2013–14 Performance Report of the Office of the Auditor General of Canada

2013–14 Estimates

Performance Report of the Office of the Auditor General of Canada

Foreword

Departmental performance reports (DPRs) are part of the Estimates documents. Estimates documents support appropriation acts, which specify the amounts and broad purposes for which the government’s funds can be spent. The Estimates documents have three parts:

- Part I (Government Expenditure Plan) provides an overview of federal spending.

- Part II (Main Estimates) lists the financial resources required by individual departments, agencies, and Crown corporations for the upcoming fiscal year.

- Part III (Departmental Expenditure Plans) consists of reports on plans and priorities (RPPs) and departmental performance reports (DPRs).

- RPPs are expenditure plans for each appropriated department and agency. Each RPP covers a three-year period, beginning with the year indicated in the title of the report, and describes departmental priorities, strategic outcomes, programs, expected results, and associated resource requirements.

- DPRs are individual department and agency accounts of actual performance for the most recently completed fiscal year, as measured against the plans set out in the respective RPPs. DPRs inform parliamentarians and Canadians of the results achieved by government organizations.

The financial information in DPRs is consistent with that found in the Public Accounts of Canada.

Message from the Auditor General of Canada

I am pleased to present the 2013–14 Performance Report of the Office of the Auditor General of Canada.

The Office had two priorities for the 2013–14 fiscal year, the first of which was to continue to implement our Strategic and Operating Review (SOR) proposal. I can now report that we met our SOR targets of reducing our appropriations requirement by $6.5 million and our staffing level by 10 percent.

Our second priority was to renew our strategic plan. During the 2013–14 year, we identified a new set of strategic objectives for the Office. From these objectives, we identified the following four areas needing improvement:

- maximizing the value of our audits for our clients,

- streamlining our governance and decision-making practices,

- increasing the empowerment of our staff, and

- ensuring that our compliance with professional standards is achieved economically.

Our surveys continue to indicate that a high percentage of users of our reports and senior managers of the organizations we audit believe that our work adds value. As part of our strategic planning renewal, we met with 21 current or former senators or members of the House of Commons, who provided us with feedback on our role, the impact of our work, and the opportunities for us to provide additional value. In general, the feedback we received was positive.

Although we continue to make sure that parliamentarians are aware of the work we do, the number of parliamentary hearings and briefings we participated in decreased from 27 in 2012–13 to 23 in 2013–14. Also, the percentage of our performance audits that were reviewed by a parliamentary committee decreased from 30 percent to 21 percent. These results concern us because the hearings allow us to explain our audit findings to parliamentarians, which we believe is important.

In March 2014, we welcomed Julie Gelfand as the Commissioner of the Environment and Sustainable Development. Ms. Gelfand’s wealth of experience in the private and non-governmental sectors includes involvement with environmental, sustainable development, and social responsibility issues.

It continues to be a privilege for me to be part of the Office of the Auditor General, which is an organization made up of highly dedicated, motivated, and skilled individuals who take great pride in what they do.

[Original signed by]

Michael Ferguson, CPA, CA

FCA (New Brunswick)

Auditor General of Canada

19 September 2014

Performance Summary

Highlights

Support for our work from our clients and those we audit remained high.

We used $84.3 million of the $88.3 million of approved parliamentary appropriations, resulting in a lapse of $4.0 million, as we met our Strategic and Operating Review budget reduction target one year earlier than planned.

We completed 100 financial audits, two special examinations, and all planned performance audit work except for one audit, which was cancelled. We also completed a previously unplanned performance audit and began work on the audit of the Senate of Canada.

Impact of our work

We followed up on 10 performance audit recommendations and found that the progress in implementing 5 of them was satisfactory.

Two of five qualifications in our financial audits from the 2012–13 fiscal year were addressed in this fiscal year, which falls below our target of 100 percent. Of the three qualifications not addressed, two were for late filing of annual reports or financial statements. The third was for our inability to obtain sufficient and appropriate audit evidence for inventory. The audit entity has commenced recording inventory at some locations and expects to have inventory recorded for all sites within two years.

In one of the special examinations we completed this year, there had been a significant deficiency in the previous examination, which had been addressed.

Engagement with parliamentary committees has decreased again, with 21 percent of our performance audit reports being reviewed by parliamentary committees, compared with 30 percent in the last fiscal year and 48 percent in the 2011–12 fiscal year. The percentage of hearings and briefings we participated in relative to the number of sitting days was 21 percent, which is unchanged from the 2012–13 fiscal year but down from 28 percent in the 2011–12 fiscal year.

Areas for improvement

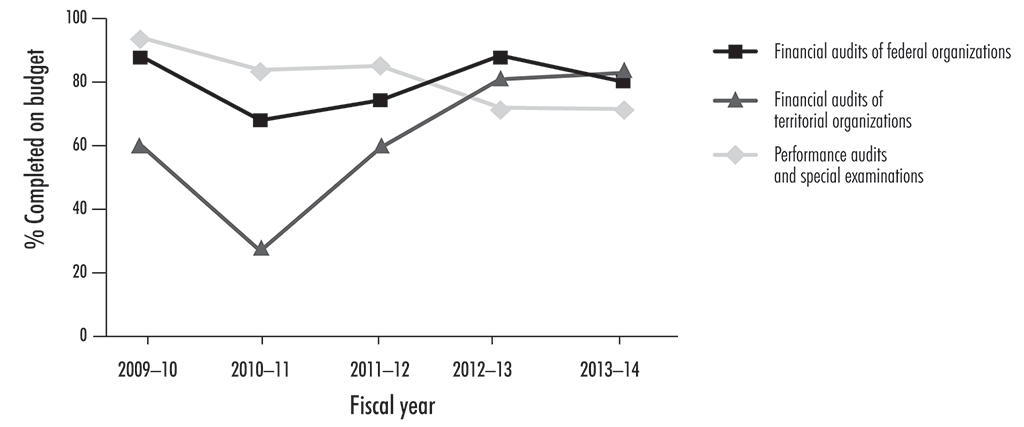

We did not meet our on-budget targets for performance audits and special examinations. For performance audits, our result was significantly affected by three audits with relatively small budgets. For special examinations, the one examination that was over budget had a more decentralized operational management than anticipated.

Our practice reviews serve as a key quality control in our audit methodology. In all cases, these reviews found the audit reports we issued to be appropriate and supported by proper evidence. However, our reviews also identified a need to improve the documentation of the nature and extent of oversight by senior auditors in some of our files.

Section I—Overview

Organizational profile

Auditor General: Michael Ferguson, CPA, CA, FCA (New Brunswick)

Year established: 1878

Main legislative authorities:

Auditor General Act, R.S.C. 1985, c. A-17

Financial Administration Act, R.S.C. 1985, c. F-11

Minister: The Honourable Joe Oliver, P.C., M.P., Minister of Finance

The Auditor General acts independently in the execution of his audit responsibilities, but reports to Parliament on expenditures through the Minister of Finance.

Who we are

The Office of the Auditor General of Canada is the legislative audit office of the federal government. We are also the legislative auditor of the three territories (Nunavut, Yukon, and the Northwest Territories). The Commissioner of the Environment and Sustainable Development assists the Auditor General in performing duties related to the environment and sustainable development. We conduct independent audits and studies that provide objective information, advice, and assurance to Parliament, territorial legislatures, Crown corporations’ boards of directors, governments, and Canadians. With our reports and testimony at parliamentary hearings, we assist Parliament and territorial legislatures in their work on the authorization and oversight of government spending and operations.

What we do

The Auditor General is an officer of Parliament who is independent from the government and reports directly to Parliament. The duties of the Auditor General are set out in the Auditor General Act, the Financial Administration Act, and other acts and orders-in-council. These duties relate primarily to legislative auditing of federal departments and agencies, Crown corporations, territorial governments, and other entities.

The Office’s main legislative auditing duties are

- financial audits,

- performance audits,

- special examinations, and

- sustainable development activities.

Financial audits

Our financial audits provide assurance that financial statements are presented fairly in accordance with the applicable financial reporting framework. Where required, we provide assurance that the organizations we audit comply, in all significant respects, with legislative authorities that are relevant to a financial audit. We audit the summary financial statements of the Government of Canada and each of the three territories, as well as the financial statements of federal and territorial Crown corporations and other organizations.

If issues or opportunities for improvement in areas such as financial reporting and internal controls come to our attention during our financial audit work, we make recommendations to management. We also provide information and advice to help audit committees meet their responsibilities for the oversight of financial reporting and internal control.

