Office of the Auditor General of Canada—2015–16 Performance Report

Office of the Auditor General of Canada—2015–16 Performance Report

Message from the Auditor General of Canada

I am pleased to present the 2015–16 Performance Report of the Office of the Auditor General of Canada.

Our strategic outcome is to contribute to well-managed government programs and better government accountability to Parliament through our legislative audit work.

In the 2015–16 fiscal year, parliamentary committees reviewed 55 percent of our performance audit reports, up from 44 percent in the 2014–15 fiscal year and 31 percent in the 2013–14 fiscal year. When the Office and senior representatives of the organizations we audit appear before parliamentary committees, the value of our work increases.

Our surveys tell us that audit committee chairs and senior managers of the organizations for which we perform financial statement audits continue to believe that our audits are understandable, fair, timely, and add value. For senior managers in the organizations that are the subject of our performance audits, results are improving though they are still below our target. We remain confident in our audit selection and reporting processes, while we are making improvements by communicating our findings and recommendations earlier in the audit.

We are reporting for the first time this year on whether our clients and senior managers in the organizations we audit find that we are independent, objective, and non-partisan in the conduct of our work. The responses for both groups exceeded our targets.

Our strategic priorities for the 2015–16 fiscal year were internally focused and were

- ensuring effective, efficient, and accountable Office governance and management;

- developing and maintaining a skilled, engaged, and bilingual workforce; and

- ensuring a culture of empowerment.

As this report indicates, we have made good progress on each of these priorities.

The staff of the Office has seen considerable change this year, including a reduction in the number of members of the Office’s Executive Committee, the implementation of new senior audit roles and responsibilities, and the new Canadian Standard on Assurance Engagements (CSAE) 3001—Direct Engagements. I am sincerely grateful for the hard work of staff members, as well as the dedication that they show to the Office and to their task of serving Parliament and all Canadians.

[Original signed by]

Michael Ferguson, CPA, CA

FCA (New Brunswick)

Auditor General of Canada

16 September 2016

Results Highlights

In the 2015–16 fiscal year, the Office of the Auditor General of Canada had a net cost of operations of $90.7 million and used 546 of its planned 557 full-time equivalent employees.

With these resources, we completed

- 88 financial audits of the federal government, territorial governments, and Crown corporations;

- 14 performance audits from the Auditor General of federal government activities and programs;

- 3 performance audits from the Commissioner of the Environment and Sustainable Development, including a report on departmental progress in implementing sustainable development strategies;

- the Commissioner’s annual report on environmental petitions;

- 4 special examinations of Crown corporations; and

- the report of our audit of senators’ expenses.

Section I—Organizational Overview

Organizational profile

Year established: 1878

Auditor General of Canada: Michael Ferguson, CPA, CA, FCA (New Brunswick)

Main legislative authorities:

Auditor General Act, R.S.C. 1985, c. A-17

Financial Administration Act, R.S.C. 1985, c. F-11

Minister: The Honourable William F. Morneau, P.C., M.P., Minister of Finance

The Auditor General acts independently in the execution of his audit responsibilities, but reports to Parliament on expenditures through the Minister of Finance.

Organizational context

Raison d’être

The Office of the Auditor General of Canada is the legislative auditor of the federal government. We are also the legislative auditor of the three territories (the Northwest Territories, Nunavut, and Yukon). The Auditor General is an Officer of Parliament who is independent of the government and reports directly to Parliament. The Commissioner of the Environment and Sustainable Development assists the Auditor General in performing duties related to the environment and sustainable development. Our independent audits and studies provide objective information, advice, and assurance to Parliament, territorial legislatures, boards of directors of Crown corporations, audit committees, governments, and Canadians. With our reports and testimony at parliamentary hearings, we assist Parliament and territorial legislatures in their work on the authorization and oversight of government spending and operations.

Responsibilities

Financial audits of Crown corporations, federal and territorial governments, and other organizations

We audit the summary financial statements of the Government of Canada and each of the three territories, as well as the financial statements of federal and territorial Crown corporations and other organizations. Our financial audits provide assurance that financial statements are presented fairly in accordance with the applicable financial reporting framework. Where required, we provide assurance that the organizations we audit comply, in all significant respects, with legislative authorities that are relevant to a financial audit.

If issues or opportunities for improvement in areas such as financial reporting and internal controls come to our attention during our financial audit work, we make recommendations to management. We also provide information and advice to help audit committees meet their responsibilities for the oversight of financial reporting and internal control.

Performance audits and studies of departments and agencies

Performance audits examine, against established criteria, whether government programs are being managed with due regard to economy, efficiency, and environmental impact, and whether the government has the means to measure and report on their effectiveness. Our reports contain recommendations for improving program management.

The Auditor General Act gives the Office of the Auditor General of Canada the discretion to determine which areas of government it will examine in its performance audits. We may decide to audit a single government program or activity, an area of responsibility that involves several departments or agencies, or an issue that affects many departments and agencies. We consider requests for audits that we receive from parliamentary committees. However, the final decision about what to audit is made by the Auditor General.

Special examinations of Crown corporations

Our special examinations assess the systems and practices maintained by Crown corporations. A special examination provides Parliament and the corporation’s board of directors with an opinion on whether there is reasonable assurance that there are no significant deficiencies in the corporation’s systems and practices that we selected for examination. These examinations focus on whether a corporation’s systems and practices provide reasonable assurance that

- its assets are safeguarded and controlled,

- its resources are managed economically and efficiently, and

- its operations are carried out effectively.

In addition to reporting on significant deficiencies, our special examinations highlight systems and practices that contribute to success. The special examinations also provide information and recommendations to boards of directors about opportunities for improvement.

All parent Crown corporations except two are subject to a special examination by the Office, to be conducted at least once every 10 years. The two exceptions are the Bank of Canada, which is exempt from this requirement, and the Canada Pension Plan Investment Board, which (under the Canada Pension Plan Investment Board Act) is subject to a special examination by an auditor who is chosen by the board of directors.

Sustainable development activities

The Commissioner of the Environment and Sustainable Development monitors the sustainable development strategies of federal departments, assesses the quality of these strategies, and examines whether the plans set out in the strategies have been implemented. The Commissioner reports to Parliament on the fairness of the information in the progress report that the federal government provides on the Federal Sustainable Development Strategy.

The Commissioner also conducts performance audits to monitor the government’s management of environmental and sustainable development issues and, on behalf of the Auditor General, reports to Parliament on issues that should be brought to its attention.

In addition, the Commissioner administers the environmental petitions process, as required by the Auditor General Act. This includes monitoring responses to environmental petitions and reporting annually to Parliament on petition activities from the previous year, including instances in which ministers did not respond to petitions within the 120-day time limit specified in legislation. The Office considers issues raised in petitions when it plans future audits.

Public Servants Disclosure Protection Act investigations

Under the Public Servants Disclosure Protection Act, the Auditor General has the mandate to investigate disclosures by public servants of wrongdoing that concerns the Office of the Public Sector Integrity Commissioner of Canada. If we determine that allegations of wrongdoing are founded, we must submit a case report to Parliament.

Other activities

Contributing to the profession

The Office of the Auditor General of Canada works with other legislative audit offices and professional standard–setting bodies to advance legislative auditing methodology, accounting and auditing standards, and best practices.

Canada is one of 192 member countries in the International Organization of Supreme Audit Institutions (INTOSAI)—an umbrella organization for the external government auditing community. The Office participates in a number of INTOSAI’s working groups and subcommittees.

We also participate in external peer reviews of other national legislative audit offices and are the subject of external peer reviews.

Building capabilities and professional capacities of audit offices

During the 2015–16 fiscal year, we provided training to auditors from a number of other national audit offices, including through a program funded by Global Affairs Canada and administered by CCAF-FCVI.

Promoting better-managed and accountable international institutions

The Office was the external auditor of the International Labour Organization until the December 2015 fiscal year-end and was appointed as the external auditor of INTERPOL for a three-year term, starting 1 April 2016. Beginning in January 2014, the Auditor General had a two-year mandate to chair the United Nations Panel of External Auditors, and a representative from the Office chaired the Panel’s Technical Group.

