Commentary on the 2021–2022 Financial Audits

Below are highlights from our commentary on the 2021–2022 financial audits.

For the complete commentary, select “full report.”

Financial effects of Canada’s COVID‑19 economic response

The overall amount the government spent or loaned responding to COVID‑19 in the 2021–22 fiscal year was approximately $76 billion.

We found that, in all material respects, the government properly accounted for COVID‑19 measures in its 2021–22 consolidated financial statements.

Amounts the federal government spent or loaned responding to COVID‑19

Source: Based on the Office of the Auditor General of Canada’s analysis of data in the consolidated financial statements of the Government of Canada

Text version

This illustration shows the amounts the federal government spent or loaned in the 2020–21 and 2021–22 fiscal years responding to the COVID‑19 pandemic.

In 2020–21, the amount spent or loaned was $299 billion, or 49% of program expenses. In 2021–22, the amount spent or loaned decreased to $76 billion, or 16% of program expenses.

COVID‑19 benefit overpayments and ineligible payments

The government has begun a multi‑year process to identify and collect overpayments or payments made to ineligible recipients.

The amounts of benefits the government overpaid or paid to ineligible recipients are identified over time as the government’s post‑payment verifications are completed.

Simplified process for accounting for overpayments or payments to ineligible recipients of COVID‑19 benefits

Source: Based on the Office of the Auditor General of Canada’s audit of the consolidated financial statements of the Government of Canada

Text version

This flow chart shows the simplified process for accounting for overpayments or payments to ineligible recipients of COVID‑19 benefits.

The first step of the process is post‑verification. The Canada Revenue Agency and Employment and Social Development Canada conduct verifications to determine whether recipients were overpaid or were ineligible.

- If a recipient was overpaid or ineligible, an accounts receivable and a recovery of expenses are recorded. Benefits expensed in the previous year are reversed in the current year.

- If the case requires more investigation, then no accounts receivable is recorded. If the investigation shows that there has been an offence, this could result in a loss of public money, which would be disclosed in the Public Accounts of Canada.

The second step of the process is notification. A notice is sent to those recipients the Canada Revenue Agency and Employment and Social Development Canada determined were overpaid or were ineligible.

The third and final step is collection. The Canada Revenue Agency and Employment and Social Development Canada make collection efforts to recover amounts owed from recipients.

- If any payments are received, the accounts receivable is reduced by that amount.

- If collection is uncertain, the accounts receivable stays on the books, but an allowance for doubtful accounts is recorded.

- If no further collection efforts can be pursued, the accounts receivable is removed from the books and disclosed as amounts written off.

Accounts receivable as a result of completed post‑payment verifications of COVID‑19 benefits

| Fiscal year (amounts in millions) |

|||

|---|---|---|---|

| 2019–20 | 2020–21 | 2021–22 | |

| Cumulative COVID‑19 benefits expenses, net of overpayments | 6,500 | 167,142 | 204,976 |

| Accounts receivable | - | 3,742 | 5,119 |

A performance audit report of specific COVID‑19 benefits will be released by the Auditor General of Canada before the end of 2022.

Government’s debt

The government expects the interest costs on its debt to increase, which is partly due to increasing market interest rates coupled with the upcoming maturity of some of its debt.