Performance audits

Performance audits examine, against established criteria, whether government programs are being managed with due regard to economy, efficiency, and environmental impact, and whether the government has the means to measure and report on their effectiveness. Our reports contain recommendations for improving program management.

The Auditor General Act gives the Office the discretion to determine what areas of government it will examine in its performance audits. We may decide to audit a single government program or activity, an area of responsibility that involves several departments or agencies, or an issue that affects many departments and agencies. We consider requests for audits that we receive from parliamentary committees. However, the final decision about what to audit is made by the Auditor General.

Special examinations

Our special examinations assess the systems and practices maintained by Crown corporations. A special examination provides the corporation’s board of directors with an opinion on whether there is reasonable assurance that there are no significant deficiencies in the corporation’s systems and practices that we selected for examination. These examinations focus on whether a corporation’s systems and practices provide reasonable assurance that

- its assets are safeguarded and controlled,

- its resources are managed economically and efficiently, and

- its operations are carried out effectively.

In addition to reporting on significant deficiencies, our special examinations highlight systems and practices that contribute to success, and they provide information and recommendations to boards of directors about opportunities for improvement.

All parent Crown corporations except two are subject to a special examination by the Office to be conducted at least once every 10 years. The two exceptions are the Bank of Canada, which is exempt from this requirement, and the Canada Pension Plan Investment Board, which (under the Canada Pension Plan Investment Board Act) is subject to a special examination by an auditor who is chosen by the board of directors.

Sustainable development activities

The Commissioner of the Environment and Sustainable Development monitors the sustainable development strategies of federal departments. The Commissioner assesses the quality of these strategies and examines whether the plans set out in the strategies have been implemented. The Commissioner also reports to Parliament on the fairness of the information in the progress report that the federal government provides on the Federal Sustainable Development Strategy.

The Commissioner of the Environment and Sustainable Development conducts performance audits to monitor the government’s management of environmental and sustainable development issues and, on behalf of the Auditor General, reports to Parliament on issues that should be brought to its attention.

The Commissioner of the Environment and Sustainable Development also administers the environmental petitions process, as required by the Auditor General Act. This includes monitoring responses to environmental petitions and reporting annually to Parliament on petition activities from the previous year, including instances where ministers did not respond to petitions within the 120-day time limit specified in legislation. The Office of the Auditor General considers issues raised in petitions when it plans future audits.

Public Servants Disclosure Protection Act investigations

Under the Public Servants Disclosure Protection Act, the Auditor General has the mandate to investigate disclosures by public servants of wrongdoing that concerns the Office of the Public Sector Integrity Commissioner. If we determine that allegations of wrongdoing are founded, we must submit a case report to Parliament.

Professional practices

In order to ensure the reliability and consistency of our audit work, the Office makes an ongoing investment in professional practices. This investment supports

- the development and maintenance of up-to-date audit methodology;

- communication and training to promote consistency in the application of audit methodology and the Office’s System of Quality Control; and

- the provision of advice on the interpretation and application of professional standards, Office policies, audit methodology, and the System of Quality Control.

Through the Professional Practices Group, the Office works with other legislative audit offices and professional associations, such as Chartered Professional Accountants of Canada and the International Public Sector Accounting Standards Board, to advance legislative auditing methodology, accounting and auditing standards, and best practices. We regularly participate in external peer reviews of other national legislative audit offices and are the subject of external peer reviews.

International activities

Our international strategy guides our international activities and positions the Office to meet future opportunities and challenges. See “Our international contribution” in Section II for more details.

Strategic outcome and performance summary

The strategic outcome of the Office of the Auditor General is to contribute to well-managed government programs and better government accountability to Parliament through our legislative auditing work.

We have identified a number of results that we expect to achieve with our audits in the short, medium, and long term:

- In the short term, we want to engage Parliament and federal and territorial organizations in the audit process, ensure that Parliament is well informed about our work, and maintain support for our role and work.

- In the medium term, we want to assist Parliament in holding the government to account; make our work relevant to federal and territorial organizations, departments, agencies, and Crown corporations; and ensure that the public is well informed about our work.

- In the long term, we want our work to lead to more effective, efficient, and economical government programs and operations, and to programs that foster sustainable development.

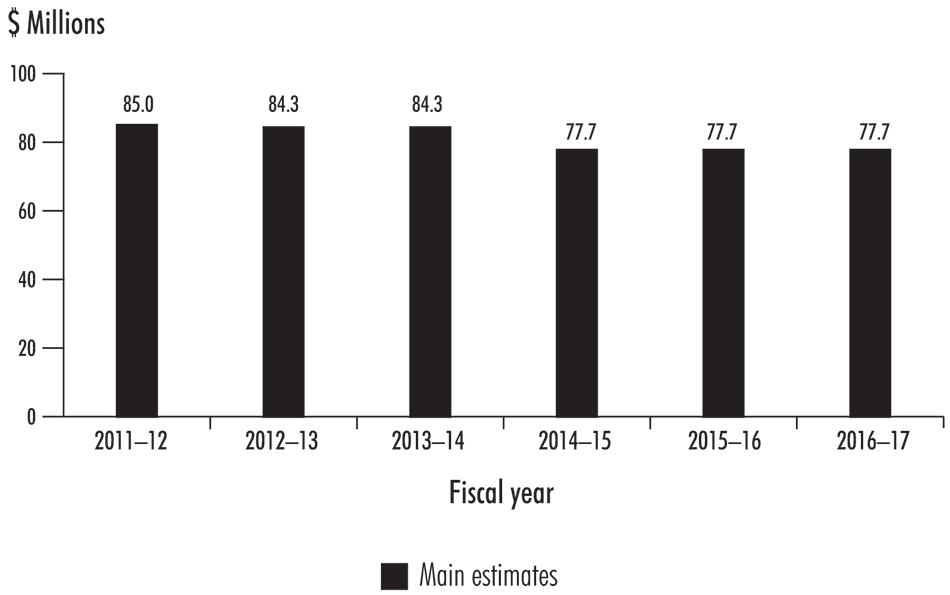

Exhibit 1 summarizes our performance indicators and financial results. Exhibit 2 presents the trend in our authorized spending.

Exhibit 1—Results summary

Performance Indicators

Strategic outcome: We contribute to a well-managed and accountable government for Canadians.

Expected Results

- Parliament and territorial legislatures are well informed.

- Parliament, territorial legislatures, and federal and territorial organizations are engaged in the audit process.

- Parliament and territorial legislatures hold government to account.

- Our work is relevant to federal and territorial organizations, departments, agencies, and Crown corporations.

- The media and public are well informed.

- Support for our role and work is maintained.

2013–14 Results

We completed

- 29 performance audits and 1 study1

- 100 financial audits

- 2 special examinations

| Objectives | Indicators and targets | 2013–14 Results |

|---|---|---|

|

Our work adds value for the key users of our reports. |

Percentage of users who find that our audits add value: 90% for all audit types. |

Target for financial audits was missed by 1%. |

|

Our work adds value for the organizations we audit. |

Percentage of senior managers who find that our audits add value:

|

Target was met for all product lines (financial audits, performance audits, and special examinations). |

|

Key users of our reports are engaged in the audit process. |

Number of parliamentary hearings and briefings we participate in: Maintain or increase. Percentage of hearings and briefings relative to sitting days: Maintain or increase. Percentage of performance audits that are reviewed by parliamentary committees: Maintain or increase. |

Level of engagement of parliamentary committees has decreased. |

|

Key users of our reports and the organizations we audit respond to our findings. |

For financial audits, the percentage of qualifications and “other matters” that are addressed from one report to the next: 100%. For performance audits, the percentage of recommendations examined in our follow-up audits for which progress is assessed as satisfactory: 75%. |

Target was not met for financial audits or performance audits.

|

|

For special examinations, the percentage of significant deficiencies that are addressed from one examination to the next: 100%. |

||

|

Our work is completed on time. |

Percentage of audits that meet statutory deadlines, where applicable, or our planned reporting dates: Varies according to audit type. |

|

|

Our work is completed on budget. |

Percentage of audits that are completed on budget: 80% for all audit types. |

|

|

Our audit reports are reliable. |

Percentage of internal practice reviews that find the opinions and conclusions expressed in our audit reports to be appropriate and supported by the evidence: 100%. |

|

|

External peer reviews find our quality management frameworks to be suitably designed and operating effectively: Yes. |

||

|

We provide a respectful workplace. |

Percentage of employees who believe the Office is an above-average place to work: 80%. |

There was no employee survey conducted in the 2013–14 fiscal year. |

|

Percentage of managers who meet our language requirements:

|

Target was not met for the Auditor General, assistant auditors general, and principals. |

|

|

Percentage of representation relative to workforce availability for women, people with disabilities, Aboriginal peoples, and members of visible minorities: 100%. |

Targets for representation of women and Aboriginal peoples were met. |

|

|

Percentage of audit professionals retained: 90%. |

||

|

We meet our sustainable development commitments. |

Development of a strategic audit plan for sustainable development work for the Office as a whole that identifies audit and non-audit products for addressing sustainable development risks and improving how the federal government manages sustainable development issues. |

|

|

Percentage of performance audit teams using the 4th E Practice Guide’s screening tool and consulting with internal environmental specialists to identify any important environmental issues related to their audit topics: 100%. |

||

|

Percentage of special examination audit teams receiving enhanced support and advice in cases where important environmental risks are identified for Crown corporations: 100%. |

1 Four follow-up chapters, originally planned as the March 2013 Status Report, were subsequently included in the 2013 Spring Report of the Auditor General of Canada, which was tabled in the 2013–14 fiscal year. These chapters were counted in our 2012–13 Performance Report.