Strategic outcome

The strategic outcome of the Office is to contribute to well-managed government programs and better government accountability to Parliament through our legislative auditing work.

Operating environment

Two major external influences affected the Office’s operations in the 2015–16 fiscal year. First, the Senate of Canada requested that the Office conduct an audit of senators’ expenses, which required a significant reallocation of resources. Second, the new Canadian Standard for Assurance Engagements (CSAE) 3001—Direct Engagements required a major update of our performance audit methodology and training.

Internally, we implemented new senior management roles and responsibilities for audit operations, and completed the merger of our performance audit and special examination methodologies.

Organizational priorities

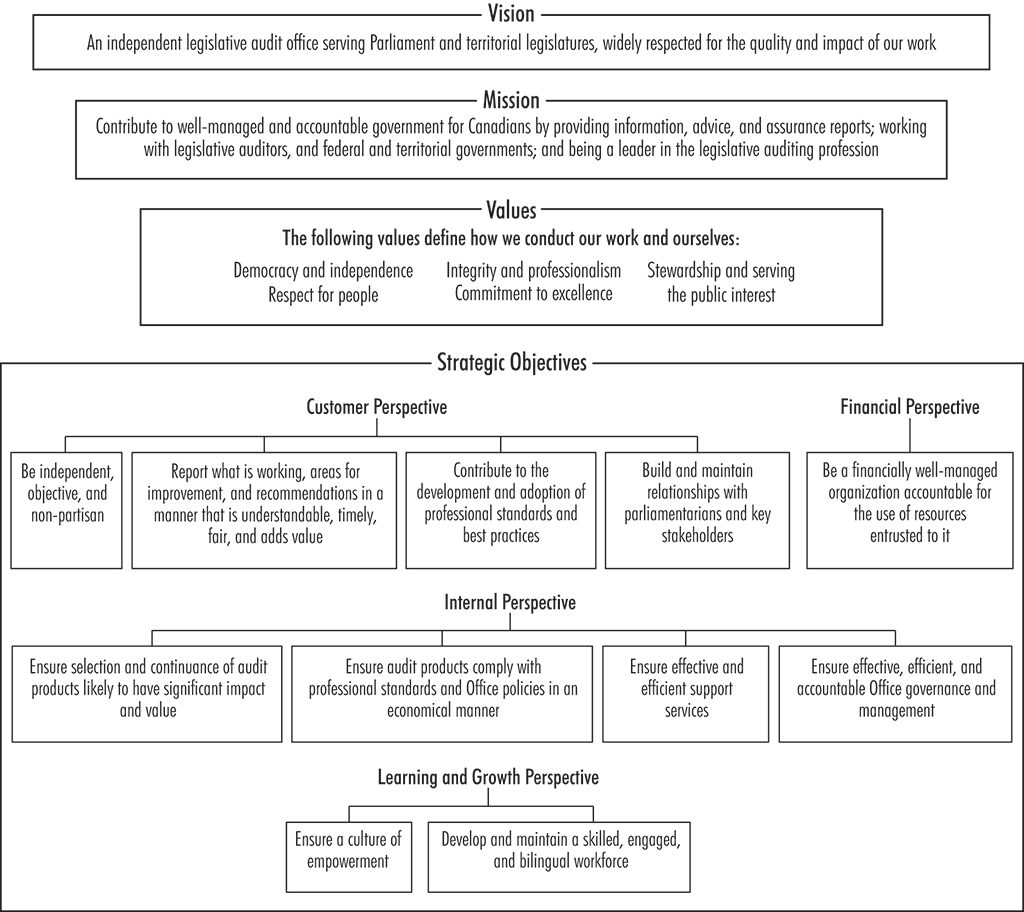

Our strategic framework articulates the objectives that we use to set our priorities, assess our performance, and support the continuous improvement of the Office (Exhibit 1).

Exhibit 1—Strategic Framework of the Office of the Auditor General of Canada

Exhibit 1—Text version

Vision

An independent legislative audit office serving Parliament and territorial legislatures, widely respected for the quality and impact of our work

Mission

Contribute to well-managed and accountable government for Canadians by providing information, advice, and assurance reports; working with legislative auditors, and federal and territorial governments; and being a leader in the legislative auditing profession

Values

The following values define how we conduct our work and ourselves:

- Democracy and independence

- Respect for people

- Integrity and professionalism

- Commitment to excellence

- Stewardship and serving the public interest

Strategic Objectives

Customer Perspective

Be independent, objective, and non-partisan

Report what is working, areas for improvement, and recommendations in a manner that is understandable, timely, fair, and adds value

Contribute to the development and adoption of professional standards and best practices

Build and maintain relationships with parliamentarians and key stakeholders

Financial Perspective

Be a financially well-managed organization accountable for the use of resources entrusted to it

Internal Perspective

Ensure selection and continuance of audit products likely to have significant impact and value

Ensure audit products comply with professional standards and Office policies in an economical manner

Ensure effective and efficient support services

Ensure effective, efficient, and accountable Office governance and management

Learning and Growth Perspective

Ensure a culture of empowerment

Develop and maintain a skilled, engaged, and bilingual workforce

For the 2015–16 fiscal year, we identified three priorities (exhibits 2 to 4):

- ensuring effective, efficient, and accountable Office governance and management;

- developing and maintaining a skilled, engaged, and bilingual workforce; and

- ensuring a culture of empowerment.

Exhibit 2—Progress on the Office governance and management priority

Strategic objective

Ensure effective, efficient, and accountable Office governance and management.

Description

Make our governance and decision-making practices as efficient and effective as possible.

Progress

In 2015, we completed the review of our governance framework and began implementing new roles and responsibilities for our senior managers in audit operations. On 1 January 2016, we made these roles and responsibilities fully operational, as planned. We began the 2015–16 fiscal year with 14 members on our Executive Committee and ended with 11. Later in 2016, we plan to further reduce the Committee by 2 members to reach our goal of a 9-member Committee.

Exhibit 3—Progress on the workforce priority

Strategic objective

Develop and maintain a skilled, engaged, and bilingual workforce.

Description

Provide our employees with the training, professional development opportunities, and workplace environment they need to support their technical development, engagement, and use of both official languages.

Progress

We updated our professional development plan, including our Policy on Learning and Professional Development and the related directives, to support the development of our employees’ skills. We will begin monitoring participation in our core curriculum courses in 2016. We finalized our Bilingualism in the Workplace Strategy to ensure that members of our staff are supported in meeting the language requirements of their positions. With respect to engagement, we launched virtual town halls (hosted by the Auditor General) and a collaborative web tool that provided forums where employees could interact and discuss topics of shared interest.

Exhibit 4—Progress on the empowerment priority

Strategic objective

Ensure a culture of empowerment.

Description

Empower our employees to make decisions about their work so that decision making can occur at the most appropriate level in the organization.

Progress

We launched the Office’s Leadership Contract, a tool that supports senior managers in the Office as they work together to continuously enhance the efficiency, quality, and impact of our work. We offered staff members a number of professional development courses on empowerment-related topics, such as delegation and coaching. We also began preparing empowerment workshops for all employees, which will start in June 2016.

Section II—Expenditure Summary

The Office of the Auditor General of Canada reports information about its expenditures on its website. This information includes all travel and hospitality expenses of the Auditor General, the Commissioner of the Environment and Sustainable Development, and all assistant auditors general. It also includes information about contracts valued at more than $10,000, quarterly financial reports, and annual audited financial statements.

Net cost of operations and related government funding

For the 2015–16 fiscal year, the Office’s net cost of operations was $90.7 million, compared with planned spending of $94.4 million. The decrease between planned and actual spending is due mainly to fewer full-time equivalent employees used than planned, and a year-end adjustment to the employee benefit plans rate. Details of our spending for the 2015–16 fiscal year can be seen in the statement of operations in our audited financial statements, which are included later in this section. The net cost of operations was funded by parliamentary authorities and by services provided without charge from other government departments. In the 2015–16 fiscal year, we used $77.7 million of parliamentary authorities, and we received $12.9 million in services provided without charge from other government departments.

