review objections, the Agency excluded certain steps in that process. Therefore, it was not reporting the actual or average times it took to review objections. Consequently, it could not determine whether it was meeting its mandate for timeliness. It also did not accurately depict the average length of time taxpayers waited for decisions on their objections. We found that there was no publicly available information on how long taxpayers could expect to wait for the Agency to resolve their objections. Finally, we found that the Agency’s information system contained data errors, which further hindered accurate reporting.

2.42 Our analysis supporting this finding presents what we examined and discusses

2.43 This finding matters because without complete and accurate measurement of the time it takes to process an objection, the Agency cannot determine whether it is meeting its mandate for the timely review of objections. Furthermore, if the Agency cannot make this determination, it cannot provide Parliament with complete and accurate information on its performance against objectives in its annual report.

2.44 In addition, taxpayers need accurate information on the expected processing times when they are deciding whether to file objections or choose other ways of resolving their disputes.

2.45 Finally, this finding matters because data errors in the Agency’s information system hinder accurate measurement and reporting of the Agency’s performance.

2.46 Our recommendations in these areas of examination appear at paragraphs 2.50, 2.57, and 2.62.

2.47 What we examined. We examined whether the Agency’s performance indicators and related targets were consistent and complete, and whether the results provided an accurate depiction of the average length of time taxpayers wait for decisions on their objections. We also examined whether these indicators provided sufficient information to taxpayers and Parliament about the Agency’s performance.

2.48 Definition of “timely.” To determine whether the Agency was meeting its mandate to respond to objections on a timely basis, the Agency would have had to define what it considered to be a timely review. It would then need to develop, monitor, and report on performance measures in line with that time frame. We found that the Agency did not define what constituted “timely.” It did not determine what would be considered a reasonable amount of time for resolving objections.

2.49 In the absence of a concrete definition of “timely,” we compared the Agency’s performance with that of similar tax administrations in other countries to determine whether processing timelines were comparable and reasonable. In an international benchmarking study reported in 2011 by the United Kingdom’s tax authority (HM Revenue and Customs), data from 2009 showed that among seven countries studied, Canada took the longest time to resolve objections. Canada took an average of 276 days compared with an average of 70 days for the other six countries. These results are consistent with the data provided on each country’s website. Although each country has its own tax administration system with varying dispute resolution processes, which may cause variations in the overall results, the difference between Canada’s results and those of the other countries is considerable.

2.50 Recommendation. The Canada Revenue Agency should define what it considers the timely resolution of an objection. It may look to other comparable organizations to help it determine what is reasonable.

The Agency’s response. Agreed. For the 2017–18 fiscal year, the Canada Revenue Agency will implement and publicly report a standard for the resolution of low-complexity objections, which represent approximately 60 percent of the yearly objection intake. This standard will be to respond to taxpayers on low-complexity objections within 180 days, 80 percent of the time. Furthermore, as processes are changed and efficiencies are gained, it is the Agency’s intention to improve on this service standard, based on available resources.

The Agency has information to measure time required and spent to resolve objection files and will continue to look at other comparable organizations for possible improvements.

In addition, the Agency will establish a measurement for the timely resolution of medium-complexity objections, which represent 35 percent of intake, by the end of the 2016–17 fiscal year and publish this measurement in the 2017–18 fiscal year.

Finally, the Agency will continue to monitor high-complexity objections in order to ensure that the time for their resolution is commensurate with their complexity.

2.51 Appeals Branch indicators. We found that the Agency had not developed and reported on a complete set of indicators for measuring the time it takes to process an objection.

2.52 The Agency had targets for appeals officers to resolve objections within given time periods, which depended on the objections’ complexity. The Agency did not have indicators for other steps in the objection process, such as timelines for assigning an objection to an appeals officer or for processing a referral within the Agency (see paragraphs 2.36 and 2.37). There was also no overall indicator for the time the Agency should take from its receipt of the notice of objection to its resolution of the objection.

2.53 We looked at the average time it took to assign an appeals officer to an objection, and the average time it took to resolve objections, for objections resolved in the five fiscal years ending 31 March 2016 (Exhibit 2.3). We found that once a taxpayer files a notice of objection, several months pass before the objection is assigned to an appeals officer to begin the review.

Exhibit 2.3—In the past five fiscal years, the Agency took months or years to resolve income tax objections

| Complexity of objections | Number of objections | Average time before objection was assigned to appeals officer | Average time from receipt to resolution of objection |

|---|---|---|---|

| Low | 135,610 | 104 days | 143 days |

| Medium | 82,748 | 233 days | 431 days |

| High | 3,867 | 204 days | 896 days |

| Complexity not assigned | 1,514 | 48 days | 207 days |

Source: Based on the Canada Revenue Agency’s data for resolved objections in the five-year period ending 31 March 2016

2.54 For timeliness targets for processing objections to be accurate, they must include the timing of all steps in the objection process that are under the Agency’s control from the time the notice of objection is mailed. These steps would include timelines for assigning an appeals officer and for making referrals within the Agency. Accurate measurement of the time it takes to process objections is not possible when steps are excluded from consideration. Our recommendation on performance indicators and targets appears at paragraph 2.57.