2 Although we did not survey parliamentarians this year, we interviewed 21 current or former senators or members of the House of Commons as part of the updating of our strategic plan. We received positive feedback on the value of our work.

3 Only two special examination surveys were completed in the 2013–14 fiscal year. Results of both surveys were positive.

Financial Results

| Legislative auditing activity1 | 2013–14 Budget2 |

2013–14 Actual spending |

2012–13 Actual spending |

|---|---|---|---|

| Financial audits of Crown corporations, territorial governments, and other organizations, and of the summary financial statements of the Government of Canada | 42.5 | 41.7 | 45.2 |

| Performance audits and studies of departments and agencies3 | 38.5 | 41.2 | 39.8 |

| Special examinations of Crown corporations | 5.9 | 3.3 | 2.8 |

| Sustainable development monitoring activities and environmental petitions | 1.5 | 1.6 | 1.8 |

| Professional practices | 10.7 | 9.5 | 10.1 |

| Total cost of operations | 99.1 | 97.3 | 99.7 |

| Costs recovered4 | (0.8) | (1.1) | (0.8) |

| Net cost of operations | 98.3 | 96.2 | 98.9 |

| Provided by: | 2013–14 Budget2 |

2013–14 Actual spending |

2012–13 Actual spending |

|---|---|---|---|

| Main estimates | (84.3) | (84.3) | (84.3) |

| Adjustments and transfers | 0 | (4.0) | (9.5) |

| Services provided without charge | (14.8) | (13.3) | (14.6) |

| Salary accruals and other adjustments | 0 | 0.3 | 3.1 |

| Costs recovered4 | 0.8 | 1.1 | 0.8 |

| Main estimates not used | 0 | (4.0) | (5.6) |

1 The cost of audit services is allocated to each legislative auditing activity.

2 Budget amounts are as reported in our 2013–14 Report on Plans and Priorities (as planned spending 2013–14).

3 This amount includes environmental and territorial government audits and studies, as well as assessment of agency performance reports.

4 The costs recovered include respendable revenue from members of the Canadian Council of Legislative Auditors, to whom we provide professional services, and from the audit of the International Labour Organization, which we audit on a cost-recovery basis.

Exhibit 2—Authorized spending trend

Our main estimates for the 2014–15 fiscal year reflect the implementation of our Strategic and Operating Review proposal to reduce our spending by $6.5 million.

Estimates by vote

For information on the Office of the Auditor General’s organizational votes and statutory expenditures, consult the Public Accounts of Canada 2014 on the Public Works and Government Services Canada website.

Section II—Reporting on Results

Our priorities for the 2013–14 fiscal year

The Office of the Auditor General identified two strategic priorities for the 2013–14 fiscal year:

- continuing to implement our Strategic and Operating Review proposal, and

- renewing our strategic plan.

Continuing to implement our Strategic and Operating Review proposal

As part of Budget 2011, the Government of Canada introduced the Strategic and Operating Review (SOR). Our SOR proposal outlined spending reductions of approximately $6.5 million, which included a 10 percent reduction in our Office staff by the end of the 2014–15 fiscal year.

In the 2013–14 fiscal year, our total number of full-time equivalent employees was 573, which was just under our 2014–15 fiscal year budget of 576. We therefore achieved our targeted SOR staff reduction one year earlier than planned.

Renewing our strategic plan

Through our review of our strategic plan, we identified a new set of strategic objectives (Exhibit 3) and identified four areas for improvement:

- maximizing the value of our audits for our clients,

- streamlining our governance and decision-making practices,

- increasing the empowerment of our staff, and

- ensuring that our compliance with professional standards is achieved economically.

Work in three of these areas began in the 2013–14 fiscal year. We identified initiatives to maximize the value of our audits, such as planning a new annual report to communicate the results of our financial audits to parliamentarians. We made progress on making our governance and decision-making practices more efficient and economical, including reducing the size of our Executive Committee and reviewing the roles and responsibilities of our senior managers. The latter initiative is also a first step toward ensuring that our employees are more empowered in their work.

Exhibit 3—Strategic Framework of the Office of the Auditor General of Canada

Vision

An independent legislative audit office serving Parliament and territorial legislatures, widely respected for the quality and impact of our work

Mission

Contribute to well managed and accountable government for Canadians by providing information, advice and assurance reports; working with legislative auditors, and federal and territorial governments; and being a leader in the legislative auditing profession

Values

The following values define how we conduct our work and ourselves:

- Serving the public interest

- Respectful relationships

- Independence and objectivity

- Trust and integrity

- Commitment to excellence

- Leading by example

Strategic Objectives

Customer Perspective

Be independent, objective, and non-partisan

Report what is working, areas for improvement, and recommendations in a manner that is understandable, timely, fair and adds value

Contribute to the development and adoption of professional standards and best practices

Build and maintain relationships with Parliamentarians and key stakeholders

Financial Perspective

Be a financially well-managed organization accountable for the use of resources entrusted to it

Internal Perspective

Ensure selection and continuance of audit products likely to have significant impact and value

Ensure audit products that comply with professional standards and Office policies in an economical manner

Ensure effective and efficient support services

Ensure effective, efficient and accountable Office governance and management

Learning and Growth Perspective

Ensure a culture of empowerment

Support continuous improvement

Develop and maintain a skilled, motivated and bilingual workforce

Performance by product line

Indicators of impact

We measure our impact and performance for our three main product lines:

- financial audits of Crown corporations, federal and territorial governments, and other organizations;

- performance audits and studies of departments and agencies; and

- special examinations of Crown corporations.

The following sections present the results for each of these product lines during the 2013–14 fiscal year.

Financial audits of Crown corporations, federal and territorial governments, and other organizations

Financial audits answer the following questions:

- Are the annual financial statements of Crown corporations, the federal and territorial governments, and other organizations presented fairly?

- Are these entities complying with their legislative authorities?

Our work adds value for key users of our reports and for the organizations we audit. To help us understand the value perceived in our financial audits, we survey the chairs of audit committees and other bodies responsible for the oversight of financial reporting, and the senior managers in the organizations we audit.

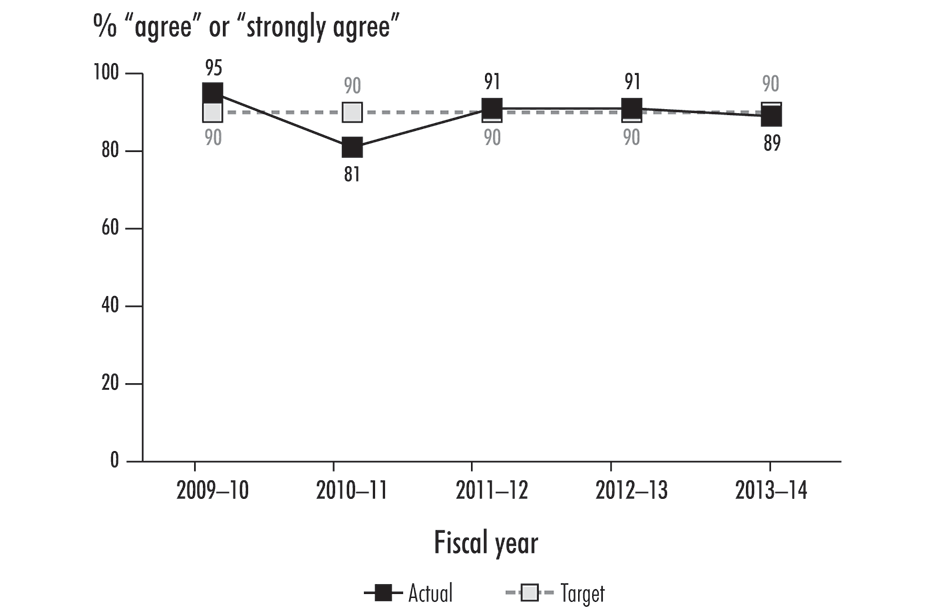

Our target is to have 90 percent of responses from audit committee chairs indicate that our audits add value. In the 2013–14 fiscal year, an average of 89 percent of responses were “agree” or “strongly agree.” This result represents a slight decline from that of 91 percent observed in the two preceding years.