Parliamentary authorities provided and used

Parliament provided the Office with up to $81.8 million in parliamentary authorities, which consisted of $78.3 million in Main Estimates authorities and $3.5 million in adjustments and transfers that for the most part are routine in nature, such as carry-forward funding, parental leave benefits, and severance payments (Exhibit 5).

Exhibit 5—Authorities provided and used (millions of dollars)

| Authorities provided | Authorities used | ||||

|---|---|---|---|---|---|

| Main Estimates | Adjustments | Total authorities available for use in 2015–16 |

2015–16 | 2014–15 | 2013–14 |

| 78.3 | 3.5 | 81.8 | 77.7 | 81.8 | 84.3 |

In the 2015–16 fiscal year, $77.7 million was charged against our total parliamentary authorities of $81.8 million. This resulted in the lapsing of $4.1 million of the Office’s parliamentary authorities provided in the 2015–16 fiscal year. The Office may carry forward lapsed authorities of up to 5 percent of its operating budget (based on Main Estimates program expenditures) into the next fiscal year, subject to parliamentary approval. The lapsed amount expected to be carried forward is $3.5 million.

The basis to determine parliamentary authorities used is not the same as the accrual accounting basis used to record the cost of operations in our financial statements. Some items recognized as expenses on the statement of operations were funded in prior years (for example, the annual amortization of capital assets). Other items will be funded by future years’ authorities (for example, severance and sick leave benefits). These differences resulted in an annual deficit of $0.1 million being recorded in our financial statements for the 2015–16 fiscal year.

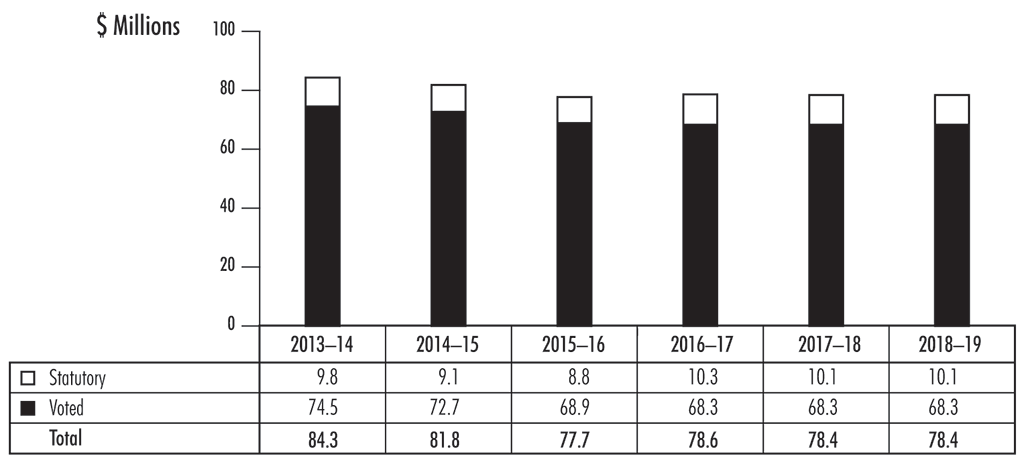

Exhibit 6 shows the trend in our spending based on parliamentary authorities used, a decrease that reflects the planned reductions from our Strategic and Operating Review proposal.

Exhibit 6—Trend in authorities used

Note: Amounts for the 2016–19 fiscal years reflect parliamentary authorities provided through Main Estimates.

Exhibit 6—Text version

| 2013–14 | 2014–15 | 2015–16 | 2016–17 | 2017–18 | 2018–19 | |

|---|---|---|---|---|---|---|

| Statutory | 9.8 | 9.1 | 8.8 | 10.3 | 10.1 | 10.1 |

| Voted | 74.5 | 72.7 | 68.9 | 68.3 | 68.3 | 68.3 |

| Total | 84.3 | 81.8 | 77.7 | 78.6 | 78.4 | 78.4 |

Expenditures by vote

For information on the Office’s organizational votes and statutory expenditures, consult the Public Accounts of Canada 2016, which is available on the Public Services and Procurement Canada website.

Human resources

The Office used 546 of its planned 557 full-time equivalent employees.

Financial statements

Statement of Management Responsibility

Including Internal Control Over Financial Reporting

Management of the Office of the Auditor General of Canada is responsible for the preparation of the accompanying financial statements for the year ended 31 March 2016 and for all information contained in these statements. These financial statements have been prepared by management in accordance with Canadian public sector accounting standards.

Management is responsible for the integrity and objectivity of the information in these financial statements. Some of the information in the financial statements is based on management’s best estimates and judgment, and gives due consideration to materiality. To fulfill its accounting and reporting responsibilities, management maintains a set of accounts that provides a centralized record of the Office’s financial transactions. Financial information submitted in the preparation of the Public Accounts of Canada, and included in the Office’s Departmental Performance Report, is consistent with these audited financial statements.

Management is also responsible for maintaining an effective system of internal control over financial reporting (ICFR), which is designed to provide reasonable assurance that financial information is reliable; that assets are safeguarded; and that transactions are properly authorized and recorded in accordance with the Financial Administration Act and other applicable legislation, regulations, authorities, and policies.

Management seeks to ensure the objectivity and integrity of data in its financial statements through the careful selection, training, and development of qualified staff; through organizational arrangements that provide appropriate divisions of responsibility; through communications aimed at ensuring that regulations, policies, standards, and managerial authorities are understood throughout the Office; and through an annual assessment of the effectiveness of the system of internal control over financial reporting.

The system of ICFR is designed to mitigate risks to a reasonable level and may not prevent or detect all misstatements. It is based on an ongoing process designed to identify and prioritize key risks, to assess the effectiveness of associated key controls, and to make any necessary adjustments.

The effectiveness and adequacy of the Office’s system of internal control are reviewed through the work of internal audit staff who conduct periodic audits of different areas of the Office’s operations. Also, financial services staff annually monitor internal control over financial reporting. As a basis for recommending approval of the financial statements to the Auditor General, the Office’s Audit Committee reviews management’s arrangements for internal controls and the accounting policies employed by the Office for financial reporting purposes. The Audit Committee also meets independently with the Office’s internal and external auditors to consider the results of their work.

A risk-based assessment of the system of internal control over financial reporting for the year ended 31 March 2016 was completed in accordance with the Treasury Board Policy on Internal Control. The results and action plans are summarized in the 2015–16 Annex to the Statement of Management Responsibility, Including Internal Control over Financial Reporting.

Collins Barrow Ottawa LLP Chartered Professional Accountants, Licensed Public Accountants, the independent auditor for the Office of the Auditor General of Canada, has expressed an opinion on the fair presentation of the financial statements of the Office in conformity with Canadian public sector accounting standards, which does not include an audit opinion on the annual assessment of the effectiveness of the Office’s internal control over financial reporting.

[Original signed by]

[Original signed by]

Michael Ferguson, CPA, CA

FCA (New Brunswick)

Auditor General of Canada

Sylvain Ricard, CPA, CA

Assistant Auditor General and

Chief Financial Officer

Ottawa, Canada

14 July 2016

Independent Auditor’s Report

To the Speaker of the House of Commons:

Report on the Financial Statements

We have audited the accompanying financial statements of the Office of the Auditor General of Canada, which comprise the statement of financial position as at 31 March 2016, and the statements of operations, change in net debt and cash flow for the year then ended, and a summary of significant accounting policies and other explanatory information.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in accordance with Canadian public sector accounting standards and for such internal control as management determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit in accordance with Canadian generally accepted auditing standards. Those standards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Opinion

In our opinion, the financial statements present fairly, in all material respects, the financial position of the Office of the Auditor General of Canada as at 31 March 2016, and the results of its operations, the change in its net debt and its cash flows for the year then ended in accordance with Canadian public sector accounting standards.