2.55 External reporting. The Agency’s external reports did not provide sufficient information to allow an assessment of its performance. Although the Agency had indicators and targets for the number of days in which to resolve objections, it did not measure all the steps of the process. Moreover, the results were not reported to Parliament or communicated to taxpayers. For example, in the Agency’s annual report to Parliament for the 2014–15 fiscal year, the key performance indicator was the percentage of decisions on income tax objections that were completed within the established time frame. The target for this indicator was to complete objections filed within the established time frame in 85 percent of instances. However, the indicator did not include the time between the mailing of notices of objections and their assignment to appeals officers, nor did it include the time for obtaining advice from areas of the Agency outside the Appeals Branch. Furthermore, the Agency did not report what the established time frames were, so it could not determine or report whether it was meeting its target.

2.56 We found that the Agency changed its indicators and targets frequently over the years. As a result, it could not compare its performance of one year with that of other years. The inability to make year-over-year comparisons meant that it could not assess whether its performance was improving.

2.57 Recommendation. The Canada Revenue Agency should modify its performance indicators so that it can accurately measure and report on whether it is meeting its mandate to provide a timely review. These indicators should include all steps in the process from the time the objection is provided by the taxpayer, and they should be consistent year over year so that the Agency can identify trends and assess performance over time. The Agency should also report these indicators, related targets, and results to Parliament and communicate them to taxpayers.

The Agency’s response. Agreed. The Canada Revenue Agency is currently introducing new indicators for the timely review of objections.

The performance indicators will be included in the Agency’s Departmental Performance Report. This not only ensures consistent reporting to Parliament and taxpayers but also creates an opportunity to monitor and modify the indicators, as required.

Moreover, the Agency is continuously seeking to improve how we measure timeliness. The current methodology for measuring timeliness is based on the complexity of the objection. In order for indicators to be meaningful to taxpayers, the Agency will publish a description of the complexity of objections on its website by the end of the 2016–17 fiscal year.

The Agency will review and amend its internal procedures ensuring that the entire time the objection is within the Agency’s control is measured to provide a more complete depiction to taxpayers of the time it takes to resolve an objection through its website by the end of the 2016–17 fiscal year.

With the ongoing implementation of efficiencies within the objection process, the Agency will continue to strive to improve its performance measurement by revising targets to provide more timely reviews of objections.

2.58 Data errors. We examined the database of completed objections for group and non-group files for the five-year period ending 31 March 2016. We found that the data contained errors, which hindered accurate performance measurement and reporting.

2.59 We found that the Agency’s information system did not have sufficient controls in place to ensure data integrity. For example, it was possible to enter a date for completing an objection that preceded the date for receipt of the objection, and in such cases, the error was not flagged by the system. For some objections, the date recorded for receipt of the notice of objection followed the date of assignment to an appeals officer. For example, we found that 20,825 objections had invalid dates (that is, errors in date sequence, such as the assignment date preceding the mailing date).

2.60 We found that some data fields in the database were blank. For example, more than half the files had no data entered for the number of hours an appeals officer worked on an objection. Agency officials informed us that the hours were not always tracked for low-complexity files because tracking hours on these files was not cost-effective. They also informed us that for group files, hours were charged only to the lead file. The Agency had targets for the maximum number of hours an appeals officer should work on a file. In the 2015–16 fiscal year, low-complexity files had a maximum of 4.5 hours that should be charged. The maximum hours for medium- and high-complexity files varied, depending on the tax issue, and ranged from 7 to 28 hours. Group files and large files had no set maximum number of hours. Given that more than half the files had no recorded hours, it was not possible to conclude how well the Agency performed against its targeted maximum hours.

2.61 Agency officials also informed us that there were coding errors and data inconsistencies for referrals to headquarters and litigation, so we were unable to determine how many files required appeals officers to seek guidance from headquarters or legal advice.

2.62 Recommendation. The Canada Revenue Agency should add appropriate controls to its objection process and its information systems to ensure the integrity of its data.

The Agency’s response. Agreed. The Canada Revenue Agency is committed to ensuring enhancements that are required for data integrity within its information system are identified and built into the regular system maintenance process. New data validities will be incorporated in the current system in upcoming release cycles in fall 2016, in May 2017, and on an ongoing basis. As well, improvements to detailed instructions to officers on data entry will be issued and monitored.

Following a business architecture review, the Agency is currently developing a systems modernization proposal that will address identified gaps in data needs and validities as well as link to other Agency systems, thereby reducing the need for manual entry requirements and improving overall data integrity.

The Agency will also ensure that existing procedural controls are clearly communicated to appeals officers, will identify any additional controls that may be necessary, and will monitor the effectiveness of these controls.

Communicating the results of objections within the Agency

Overall message

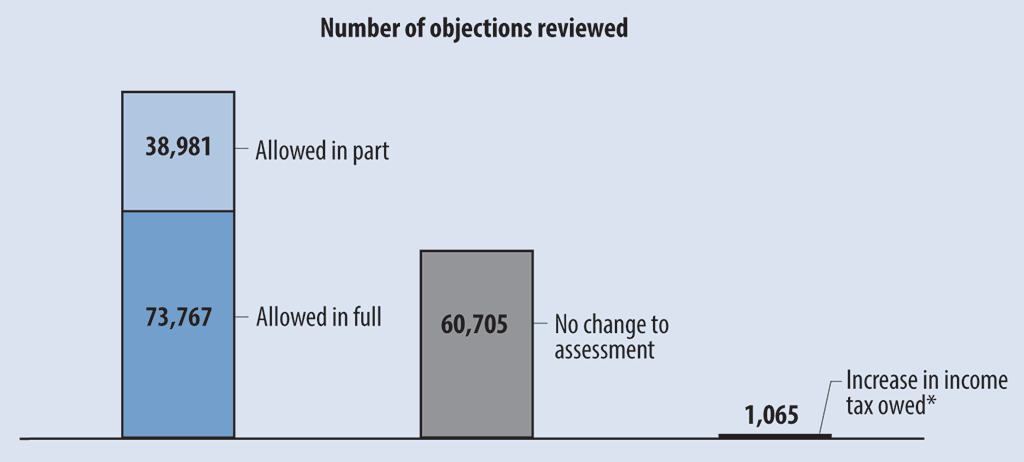

2.63 Overall, we found that the Agency did not adequately share information about the results of objections or appeals with the Agency’s auditors, assessors, or appeals officers, which restricted its ability to learn and to improve its performance and processes. We also found that 65 percent of objections accepted and processed by the Canada Revenue Agency were decided in favour of the taxpayers for either all or part of the disputed tax amounts.