Exhibit 4 shows the trend in responses from audit committee chairs.

Exhibit 4—Financial audits add value for audit committee chairs

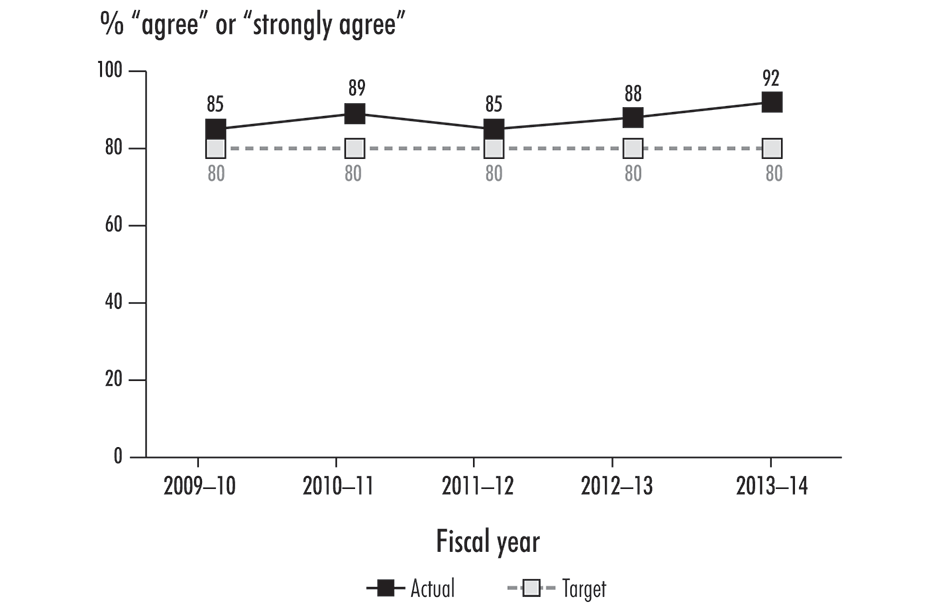

Our target is to have 80 percent of responses from senior managers of Crown corporations and large departments indicate that our financial audits add value. On average, 92 percent of responses from senior managers surveyed in the 2013–14 fiscal year indicate that they “agree” or “strongly agree” that our financial audits add value. This represents an increase over the previous year’s result of 88 percent.

Exhibit 5 shows the trend in responses from senior managers.

Exhibit 5—Financial audits add value for senior management

Key users of our reports and the organizations we audit respond to our findings. For our financial audits, we monitor the corrective action taken by the organizations we audit in response to qualifications and “other matters” contained in our audit reports. Our indicator is the percentage of qualifications and “other matters” that are addressed from one report to the next.

In our financial audit reports, there are three types of qualifications that can be presented, corresponding to the following three circumstances: the financial statements are materially misstated (qualified opinion or adverse opinion); the auditors are unable to obtain sufficient appropriate audit evidence (qualified opinion or disclaimer of opinion); and the organization failed to comply with legislative authorities.

Our reports may also include “other matters”—for example, comments concerning an organization’s financial sustainability or ability to fulfill its mandate.

Exhibit 6 summarizes the qualifications and “other matters” in the financial audit reports we issued in the 2012–13 and 2013–14 fiscal years.

Exhibit 6—Qualifications and “other matters” issued in the financial audit reports for the 2012–13 and 2013–14 fiscal years

| Fiscal year | Number of audit reports that contained qualifications or “other matters” | Total number of qualifications or “other matters” | Qualifications | Number of “other matters” | ||

|---|---|---|---|---|---|---|

| Inability to obtain sufficient appropriate audit evidence | Materially misstated financial statements | Compliance with authorities | ||||

| 2012–13 | 8 | 12 | 3 | 0 | 5 | 4 |

| 2013–14 | 6 | 7 | 1 | 0 | 2 | 4 |

Although we do not control whether organizations respond to our findings, our target is that they address them all. Of the 12 qualifications and “other matters” we reported in the 2012–13 fiscal year, 6 qualifications were for entities that have since been dissolved by the government, and 1 was for an entity for which we no longer issue a separate audit opinion. Of the remaining 5 qualifications, 2 (40 percent) were addressed in the 2013–14 fiscal year, compared with 61 percent the previous year. Of the 3 that were not addressed, 2 were matters of non-compliance with authorities, and 1 reflected our inability to obtain sufficient and appropriate audit evidence for inventory. These compliance qualifications arose in the following jurisdictions: the Northwest Territories (1) and Nunavut (2). Both qualifications that were due to non-compliance with authorities involved the late tabling of annual reports or financial statements (compared with 3 in the 2012–13 fiscal year). With respect to the qualification due to the inability to obtain sufficient and appropriate audit evidence for inventory, the audit entity has commenced recording inventory at some locations and expects to have inventory recorded for all sites within two years.

Performance audits and studies of departments and agencies

Performance audits answer the following questions:

- Are federal government programs well managed?

- Have the programs been run with due regard to economy, efficiency, and their environmental effects?

- Does the government have the means to measure the programs’ effectiveness where it is reasonable and appropriate to do so?

Our Office also conducts studies. Among other things, studies can identify criteria for future audits or document subjects of particular interest to Parliament.

In the 2013–14 fiscal year, we completed 29 performance audits and one study. The performance audits and related work planned for in our 2013–14 Report on Plans and Priorities are listed in Section III—Supplementary Information, along with their planned and actual reporting dates.

Our work adds value for the key users of our reports. We periodically survey the members of parliamentary committees that review our performance audit reports. The most recent survey, conducted for the 2012–13 fiscal year, indicated that 96 percent of parliamentarians surveyed agreed that the work of the Office of the Auditor General is “often” or “almost always” valuable to them.

In 2013–14, we interviewed 21 current or former senators or members of the House of Commons, as part of the updating of our strategic plan. We asked for their feedback regarding the role and impact of our work, the usability of our reports, the credibility of the information provided by the Office, the coverage we provide of the main areas of our mandate, and opportunities for the Office to provide additional value to them. We received positive feedback overall. Several opportunities for the Office to increase the value of its work were also identified, and this information has become important as input to our strategic planning.

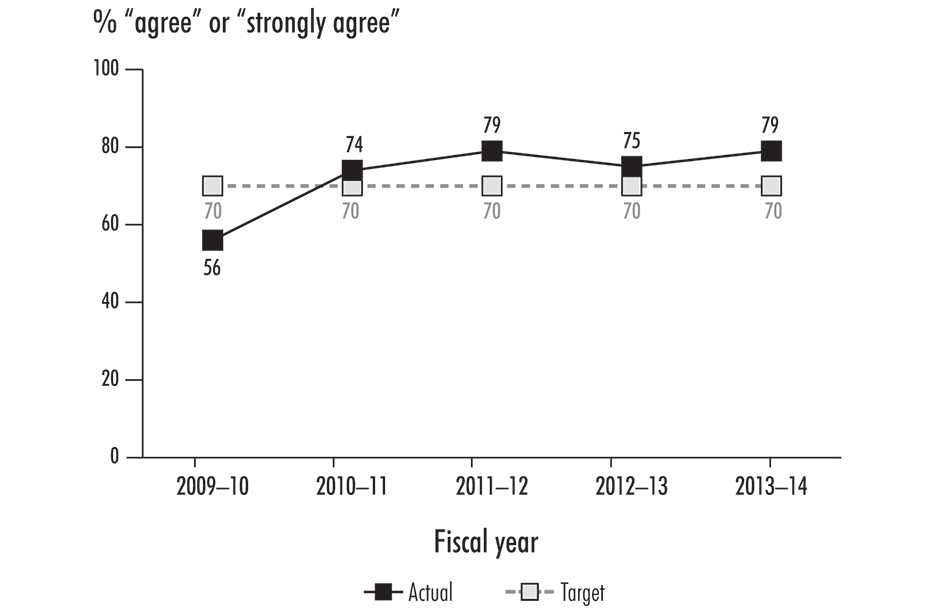

Our work adds value for the organizations we audit. After each performance audit is tabled in Parliament, we survey the senior management of the organizations we have audited. Our target is to have 70 percent of the responses from senior management indicate that they “agree” or “strongly agree” that our performance audits add value for them. For audits completed in the 2013–14 fiscal year, 79 percent of responses from senior managers indicated that they “agree” or “strongly agree” that our audits add value, continuing the positive results of the last three years (Exhibit 7).

