2015 Spring Reports of the Auditor General of Canada Report 3—Tax-Based Expenditures

2015 Spring Reports of the Auditor General of Canada Report 3—Tax-Based Expenditures

Performance audit reports

This report presents the results of a performance audit conducted by the Office of the Auditor General of Canada under the authority of the Auditor General Act.

A performance audit is an independent, objective, and systematic assessment of how well government is managing its activities, responsibilities, and resources. Audit topics are selected based on their significance. While the Office may comment on policy implementation in a performance audit, it does not comment on the merits of a policy.

Performance audits are planned, performed, and reported in accordance with professional auditing standards and Office policies. They are conducted by qualified auditors who

- establish audit objectives and criteria for the assessment of performance;

- gather the evidence necessary to assess performance against the criteria;

- report both positive and negative findings;

- conclude against the established audit objectives; and

- make recommendations for improvement when there are significant differences between criteria and assessed performance.

Performance audits contribute to a public service that is ethical and effective and a government that is accountable to Parliament and Canadians.

Introduction

Background

3.1 The principal function of the tax system is to raise the revenues necessary to fund government spending. The tax system can also be used to achieve public policy objectives by encouraging certain behaviours (for example, using public transit, moving to get a job, saving for retirement).

Tax expenditure—The forgone tax revenues associated with a given tax measure.

Forgone tax revenues—Estimated tax revenues that the government will not receive because of the introduction of tax measures.

3.2 Tax measures can pursue different objectives. Many are basic objectives of the tax system, such as better recognizing the ability of individuals to pay, or facilitating compliance and the administration of the tax system. Tax measures that governments use to promote specific policy objectives are often described as “tax expenditures” because these measures reduce the amount of revenue that governments would otherwise collect. “Expenditures” are typically thought of as outlays or expenses, but “tax expenditures” involve no such outlays. Rather, a tax expenditure usually reduces or delays the taxes that citizens or businesses would have paid without the underlying tax measure. Tax measures that involve expenditures can include

- tax exemptions (remove the obligation to pay tax),

- deferrals (delay the payment of tax),

- deductions (reduce total taxable income), or

- credits (directly reduce the amount of tax payable).

3.3 Each year, the Canadian government forgoes tens of billions of dollars in tax revenues resulting from tax expenditures. The Department of Finance Canada does not provide an estimate of the total amount of tax expenditures, as adding the estimated costs of individual tax expenditures does not result in an accurate total estimate. The main reasons for not providing a total estimated value are that the income tax rate structure is progressive and that tax measures interact with one another. In this regard, the Canadian position is similar to those adopted by the federal governments of Australia and the United States.

3.4 The Department of Finance Canada takes a broad view of what constitutes a tax expenditure. The Department identifies approximately 140 tax expenditures related to personal and corporate income tax. We have classified these 140 tax expenditures into two subsets, the first of which can be considered structural or internal to the tax system. Tax expenditures in this subset are intended to make the tax system fair and efficient.

3.5 The second type of tax expenditure contains measures that are close or perfect substitutes for the government’s direct spending. The Department of Finance Canada does not have an official position on whether some tax expenditures are substitutes for direct spending. For the purpose of this audit, we refer to these tax expenditures as “tax-based expenditures.” For these measures, the government could have chosen, for example, to send a cheque to families (direct spending) instead of providing a tax credit (using the tax system). Depending on tax experts’ interpretations, the number of tax-based expenditures for personal and corporate income tax varies greatly.

Direct program spending—The portion of total budgetary spending that includes operating and capital spending and grants and contributions but excludes public debt charges and major transfers to persons and to other levels of government (as specified in the Public Accounts).

3.6 Government spending can be channelled through the tax system in the form of tax measures or through direct program spending (Exhibit 3.1). As recognized in economics literature, tax-based expenditures operate like direct expenditures and can be used to achieve policy goals. In fact, the International Monetary Fund’s Fiscal Transparency Code states that “because the government policy objectives could be achieved alternatively through a subsidy or other direct outlays, [tax expenditures] are regarded as equivalent to budget expenditure.”