2.64 These findings are important because in our view, assessment decisions that are overturned through the objection process or through the courts may signal inconsistencies in assessment or objection processes. Sharing information about overturned assessments could help assessors, auditors, and appeals officers deliver accurate and consistent decisions, which could ultimately reduce the numbers of objections and appeals.

Dismissed objections—Objections that do not meet the filing deadline or other limitations to the right to object as outlined in the Income Tax Act. All objections are reviewed by appeals officers to determine whether they meet deadline and limitation requirements. Objections that do not meet those requirements are deemed invalid by the Agency and are not reviewed on their merit to determine whether they should be allowed in full or in part, or denied.

2.65 When a taxpayer files an objection, the Canada Revenue Agency determines whether the objection should be reviewed or dismissed. If the objection is dismissed, the Agency considers its original assessment to be upheld. Otherwise, the Agency provides an impartial review of the objection and renders a decision.

2.66 Objections under review have several possible outcomes. The appeals officer may decide in favour of the taxpayer. For example, if a taxpayer is claiming automobile expenses that were denied in an assessment, and the appeals officer finds sufficient evidence to support the claim, the appeals officer grants the full deduction and adjusts the taxes payable accordingly. The Agency refers to such an objection as “allowed in full.” However, if the appeals officer finds evidence that the taxpayer incurred fewer expenses than claimed, but that some of the expenses are supported, the appeals officer may allow part of the deduction. The Agency refers to this type of objection as “allowed in part.” Alternatively, if no evidence supports the deduction, the appeals officer disallows the claim and confirms the assessment.

Sixty-five percent of decisions about objections were fully or partially in favour of the taxpayers

2.67 We found that in the past five fiscal years, 50 percent of the objections the Canada Revenue Agency received were allowed in full or in part. However, as mentioned in paragraph 2.65, not all objections received by the Agency were reviewed—some were dismissed. We found that the rate of objections allowed in full or in part increased to 65 percent when we examined only the files that the Agency actually reviewed and decided on.

2.68 Our analysis supporting this finding presents what we examined and discusses

2.69 This finding matters because objection decisions in favour of taxpayers may indicate problems with either assessments or the processing of objections. Each objection the Agency processes costs the Agency and the taxpayer time and resources. Objections favourable to taxpayers have a financial impact on the Agency because they reduce its expected revenues.

2.70 Our recommendation in this area of examination appears at paragraph 2.77.

2.71 What we examined. We examined the reasons decisions about objections favoured the taxpayers. We did not examine the validity of the decisions made by the Agency or the courts.

2.72 Decisions in favour of the taxpayer. Of the 223,739 objections resolved in the five-year period ending 31 March 2016, the Canada Revenue Agency dismissed 49,221 objections and reviewed 174,518 objections. We found that 65 percent of the objections reviewed resulted in decisions that favoured taxpayers in full or in part (Exhibit 2.4). Of these favourable decisions, $6.1 billion of taxes out of a total $11.6 billion in dispute were favourably allowed to taxpayers, and most of the amounts claimed were allowed in full. In that same period, the Agency cancelled almost $1.1 billion in penalties and interest related to the objections.

Exhibit 2.4—Almost two thirds of objections were allowed in full or in part

* Represents the number of reviewed objections that resulted in an increase in income taxes owed.

Source: Based on the Canada Revenue Agency’s data for objections the Agency reviewed in the five-year period ending 31 March 2016

Exhibit 2.4—text version

This is a graphic that shows, of the objections the Canada Revenue Agency reviewed in the five-year period ending 31 March 2016, how many objections the Agency allowed in part or full, how many resulted in no change, and how many resulted in an increase in income tax owed.

For the five-year period ending 31 March 2016, the Agency reviewed 174,518 objections. Of these, the Agency allowed in full 73,767 and in part 38,981; 60,705 resulted in no change to assessment and 1,065 resulted in an increase in the amount of income tax owed.

2.73 There were various reasons for overturning an assessment, such as when the Agency received new information from the taxpayer to support an objection. In other cases, the Agency may have allowed an objection because the assessor had improperly applied the law, facts, or its own policies. Sometimes, headquarters provided direction on how an objection would be resolved. For example, headquarters often provided field employees (that is, those working outside of headquarters) with instructions on how to resolve objections for group files.

2.74 The Agency tracked the decisions it made on objections and the underlying reasons for the decisions. We found that in many cases, the objections were allowed in full or in part because the taxpayer provided additional information that supported the objection. For 32 percent of objections, the assessor did not request that information when they did the assessment. For 28 percent of objections, the information was provided but not obvious to the assessor. Had the Agency requested or examined the information earlier, it might have assessed the file differently. Exhibit 2.5 shows a breakdown of the reasons for overturned assessments in the five-year period ending 31 March 2016.