Exhibit 7—Performance audits add value for senior management

Key users of our reports are engaged in the audit process. Once our reports are submitted to Parliament, they are referred to the Standing Committee on Public Accounts. The reports of the Commissioner of the Environment and Sustainable Development are referred to the Standing Committee on Environment and Sustainable Development. Although many parliamentary committees draw on our work, the Office’s main relationship is with the Standing Committee on Public Accounts.

Our appearances before committees assist parliamentarians in fulfilling their oversight role and give us the opportunity to increase awareness and understanding of the issues raised in our reports. We therefore monitor the level of involvement of parliamentary committees by tracking the percentage of our audits that are reviewed by committees. We also assess the committees’ level of interest in our reported findings by looking at how frequently they ask us to appear before them to elaborate on our findings.

In the 2013–14 fiscal year, the number of times we appeared before the Standing Committee on Public Accounts remained consistent with the previous two years. However, overall parliamentary committees reviewed 21 percent of our performance audit reports, which is down from 30 percent in the 2012–13 fiscal year, and from 48 percent in the 2011–12 fiscal year. We participated in 23 committee hearings and briefings. This is a decrease from 27 hearings and briefings in the 2012–13 fiscal year and 29 in the 2011–12 fiscal year. The percentage of hearings and briefings we participated in relative to the number of sitting days remained at 21 percent compared with 2012–13, down from 28 percent in 2011–12.

We also participated in seven hearings and briefings in the northern legislative assemblies. It is the norm for the assemblies to hold a hearing on each of the performance audits that are tabled.

Key users of our reports and the organizations we audit respond to our findings. Departments and agencies are responsible for taking corrective action in response to our audit findings. Departmental chief audit executives are responsible for reporting to their departmental audit committee on whether management’s action plans have been implemented and whether there is reason to question the effectiveness of the actions taken. Departmental audit committees are responsible for advising the organization’s deputy head on the effectiveness of arrangements in place for monitoring and following up on management action plans that respond to recommendations from our Office.

Periodically, we follow up on the government’s progress in implementing recommendations we made in previous performance audits. We audit selected recommendations and findings from prior reports to determine if progress in addressing them has been satisfactory. In the 2013–14 fiscal year, we examined the progress made in addressing 10 of our previous recommendations and found it to be satisfactory in 5 instances (50 percent).

Special examinations of Crown corporations

A special examination of a Crown corporation answers the following:

- Do the systems and practices used by Crown corporations provide reasonable assurance that assets are safeguarded and controlled, that resources are managed economically and efficiently, and that operations are carried out effectively?

In the 2013–14 fiscal year, we reported on the special examinations of two Crown corporations: the Canadian Museum of Civilization Corporation (renamed the Canadian Museum of History on 12 December 2013) and the Laurentian Pilotage Authority.

In the 2014 Spring Report of the Auditor General of Canada, Chapter 9, Special Examinations of Crown Corporations—2013, we presented the main points of the special examination reports that were issued to the boards of directors of these audited Crown corporations and that have since been made public. No significant deficiencies were identified in either of these two special examination reports.

Our work adds value for the key users of our reports and for the organizations we audit. To help us understand the value perceived in our special examinations by the users of these reports and by the organizations we audit, we survey board chairs and chief executive officers. For the two special examinations we carried out in the 2013–14 fiscal year, we received responses from one board chair and one senior manager.

Because of the small number of respondents, we do not present detailed results. However, we do follow up when respondents raise issues or identify opportunities to improve our performance. Over the past several years, the feedback we have received has been positive and consistent with our targets.

Key users of our reports and the organizations we audit respond to our findings. We monitor the corrective action taken in response to significant deficiencies reported in our special examinations.

We completed two special examinations in the 2013–14 fiscal year. The Canadian Museum of Civilization Corporation (now the Canadian Museum of History) had no significant deficiencies reported in its 2006 special examination. The Laurentian Pilotage Authority had addressed the significant deficiency reported in its 2005 special examination.

Organizational performance

We measure and manage our performance as an organization in a number of ways. The following section describes our key performance objectives, measures, and targets, along with our results for the 2013–14 fiscal year.

Delivering work on time and on budget

On time

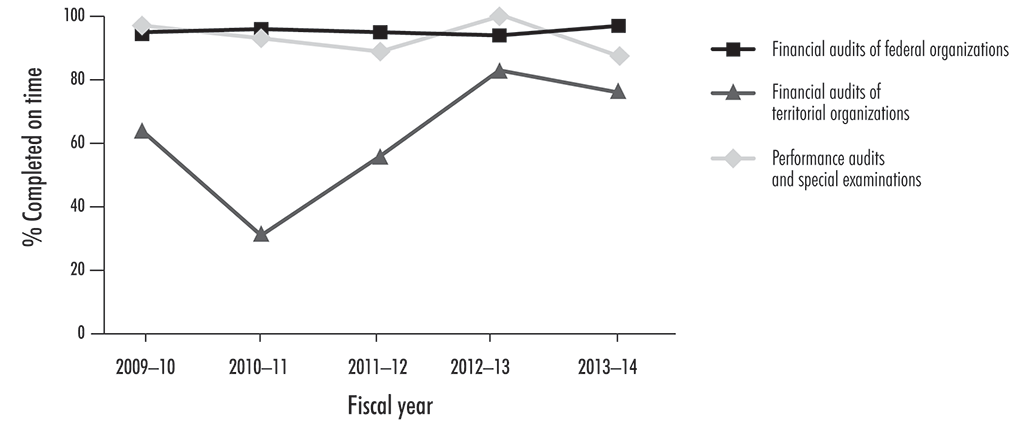

We completed 44 of 46 financial audits of federal Crown corporations on time (96 percent). The audits of the Freshwater Fish Marketing Corporation and Atomic Energy of Canada Limited were not completed on time. For financial audits of other federal organizations with a statutory deadline, we completed all 14 audits on time (100 percent).

For audits of federal organizations without a statutory deadline, we target 150 days after the end of the financial reporting period for the completion of our work. In the 2013–14 fiscal year, we completed all 15 audits on time (100 percent), exceeding our target of 80 percent.

Historically, territorial financial audits have presented some unique challenges. For instance, member of the entity’s management staff have not always been adequately prepared for our audits. In the 2013–14 fiscal year, we completed 16 of these 21 audits on time (76 percent). This result exceeds our target of 60 percent for the second year in a row.

The Office determines when individual performance audit reports will be presented to the House of Commons, as there are no statutory deadlines for these reports. However, we communicate to the House of Commons Standing Committee on Public Accounts our planned schedule for submitting performance audits for the coming fiscal year in our Report on Plans and Priorities and measure our on-time performance against this plan. In the 2013–14 fiscal year, 86 percent of the Office’s performance audits were on time, slightly short of our target of 90 percent.

We reported on all audits planned for the 2013–14 fiscal year except for one, an audit on workforce adjustment measures, which has been cancelled. One additional audit not listed, a follow-up report on child and family services in Nunavut, was completed within the fiscal year. Reports for two planned audits were subsequently presented as multiple chapters, because of the significance of their findings.

The two special examinations that we included in our 2013–14 Report on Plans and Priorities were delivered on or before the statutory deadline, as planned.

The performance audits and related work planned for in our 2013–14 Report on Plans and Priorities are listed in Section III—Supplementary Information, along with their planned and actual reporting dates.

Exhibit 8 shows the trends in our performance for producing our audits on time.

Exhibit 8—Percentage of audits completed on time

On budget

For all of our audits, being “on budget” means completing the audit in no more than 115 percent of the budgeted hours for the audit. This recognizes that factors outside the control of the audit team, such as client readiness and the number and complexity of issues identified, can affect time spent on an audit. It also reflects the balance we want to establish between assuring high-quality work and meeting our budgets.