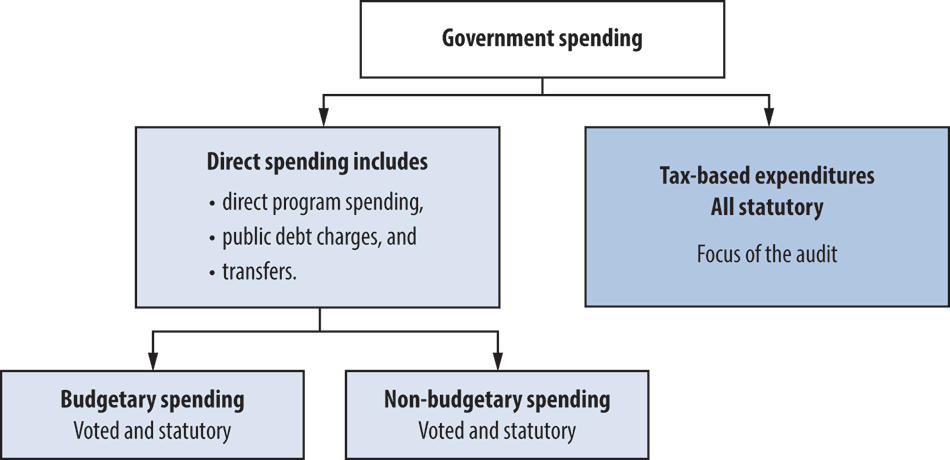

Exhibit 3.1—Main components of government spending

Budgetary expenditures—The largest portion of the government’s expenditures, including operating and capital expenditures; transfer payments to other levels of government, individuals, and organizations; public debt charges; and payments to Crown corporations.

Non-budgetary expenditures—Changes in the composition of the financial assets of the government, including loans, investments, and advances.

Voted spending—Expenditures voted by Parliament annually for a federal department or agency in a particular expenditure category, such as operations, capital, or grants.

Statutory spending—Expenditures authorized under specific legislation. As they are already approved by statute, they do not require further approval. Over 60 percent of government spending is statutory.

3.7 Tax-based expenditures impose a cost on governments because of forgone revenues. Among the largest measured tax-based expenditures in 2013 were

- the low tax rate for small businesses ($2.9 billion),

- the Age Credit ($2.8 billion),

- the Charitable Donations Tax Credit ($2.2 billion), and

- the Scientific Research and Experimental Development Investment Tax Credit (non-refundable component: $1.8 billion).

3.8 Direct government spending is made up of budgetary expenditures and non-budgetary expenditures that are further broken down into voted and statutory expenditures.

3.9 Among other responsibilities, the Department of Finance Canada

- develops and evaluates federal tax policies and legislation in the areas of personal income tax, corporate income tax, and sales and excise tax;

- screens proposals for new tax expenditures;

- evaluates the relevance and effectiveness of tax expenditures;

- prepares estimates of the forgone revenues from tax expenditures; and

- monitors the effects of tax expenditures to determine unintended revenue losses.

3.10 Canada Revenue Agency (CRA). The CRA is responsible for administering Canada’s tax laws, including the Income Tax Act.

3.11 The CRA undertakes a wide range of activities to assess and process tax returns, information returns, and payments for individuals and businesses. It detects non-compliance, for example, through risk assessment, third-party data matching, verification, audits, and other means. Through these activities, it supports the process of assessing tax returns. The Canada Revenue Agency advises the Tax Policy Branch of the Department of Finance Canada if the Agency identifies issues with the legislation, both when the legislation is being developed and once it has been implemented, if any unforeseen issues are identified during administration.