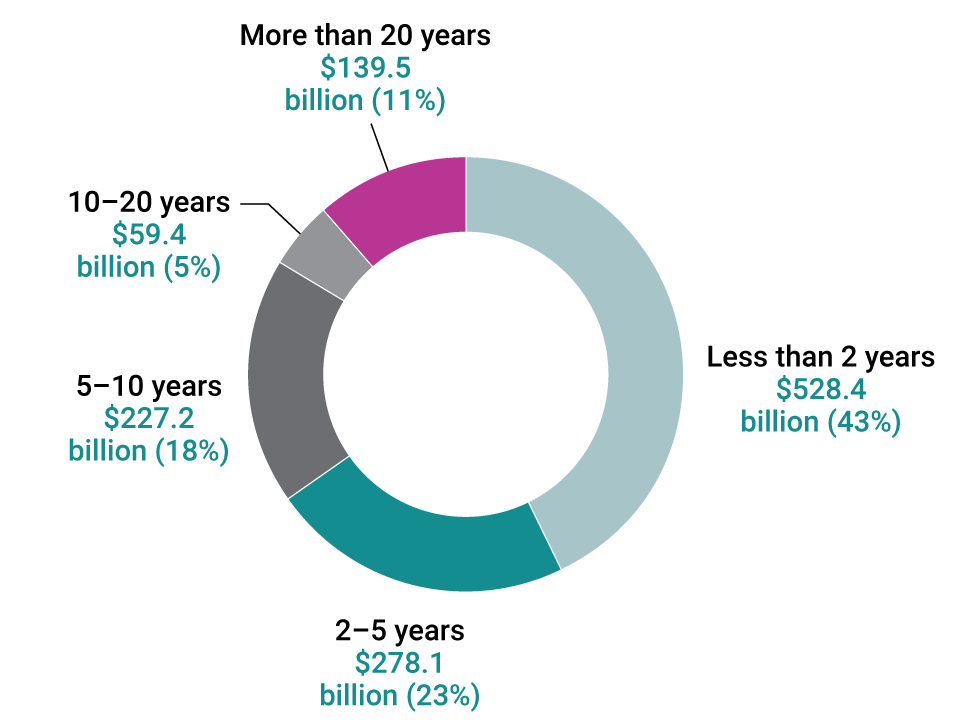

The composition of the government’s $1.233 trillion of market debt, as of 31 March 2022, by term to maturity

Source: The Bank of Canada and the 2021–22 Public Accounts of Canada

Text version

This pie chart shows the composition of the government’s $1.233 trillion of market debt as at 31 March 2022. The amounts are shown by maturity date as follows:

- $528.4 billion, or 43%, of the market debt had a maturity date of less than 2 years.

- $278.1 billion, or 23%, of the market debt had a maturity date from 2 to 5 years.

- $227.2 billion, or 18%, of the market debt had a maturity date of 5 to 10 years.

- $59.4 billion, or 5%, of the market debt had a maturity date of 10 to 20 years.

- $139.5 billion, or 11%, of the market debt had a maturity date of more than 20 years.

Results of our 2021–2022 financial audits

Our Office provided the government with an unmodified audit opinion on its 2021–22 consolidated financial statements, which provides credibility to the government’s financial reporting. Overall, we were satisfied with the credibility of the financial statements prepared by the federal government organizations we audit.

-

National Defence has overcome earlier challenges in providing the documentation to support the estimated pension obligations needed for our audit of the department’s Reserve Force Pension Plan.

We expect to complete the respective audits by January 2023.

-

The Trans Mountain Corporation faced a significant uncertainty about its continued operations.

In April 2022 the corporation entered into an agreement to borrow up to $10 billion to allow the corporation to meet its financial obligations.

The Auditor General’s observations on the Government of Canada’s 2021–22 consolidated financial statements

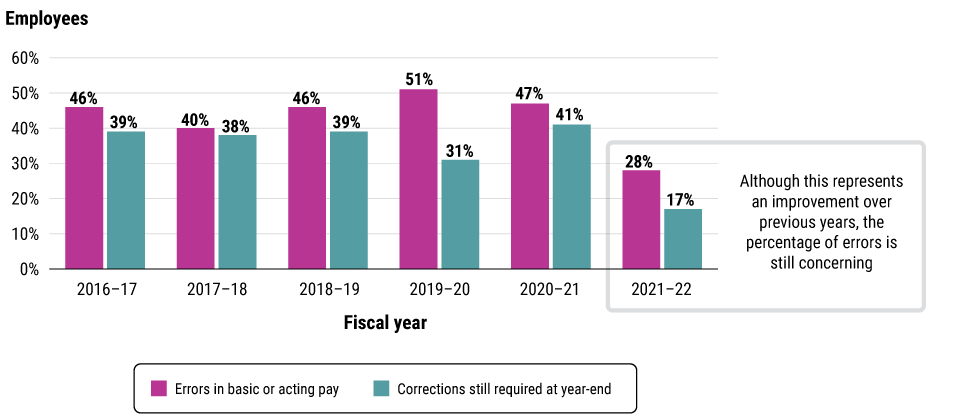

Pay administration

Pay errors continued for many government employees

Source: Based on the Office of the Auditor General of Canada’s analysis of a sample of employees’ pay transactions used in the audit of the consolidated financial statements of the Government of Canada for the 6 fiscal years ending March 31 from 2017 to 2022