Our results for the 2013–14 fiscal year were mixed, in that we met only three of our six targets (see Indicator Table 2 in Section III for details). We did not meet our on-budget targets for performance audits and special examinations. For performance audits, our result was significantly affected by three audits with relatively small budgets. For special examinations, the one examination that was over budget had a more decentralized operational management than anticipated.

Exhibit 9 shows the trends in our performance for producing our audits on budget.

Exhibit 9—Percentage of audits completed on budget

Ensuring our audit reports are reliable

Our audit work is guided by a rigorous methodology and System of Quality Control. Annual internal reviews and periodic external peer reviews provide the Auditor General with opinions on whether our audits are conducted in accordance with professional standards and on whether our System of Quality Control is appropriately designed and effectively implemented. Our first annual monitoring report on the design of our System of Quality Control was completed in 2013. Annual internal reviews also conclude on whether the opinions and conclusions contained in our audit reports are appropriate. We report publicly on the results of these reviews in order to provide assurance to parliamentarians and the public that they can rely on the opinions and conclusions contained in our audit reports. The internal audits and reviews completed in the 2013–14 fiscal year are listed in Section III—Supplementary Information.

Internal practice reviews

Each year, we conduct practice reviews of our financial audits, special examinations, and performance audits by assessing whether the audit opinions were appropriate, and whether we complied with our System of Quality Control and with professional standards.

In the 2013–14 fiscal year, we completed 15 practice reviews—7 of financial audits and 8 of direct reporting engagements (performance audits and special examinations). In all cases, we found that the opinions and conclusions expressed in the audit reports were appropriate and supported by proper evidence. In four instances, we found a need to improve the documentation of review by the practitioner at key points in the audit.

External reviews

We periodically seek independent assurance that our System of Quality Control is suitably designed and operating effectively to produce independent, objective, and supportable information that Parliament can rely on to examine the government’s performance and hold it to account. This is done through peer reviews conducted by other national legislative audit offices. The Office has committed to requesting an external peer review at least once during the 10-year mandate of each Auditor General. The most recent peer review was conducted in the 2009–10 fiscal year.

A second type of external review is conducted by the provincial professional accounting bodies, which examine our compliance with professional standards and our training of accounting students. We received reports from two provincial institutes in the 2013–14 fiscal year, both of which concluded that the Office was following professional standards and was meeting the training requirements.

Internal audits

We also audit our management and administrative practices to assure the Auditor General that the Office is complying with government and Office policies. These internal audits also provide managers with assessments and recommendations, and when they are completed, the results are published on our website.

Two internal audits were begun in the 2013–14 fiscal year. Both will be finalized and reported on in the 2014–15 fiscal year.

Providing a respectful workplace

The Office has set three objectives for providing a respectful workplace, each with its own indicators and targets:

- Provide a workplace environment where employees are satisfied and engaged.

- Promote a bilingual workplace.

- Assemble a workforce that represents the Canadian workforce.

We also monitor employee retention.

Satisfied and engaged employees

Employees are provided with timely business-related information and updates on the topics of importance to them, ensuring the flow of communication throughout the Office of the Auditor General. In the 2013–14 fiscal year, the Auditor General met with employees through a series of round-table sessions. The purpose of these sessions was to discuss topics of interest to employees and to identify possible solutions to their concerns. As a result of these discussions, an action register was compiled and posted on the Office’s INTRAnet so that all employees could share the feedback and suggestions. Frequently asked questions were also developed and posted on the INTRAnet so that employees could see questions of interest raised by their colleagues. In addition, a new communications tool—the AG Corner—was developed and made available on the INTRAnet to provide a virtual dialogue with the Office’s Executive Committee.

This past year, employees were consulted on the new strategic plan that is being developed for the Office, and they have been kept informed of the plan’s status. As initiatives are begun or completed in the coming months, employees will be invited to participate in events such as town halls.

Improvements were made to the Audit Practices training curriculum in the 2013–14 fiscal year. In June 2013, a one-day Audit Services Group Exchange event was held to identify and clarify training needs for Audit Services staff. The following gaps were identified through this event: technology-related needs (software and systems used at the Office), better understanding of the audit process for non-auditors, and opportunities to share knowledge among employees in the Audit Services Group and throughout the Office.

A bilingual workforce

The Office demonstrates its commitment to maintaining a bilingual workforce through a variety of initiatives. Our Official Languages (OL) training program includes individual and group classes taught by four full-time instructors, in addition to our structured web-based learning. Our Official Languages subcommittee includes representation from a diverse group of people across the organization. This committee, in collaboration with Human Resources, promotes regular OL awareness-building activities, such as the celebration of Linguistic Duality Day, the Franco-Ontarian Festival, and Saint-Jean-Baptiste Day.

Bilingual capacity in the management group has remained virtually unchanged over the past year, with 82 percent of our senior management group (the Auditor General, assistant auditors general, and principals) meeting the language requirements of their positions in the 2013–14 fiscal year (our target remains 100 percent), compared with 84 percent in the 2012–13 fiscal year. In the 2013–14 fiscal year, 78 percent of directors met the language requirements for their positions, compared with 79 percent in the 2012–13 fiscal year.

A representative workforce

Employment equity is an important underlying value of the Office of the Auditor General of Canada. We are committed to ensuring equal opportunity in our workplace for all employees. Despite the limited recruitment resulting from the Strategic and Operating Review, the Office has largely maintained its internal representation of all four designated groups (women, Aboriginal peoples, persons with disabilities, and persons in a visible minority) through the 2013–14 fiscal year. Our employment equity results for women and Aboriginal peoples continue to exceed our goal of 100 percent of workforce availability, and our representation of persons in a visible minority, expressed as a percentage of workforce availability, has increased by over 9 percentage points since the previous reporting period. A detailed report on employment equity is provided annually to the Treasury Board of Canada Secretariat.

Employee retention

The Office’s retention rate for audit professionals for the 2013–14 fiscal year is 93 percent, which is slightly above our 90 percent target. The need to maintain the right staff complement is addressed every year at both macro and micro levels. An Office-wide capacity review is completed every year as we analyze our needs according to the planned audits. For each audit, professional auditing standards require a review by the responsible principal of the number and expertise of staff assigned to the audit.

Financial performance

Our 2013–14 budgeted cost of operations was $99.1 million. This amount consisted of the $84.3 million provided in Main Estimates, and $14.8 million for services provided by other government organizations without charge.

In the 2013–14 fiscal year, parliamentary appropriations approved totalled $88.3 million (Exhibit 10). This amount comprised $84.3 million in Main Estimates and a further $4.0 million in adjustments and transfers that are routine in nature, such as the carry-forward funding, economic increases, parental leave, and severance payments.

Exhibit 10—Voted and statutory appropriations

| Vote # or statutory item (S) | Vote or statutory wording | 2013–14 ($ millions) | ||

|---|---|---|---|---|

| Main Estimates | Appropriations approved |

Appropriations used |

||

| 15 | Program expenditures | 74.1 | 78.5 | 74.5 |

| (S) | Contributions to employee benefit plans | 10.2 | 9.8 | 9.8 |

| Total | 84.3 | 88.3 | 84.3 | |

The Office used $84.3 million of the parliamentary appropriations approved, which resulted in a lapse of $4.0 million in the 2013–14 fiscal year ($5.6 million in the 2012–13 fiscal year). Like government departments and agencies, the Office may carry forward lapsed amounts and adjustments of up to five percent of its operating budget (based on Main Estimates program expenditures) into the next fiscal year, subject to parliamentary approval.

Sustainable development commitments

Sustainable development requires the integration of environmental, economic, and social considerations in the development and implementation of government programs. The Office’s sustainable development commitments are to further integrate environmental considerations into our audit selection and planning decisions. Our recent results are summarized in Exhibit 11.

Exhibit 11—Selected sustainable development commitments, indicators and targets, and performance

| Commitment | Indicators and targets | 2013–14 Actual |

|---|---|---|

| Prepare a strategic audit plan for sustainable development auditing. | By September 2014, the development of a strategic audit plan for sustainable development work for the Office as a whole that identifies audit and non-audit products for addressing sustainable development risks and improving how the federal government manages sustainable development issues. | N/A1 |

| Use the Office’s environmental risk assessment guide (4th E Practice Guide) when preparing individual performance audits. | 100% of performance audit teams use the 4th E Practice Guide’s screening tool and consult with internal environmental specialists to determine if there are any important environmental issues related to their audit topics. | 100% |

| Provide enhanced support and advice to audit teams that conduct special examinations in which important environmental risks for Crown corporations have been identified. | 100% of these audit teams receive enhanced support and advice. | 100% |

1Target established in the 2013–14 fiscal year as part of the Office’s 2014–16 Sustainable Development Strategy.