Focus of the audit

3.12 This audit examined whether the Department of Finance Canada, with the support of the Canada Revenue Agency and consistent with their respective roles and responsibilities, properly manages tax-based expenditures. We also examined whether the Department of Finance Canada reported clear and useful information on tax-based expenditures to support proper scrutiny by Parliament and Canadians.

3.13 This audit matters because important programs are delivered through the tax system, and the resulting tax-based expenditures could account for tens of billions of dollars annually. Furthermore, Parliament requires complete information on tax-based expenditures to exercise adequate oversight.

3.14 Exhibit 3.2 presents the tax-based expenditures that we examined.

Exhibit 3.2—Nine tax-based expenditures were audited

| Tax-based expenditure | Scope of auditing | Projected value in 2013 by the Department of Finance Canada | |

|---|---|---|---|

| Analysis * | Monitoring ** and evaluation *** | ||

| First-Time Home Buyers’ Tax Credit | Yes | Yes | $115 million |

| Children’s Fitness Tax Credit | Yes | Yes | $115 million |

| Mineral Exploration Tax Credit for Flow-Through Share Investors | No | Yes | $40 million |

| Age Credit | No | Yes | $2.8 billion |

| Textbook Tax Credit | Yes | Yes | $33 million |

| Special tax rate for credit unions | No | Yes | $37 million |

| Class 43.1 and 43.2: material to produce energy from alternative renewable sources | No | Yes | Not available |

| Scientific Research and Experimental Development (SR&ED) Investment Tax Credit | No | Yes | Non-refundable component: $1.8 billion |

| Search and Rescue Volunteers Tax Credit | Yes | No | Not available because the tax measure was introduced in 2014. |

* Analysis refers to the work performed by the Department of Finance Canada before a tax measure is implemented.

** Monitoring refers to work performed after a tax measure is implemented, such as analyzing data pertaining to the tax measure and reviewing comments from stakeholders following the measure’s implementation. In addition, monitoring can include analyses on selected aspects of tax measures, such as design, cost, or impact on low-income Canadians.

*** Evaluation refers to the reviews performed after a tax measure is implemented, where effectiveness, equity, compliance and administration issues, and the efficiency of the means to deliver government support are examined together to assess the ongoing relevance and performance of the tax measure.

3.15 More details about the audit objectives, scope, approach, and criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Informing Canadians on tax-based expenditures

The information provided by the Department of Finance Canada on tax-based expenditures does not adequately support parliamentary oversight

3.16 Overall, in our opinion, information provided by the Department of Finance Canada on tax-based expenditures does not adequately support parliamentary oversight. Some information that is available for direct program spending is not available for tax-based expenditures. For example, the report does not include future cost projections. Also, experience abroad provides examples where additional details related to tax-based expenditures are disclosed or reported in a consolidated manner. We consider these examples to represent good practices.

3.17 This finding matters because a properly designed tax expenditure report is critical to provide parliamentarians and Canadians with comprehensive and consolidated information on tax expenditures and what these expenditures are accomplishing. Also, in our opinion, Parliament requires comprehensive and consolidated information to effectively exercise its oversight of tax-based expenditures and understand total government spending.

3.18 Our analysis supporting this finding presents what we examined and discusses

- the Tax Expenditures and Evaluations report,

- the reports on Plans and Priorities, and

- reporting practices followed in other jurisdictions.

3.19 Public reporting and parliamentary oversight of government spending are important elements of an effective tax expenditure management system. In Canada, all government spending requires parliamentary approval. Each year, non-statutory spending must be voted on by Parliament by way of an appropriation act. This process allows parliamentarians to scrutinize expenditures, ask questions, and keep the government accountable.

3.20 Statutory expenditures are governed by specific legislation; they represent a significant proportion of the government’s spending and do not require yearly approval by Parliament. Tax-based expenditures fall into this category. Statutory expenditures are not subject to ongoing parliamentary scrutiny through appropriation bills. Furthermore, unlike direct program spending, tax expenditures are not subject to a spending limit authorized by Parliament and may put pressure on the federal government’s finances.