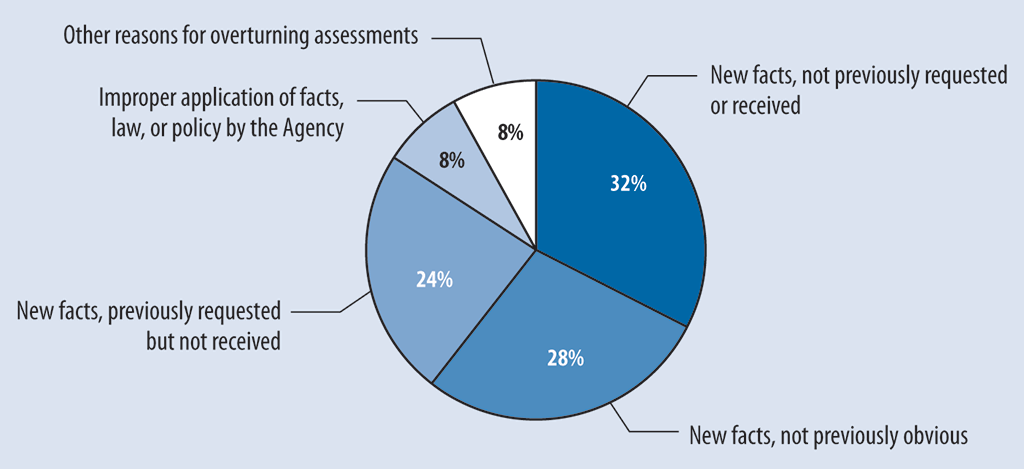

Exhibit 2.5—Most cases of overturned assessments resulted from additional information provided by the taxpayer

Source: Based on the Canada Revenue Agency’s data for objections the Agency reviewed in the five-year period ending 31 March 2016

Exhibit 2.5—text version

This is a graphic that shows, of the objections the Canada Revenue Agency reviewed in the five-year period ending 31 March 2016, how many assessments the Agency overturned and why.

For the five-year period ending 31 March 2016, the Canada Revenue Agency overturned 113,855 assessments. Of these, the Agency overturned 37,095 (or 32 percent) because of new facts, not previously requested or received. The Agency overturned 31,988 assessments (or 28 percent) because it received new facts, not previously obvious. The Agency overturned 27,000 assessments (or 24 percent) because it received new facts that it had previously requested but not received. The Agency overturned 8,780 assessments (or 8 percent) because it had improperly applied facts, law, or policy. The Agency overturned 8,992 assessments (or 8 percent) for other reasons.

2.75 In January 2016, the Agency implemented a protocol for situations at the objection stage in which a taxpayer provides the appeals officer with information that had been requested earlier by the auditor. In such cases, the information is returned to the audit area for review and recommendations. The purpose of the protocol is to ensure that tax issues are resolved at the audit stage in consideration of all relevant information.

2.76 We also looked at the complexity of objections. We found that in the past five fiscal years, low-complexity objections represented more than 60 percent of all objections, but they had a tax amount in dispute that represented less than 3 percent of the total tax amount in dispute. These objections took an average of 143 days to process (see Exhibit 2.3), and the taxpayers were allowed more than 68 percent of the tax amount in dispute.

2.77 Recommendation. The Canada Revenue Agency should review the reasons objections are decided in favour of taxpayers so that it can identify opportunities to resolve issues before objections are filed.

The Agency’s response. Agreed. The Canada Revenue Agency remains committed to analyzing the reasons assessments are overturned to identify opportunities to improve service to Canadians.

The ability to file an objection is one of the key foundations of a fair and equitable tax administration. Every year, the Agency undertakes millions of actions related to T1 and T2 returns, using different administrative approaches, and only 0.1 percent of these actions result in an objection. These approaches, during or after the initial assessment, include automated processes, in-person audits, and written requests for additional information. The objection process gives taxpayers an opportunity to provide additional information, if needed, to be considered by the Agency.

The Agency has formalized its feedback loop process introduced following the 2012 evaluation, in collaboration with assessing and audit areas. Quarterly reporting, containing reasons for objections decisions, will be issued to audit and assessing areas starting in the third quarter of the 2016–17 fiscal year.

The formalized process will identify opportunities for improvements in processes, required documentation, and training as well as improve service to taxpayers through clear communications or correspondence.

With the introduction of a protocol with the audit area and through discussions with tax professionals, the Agency will continue to emphasize the importance of providing complete and accurate information at the earliest stage possible.

The Agency did not adequately share information and the results of decisions, which limited its ability to improve its performance

2.78 We found that the Canada Revenue Agency provided limited information about objection decisions to previous assessors of taxpayers’ files. This lack of information sharing resulted in missed opportunities for previous assessors to learn and improve their practices. When taxpayers filed objections to assessments, the Agency reversed its previous decisions about assessments for 65 percent of the objections reviewed. In our view, these reversals may signal inconsistencies in the assessment or objection processes.

2.79 Our analysis supporting this finding presents what we examined and discusses

- feedback to assessors, auditors, and appeals officers;

- feedback from litigation; and

- feedback from Quality Assurance.

2.80 This finding matters because learning opportunities occur when results of objections and appeals are communicated to assessors, auditors, and appeals officers. If these assessors do not know that their work was overturned by an appeals officer or the courts, they are likely to continue to assess in the same way. Moreover, effective communication within the Agency increases the likelihood that taxpayers across Canada are assessed consistently and fairly.