Our international contribution

Our international strategy guides our international activities and positions the Office to meet future opportunities and challenges. The Office plays an active role in shaping professional accounting and auditing standards, particularly as they relate to the public sector. A senior member of the Office was appointed to the International Public Sector Accounting Standards Board, which develops accounting standards for use by public sector entities around the world for preparation of general-purpose financial statements.

Canada is one of 192 member countries in the International Organization of Supreme Audit Institutions (INTOSAI)—an umbrella organization for the external government auditing community. The Office participates in a number of its working groups and subcommittees, including the

- Subcommittee on Financial Audit,

- Subcommittee on Performance Audit,

- Working Group on Environmental Auditing,

- Working Group on Financial Modernization and Regulatory Reform, and

- Working Group on the Value and Benefits of Supreme Audit Institutions.

The Office, represented by the Auditor General, is the Chair of the Subcommittee on Accounting and Reporting of INTOSAI. The Auditor General is also a member of the Board of the INTOSAI Development Initiative, which is the group responsible for coordinating capacity building within INTOSAI.

Building capabilities and professional capacities of audit offices

During the 2013–14 fiscal year, the Office continued its efforts to help build capacity in audit institutions in French sub-Saharan Africa, through partnerships with the Department of Foreign Affairs, Trade and Development Canada (DFATD) and two executing agencies. One assistance project ended in July 2013, and another, temporarily suspended following political unrest, was reinstated in February 2014. We also continued to provide training to auditors from other national audit offices through a program administered by the Canadian Comprehensive Auditing Foundation. This DFATD-funded program, which was established in 1980, brings auditors from other national audit offices to Canada for 10 months of training in performance auditing, accountability, and governance.

Promoting better managed and accountable international institutions

The Office is the external auditor of the International Labour Organization until 2015. In past years, the Office was the external auditor of a number of United Nations organizations. Since December 2013, the Auditor General has chaired the UN Panel of External Auditors. A representative from the Office also chairs the Technical Group of the Panel.

Section III—Supplementary Information

Financial statements

Statement of Management Responsibility

Including Internal Control Over Financial Reporting

Management of the Office of the Auditor General of Canada is responsible for the preparation of the accompanying financial statements for the year ended 31 March 2014 and for all information contained in these statements. These financial statements have been prepared by management in accordance with Canadian public sector accounting standards.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management’s best estimates and judgment, and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the Office’s financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada, and included in the Office’s Departmental Performance Report, is consistent with these audited financial statements.

Management is also responsible for maintaining an effective system of internal control over financial reporting (ICFR), which is designed to provide reasonable assurance that financial information is reliable; that assets are safeguarded; and that transactions are properly authorized and recorded in accordance with the Financial Administration Act and other applicable legislation, regulations, authorities and policies.

Management seeks to ensure the objectivity and integrity of data in its financial statements through the careful selection, training, and development of qualified staff; through organizational arrangements that provide appropriate divisions of responsibility; through communications aimed at ensuring that regulations, policies, standards, and managerial authorities are understood throughout the Office; and through an annual assessment of the effectiveness of the system of internal control over financial reporting.

The system of ICFR is designed to mitigate risks to a reasonable level and may not prevent or detect misstatements. It is based on an ongoing process designed to identify and prioritize key risks, to assess effectiveness of associated key controls, and to make any necessary adjustments.

The effectiveness and adequacy of the Office’s system of internal control are reviewed through the work of internal audit staff who conduct periodic audits of different areas of the Office’s operations. Also, financial services staff annually monitor internal control over financial reporting. As a basis for recommending approval of the financial statements to the Executive Committee, the Office’s Audit Committee reviews management’s arrangements for internal controls and the accounting policies employed by the Office for financial reporting purposes. The Audit Committee also meets independently with the Office’s internal and external auditors to consider the results of their work.

A risk-based assessment of the system of internal control over financial reporting for the year ended 31 March 2014 was completed in accordance with the Treasury Board Policy on Internal Control. The results and action plans are summarized in the 2013–14 Annex to the Statement of Management Responsibility, Including Internal Control over Financial Reporting.

Collins Barrow Ottawa LLP Chartered Accountants, Licensed Public Accountants, the independent auditor for the Office of the Auditor General of Canada, has expressed an opinion on the fair presentation of the financial statements of the Office in conformity with Canadian public sector accounting standards, which does not include an audit opinion on the annual assessment of the effectiveness of the Office’s internal control over financial reporting.

[Original signed by]

Michael Ferguson, CPA, CA

FCA (New Brunswick)

Auditor General of Canada

[Original signed by]

Sylvain Ricard, CPA, CA

Assistant Auditor General and

Chief Financial Officer

Ottawa, Canada

14 July 2014

Independent Auditor’s Report

To the Speaker of the House of Commons:

Report on the Financial Statements

We have audited the accompanying financial statements of the Office of the Auditor General of Canada, which comprise the statement of financial position as at 31 March 2014, and the statements of operations, change in net debt and cash flow for the year then ended, and a summary of significant accounting policies and other explanatory information.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with Canadian public sector accounting standards and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Canadian generally accepted auditing standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Office of the Auditor General of Canada as at 31 March 2014, and the results of its operations, the change in its net debt and its cash flows for the year then ended in accordance with Canadian public sector accounting standards.

Report on Other Legal and Regulatory Requirements

In our opinion, the transactions of the Office of the Auditor General of Canada that have come to our notice during our audit of the financial statements have, in all significant respects, been in accordance with the Financial Administration Act and regulations and the Auditor General Act.

Other Matter

The financial statements of the Office of the Auditor General of Canada for the year ended 31 March 2013 (prior to the reclassification of prior year figures) were audited by another auditor who expressed an unmodified opinion on those financial statements on 31 July 2013.

[Original signed by]

Collins Barrow Ottawa LLP

Chartered Accountants, Licensed Public Accountants

14 July 2014

Ottawa, Canada

Office of the Auditor General of Canada

Statement of Financial Position

as at 31 March

| 2014 | 2013 | |

|---|---|---|

| Financial assets | ||

|

Due from the Consolidated Revenue Fund

|

6,686 | 8,069 |

|

Accounts receivable

|

1,072 | 777 |

| 7,758 | 8,846 | |

| Liabilities | ||

|

Accounts payable and accrued liabilities

|

||

|

Due to employees

|

3,874 | 3,567 |

|

Due to others

|

2,415 | 3,411 |

|

Vacation pay

|

3,612 | 3,618 |

|

Post-employment benefits and compensated absences (note 4)

|

9,799 | 10,823 |

| 19,700 | 21,419 | |

| Net debt | (11,942) | (12,573) |

| Non-financial assets | ||

|

Tangible capital assets (note 5)

|

2,470 | 1,828 |

|

Prepaid expenses

|

371 | 288 |

| 2,841 | 2,116 | |

| Accumulated deficit | (9,101) | (10,457) |

The accompanying notes are an integral part of these financial statements.

Approved by

[Original signed by]

Michael Ferguson, CPA, CA

FCA (New Brunswick)

Auditor General of Canada

[Original signed by]

Sylvain Ricard, CPA, CA

Assistant Auditor General and

Chief Financial Officer

Office of the Auditor General of Canada

Statement of Operations

for the year ended 31 March

| 2014 | 2014 | 2013 | |

|---|---|---|---|

| Budget (Note 10) |

Actual | Actual | |

| Expenses (note 6) | |||

|

Financial audits of Crown corporations, territorial governments, other organizations, and the summary financial statements of the Government of Canada

|

42,500 | 41,656 | 45,149 |

|

Performance audits and studies

|

38,500 | 41,205 | 39,577 |

|

Special examinations of Crown corporations

|

5,900 | 3,297 | 2,846 |

|

Sustainable development monitoring activities and environmental petitions

|

1,500 | 1,615 | 1,833 |

|

Assessments of agency performance reports

|

– | – | 209 |

|

Professional practices (note 7)

|

10,700 | 9,513 | 10,094 |

| Total cost of operations | 99,100 | 97,286 | 99,708 |

| Costs recovered | |||

|

International audits

|

800 | 1,023 | 778 |

|

Other

|

100 | 447 | 199 |

|

Costs recovered not available for use

|

(100) | (413) | (160) |

| Net costs recovered | 800 | 1,057 | 817 |

| Net cost of operations | 98,300 | 96,229 | 98,891 |

| Government funding | |||

|

Parliamentary appropriations used (note 3)

|

84,300 | 84,265 | 88,210 |

|

Services provided without charge (note 8)

|

14,800 | 13,320 | 14,615 |

| 99,100 | 97,585 | 102,825 | |

| Annual surplus | 800 | 1,356 | 3,934 |

| Accumulated deficit, beginning of year | (10,457) | (10,457) | (14,391) |

| Accumulated deficit, end of year | (9,657) | (9,101) | (10,457) |

The accompanying notes are an integral part of these financial statements.