Report on Other Legal and Regulatory Requirements

In our opinion, the transactions of the Office of the Auditor General of Canada that have come to our notice during our audit of the financial statements have, in all significant respects, been in accordance with the Financial Administration Act and regulations and the Auditor General Act.

[Original signed by]

Collins Barrow Ottawa LLP

Chartered Professional Accountants, Licensed Public Accountants

14 July 2016

Ottawa, Canada

Office of the Auditor General of Canada

Statement of Financial Position

as at 31 March

| 2016 | 2015 | |

|---|---|---|

| Financial assets | ||

|

Due from the Consolidated Revenue Fund

|

6,814 | 7,601 |

|

Accounts receivable

|

2,037 | 1,457 |

| 8,851 | 9,058 | |

| Liabilities | ||

|

Accounts payable and accrued liabilities (note 4)

|

7,903 | 7,369 |

|

Vacation pay

|

3,784 | 3,697 |

|

Sick leave benefits (note 5)

|

4,159 | 4,108 |

|

Severance benefits (note 5)

|

3,920 | 4,636 |

|

Maternity/parental leave benefits (note 5)

|

563 | 954 |

| 20,329 | 20,764 | |

| Net debt | (11,478) | (11,706) |

| Non-financial assets | ||

|

Tangible capital assets (note 6)

|

1,831 | 2,243 |

|

Prepaid expenses

|

240 | 184 |

| 2,071 | 2,427 | |

| Accumulated deficit | (9,407) | (9,279) |

Contractual obligations (note 11)

The accompanying notes are an integral part of these financial statements.

Approved by

[Original signed by]

[Original signed by]

Michael Ferguson, CPA, CA

FCA (New Brunswick)

Auditor General of Canada

Sylvain Ricard, CPA, CA

Assistant Auditor General and

Chief Financial Officer

Office of the Auditor General of Canada

Statement of Operations

for the year ended 31 March

| 2016 | 2016 | 2015 | |

|---|---|---|---|

| Budget (Note 13) |

Actual | Actual | |

| Expenses (note 7) | |||

|

Financial audits of Crown corporations, territorial governments, other organizations, and the summary financial statements of the Government of Canada

|

41,400 | 43,053 | 37,314 |

|

Performance audits and studies

|

38,200 | 34,929 | 43,633 |

|

Special examinations of Crown corporations

|

5,200 | 3,480 | 3,124 |

|

Sustainable development monitoring activities and environmental petitions

|

1,500 | 1,664 | 1,539 |

|

Professional practices (note 8)

|

8,900 | 9,087 | 7,950 |

| Total cost of operations | 95,200 | 92,213 | 93,560 |

| Costs recovered | |||

|

International audits

|

800 | 1,296 | 1,007 |

|

Other

|

– | 364 | 329 |

|

Costs recovered not available for use

|

– | (178) | (207) |

| Net costs recovered | 800 | 1,482 | 1,129 |

| Net cost of operations before government funding and transfers | 94,400 | 90,731 | 92,431 |

| Government funding and transfers | |||

|

Parliamentary authorities used (note 3)

|

81,200 | 77,683 | 81,863 |

|

Services provided without charge (note 9)

|

12,900 | 12,949 | 12,587 |

|

Transfer of the transition payments for implementing salary payments in arrears (note 10)

|

– | (29) | (2,197) |

| Total government funding and transfers | 94,100 | 90,603 | 92,253 |

| Annual surplus (deficit) | (300) | (128) | (178) |

| Accumulated deficit, beginning of year | (9,279) | (9,279) | (9,101) |

| Accumulated deficit, end of year | (9,579) | (9,407) | (9,279) |

The accompanying notes are an integral part of these financial statements.

Office of the Auditor General of Canada

Statement of Change in Net Debt

for the year ended 31 March

| 2016 | 2016 | 2015 | |

|---|---|---|---|

| Budget (Note 13) |

Actual | Actual | |

| Annual surplus (deficit) | (300) | (128) | (178) |

| Acquisitions of tangible capital assets | (700) | (537) | (675) |

| Amortization of tangible capital assets | 900 | 939 | 881 |

| Net loss on disposal of tangible capital assets | – | 10 | 21 |

| (100) | 284 | 49 | |

| Acquisition of prepaid expenses | – | (240) | (184) |

| Use of prepaid expenses | – | 184 | 371 |

| – | (56) | 187 | |

| Decrease/(increase) in net debt, during the year | (100) | 228 | 236 |

| Net debt, beginning of year | (11,706) | (11,706) | (11,942) |

| Net debt, end of year | (11,806) | (11,478) | (11,706) |

The accompanying notes are an integral part of these financial statements.

Office of the Auditor General of Canada

Statement of Cash Flow

for the year ended 31 March

| 2016 | 2015 | |

|---|---|---|

| Operating transactions | ||

|

Cash paid for

|

||

|

Employee salaries, wages, and benefits

|

(60,420) | (58,135) |

|

Statutory contributions to employee benefit plans

|

(10,026) | (9,794) |

|

Materials, supplies, and services

|

(10,020) | (12,180) |

|

Services provided by related parties

|

(1,639) | (1,601) |

|

Other

|

(178) | (206) |

|

Transition payments for implementing salary payments in arrears (note 10)

|

(29) | (2,197) |

| (82,312) | (84,113) | |

|

Cash received from

|

||

|

Salaries and benefits recovered

|

1,790 | 1,325 |

|

International audits

|

1,364 | 926 |

|

Sales tax recovered

|

975 | 1,184 |

|

Other

|

250 | 405 |

| 4,379 | 3,840 | |

|

Parliamentary authorities used (note 3)

|

77,683 | 81,863 |

| 82,062 | 85,703 | |

|

Cash provided/(used) by operating transactions

|

(250) | 1,590 |

| Capital transactions | ||

|

Cash used to acquire tangible capital assets

|

(537) | (675) |

|

Cash applied to capital transactions

|

(537) | (675) |

| Increase/(Decrease) in Due from the Consolidated Revenue Fund | (787) | 915 |

| Due from the Consolidated Revenue Fund, beginning of year | 7,601 | 6,686 |

| Due from the Consolidated Revenue Fund, end of year | 6,814 | 7,601 |

The accompanying notes are an integral part of these financial statements.

Office of the Auditor General of Canada

Notes to the financial statements for the year ended 31 March 2016

1. Authority and objective

The Auditor General Act, the Financial Administration Act, and a variety of other acts and orders-in-council set out the duties of the Auditor General and the Commissioner of the Environment and Sustainable Development.

The program activity of the Office of the Auditor General of Canada is legislative auditing and consists of performance audits and studies of departments and agencies; the audit of the summary financial statements of the Government of Canada; financial audits of Crown corporations, territorial governments, and other organizations; special examinations of Crown corporations; and sustainable development monitoring activities and environmental petitions.

The Office is funded by the Government of Canada through parliamentary authorities and is not taxable under the provisions of the Income Tax Act.

Pursuant to the Financial Administration Act, the Office is a department of the Government of Canada. It is listed in Schedule I.1 of the Act as a division or a branch of the federal public administration, and in Schedule V of the Act as a separate agency.

2. Significant accounting policies

a) Basis of presentation

The financial statements of the Office have been prepared by management in accordance with Canadian public sector accounting standards (PSAS).

b) Parliamentary authorities

The Office’s annual parliamentary authorities are reported directly in the Statement of Operations in the fiscal year for which they are approved by Parliament and used by the Office. Financial reporting of authorities does not parallel financial reporting according to Canadian public sector accounting standards since authorities are primarily based on cash flow requirements. Consequently, items recognized in the Statement of Operations and in the Statement of Financial Position are not necessarily the same as those provided through authorities from Parliament. Note 3 provides a reconciliation between the two bases of reporting.

c) Costs recovered

Costs recovered are from international audits, audit professional services provided to members of Canadian Council of Legislative Auditors (CCOLA), and other refunds and adjustments.

These costs are accounted for in the period services are rendered or in the period in which the underlying transaction or event that gave rise to the revenue takes place.