2.81 Our recommendation in this area of examination appears at paragraph 2.95.

2.82 What we examined. We examined whether the Canada Revenue Agency adequately shared information with Agency stakeholders involved in the income tax assessment and objection process.

2.83 In the 2004 November Report of the Auditor General of Canada, Chapter 6, Canada Revenue Agency—Resolving Disputes and Encouraging Voluntary Disclosures, we indicated the importance of having auditors understand the changes made to their assessments. In 2012, the Agency conducted an evaluation of its Appeals Branch, which noted that information sharing among Canada Revenue Agency stakeholders was not sufficient to support program improvements.

2.84 In 2015, headquarters solicited and summarized suggestions from appeals officers about how to reduce the time to review an objection or make the overall objection process more efficient. While headquarters acted on some of the suggestions, most were not addressed, nor was there a targeted timeline for their completion.

2.85 Many stakeholders within the Agency have an interest in the outcome of the objection process. These stakeholders include assessors, auditors, appeals officers, and those providing advice on objections from headquarters. Effective communication about objection decisions can improve stakeholders’ understanding and help ensure consistency in decision making. Communicating opportunities to improve processes can also lead to greater efficiency in managing objections.

2.86 Feedback to assessors, auditors, and appeals officers. The Agency’s Compliance Programs Branch is responsible for auditing income tax files flagged for audit. We examined objections to assessments resulting from an Agency audit in the five-year period ending 31 March 2016. We found that 65 percent of the objections reviewed by the Agency were fully or partially allowed in favour of taxpayers. Objections to assessments from an Agency audit resulted in approximately $5.1 billion being allowed to taxpayers out of a total $9.8 billion in dispute in the same five-year period.

2.87 We found that auditors who completed an assessment of a file received limited information on any changes to their assessments that might result from objections or appeals to court. Although appeals officers or the litigation group could contact auditors when they needed additional information or clarification, such contacts were on an exceptional basis. Without such contacts, the auditors who made errors in their assessments would not necessarily learn from their experience and adjust their approach to assessing files.

2.88 The Agency did prepare quarterly reports that showed objection decision results up to the end of March 2015. The Agency distributed the reports to the various functions in headquarters as well as to field offices. We found that the information was presented in an unclear manner. For example, the reason for decisions on objections was coded, which made it difficult to extract information. Since March 2015, the Agency discontinued issuing these reports because it was developing new reports to improve feedback to the functions in headquarters and to field offices.

2.89 As mentioned previously, appeals officers often based their reviews on information that had not been used by the auditors who did the assessments. Possible reasons for these situations were that the auditor did not request the information from the taxpayer, the information was requested but not received, or the information was in the file but not obvious to the auditor (see Exhibit 2.5). Often, this information resulted in a partial or full reversal of the auditor’s assessment. In our opinion, if auditors were informed about what information appeals officers used in making a decision, they would know what to ask for and how to use information from taxpayers in making assessments. Having the information might improve the assessments and reduce the number of objections. Our recommendation on providing feedback within the Agency appears at paragraph 2.95.

2.90 Feedback from litigation. When a taxpayer appeals an objection decision, the file might proceed to court. Alternatively, an Agency litigation officer might settle an appeal directly with the taxpayer in certain cases filed under an informal procedure of the Tax Court of Canada. For every case in which the appeal was allowed in full or in part, or in the case of a settlement, the Department of Justice Canada reported to the Agency litigation officers assigned to the file.

2.91 If the assessed income taxes were changed because of either a settlement or a court decision, the file was returned to the appeals officer to make the adjustment. The result of the court decision was available through research using tools available to Agency personnel; however, we found that the appeals officer or previous assessor received no formal communication about why the assessment was overturned. Therefore, if any of the previous assessors had made an error in the assessment or the objection decision, they would not learn from their mistake. They would likely continue to treat files with similar issues in the same way, increasing the risk of repeated errors. Our recommendation on feedback within the Agency appears at paragraph 2.95.

2.92 In the case of a significant court decision that might require a change in assessing practices, raise potential tax policy issues, or have significant tax revenue implications, the Agency would meet with the Department of Finance Canada and the Department of Justice Canada, as required, to consider appropriate action. The results would be communicated to appeals officers and assessing branches.

2.93 Feedback from Quality Assurance. The Agency’s Quality Assurance group reviews a sample of objection files each year. This review assesses whether a file was completed in accordance with the Agency’s policies and procedures.

2.94 We found that appeals officers might not have been informed of the results of a quality review of their files. Field offices were informed of the results and had to prepare action plans to address the issues identified. We found that there was limited follow-up on those action plans, so we could not conclude whether the feedback from the Quality Assurance group resulted in improvements in processing objections.

2.95 Recommendation. The Canada Revenue Agency should ensure that decisions on objections and appeals are shared within the Agency in such a way that those performing assessments can use that information to improve future assessments.

The Agency’s response. Agreed. The Canada Revenue Agency is committed to ensuring that objections and appeals decisions are shared with all assessing and audit areas.

At the beginning of the 2016–17 fiscal year, the Agency formalized the feedback loop process and continues to strengthen ongoing collaboration between the audit and assessing branches, the regions, and the Appeals Branch in the analysis of objections and appeals results. This collaboration uses a variety of mechanisms, such as regular reporting and analysis, structured discussions on issues, and implementation of action plans to address the identified areas for improvement.

The Agency is taking steps to strengthen its practice of sharing business intelligence from the objections and appeals processes. This will enhance the monitoring of trends, leading to potential resolution of policy, legislation, and procedural issues in both the Appeals Branch and audit and assessing areas, thus improving service to taxpayers.