Text version

This bar chart shows for each fiscal year from 2016–17 to 2021–22 the percentage of employees in our sample with an error in basic or acting pay and who were awaiting a correction at year-end. The chart shows that the percentage of employees in our sample who had an error in basic or acting pay during the fiscal year decreased from 46% in 2016–17 to 40% in 2017–18 and then increased to 46% in 2018–19 and to 51% in 2019–20. The percentage then decreased to 47% in 2020–21 and to 28% in 2021–22. The chart also shows that the percentage of employees in our sample who were awaiting a correction at year-end was steady at either 38% or 39% for the 3 fiscal years from 2016–17 to 2018–19 and then decreased to 31% in 2019–20. The percentage then increased to 41% in 2020–21 and then decreased to 17% in 2021–22.

The government is at risk of loss for long‑outstanding pay action requests involving overpayments

The government needs to take steps to recover overpayments of salaries, wages, or employment-related allowances in a timely manner because legal limitation periods mean that certain recovery mechanisms may no longer be available to the government in its recovery efforts.

- outstanding pay action requests involved a total of over $500 million in overpayments to more than 100,000 employees

- about half of these requests had been outstanding for more than 3 years

National defence inventory and asset pooled items

The department is experiencing delays in completing its 10‑year action plan

For nearly 2 decades, we have raised concerns about National Defence’s ability to properly account for the quantities and values of its inventory. In our view, the errors we noted in our audits indicate continued weaknesses in the department’s internal controls that need to be addressed.

Additional insights

Environmental, social, and governance reporting

Enhanced reporting will soon be required for some federal organizations

These are some examples of factors considered when assessing how well organizations perform on environmental, social, and governance matters.

Source: Based on information from the website for the Federal Sustainable Development Strategy and several other federal government websites

Text version

Examples of factors considered when assessing how well organizations perform on environmental matters are mitigation of climate change effects, biodiversity protection, and energy efficiency.

Examples of factors considered when assessing how well organizations perform on social matters are gender, diversity, and inclusion; Indigenous rights; and cybersecurity and data privacy.

Examples of factors considered when assessing how well organizations perform on governance matters are board composition, executive compensation, and whistleblower protection.