Cost recoveries related to International audits and to CCOLA become available for use when funds are received. Other refunds and adjustments are considered to be earned on behalf of the Government of Canada and are not available to discharge the Office’s obligations. As a result, these recoveries are deducted as costs recovered not available for use.

d) Due from the Consolidated Revenue Fund

The financial transactions of the Office are processed through the Consolidated Revenue Fund of the Government of Canada. The “Due from the Consolidated Revenue Fund” balance represents the amount of cash that the Office is entitled to draw from the Consolidated Revenue Fund, without further parliamentary authorities, in order to discharge its liabilities.

e) Accounts receivable

Accounts receivable are stated at the lower of cost and net recoverable value. A valuation allowance is recorded for accounts receivable where recovery is considered uncertain.

f) Tangible capital assets

Tangible capital assets are recorded at historical cost less accumulated amortization. The Office capitalizes the costs associated with the development of software used internally, such as installation costs, professional service contract costs, and salary costs of employees directly associated with these projects. The costs of software maintenance, project management and administration, data conversion, and training and development are expensed in the year incurred.

Amortization of tangible capital assets begins when assets are put into use and is recorded using the straight-line method over the estimated useful lives of the assets as follows:

| Tangible capital assets | Useful life |

|---|---|

| Leasehold improvements | 10 years |

| Furniture and fixtures | 7 years |

| Informatics software | 3 years |

| Informatics hardware and infrastructure | 3 years |

| Office equipment | 4 years |

| Motor vehicle | 5 years |

g) Accounts payable and accrued liabilities

Accounts payable and accrued liabilities represent obligations of the Office for salary and wages, for material and supply purchases, and for the cost of services rendered to the Office.

Salary-related accrued liabilities are determined using the employees’ salary at year-end. Accounts payable and accrued liabilities are measured at cost.

h) Vacation pay

Vacation pay is accrued as the benefit is earned by the employees under their respective terms of employment using the employees’ salary at year-end.

i) Net debt

The net debt is calculated as the difference between liabilities and financial assets. The net debt is due to obligations that are expected to be paid from future parliamentary authorities, the most significant part being related to vacation pay, sick leave benefits, severance benefits, and maternity/parental leave benefits liabilities.

j) Accumulated deficit

The accumulated deficit represents liabilities incurred by the Office, net of tangible capital assets and prepaid expenses, that have not yet been funded through parliamentary authorities. Significant components of this amount are vacation pay, sick leave benefits, severance benefits, and maternity/parental leave benefits liabilities.

k) Employee benefits

i) Pension benefits

All eligible employees participate in the Public Service Pension Plan, a plan administered by the Government of Canada. The Office’s contributions are currently based on a multiple of an employee’s required contributions and may change over time, depending on the experience of the Plan. The Office’s contributions are expensed during the year in which the services are rendered and represent its total pension obligation. The Office is not required to make contributions with respect to any actuarial deficiencies of the Public Service Pension Plan.

ii) Health and dental benefits

The Government of Canada sponsors employee benefit plans (health and dental) in which the Office participates. Employees are entitled to health and dental benefits, as provided for under labour contracts and conditions of employment. The Office’s contributions to the plans, which are provided without charge by the Treasury Board Secretariat, are recorded at cost based on a percentage of the salary expenses and charged to personnel expenses in the year incurred. They represent the Office’s total obligation to the plans. Current legislation does not require the Office to make contributions for any future unfunded liabilities of the plans.

iii) Severance benefits

The accumulation of severance benefits for employees ceased in the 2012–13 fiscal year. Management has determined the accrued benefit obligation using the employees’ salary at year-end and the number of weeks earned but unpaid for employees who have elected to defer the receipt of their full or partial severance benefits payment.

iv) Maternity/parental leave benefits

Employees are entitled to maternity/parental leave benefits as provided for under labour contracts and conditions of employment. The benefits earned are event-driven, meaning the Office’s obligation for the cost of the entire benefit arises upon occurrence of a specific event, being the commencement of the maternity/parental leave. Management has determined the accrued benefit obligation and benefit expenses based on its best estimates.

v) Sick leave benefits

Employees are eligible to accumulate sick leave benefits until the end of employment according to their terms of employment. Sick leave benefits are earned based on employee services rendered and are paid upon an illness or injury related absence. These are accumulating non-vesting benefits that can be carried forward to future years, but are not eligible for payment on retirement or termination, nor can these be used for any other purpose. A liability is recorded for unused sick leave credits expected to be used in future years in excess of future allotments, based on an actuarial valuation using an accrued benefit method. Changes in actuarial assumptions and any variance between the expected and the actual experience of the sick leave benefits plan give rise to actuarial gains or losses. These gains or losses are amortized on a straight-line basis over the expected average remaining service life of the employees, starting in the fiscal year following the one in which they arose.

l) Services provided without charge by other government departments

Services provided without charge by other government departments are recorded as operating expenses by the Office at their estimated cost. A corresponding amount is reported as government funding.

m) Allocation of expenses

All direct expenses related to the delivery of audits and professional practice projects, such as salary, professional services, travel, and other associated costs, are allocated to each audit and professional practice project. All other expenses, including services provided without charge, are treated as overhead and allocated to audits and professional practices projects based on the direct staff cost charged to them.

n) Measurement uncertainty

These financial statements are prepared in accordance with Canadian public sector accounting standards. These standards require management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of costs recovered, government funding and transfers, and expenses during the reporting period. Services provided without charge, sick leave benefits, and amortization of tangible capital assets are the most significant items for which estimates are used. Actual results could differ significantly from the estimates. These estimates are reviewed annually, and as adjustments become necessary, they are recognized in the financial statements in the period in which they become known.

3. Parliamentary authorities

The Office is funded through annual parliamentary authorities. Items recognized in the Statement of Operations in one year may be funded through parliamentary authorities in prior, current or future years. Accordingly, the Office has different net results of operations for the year on a government funding basis than on an accrual accounting basis. The differences are reconciled in the following tables:

a) Reconciliation of net cost of operations to current year authorities used

| 2016 | 2015 | |

|---|---|---|

| Net cost of operations before government funding and transfers | 90,731 | 92,431 |

| Adjustments for items affecting net cost of operations but not affecting authorities: | ||

|

Services provided without charge by other government departments

|

(12,949) | (12,587) |

|

Amortization of tangible capital assets

|

(939) | (881) |

|

Loss on disposal of tangible capital assets

|

(10) | (21) |

|

Decrease in liabilities not charged to authorities

|

228 | 236 |

| Total items affecting net costs of operations but not affecting authorities | (13,670) | (13,253) |

| Adjustments for items not affecting net cost of operations but affecting authorities: | ||

|

Acquisition of tangible capital assets

|

537 | 675 |

|

Transition payments for implementing salary payments in arrear

|

29 | 2,197 |

|

Increase (decrease) in prepaid expenses

|

56 | (187) |

| Total items not affecting net cost of operations but affecting authorities | 622 | 2,685 |

| Current year authorities used | 77,683 | 81,863 |

b) Authorities provided and used

| 2016 | 2015 | |

|---|---|---|

| Authorities provided | ||

|

Voted—Operating expenditures

|

72,992 | 76,707 |

|

Statutory—Contributions to employee benefit plans

|

8,806 | 9,112 |

|

Statutory—Spending of proceeds from disposal of tangible capital assets

|

3 | 11 |

| Current year authorities provided | 81,801 | 85,830 |

|

Less: Lapsed authorities

|

4,118 | 3,967 |

| Current year authorities used | 77,683 | 81,863 |

The Office may carry forward lapsed authorities of up to 5 percent of its operating budget (based on Main Estimates program expenditures) into the next fiscal year, subject to parliamentary approval. The lapsed amount expected to be carried forward is $3.5 million ($3.5 million in 2014–15).

4. Accounts payable and accrued liabilities

Accounts payable and accrued liabilities are measured at cost.