Improved quarterly data analysis reports will be shared in the third quarter of the 2016–17 fiscal year following systems upgrades and process changes, which will allow for improved identification of the source of the assessments that come to objections and more focused conversations on improvements.

Conclusion

2.96 We concluded that the Canada Revenue Agency did not process income tax objections in a timely manner.

2.97 Although the Agency had developed and reported performance indicators for the objection process, the indicators were incomplete and inaccurate. Specifically, there was no indicator or target for the time that taxpayers should wait for decisions on their objections.

2.98 In addition, the Agency did not adequately analyze or review decisions on income tax objections and appeals, and there was insufficient sharing of the results of these objection and court decisions within the Agency.

About the Audit

The Office of the Auditor General’s responsibility was to conduct an independent examination of the Appeals Branch of the Canada Revenue Agency, to provide objective information, advice, and assurance to assist Parliament in its scrutiny of the government’s management of resources and programs.

All of the audit work in this report was conducted in accordance with the standards for assurance engagements set out by the Chartered Professional Accountants of Canada (CPA) in the CPA Canada Handbook—Assurance. While the Office adopts these standards as the minimum requirement for our audits, we also draw upon the standards and practices of other disciplines.

As part of our regular audit process, we obtained management’s confirmation that the findings in this report are factually based.

Objective

The audit objective was to determine whether the Canada Revenue Agency was efficiently managing the income tax objections and appeals process.

Scope and approach

Although objections and appeals include several types of files (personal, corporate, trusts, goods and services tax, Canada Pension Plan, and Employment Insurance), we focused on those related to personal and corporate tax returns, as they were the most numerous and had the greatest dollar value. Our audit excluded notices of objection or appeals that involved examination of trusts, goods and services tax, Canada Pension Plan, or Employment Insurance.

Furthermore, our audit excluded an examination of income tax appeals processed through the Tax Court of Canada or any other subsequent appeals to courts, and any review of performance indicators associated with such appeals.

We examined the Department of Justice Canada and the Department of Finance Canada to the extent of their involvement in the court appeals process and in identifying the need for legislative changes.

At the Agency, we examined the legislation, policies, and procedures in place to manage the program. We interviewed officials at the Agency’s headquarters, the two objections intake centres in Surrey, British Columbia, and Sudbury, Ontario, and several officials at various tax service offices across Canada. The interviews included meetings with management, officials from litigation, auditors, appeals officers, and others involved in managing or coordinating the objections inventory. We also met with officials from the Department of Justice Canada and the Department of Finance Canada.

We analyzed data extracted from the information systems of the Agency’s Appeals Branch to identify and compare information related to the objection process. Our data included all individual and corporate income tax objections resolved over five fiscal years: 2011–12 to 2015–16. We conducted a file review of a random sample of these objections to assess the quality of the data. Although we noted issues with the integrity of data, as mentioned in this report, we found the data sufficiently reliable for the purpose of our analysis.

We did not examine the validity of the Agency’s decisions on objections filed with the Agency nor of the decisions on taxpayers’ files that were appealed to the courts.

Criteria

To determine whether the Canada Revenue Agency reviewed income tax objections in a timely manner, we used the following criteria:

| Criteria | Sources |

|---|---|

|

The Canada Revenue Agency reviews income tax objections in a timely manner. |

|

To determine whether the Canada Revenue Agency developed and reported performance indicators in line with its mandate for processing income tax objections, we used the following criteria:

| Criteria | Sources |

|---|---|

|

The Canada Revenue Agency establishes relevant performance indicators to assess that its actions achieve the desired results. |

|

|

The Canada Revenue Agency reports whether its actions achieve the desired results. |

|

To determine whether the Appeals Branch of the Canada Revenue Agency, with the support of the Department of Justice Canada and the Department of Finance Canada, as required, analyzed and reviewed decisions on income tax objections and appeals and shared the results of these analyses and reviews within the Agency, we used the following criteria:

| Criteria | Sources |

|---|---|

|

The Appeals Branch analyzes and reviews decisions for income tax objections and shares the results of these analyses and reviews within the Agency. |

|

|

The Appeals Branch analyzes and reviews decisions for income tax appeals and shares the results of these analyses and reviews within the Agency. |

|

Management reviewed and accepted the suitability of the criteria used in the audit.

Period covered by the audit

The audit covered the period between 1 April 2011 and 31 March 2016. Audit work for this report was completed on 8 July 2016.

Audit team

Assistant Auditor General: Nancy Cheng

Principal: Jean Goulet

Director: Tammy Meagher

Lucie Després

Suzanne Moorhead

Manav Kapoor

List of Recommendations

The following is a list of recommendations found in this report. The number in front of the recommendation indicates the paragraph where it appears in the report. The numbers in parentheses indicate the paragraphs where the topic is discussed.

