Office of the Auditor General of Canada—Quarterly Financial Report for the quarter ended 30 June 2018

Office of the Auditor General of Canada Quarterly Financial Report for the quarter ended 30 June 2018

Statement outlining results, risks, and significant changes in operations, personnel, and program

Introduction

This quarterly report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board, and it should be read in conjunction with the Main Estimates. This quarterly report has not been subject to an external audit or review.

The Office of the Auditor General has one program activity: legislative auditing. The Office conducts independent audits and studies that provide objective information, advice, and assurance to Parliament, government, and Canadians.

Mandate

The Auditor General is an Officer of Parliament, who is independent from the government and reports directly to Parliament. The duties are set out in the Auditor General Act, the Financial Administration Act, and other acts and orders-in-council. These duties relate to legislative auditing and, in certain cases, to monitoring of federal departments and agencies, Crown corporations, territorial governments, and other entities.

Basis of presentation

This quarterly report has been prepared by management using an expenditure basis of accounting. The accompanying Statement of Authorities includes the Office’s spending authorities granted by Parliament and those used by the Office consistent with the Main Estimates for the 2018–19 fiscal year. This quarterly report provides financial information on the use of spending authorities. The Office uses the full accrual method of accounting to prepare and present its annual financial statements that are part of the departmental results reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

Highlights of quarterly and year-to-date results

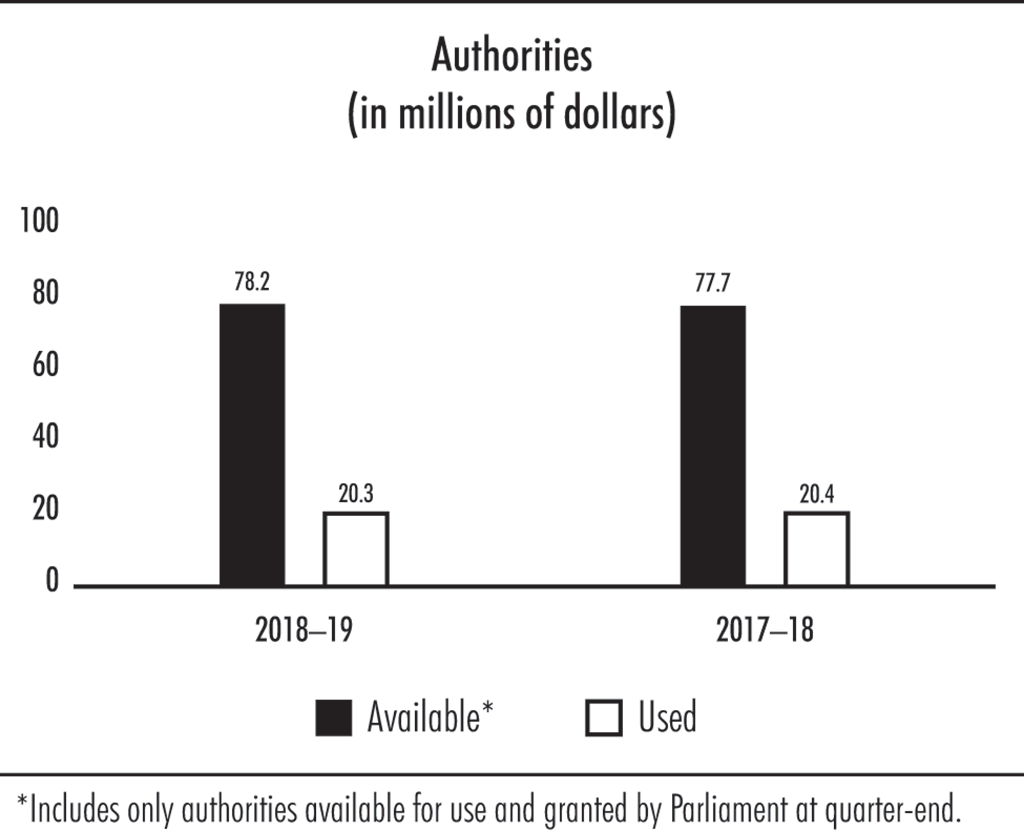

The authorities available for use have slightly increased because of recent economic salary increases.