3.21 Because tax expenditures are excluded from the expenditure management system, they are not reviewed by parliamentarians. Many subject matter experts believe that both tax expenditures and direct program spending should be considered together. These experts also believe that tax expenditure reporting should be included in budget documents. For many years, the information on tax expenditures and direct program spending has been considered separately. As a step in the right direction, the government now publishes the two types of information on the same day. Since 2013, the Department of Finance Canada has published the Tax Expenditures and Evaluations report on the day the government tables the Main Estimates.

3.22 Our recommendation in this area of examination appears at paragraph 3.33.

3.23 What we examined. We examined whether the Department of Finance Canada reported clear and useful information on tax-based expenditures.

3.24 Tax Expenditures and Evaluations report. Since 1994, the Department of Finance Canada has published tax expenditures for personal and corporate income taxes as well as for the goods and services tax (GST). The Department of Finance Canada Tax Expenditures and Evaluations report presents tax expenditures, estimates of forgone revenues, and current-year projections for many tax measures. The information is further categorized by themes such as culture, education, or employment.

3.25 Beginning in 2000, the tax expenditures report has been separated into two documents. The first document, the Tax Expenditures and Evaluations report, is published annually. It provides past years’ estimates for tax expenditures as well as past and current-year projections. It also provides research and analytical papers addressing specific tax measures.

3.26 The companion document, Tax Expenditures: Notes to the Estimates/Projections, is a reference that presents, at the time of publication, the existing tax expenditures and their objectives. This document also explains how the estimates and projections are calculated. This document is updated periodically and was last published in 2010.

3.27 We found that the annual Tax Expenditures and Evaluations report does not include valuable information that may be available in departments’ expenditure reports or in tax expenditure reports published in some other jurisdictions. For instance, the Department of Finance Canada does not

- report on the number of beneficiaries for each tax expenditure (this information, however, is provided in a separate table by the Canada Revenue Agency for selected tax expenditures);

- consolidate the information about the objective or purpose of each tax expenditure every year (this information was last published in 2010); or

- publish future cost projections of its tax expenditures (this information was last published in the 2008 report).

3.28 Reports on Plans and Priorities. The Tax Expenditures and Evaluations report contrasts with reports on plans and priorities for direct program spending. Reports on plans and priorities describe programs and sub-programs and outline their expected results and their associated resource requirements for the next three fiscal years.

3.29 Reporting practices followed in other jurisdictions. Some international jurisdictions have adopted reporting practices that, we believe, provide valuable information not readily available in Canada.

3.30 Tax expenditures reports published in other jurisdictions (for example, Australia, France, and Pennsylvania) at times include a short description of the tax measure, a discussion of its purpose or objective, the future cost of each tax expenditure, the number of beneficiaries, the administrative costs, and the reliability of the estimation method, as well as references to direct spending programs. We believe that details such as these could improve the quality and completeness of the reporting by the Department of Finance Canada.

3.31 In addition, in our view, those who review government spending would gain by being able to cross-reference tax-based expenditures to direct program spending. France offers an example of good reporting that links tax expenditure items with direct spending under the same program or sub-program.

3.32 There is no requirement to prepare Tax Expenditures and Evaluations reports or to table them in Parliament. We believe that reporting in Parliament along with the related budget documents would greatly support parliamentary oversight.

3.33 Recommendation. To adequately support parliamentary oversight, the Department of Finance Canada should adopt improved reporting practices for tax-based expenditures to provide additional information, including

- cross-references of tax expenditures to direct program spending, so that readers can understand total government spending; and

- projected cost estimates in future years.

Also, in order to support parliamentary oversight, the annual Tax Expenditures and Evaluations report should be tabled in Parliament.