The following table presents details of the Office’s accounts payable and accrued liabilities:

| 2016 | 2015 | |

|---|---|---|

| Due to employees | 6,491 | 6,071 |

| Due to others | 1,412 | 1,298 |

| Total | 7,903 | 7,369 |

5. Employee benefits

a) Pension benefits

The Office’s eligible employees participate in the Public Service Pension Plan (the Plan), which is established and governed by the Public Service Superannuation Act, and sponsored and administered by the Government of Canada. Contributions to the Plan are required from both the employees and the Office.

The Plan provides pension benefits based on the number of years of pensionable service and salaries of the employees. Pension benefits accrue up to a maximum period of 35 years at a rate of 2 percent per year of pensionable service, times the average of the best 5 consecutive years of earnings. The benefits are integrated with Canada/Québec Pension Plan benefits and they are indexed to inflation.

The Office’s contribution rate depends on the employee’s start date and the salary. Overall for the Plan, for employment start dates before 1 January 2013, the employer’s contribution rate is approximately 1.25 times (1.41 times in 2014–15) the employee’s contribution; and for these employees, an unreduced pension benefit can be received at age 60 with at least 2 years of pensionable service (or age 55 with 30 years of service). For employment start dates after 31 December 2012, the employer’s contribution rate is approximately 1.24 times (1.39 times in 2014–15) the employee’s contribution; and an unreduced pension benefit can be received at age 65 with at least 2 years of pensionable service (or age 60 with 30 years of service).

The Office’s expense in relation to the Plan in 2015–16 amounts to $6.1 million ($6.2 million in 2014–15). The Office’s responsibility with regard to the Plan is limited to its contributions. Actuarial surpluses or deficiencies are recognized in the financial statements of the Government of Canada, as the Plan’s sponsor.

b) Severance benefits

Since the accumulation of severance benefits for employees under the severance program ceased in the 2012–13 fiscal year, the obligation is adjusted at year-end to reflect the current salary of employees who have elected to defer the receipt of the severance benefits payment to the time of employment termination or retirement. The Office’s severance benefits are unfunded and are expected to be paid from future parliamentary authorities.

c) Maternity/parental leave benefits

The Office provides maternity/parental leave benefits as provided for under labour contracts and conditions of employment. Management determined the accrued benefit obligation and benefit expenses based on the difference between 93 percent of the employee’s weekly rate of pay and the maternity/parental leave benefit they are entitled to receive under the Employment Insurance or the Québec Parental Insurance Plan. The maternity/parental leave at year-end is unfunded and is expected to be paid from future parliamentary authorities.

Information about severance benefits and maternity/parental leave benefits, measured as at 31 March, is presented in the following table.

| Severance benefits | Maternity/parental leave benefits | |||

|---|---|---|---|---|

| 2016 | 2015 | 2016 | 2015 | |

| Accrued benefit obligation, beginning of year | 4,636 | 5,251 | 954 | 706 |

| Current year benefit costs | 47 | 41 | 714 | 1,675 |

| Benefits paid | (763) | (656) | (1,105) | (1,427) |

| Accrued benefit obligation, end of year | 3,920 | 4,636 | 563 | 954 |

d) Sick leave benefits

Employees are credited, based on service, a maximum of 15 days annually for use as paid absences due to illness or injury. Employees are allowed to accumulate unused sick day credits each year. Accumulated credits may be used in future years to the extent that the employee’s illness or injury exceeds the current year’s allocation of credits. The use of accumulated sick days for sick leave compensation ceases on end of employment. These sick leave benefits are unfunded and are expected to be paid from future parliamentary authorities.

Annually, the Office obtains an actuarial valuation of the accrued employee sick leave benefit obligation for accounting purposes. Actuarial assumptions are used to determine the sick leave accrued benefit obligation. The assumptions are reviewed at 31 March of each year and are management’s best estimate based on an analysis of the historical data up to the reporting date. The key assumptions used are: a discount rate of 1.35 percent (1.52 percent in 2015), which is based on an average yield of government borrowings over the remaining life of the benefits; a rate of salary increase of 3 percent (3 percent in 2015); an average turnover rate of 6 percent (none assumed in 2015); and a retirement age of 58 (58 in 2015).

Information about the sick leave benefits as at 31 March is as follows:

| 2016 | 2015 | |

|---|---|---|

| Accrued benefits obligation, beginning of year | 4,108 | 3,842 |

|

Current year benefit cost

|

495 | 405 |

|

Interest on the accrued benefit obligation

|

70 | 97 |

|

Benefits paid

|

(514) | (401) |

|

Actuarial (gain)/loss

|

(1,813) | 165 |

| Accrued benefit obligation, end of year | 2,346 | 4,108 |

| Unamortized accumulated actuarial gain | 1,813 | – |

| Accrued benefit liability | 4,159 | 4,108 |

This year’s actuarial gain of $1.8 million is mainly due to changes made to actuarial assumptions such as introducing an employee turnover rate assumption and revisions to sick leave utilization assumptions based on additional information available to management.

In prior years, the Office immediately recorded all actuarial gains and losses in the Statement of Operations as these were not material. Due to the significance of this year’s actuarial gain, the Office adopted an amortization policy for actuarial gains and losses in accordance with PSAS. As a result, the actuarial gain of $1.8 million will be amortized starting in 2016–17 over the expected average remaining service life of employees which is 10 years as at 31 March 2016.

Changes in assumptions can result in significantly higher or lower estimates of the accrued benefit obligation. The following table illustrates the possible impact of a change in the actuarial assumptions on the accrued benefit obligation as at 31 March 2016.

| Assumptions | Increase (decrease) in the accrued benefit obligation |

|---|---|

| Discount rate | |

|

Increase by 1%

|

(144) |

|

Decrease by 1%

|

163 |

| Salary increase | |

|

Increase by 1%

|

135 |

|

Decrease by 1%

|

(122) |

| Retirement age | |

|

Increase by 1 year

|

230 |

|

Decrease by 1 year

|

(220) |

| Turnover rate | |

|

Increase factors by 10%

|

(56) |

|

Decrease factors by 10%

|

59 |

| Sick leave utilization rates | |

|

Increase factors by 10%

|

301 |

|

Decrease factors by 10%

|

(284) |

6. Tangible capital assets

| Cost | Accumulated amortization | 2016 Net book value |

2015 Net book value |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Opening balance | Acquisitions | Disposals | Closing balance | Opening balance | Amortization | Disposals | Closing balance | |||

| Leasehold improvements | 3,519 | 83 | 143 | 3,459 | 3,087 | 98 | 133 | 3,052 | 407 | 432 |

| Furniture and fixtures | 4,470 | 6 | 21 | 4,455 | 4,319 | 43 | 21 | 4,341 | 114 | 151 |

| Informatics software | 4,045 | 312 | – | 4,357 | 2,982 | 494 | – | 3,476 | 881 | 1,063 |

| Informatics hardware and infrastructure | 1,487 | 9 | 46 | 1,450 | 999 | 240 | 46 | 1,193 | 257 | 488 |

| Office equipment | 948 | 127 | 11 | 1,064 | 853 | 59 | 11 | 901 | 163 | 95 |

| Motor vehicle | 24 | – | – | 24 | 10 | 5 | – | 15 | 9 | 14 |

| Total | 14,493 | 537 | 221 | 14,809 | 12,250 | 939 | 211 | 12,978 | 1,831 | 2,243 |

The cost of tangible capital assets not being amortized because they are under development totals $251,000 ($32,000 in 2015) and is included within Informatics software.

7. Expenses by object

Summary of expenses by object for the year ended 31 March are as follows:

| 2016 | 2015 | |

|---|---|---|

| Personnel | 72,533 | 73,015 |

| Rentals | 8,864 | 8,774 |

| Professional and special services | 4,716 | 5,893 |

| Transportation and communications | 3,249 | 3,519 |

| Amortization of tangible capital assets | 939 | 881 |

| Information | 679 | 455 |

| Small machinery and equipment | 659 | 446 |

| Utilities, materials, and supplies | 268 | 257 |

| Repairs and maintenance | 226 | 202 |

| Interest on the sick leave accrued benefit obligation | 70 | 97 |

| Net loss on disposal of tangible capital assets | 10 | 21 |

| Total cost of operations | 92,213 | 93,560 |

The total cost of operations includes services provided without charge by other government departments as explained in note 9 a).