Figure 1—text version

Authorities (in millions of dollars)

| AvailableNote * | Used | |

|---|---|---|

| 2018–19 | 78.2 | 20.3 |

| 2017–18 | 77.7 | 20.4 |

Risks and uncertainties

Our funding base is insufficient to address the increasing audit and service cost pressures the Office is facing. Although the Office was allocated an additional $8.25 million in ongoing funding through Vote 40 of the 2018 Budget, this amount is not sufficient to address our needs.

Further, this additional funding is not expected to be approved until the second quarter. As such, we are reviewing our resource allocations to ensure that we can produce all required audits as efficiently as possible in the near term, and we are considering potential options for the longer term.

Significant changes in operations, personnel, and program

A new Senior General Counsel was appointed and assumed the position on 1 January 2018.

Approved by:

[Original signed by]

Michael Ferguson, Chartered Professional AccountantCPA, Chartered AccountantCA

Fellow Chartered Professional AccountantFCPA, Fellow of the Order of Chartered AccountantsFCA (New Brunswick)

Auditor General of Canada

[Original signed by]

Sylvain Ricard, Chartered Professional AccountantCPA, Chartered AccountantCA

Assistant Auditor General and

Chief Financial Officer

Ottawa, Canada

29 August 2018

Statement of authorities (unaudited)

(in thousands of dollars)

| Fiscal year 2018–19 | Fiscal year 2017–18 | |||||

|---|---|---|---|---|---|---|

| Total available for use for the year ending 31 March 2019Footnote * |

Used during the quarter ended 30 June 2018 |

Year to date used at quarter-end | Total available for use for the year ended 31 March 2018Footnote * |

Used during the quarter ended 30 June 2017 |

Year to date used at quarter-end | |

| Vote 1—Program expenditures | 71,688 | 18,144 | 18,144 | 70,929 | 18,257 | 18,257 |

| Less revenues netted against program expenditures | (2,660) | (112) | (112) | (2,660) | (106) | (106) |

| Net Vote 1—Program expenditures | 69,028 | 18,032 | 18,032 | 68,269 | 18,151 | 18,151 |

| Budgetary statutory authorities | 9,197 | 2,299 | 2,299 | 9,421 | 2,308 | 2,308 |

| Total budgetary authorities | 78,225 | 20,331 | 20,331 | 77,690 | 20,459 | 20,459 |

| Non-budgetary authorities | 0 | 0 | 0 | 0 | 0 | 0 |

| Total authorities | 78,225 | 20,331 | 20,331 | 77,690 | 20,459 | 20,459 |

Departmental budgetary expenditures by standard object (unaudited)

(in thousands of dollars)

| Fiscal year 2018–19 | Fiscal year 2017–18 | |||||

|---|---|---|---|---|---|---|

| Planned expenditures for the year ending 31 March 2019 |

Expended during the quarter ended 30 June 2018 |

Year to date expended at quarter-end | Planned expenditures for the year ended 31 March 2018 |

Expended during the quarter ended 30 June 2017 |

Year to date expended at quarter-end | |

| Expenditures: | ||||||

|

Personnel

|

69,704 | 17,562 | 17,562 | 69,169 | 17,245 | 17,245 |

|

Transportation and communications

|

3,137 | 891 | 891 | 3,296 | 1,092 | 1,092 |

|

Information

|

561 | 174 | 174 | 532 | 160 | 160 |

|

Professional and special services

|

5,250 | 1,008 | 1,008 | 5,038 | 1,280 | 1,280 |

|

Rentals

|

1,077 | 735 | 735 | 1,034 | 722 | 722 |

|

Repair and maintenance

|

265 | 16 | 16 | 242 | 4 | 4 |

|

Utilities, materials and supplies

|

210 | 26 | 26 | 268 | 34 | 34 |

|

Acquisition of machinery and equipment

|

656 | 29 | 29 | 752 | 26 | 26 |

|

Other subsidies and payments

|

25 | 2 | 2 | 19 | 2 | 2 |

|

Total gross budgetary expenditures

|

80,885 | 20,443 | 20,443 | 80,350 | 20,565 | 20,565 |

| Less revenues netted against expenditures: | ||||||

|

Costs recovered

|

||||||

|

Members of the Canadian Council of Legislative Auditors (CCOLA)

|

(660) | (112) | (112) | (660) | (106) | (106) |

|

International audit

|

(2,000) | 0 | 0 | (2,000) | 0 | 0 |

|

Total cost recovered

|

(2,660) | (112) | (112) | (2,660) | (106) | (106) |

| Total net budgetary expenditures | 78,225 | 20,331 | 20,331 | 77,690 | 20,459 | 20,459 |