The Department’s response. Agreed. The Department of Finance Canada agrees with the objective of continuously improving the information on tax expenditures that is provided to Canadians. The Government of Canada provides extensive information on tax expenditures through its annual Tax Expenditures and Evaluations report. This report helps inform the public debate on tax expenditures and contributes to transparency and accountability. Along with its companion reference document, Tax Expenditures: Notes to the Estimates/Projections, this report provides valuable information to the public on the objectives, design, and actual and projected costs of federal tax expenditures. International organizations have recognized the quality of Canada’s reporting on tax expenditures.

Starting with the next edition of Tax Expenditures and Evaluations, the Department will provide two additional years of cost projections, to the extent that sufficient information exists to develop reasonable projection assumptions. The Department will also add information in the companion reference document, Tax Expenditures: Notes to the Estimates/Projections, to better inform readers on government spending programs.

Analyzing proposed tax measures

For most of the tax measures we examined, the Department of Finance Canada analyzed most key elements of its framework

3.34 Overall, we found that when analyzing tax-based expenditures before they were implemented, the Department of Finance Canada considered most key elements of its analytical framework, such as the need for government intervention, and efficiency, effectiveness, and equity. Analyses on potential tax measures are prepared to support the decision-making process. It is therefore important that the Department analyze tax measures consistently.

3.35 Our analysis supporting this finding presents what we examined and discusses

3.36 Tax policy considerations such as policy need (relevance), efficiency, effectiveness, equity, and spending alternatives, as well as forgone revenues, are important elements to analyze before implementing a new tax measure. These considerations are listed as best practices by organizations such as the Organisation for Economic Co-operation and Development and the International Monetary Fund.

3.37 We made no recommendations in this area of examination.

3.38 What we examined. We examined whether the Department of Finance Canada considered key elements we had identified—policy need (relevance), efficiency, effectiveness, equity, spending alternatives, and forgone revenues—while analyzing the proposed tax measures before they were implemented. We examined four measures:

- First-Time Home Buyers’ Tax Credit,

- Children’s Fitness Tax Credit,

- Textbook Tax Credit, and

- Search and Rescue Volunteers Tax Credit.

3.39 We selected these measures because they were introduced between 2006 and 2014. Therefore, the analysis of proposed tax measures should have taken place during that period of time. In our opinion, these measures could be seen as substitutes for direct program spending.

3.40 Analytical framework. The Department of Finance Canada has a framework to analyze tax-based expenditures before they are implemented. According to the Department, the analysis of proposals for new tax measures is tailored to the context, and it is not always relevant to include all the elements of the analytical framework. The Department indicated that the following elements may be considered when analyzing a given tax issue or a proposed tax change:

- relevance, taking into account government support and actions in a given area (that is, does a tax measure have a clearly identified and sound rationale? Does it answer a real policy need?);

- consistency with government priorities and roles and responsibilities of the federal government;

- effectiveness in achieving its policy objective(s);

- economic (efficiency) impacts;

- impact on different groups of taxpayers (for example, by income class or industry);

- equity and impact on fairness of the tax system;

- cost and revenue impact and long-term fiscal sustainability;

- legislative feasibility;

- impact on complexity of the tax system;

- impact on compliance and administrative costs;

- vulnerability to tax planning, avoidance, and evasion;

- potential provincial, territorial, or international impacts;

- gender and environmental impacts; and

- existence of alternative means (including non-tax measures and programs) to achieve the same objectives more efficiently.

3.41 For the purpose of our audit, we selected the following elements: policy need (relevance), efficiency, effectiveness, equity, spending alternatives, and forgone revenues.

3.42 We found that the Department analyzed the issues related to policy need, efficiency, effectiveness, equity, and forgone revenues for most of the selected tax measures. However, the Department did not consider spending alternatives for the tax measures we examined.

Evaluating existing tax-based expenditures

The Department of Finance Canada does not systematically evaluate all existing tax-based expenditures

3.43 Overall, we found that the Department of Finance Canada monitored all selected tax-based expenditures. However, the Department did not systematically evaluate all tax-based expenditures. Also, evaluations prepared by the Department were generally not published.