8. Professional practices

The Office works with other legislative audit offices and professional associations, such as the Chartered Professional Accountants of Canada, to advance legislative audit methodology, accounting and auditing standards, and best practices. International activities include participation in organizations and events that have an impact on the Office’s work as legislative auditors. Peer reviews include the cost of participating in peer reviews of other national legislative audit offices and being the subject of a peer review.

| 2016 | 2015 | |

|---|---|---|

| Methodology | 5,337 | 4,623 |

| International activities | 1,724 | 1,478 |

| Participation in standard-setting activities | 1,066 | 821 |

| Canadian Council of Legislative Auditors | 960 | 911 |

| Peer reviews | – | 117 |

| Professional practices | 9,087 | 7,950 |

9. Related party transactions

The Office is related as a result of common ownership to all Government of Canada departments, agencies, and Crown corporations. The Office enters into transactions with these organizations in the normal course of business and on normal trade terms. The Office is mindful of its independence and objectivity when entering into any such transactions. The Office conducts independent audits and studies without charge to federal departments and agencies, Crown corporations, territorial governments, and other organizations.

a) Common services provided without charge by other government departments

During the year, the Office received the following services without charge from certain common service organizations. The expenses related to these services have been recorded in the Office’s Statement of Operations and in the Expenses by object (note 7):

| 2016 | 2015 | |

|---|---|---|

| Office accommodation—Public Services and Procurement Canada | 7,820 | 7,668 |

| Office’s contribution to the health and dental insurance plans—Treasury Board Secretariat | 5,129 | 4,919 |

| Services provided without charge | 12,949 | 12,587 |

The Government has centralized some of its administrative activities for efficiency, cost-effectiveness purposes, and economic delivery of programs to the public. As a result, the Government uses central agencies and common services organizations so that one department performs services for all other departments and agencies without charge. The costs of these services, such as the payroll and cheque issuance services provided by Public Services and Procurement Canada, are not included in the Office’s Statement of Operations.

b) Other transactions with related parties

| 2016 | 2015 | |

|---|---|---|

| Expenses—Other government departments and agencies | 10,228 | 11,395 |

| Accounts receivable—Other government departments and agencies | 1,399 | 827 |

| Accounts payable—Other government departments and agencies | 58 | 125 |

Expenses disclosed in (b) exclude common services provided without charge disclosed in (a). The most significant components of the expenses are related to the statutory contributions to employee benefit plans, translation services, security services, and network services.

10. Transfer of the transition payments for implementing salary payments in arrears

The Government of Canada implemented salary payments in arrears in 2014–15. As a result, a one-time payment was issued to employees which will be recovered from them in the future. Employees who were on leave without pay when the initial one-time transition payments were issued in 2014–15 will receive the transition payment shortly after their return to work from their leave without pay. In 2015–16, payments totalling $29,000 ($2.2 million in 2014–15) were issued. This change to the pay system has no impact on the expenses of the Office. However, transition payments do result in the use of additional parliamentary authorities by the Office. Prior to year-end, the account receivable related to the transition payments is transferred to a central account administered by Public Services and Procurement Canada, which is responsible for the administration of the Government pay system.

11. Contractual obligations

The nature of the Office’s activities can result in contracts and obligations whereby the Office will be obligated to make future payments when the services/goods are received. Contractual obligations estimated as at 31 March 2016 are summarized as follows:

| 2017 | 2018 | 2019 | 2020 | 2021 and thereafter |

Total | |

|---|---|---|---|---|---|---|

| Goods and services | 1,978 | 60 | 25 | 3 | – | 2,066 |

| Professional services | 858 | 72 | 28 | – | – | 958 |

| Operating leases | 168 | 168 | 168 | 41 | – | 545 |

| Total | 3,004 | 300 | 221 | 44 | – | 3,569 |

12. Financial instruments

The following analysis presents the Office’s exposure to credit and liquidity risks at the reporting date.

a) Credit risk

The Office is exposed to low credit risk resulting from the possibility that parties may default on their financial obligations to pay the Office. Management believes the risk of loss on its accounts receivable balances to be low due to the credit quality of these parties. Accounts receivable balances are managed and analyzed on an ongoing basis. Accordingly, management believes that all amounts receivable will be collected and has determined that a valuation allowance is not required.

b) Liquidity risk

Liquidity risk is the risk that the Office will encounter difficulty in meeting its obligation associated with financial liabilities. The Office’s objective for managing liquidity risk is to manage operations and cash expenditures within the authorities approved by Parliament. Management believes this risk is low.

13. Budget figures

Budget figures have been provided for comparison purposes and have been derived from the 2015–16 planned spending figures included in the 2015–16 Report on Plans and Priorities.

14. Comparative figures

Certain 2014–15 comparative figures have been reclassified to conform to the presentation adopted for the 2015–16 fiscal year.

Section III—Performance Analysis

Exhibit 7 presents the Office’s performance measures and results for each of our strategic objectives. “Support continuous improvement” is no longer a separate objective in the Office’s strategic framework, as supporting continuous improvement is at the core of all our strategic planning activities.

Exhibit 7—Performance measures and results for the 2015–16 fiscal year

| Strategic objective | Indicators | Target | Results for the 2015–16 fiscal year | Discussion |

|---|---|---|---|---|

|

1. Be independent, objective, and non-partisan. |

Percentage compliance with professional standards and Office policies for independence |

100% |

Target met |

|

|

Number of founded complaints and allegations regarding failure to comply with professional standards, legal and regulatory requirements, or the Office’s System of Quality Control |

Zero |

Target met |

||

|

Percentage of clients who find that we are independent, objective, and non-partisan |

90% |

Target met |

||

|

Percentage of senior managers in the organizations we audit who find that we are independent, objective, and non-partisan |

80% |

Target met |

||

|

2. Report what is working, areas for improvement, and recommendations in a manner that is understandable, timely, fair, and adds value. |

Percentage of users who find that our audits are understandable, timely, fair, and add value: |

|||

|

90% |

Target met |

||

|

90% |

Not available |

||

|

Percentage of senior managers in the organizations we audit who find that our audits are understandable, timely, fair, and add value: |

||||

|

80% |

Target met |

||

|

80% |

69% |

||

|

Percentage of reports to Parliament that are reviewed by parliamentary committees |

65% |

55% |

||

|

Percentage of audits that meet statutory deadlines, where applicable, or our planned reporting dates: |

||||

|

100% |

88% |

||

|

80% |

Target met |

||

|

Percentage of audit recommendations/opinions addressed by entities: |

||||

|

100% |

50% |

||

|

75% |

Not available |

||

|

100% |

Target met |

||

|

3. Contribute to the development and adoption of professional standards and best practices. |

Percentage of commitments met to contribute to domestic and international professional standards bodies |

100% |

Target met |

|

|

4. Build and maintain relationships with parliamentarians and key stakeholders. |

Percentage of clients who find that auditors met relationship expectations |

90% |

Target met |

|

|

Percentage of senior managers in the organizations we audit who find that auditors met relationship expectations: |

||||

|

80% |

Target met |

||

|

80% |

74% |

||

|

80% |

Target met |

||

|

5. Be a financially well-managed organization accountable for the use of resources entrusted to it. |

Percentage compliance with financial management and reporting requirements |

100% |

99% |

11 instances where goods and services were received without a duly executed contract or amendment |

|

6. Ensure selection and continuance of audit products likely to have significant impact and value. |

Completion of a value proposition review of our audit products |

Once every three years |

Target met |

|

|

Completion of a report informing Parliament of the value and impact of our financial audit work |

Spring 2016 |

Target not met |

Deferred to spring 2017 |

|

|

7. Ensure audit products comply with professional standards and Office policies in an economical manner. |

Percentage of internal practice reviews that find the opinions and conclusions expressed in our audit reports to be appropriate and supported by the evidence |

100% |

Target met |

|

|

Percentage of internal and external reviews that find engagement leaders complied with professional standards |