Office of the Auditor General of Canada

Statement of Change in Net Debt

for the year ended 31 March

| 2014 | 2014 | 2013 | |

|---|---|---|---|

| Budget (Note 10) |

Actual | Actual | |

| Annual surplus | 800 | 1,356 | 3,934 |

| Acquisitions of tangible capital assets | (400) | (1,420) | (531) |

| Amortization of tangible capital assets | 600 | 751 | 972 |

| Net loss on disposal of tangible capital assets | – | 27 | 28 |

| 1,000 | 714 | 4,403 | |

| Acquisition of prepaid expenses | (290) | (371) | (288) |

| Use of prepaid expenses | 300 | 288 | 314 |

| 10 | (83) | 26 | |

| Decrease in net debt, during the year | 1,010 | 631 | 4,429 |

| Net debt, beginning of year | (12,573) | (12,573) | (17,002) |

| Net debt, end of year | (11,563) | (11,942) | (12,573) |

The accompanying notes are an integral part of these financial statements.

Office of the Auditor General of Canada

Statement of Cash Flow

for the year ended 31 March

| 2014 | 2013 | |

|---|---|---|

| Operating transactions | ||

|

Cash paid for

|

||

|

Employee salaries, wages, and benefits

|

(65,472) | (68,878) |

|

Statutory contributions to employee benefit plans

|

(10,233) | (10,435) |

|

Materials, supplies, and services

|

(10,041) | (7,986) |

|

Services provided by related parties

|

(1,920) | (1,974) |

|

Other

|

(413) | (160) |

| (88,079) | (89,433) | |

|

Cash received from

|

||

|

Salaries and benefits recovered

|

982 | 1,183 |

|

International audits

|

964 | 869 |

|

Other

|

1,905 | 1,201 |

| 3,851 | 3,253 | |

|

Parliamentary appropriations used (note 3)

|

84,265 | 88,210 |

| 88,116 | 91,463 | |

|

Cash provided/(used) by operating transactions

|

37 | 2,030 |

| Capital transactions | ||

|

Cash used to acquire tangible capital assets

|

(1,420) | (531) |

|

Cash applied to capital transactions

|

(1,420) | (531) |

| Increase/(Decrease) in Due from the Consolidated Revenue Fund | (1,383) | 1,499 |

| Due from the Consolidated Revenue Fund, beginning of year | 8,069 | 6,570 |

| Due from the Consolidated Revenue Fund, end of year | 6,686 | 8,069 |

The accompanying notes are an integral part of these financial statements.

Office of the Auditor General of Canada

Notes to the financial statements for the year ended 31 March 2014

1. Authority and objective

The Auditor General Act, the Financial Administration Act, and a variety of other acts and orders-in-council set out the duties of the Auditor General and the Commissioner of the Environment and Sustainable Development. These duties relate to legislative auditing of federal departments and agencies, Crown corporations, territorial governments, other organizations, and one international organization.

The program activity of the Office of the Auditor General of Canada is legislative auditing and consists of performance audits and studies of departments and agencies; the audit of the summary financial statements of the Government of Canada; financial audits of Crown corporations, territorial governments, and other organizations; special examinations of Crown corporations; sustainable development monitoring activities and environmental petitions.

The Office is funded through annual appropriations received from the Parliament of Canada and is not taxable under the provisions of the Income Tax Act.

Pursuant to the Financial Administration Act, the Office is a department of the Government of Canada for the purposes of that Act and is listed in Schedule I.1, and is a separate agency for the purposes of Schedule V.

2. Significant accounting policies

a) Basis of presentation

The financial statements of the Office have been prepared by management in accordance with Canadian public sector accounting standards.

b) Parliamentary appropriations

The Office’s annual parliamentary appropriations are reported directly in the statement of operations in the fiscal year for which they are approved by Parliament and used by the Office.

c) Costs recovered

The costs of audits are paid from monies appropriated by Parliament to the Office. However, fees for international audits recover the direct costs incurred and are recognized in the period the audit services are provided. Amounts recovered are available for use by the Office. Other costs recovered represent audit professional services provided to members of the Canadian Council of Legislative Auditors (CCOLA), and other refunds and adjustments. Direct salary and other costs recovered from members of CCOLA are also available for use by the Office.

d) Due from the Consolidated Revenue Fund

The financial transactions of the Office are processed through the Consolidated Revenue Fund of the Government of Canada. The “Due from the Consolidated Revenue Fund” balance represents the amount of cash that the Office is entitled to draw from the Consolidated Revenue Fund, without further appropriations, in order to discharge its liabilities.

e) Accounts receivable

Accounts receivable are stated at the lower of cost and amounts the Office is reasonably assured to receive; a provision for bad debt is made where recovery is considered uncertain.

f) Tangible capital assets

Tangible capital assets are recorded at historical cost less accumulated amortization. The Office capitalizes the costs associated with the development of software used internally including software licences, installation costs, professional service contract costs, and salary costs of employees directly associated with these projects. The costs of software maintenance, project management and administration, data conversion, and training and development are expensed in the year incurred.

Amortization of tangible capital assets begins when assets are put into use and is recorded using the straight-line method over the estimated useful lives of the assets as follows:

| Tangible capital assets | Useful life |

|---|---|

| Leasehold improvements | 10 years |

| Informatics software | 3 years |

| Furniture and fixtures | 7 years |

| Informatics Hardware and Infrastructure | 3 years |

| Office equipment | 4 years |

| Motor vehicle | 5 years |

g) Accounts payable and accrued liabilities

i) Due to employees

Amounts due to employees represent obligations of the Office for salary and wages using the employees’ salary levels at year end. These amounts are funded through parliamentary appropriations.

ii) Due to others

Amounts due to others represent obligations of the Office for material and supply purchases and for the cost of services rendered to the Office. These amounts are funded through parliamentary appropriations.

iii) Vacation pay

Vacation pay is expensed as benefits accrue to employees under their respective terms of employment using the employees’ salary levels at year end. Vacation pay liabilities represent obligations of the Office that are funded through parliamentary appropriations.

h) Net debt

The net debt is calculated as the difference between liabilities and financial assets. Post-employment benefits and compensated absences represent the most significant component of net debt as these obligations are paid from future parliamentary appropriations.

i) Accumulated deficit

The accumulated deficit represents liabilities incurred by the Office, net of tangible capital assets and prepaid expenses that have not yet been funded through appropriations. Significant components of this amount are post-employment benefits, compensated absences, and vacation pay liabilities.

j) Retirement benefits, post-employment benefits and compensated absences

i) Retirement benefits

All eligible employees participate in the Public Service Pension Plan, a plan administered by the Government of Canada. The Office’s contributions are currently based on a multiple of an employee’s required contributions and may change over time, depending on the experience of the Plan. The Office’s contributions are expensed during the year in which the services are rendered and represent its total pension obligation. The Office is not currently required to make contributions with respect to any actuarial deficiencies of the Public Service Pension Plan.

ii) Post-employment benefits

The accumulation of severance benefits for employees ceased in the 2012–13 fiscal year. Management has determined the accrued benefit obligation using the employees’ salary at year end and the number of weeks earned but unpaid. The Office’s severance benefits are not pre-funded and will be paid from future appropriations.

iii) Compensated absences

Employees are entitled to sick leave benefits that accumulate but do not vest. The benefits are earned based on employee services rendered and are paid upon an illness- or injury-related absence. The obligation and the benefit expenses are actuarially determined and are recorded based on the expected future use of the benefits. The Office’s compensated absences will be paid from future appropriations.

Employees are entitled to maternity/parental leave benefits as provided for under labour contracts and conditions of employment. The benefits earned are event driven meaning the Office’s obligation for the cost of the entire benefit arises upon occurrence of a specific event being the commencement of the maternity/parental leave. Management has determined the accrued benefit obligation and benefit expenses based on its best estimates. The unpaid portion of maternity/parental leave at year-end will be paid from future appropriations.

k) Services provided without charge by other government departments