3.44 We found examples where the Department of Finance Canada identified issues in relation to certain tax measures before implementing them. Despite those issues, the Department had yet to evaluate these tax measures.

3.45 Regular evaluations of all tax-based expenditures are important, since circumstances leading to their implementation can change. For example, according to the Department, measures that were implemented to support a declining economy should be reviewed when macroeconomic conditions improve.

3.46 Our analysis supporting this finding presents what we examined and discusses

- monitoring,

- evaluation planning,

- evaluations,

- tax measures that were analyzed and evaluated,

- tax measures that were analyzed and not evaluated, and

- published research information on tax expenditures.

3.47 Evaluation requirements for direct program spending. Direct program spending is subject to the Treasury Board Policy on Evaluation published in 2009. Officials from the Treasury Board of Canada Secretariat informed us that the 2009 policy was developed to support the Expenditure Management System, including strategic reviews that addressed 100 percent of direct program spending and the operating costs of an organization’s major statutory programs. The policy requires departments to evaluate all direct program spending over a five-year cycle. The policy defines evaluation as the systematic collection and analysis of evidence on the outcomes of programs to make judgments about their relevance, performance, and alternative ways to deliver them or to achieve the same results. This requirement to evaluate programs does not apply to transfers and public debt charges.

3.48 Evaluation requirements for tax-based expenditures. While the administrative aspects of tax expenditures may be evaluated by the Canada Revenue Agency as part of its risk-based audit and evaluation plan, the policy requirement to evaluate programs does not apply to tax-based expenditures. Tax expenditures are the Department of Finance Canada’s responsibility. These expenditures are not covered by Treasury Board’s evaluation policy. Also, while some tax expenditures have been reviewed and modified by the government, tax expenditures are not subject to strategic reviews.

3.49 Exhibit 3.3 compares the approval and review processes of direct program spending and tax-based expenditures.

Exhibit 3.3—Comparison of direct program spending and tax-based expenditures for approvals and reviews

| Attribute | Direct program spending | Tax-based expenditures |

|---|---|---|

| Cabinet and ministerial approval | Memorandum to Cabinet, Treasury Board submission | Briefing notes prepared for the Minister of Finance and the Prime Minister |

| Maximum value of the measure | Total authorities granted by Parliament through an appropriation act | No maximum |

| Approval by Parliament | Parliamentary scrutiny and approval of Estimates each year by annual appropriation act | Approved in the Budget Implementation Act or other statutes |

| Evaluation | Required every five years, according to the Treasury Board Policy on Evaluation | No requirements |

| Subject to expenditure reviews | Yes | No |

Non-refundable tax credits—Non-refundable tax credits are deducted from the taxes owed by taxpayers to the government. When the credits exceed the taxes owed, the excess is not refundable to taxpayers.

Refundable tax credits—Like non-refundable tax credits, refundable tax credits are deducted from the taxes owed by taxpayers to the government. In contrast, however, when the credits exceed the taxes owed, the excess is refundable to taxpayers.

3.50 Since the 2012–13 fiscal year, the government has adopted a new accounting standard. Under this new standard, most refundable tax credits are reclassified as part of direct program spending. The Treasury Board of Canada Secretariat has advised us that refundable tax credits are, however, not covered by its Policy on Evaluation. The Policy applies to direct program spending as reported in the Estimates. Accounting standards continue to treat non-refundable tax-based expenditures differently from direct program spending.

3.51 Our recommendations in this area of examination appear at paragraphs 3.61 and 3.63.

3.52 What we examined. We examined the process the Department of Finance Canada used to monitor and evaluate tax measures. We also examined the extent to which the Department of Finance Canada evaluated the measures we examined. We wanted to ensure that evaluations included these key elements:

- an evaluation of effectiveness (that is, a comparison of policy outcomes with objectives);

- equity;

- implementation costs and compliance issues for the tax administration;

- efficiency of delivery; and

- frequency of evaluation.