Processing objections and measuring results

| Recommendation | Response |

|---|---|

|

2.31 The Canada Revenue Agency should provide taxpayers with the time frames in which it expects to resolve their objections. Time frames should be based on objections’ level of complexity. (2.28–2.30) |

The Agency’s response. Agreed. The Canada Revenue Agency currently provides estimated time frames to contact the taxpayer and begin work on the objection through an acknowledgement letter. Within this fiscal year, this information will be improved to provide a more accurate estimate of time to receive a final response on the objection. Expected and actual time frames related to complexity will begin to be shared with the general public on the Agency’s website by the end of the 2016–17 fiscal year. Also, by the end of the 2016–17 fiscal year, the Agency will clarify, on its external website, the steps to resolving taxpayer disputes, including the requirement to provide any relevant information. |

|

2.34 The Canada Revenue Agency should develop and implement an action plan with defined timelines and targets to reduce the inventory of outstanding objections to a reasonable level. (2.32–2.33) |

The Agency’s response. Agreed. The Canada Revenue Agency has identified some areas of delay within the objections process and will develop a strategy for reducing the backlog of unresolved objections that optimizes its processes and its available resources in order to respond to taxpayers in a more timely fashion. This strategy will be finalized in early 2017. Work is ongoing and will leverage the additional information as it is identified through the process review that will be undertaken. |

|

2.39 The Canada Revenue Agency should conduct a complete review of the objection process to identify and implement modifications to improve the timely resolution of objections. (2.35–2.38) |

The Agency’s response. Agreed. Beginning in fall 2016, the Canada Revenue Agency will conduct a review of the objections process, taking into consideration ongoing planned enhancements and suggestions received from appeals officers in the 2015–16 fiscal year, to identify and resolve delays in the process, while taking into account its available resources. In addition, beginning in the 2017–18 fiscal year, as part of the initial step when objections are received and screened, taxpayers will be contacted, when needed, to provide any missing information to ensure that the file is complete when assigned for resolution. |

|

2.50 The Canada Revenue Agency should define what it considers the timely resolution of an objection. It may look to other comparable organizations to help it determine what is reasonable. (2.48–2.49) |

The Agency’s response. Agreed. For the 2017–18 fiscal year, the Canada Revenue Agency will implement and publicly report a new service standard for the resolution of low-complexity objections, which represent approximately 60 percent of the yearly objection intake. This standard will be to respond to taxpayers on low-complexity objections within 180 days, 80 percent of the time. Furthermore, as processes are changed and efficiencies are gained, it is the Agency’s intention to improve on this service standard, based on available resources. The Agency has information to measure time required and spent to resolve objection files and will continue to look at other comparable organizations for possible improvements. In addition, the Agency will establish a measurement for the timely resolution of medium-complexity objections, which represent 35 percent of intake, by the end of the 2016–17 fiscal year and publish this measurement in the 2017–18 fiscal year. Finally, the Agency will continue to monitor high-complexity objections in order to ensure that the time for their resolution is commensurate with their complexity. |

|

2.57 The Canada Revenue Agency should modify its performance indicators so that it can accurately measure and report on whether it is meeting its mandate to provide a timely review. These indicators should include all steps in the process from the time the objection is provided by the taxpayer, and they should be consistent year over year so that the Agency can identify trends and assess performance over time. The Agency should also report these indicators, related targets, and results to Parliament and communicate them to taxpayers. (2.51–2.56) |

The Agency’s response. Agreed. The Canada Revenue Agency is currently introducing new indicators for the timely review of objections. The performance indicators will be included in the Agency’s Departmental Performance Report. This not only ensures consistent reporting to Parliament and taxpayers but also creates an opportunity to monitor and modify the indicators, as required. Moreover, the Agency is continuously seeking to improve how we measure timeliness. The current methodology for measuring timeliness is based on the complexity of the objection. In order for indicators to be meaningful to taxpayers, the Agency will publish a description of the complexity of objections on its website by the end of the 2016–17 fiscal year. The Agency will review and amend its internal procedures ensuring that the entire time the objection is within the Agency’s control is measured to provide a more complete depiction to taxpayers of the time it takes to resolve an objection, through its website by the end of the 2016–17 fiscal year. With the ongoing implementation of efficiencies within the objection process, the Agency will continue to strive to improve its performance measurement by revising targets to provide more timely reviews of objections. |

|

2.62 The Canada Revenue Agency should add appropriate controls to its objection process and its information systems to ensure the integrity of its data. (2.58–2.61) |

The Agency’s response. Agreed. The Canada Revenue Agency is committed to ensuring enhancements that are required for data integrity within its information system are identified and built into the regular system maintenance process. New data validities will be incorporated in the current system in upcoming release cycles in fall 2016, in May 2017, and on an ongoing basis. As well, improvements to detailed instructions to officers on data entry will be issued and monitored. Following a business architecture review, the Agency is currently developing a systems modernization proposal that will address identified gaps in data needs and validities as well as link to other Agency systems, thereby reducing the need for manual entry requirements and improving overall data integrity. The Agency will also ensure that existing procedural controls are clearly communicated to appeals officers, will identify any additional controls that may be necessary, and will monitor the effectiveness of these controls. |

Communicating the results of objections within the Agency

| Recommendation | Response |

|---|---|

|

2.77 The Canada Revenue Agency should review the reasons objections are decided in favour of taxpayers so that it can identify opportunities to resolve issues before objections are filed. (2.72–2.76) |

The Agency’s response. Agreed. The Canada Revenue Agency remains committed to analyzing the reasons assessments are overturned to identify opportunities to improve service to Canadians. The ability to file an objection is one of the key foundations of a fair and equitable tax administration. Every year, the Agency undertakes millions of actions related to T1 and T2 returns, using different administrative approaches, and only 0.1 percent of these actions result in an objection. These approaches, during or after the initial assessment, include automated processes, in-person audits, and written requests for additional information. The objection process gives taxpayers an opportunity to provide additional information, if needed, to be considered by the Agency. The Agency has formalized its feedback loop process introduced following the 2012 evaluation, in collaboration with assessing and audit areas. Quarterly reporting, containing reasons for objections decisions, will be issued to audit and assessing areas starting in the third quarter of the 2016–17 fiscal year. The formalized process will identify opportunities for improvements in processes, required documentation, and training as well as improve service to taxpayers through clear communications or correspondence. With the introduction of a protocol with the audit area and through discussions with tax professionals, the Agency will continue to emphasize the importance of providing complete and accurate information at the earliest stage possible. |

|

2.95 The Canada Revenue Agency should ensure that decisions on objections and appeals are shared within the Agency in such a way that those performing assessments can use that information to improve future assessments. (2.86–2.94) |