100% |

Target met |

||

|

Percentage of internal and external reviews that find our System of Quality Control is suitably designed and operating effectively |

100% |

Internal target met |

No external review conducted (in development for 2018–19) |

|

|

Percentage of audits that are completed on budget |

80% |

74% |

||

|

8. Ensure effective and efficient support services. |

Percentage of internal service standards met (Human Resources, IT, Security, Editorial Services) |

100% |

69% |

|

|

Percentage of internal clients who find support services are effective and efficient |

85% |

Not available |

Indicator approved; monitoring to be put in place in 2016 |

|

|

9. Ensure effective, efficient, and accountable Office governance and management. |

Full implementation of new senior audit roles and responsibilities |

1 January 2016 |

Target met |

|

|

Implementation of revised governance framework |

1 January 2016 |

Target met |

||

|

Percentage of employees who find that the Office is well governed and managed |

85% |

77% |

||

|

10. Ensure a culture of empowerment. |

Development of an action plan to respond to empowerment survey results |

31 December 2015 |

Target met |

|

|

Percentage of employees who find the Office ensures a culture of empowerment |

80% |

Target met |

||

|

11. Develop and maintain a skilled, engaged, and bilingual workforce. |

Percentage of auditors who complete mandatory training within the allotted time frame |

100% |

Not available |

Monitoring to begin in 2016 |

|

Percentage of employees who find the Office develops and maintains an engaged workforce |

85% |

Target met |

||

|

Percentage of staff who meet the language requirements of their positions: |

||||

|

100% |

Target met |

||

|

100% |

78% |

||

|

100% |

81% |

||

|

Percentage of employees who find that the Office develops and maintains a bilingual workforce |

90% |

89% |

Discussion of current results

Strategic Objective 2—Report what is working, areas for improvement, and recommendations in a manner that is understandable, timely, fair, and adds value

Parliamentary feedback. Given the federal election in 2015, we did not survey parliamentarians; we wanted to give new members of Parliament time to become familiar with our mandate and work. However, we meet annually with the Standing Committee on Public Accounts to discuss our plans and review our performance.

Parliamentary engagement. When the Office and senior representatives of the organizations we audit appear before parliamentary committees, the value of our work increases. Parliamentary committees reviewed 55 percent of our reports that were presented to Parliament in the 2015–16 fiscal year. Though this result is below our target of 65 percent, it reflects an increase from 44 percent in the 2014–15 fiscal year and from 31 percent in the 2013–14 fiscal year.

In total, we participated in 20 parliamentary committee hearings and briefings on our audit work. The Standing Committee on Public Accounts—the primary client for our work—reviewed 47 percent of the reports that were referred to it. Both these results are similar to what we observed in the 2014–15 fiscal year, even though the 2015–16 fiscal year had fewer sitting days due to the 2015 general election.

Senior managers’ feedback. For responses from senior managers of organizations subject to performance audits, 68 percent either agreed or strongly agreed that our audit reports were understandable, timely, fair, and added value. This result is below our target of 80 percent, although higher than the 2014–15 result of 59 percent. While results for three of the five elements that make up this indicator were positive, senior managers provided the fewest positive responses on whether our audits focused on areas of significant risk (71 percent) and whether our audits were being reported objectively and fairly (58 percent). Respondents were most concerned that our audits focused on negative findings and did not include enough positive observations to provide balanced reporting.

Meeting statutory deadlines. Of the 59 financial audits and special examinations that were to be completed in the 2015–16 fiscal year, 52, or 88 percent, were completed on time. In all cases where statutory deadlines were not met, we encountered issues with client readiness.

Qualifications in financial audits. Three, or 50 percent, of the six qualifications and other matters in financial audit reports issued in the 2014–15 fiscal year were not addressed in the 2015–16 fiscal year. Of the two qualifications, one was non-compliance with authorities and involved the late tabling of an annual report, while the other concerned the audit entity’s inability to supply sufficient and appropriate audit evidence for inventory. The other matter that was not addressed related to the dissolution of an entity, for which no further action is required.

Follow-up in performance audits. The Office did not report any follow-up work in our performance audits tabled in the 2015–16 fiscal year.

Strategic Objective 4—Build and maintain relationships with parliamentarians and key stakeholders

Relationship expectations. In two of our three audit practices, we met our target for relationship management with senior managers in the organizations we audited. In our performance audit practice, responses to our post-audit surveys from senior management did not meet our target. An average of 74 percent of the responses either agreed or strongly agreed that we met senior managers’ relationship expectations. Senior managers provided the fewest positive results on whether they had a reasonable amount of time to comment on and respond to audit findings and recommendations, and whether auditors resolved issues and significant differences of views in a timely manner. To help identify and resolve differences of views earlier in an audit, we are working to improve our fact validation process with entities.

Strategic Objective 7—Ensure audit products comply with professional standards and Office policies in an economical manner

Completing work on budget. Seventy-four percent of the audits we completed in the 2015–16 fiscal year (83 of 112) were on budget. In our financial audit practice, where 24 audits were over budget, more than two thirds were as a result of client delays or capacity issues, and audit issues or unforeseen work. In 2 of the audits, we believe that staff turnover within our Office also had a significant impact. Two of our performance audits were over budget, including the audit of senators’ expenses, and one other where the large number of organizations added complexity and administrative delays. In our special examination practice, two examinations were over budget. In one case, we experienced turnover of the two senior auditors.

Strategic Objective 8—Ensure effective and efficient support services

Meeting service standards. We have defined many internal service standards, with certain key standards regularly reported to the Executive Committee. We did not meet one of our service standards for information technology as our document management system was unavailable for 24 hours during a major update. We also did not meet our service standard of no significant security breaches:

- Summary information was made public by a consultant engaged in the audit of the Canada Pension Plan Disability program prior to the tabling of the audit report in Parliament. An internal administrative investigation was conducted, which found that the consultant did not follow the terms and conditions of his contract. We have reviewed the process surrounding the return of audit documents that we discuss with our advisors.

Strategic Objective 9—Ensure effective, efficient, and accountable Office governance and management

Office governance. The Office participates in the Public Service Employee Survey every three years. The survey provides feedback from employees across a range of topics. The most recent survey was conducted in 2014, when an average of 77 percent of employees either agreed or strongly agreed with the statements that we monitor regarding Office governance and management. Employees provided the fewest positive responses on whether senior management made timely decisions and communicated effectively, and whether employees were comfortable initiating formal grievances or complaints. The Office has since implemented new senior management roles and responsibilities to improve decision making, and implemented changes to senior management communication tools and processes. The Office has also hired an external conflict resolution service provider, clarified the role of our internal Respectful Workplace Coordinator, and appointed a Respectful Workplace Champion.

Strategic Objective 11—Develop and maintain a skilled, engaged, and bilingual workforce

Bilingual workforce. Senior management and supervisors who work in designated bilingual regions of the country must demonstrate certain proficiency in reading, writing, and speaking in their second official language. While targets were met for reading and writing, approximately 20 percent of our senior management and supervisors still need to demonstrate their ability to speak in their second official language.

Section IV—Supplementary Information

Sustainable development

The following supplementary information on sustainable development is available on the website of the Office of the Auditor General of Canada:

- sustainable development strategy for the Office, and

- green procurement information (Theme IV of the Federal Sustainable Development Strategy).

Additional financial information

The Office provides the following unaudited financial information on service contracts, travel and hospitality expenses, and compensation and benefits.

Table 1—Total value of service contracts

This table highlights the Office’s contracting activity for services in calendar year 2015, excluding contracting activity with other government departments.

| Contracts with original value less than $25,000 |

Contracts with original value greater than $25,000 |

|||||

|---|---|---|---|---|---|---|

| ($) | Number | Percentage | ($) | Number | Percentage | |

| Competitive contracts | 1,102,040 | 123 | 33% | 1,597,547 | 34 | 94% |

| Non-competitive contracts | 1,673,252 | 255 | 67% | 206,891 | 2 | 6% |

| Total | 2,775,292 | 378 | 100% | 1,804,438 | 36 | 100% |