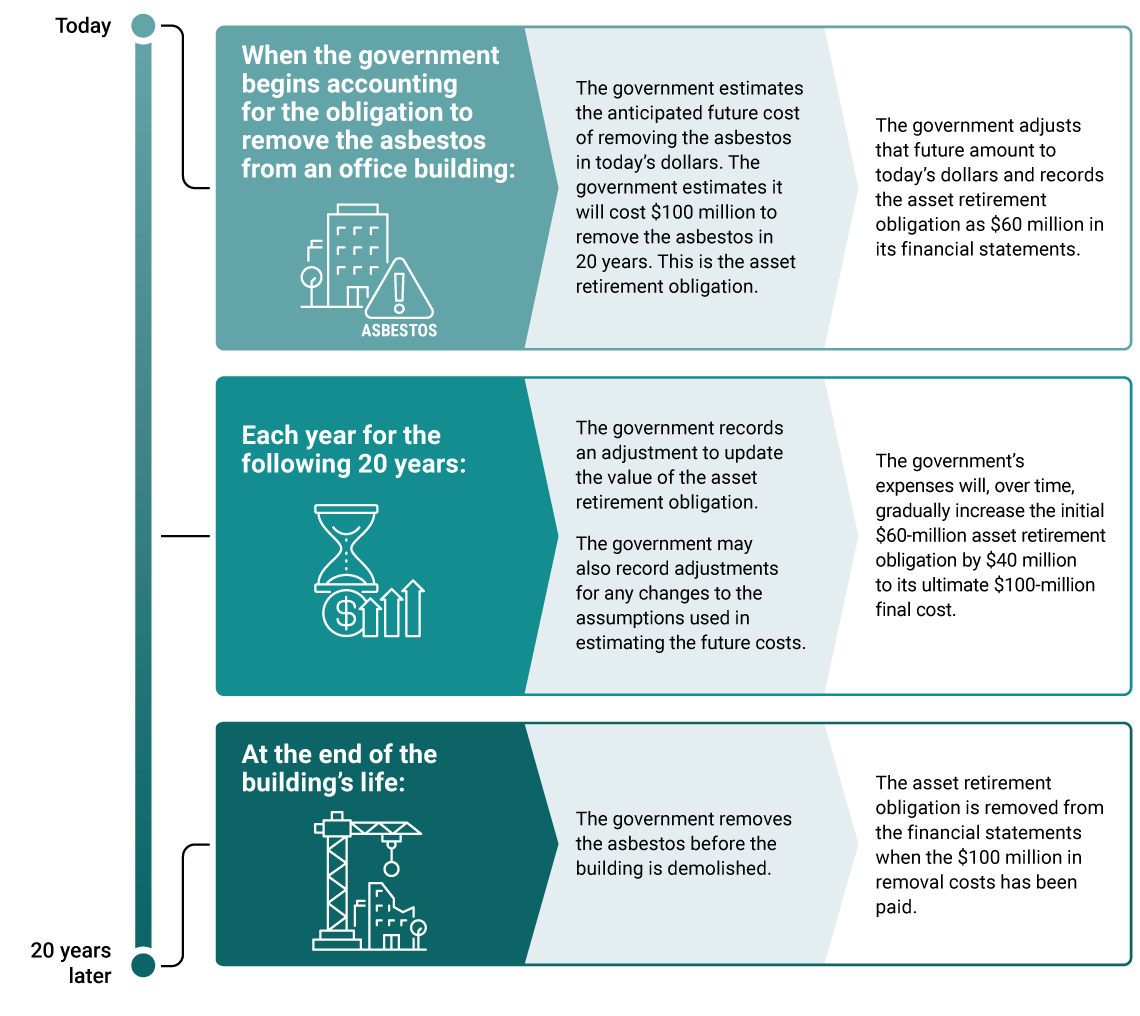

Asset retirement obligations

A new accounting standard will impact the government’s consolidated financial statements starting in the 2022–23 fiscal year.

The Government of Canada owns $91.9 billion of tangible capital assets that are managed by various federal organizations across Canada. The government may be legally required to take actions to remediate or dispose of some tangible capital assets. For example, buildings with asbestos may need to be remediated or some marine vessels may need to be dismantled.

The government has a great deal of work to do in its preparation for the new accounting standard.

Example—Removal of asbestos from an office building

Source: Example developed by the Office of the Auditor General of Canada on the basis of a new public sector accounting standard

Text version

This flow chart shows an example for accounting for asset retirement obligations.

When the government begins accounting for the obligation to remove the asbestos from an office building, the following happens:

- The government estimates the anticipated future cost of removing the asbestos in today’s dollars. The government estimates it will cost $100 million to remove the asbestos in 20 years. This is the asset retirement obligation.

- The government adjusts that future amount to today’s dollars and records the asset retirement obligation as $60 million in its financial statements.

Each year for the following 20 years, the following happens:

- The government records an adjustment to update the value of the asset retirement obligation. The government may also record adjustments for any changes to the assumptions used in estimating the future costs.

- The government’s expenses will, over time, gradually increase the initial $60‑million asset retirement obligation by $40 million to its ultimate $100‑million final cost.

At the end of the building’s life, the following happens:

- The government removes the asbestos before the building is demolished.

- The asset retirement obligation is removed from the financial statements when the $100 million in removal costs has been paid.

Find out more

Videos