The Agency’s response. Agreed. The Canada Revenue Agency is committed to ensuring that objections and appeals decisions are shared with all assessing and audit areas. At the beginning of the 2016–17 fiscal year, the Agency formalized the feedback loop process and continues to strengthen ongoing collaboration between the audit and assessing branches, the regions, and the Appeals Branch in the analysis of objections and appeals results. This collaboration uses a variety of mechanisms, such as regular reporting and analysis, structured discussions on issues, and implementation of action plans to address the identified areas for improvement. The Agency is taking steps to strengthen its practice of sharing business intelligence from the objections and appeals processes. This will enhance the monitoring of trends, leading to potential resolution of policy, legislation, and procedural issues in both the Appeals Branch and audit and assessing areas, thus improving service to taxpayers. Improved quarterly data analysis reports will be shared in the third quarter of the 2016–17 fiscal year following systems upgrades and process changes, which will allow for improved identification of the source of the assessments that come to objections and more focused conversations on improvements. |

Appendix—Outcomes of objection decisions for the 2011–12 to 2015–16 fiscal years

| Category | Objections | Tax amounts | Average time to process an objection (days) | ||||

|---|---|---|---|---|---|---|---|

| Total (number) | Allowed in full or in part (number) | Allowed in full or in part (percentage of total) |

Amount in dispute ($ millions) |

Allowed in favour of taxpayers ($ millions) |

Allowed in favour of taxpayers (percentage of total) |

||

|

Note: Figures include all objections received by the Canada Revenue Agency, including those that were dismissed, for which cases the Agency considered the assessments to be upheld. |

|||||||

|

All |

223,739 |

112,748 |

50.4% |

$13,270 |

$6,059 |

45.7% |

263 |

|

Type of income tax: |

|

|

|

|

|

|

|

|

188,008 |

95,786 |

50.9% |

$2,556 |

$1,031 |

40.3% |

227 |

|

35,731 |

16,962 |

47.5% |

$10,715 |

$5,027 |

46.9% |

454 |

|

Complexity of objection:Note 1 |

|

|

|

|

|

|

|

|

135,610 |

64,697 |

47.7% |

$361 |

$247 |

68.5% |

143 |

|

82,748 |

45,838 |

55.4% |

$5,362 |

$2,142 |

39.9% |

431 |

|

3,867 |

1,968 |

50.9% |

$7,487 |

$3,656 |

48.8% |

896 |

|

Origin of objection:Note 2 |

|

|

|

|

|

|

|

|

174,893 |

84,624 |

48.4% |

$1,528 |

$939 |

61.5% |

183 |

|

47,143 |

27,158 |

57.6% |

$11,395 |

$5,114 |

44.9% |

532 |

| Category | Objections | Tax amounts | Average time to process an objection (days) | ||||

|---|---|---|---|---|---|---|---|

| Total (number) | Allowed in full or in part (number) | Allowed in full or in part (percentage of total) |

Amount in dispute ($ millions) |

Allowed in favour of taxpayers ($ millions) |

Allowed in favour of taxpayers (percentage of total) |

||

|

Note: Figures include all objections received by the Canada Revenue Agency, including those that were dismissed, for which cases the Agency considered the assessments to be upheld. |

|||||||

|

All |

143,166 |

94,298 |

65.9% |

$4,606 |

$1,317 |

28.6% |

1,503 |

|

Type of income tax: |

|

|

|

|

|

|

|

|

140,413 |

92,864 |

66.1% |

$1,496 |

$469 |

31.4% |

1,513 |

|

2,753 |

1,434 |

52.1% |

$3,110 |

$848 |

27.3% |

1,001 |

|

Complexity of objection:Note 1 |

|

|

|

|

|

|

|

|

12,679 |

6,280 |

49.5% |

$40 |

$24 |

60.3% |

221 |

|

128,486 |

86,862 |

67.6% |

$1,664 |

$516 |

31.0% |

1,615 |

|

1,003 |

577 |

57.5% |

$2,822 |

$757 |

26.8% |

1,632 |

|

Origin of objection:Note 2 |

|

|

|

|

|

|

|

|

31,806 |

17,414 |

54.8% |

$150 |

$67 |

44.6% |

456 |

|

111,355 |

76,881 |

69.0% |

$4,456 |

$1,250 |

28.0% |

1,802 |

| Category | Objections | Tax amounts | Average time to process an objection (days) | ||||

|---|---|---|---|---|---|---|---|

| Total (number) | Allowed in full or in part (number) | Allowed in full or in part (percentage of total) |

Amount in dispute ($ millions) |

Allowed in favour of taxpayers ($ millions) |

Allowed in favour of taxpayers (percentage of total) |

||

|

Note: Figures include all objections received by the Canada Revenue Agency, including those that were dismissed, for which cases the Agency considered the assessments to be upheld. |

|||||||

|

All |

366,905 |

207,046 |

56.4% |

$17,877 |

$7,375 |

41.3% |