3.53 We selected eight measures:

- First-Time Home Buyers’ Tax Credit,

- Children’s Fitness Tax Credit,

- Mineral Exploration Tax Credit for Flow-Through Share Investors,

- Age Credit,

- Textbook Tax Credit,

- Special tax rate for credit unions,

- Class 43.1 and 43.2: material to produce energy from alternative renewable sources, and

- Scientific Research and Experimental Development (SR&ED) Investment Tax Credit.

3.54 We selected these measures because they have been implemented long enough that the Department of Finance Canada could have evaluated them between 2008 and 2014. In our opinion, these measures could be seen as substitutes for direct program spending.

3.55 Monitoring. According to the Organisation for Economic Co-operation and Development, it is good practice to monitor the effects of a tax measure and use that information to evaluate the measure formally. For the purpose of this audit, we define monitoring as analyzing data pertaining to the tax measure and reviewing comments from stakeholders following the measure’s implementation. In addition, monitoring can include analyses on selected aspects of tax measures such as design, cost, or impact on low-income Canadians. The Department of Finance Canada provided evidence showing that it monitored all selected tax-based expenditures.

3.56 Evaluation planning. For the purpose of this audit, evaluations are the reviews performed after the implementation of the tax measure where effectiveness, equity, compliance and administration issues, and the efficiency of the means to deliver the government support are examined together to assess the ongoing relevance and performance of the tax measure. This periodic evaluation is similar to the practice used to review direct program spending.

3.57 We found that the Department establishes annual and medium-term work plans for evaluation work to be done on various topics and to be potentially published in its annual report. According to the Department, the same elements listed in paragraph 3.40 could be considered when evaluating existing tax measures. The Department chooses measures to review according to current priorities and issues of interest. Work plans are influenced by comments the Department receives from stakeholders on potential and existing tax expenditures.

3.58 Evaluations. We found that the Department did not evaluate four of the eight measures that we examined:

- Mineral Exploration Tax Credit,

- Age Credit,

- Textbook Tax Credit, and

- First-Time Home Buyers’ Tax Credit.

While the Department monitored these credits, not all elements related to these tax measures were assessed together. In our view, the monitoring of selected issues does not constitute an evaluation, since it does not provide a complete set of information regarding the ongoing relevance and overall performance of tax measures.

3.59 Tax measures that were analyzed and evaluated. We found that the Department was aware of some issues regarding the design of the Children’s Fitness Tax Credit prior to implementation in 2007. An Expert Panel appointed in 2006 to advise the Department on the credit’s design raised a concern that some parents may lack the means to pay for membership fees, programs, or camps. The Panel requested that, after four years of implementation, the Children’s Fitness Tax Credit be reviewed. We found that the Department prepared an appropriate evaluation in 2013 in response to the Expert Panel. This information was not made public.

3.60 Tax measures that were analyzed and not evaluated. Regarding the Textbook Tax Credit, we found that the Department identified some possible design issues before the credit’s implementation. The Department estimated the projected impact of the Textbook Tax Credit on full-time and part-time students by level of income. The Department also considered the cost of expanding the existing Education Tax Credit as an alternative to introducing the Textbook Tax Credit. For the First-Time Home Buyers’ Tax Credit, we found that the Department identified some risks regarding this tax credit that the government had introduced to stimulate housing demand during the financial turmoil in 2009. We found that the Department did not evaluate these two tax credits years after their implementation, despite possible issues that it identified. In fact, the Department indicated that based on its monitoring, there was little need to evaluate the First-Time Home Buyers’ Tax Credit and the Textbook Tax Credit. The Department does not have complete information to determine if these tax measures are relevant and performing as intended.

3.61 Recommendation. The Department of Finance Canada should conduct systematic and ongoing prioritized evaluations of all tax-based expenditures, similar to what all departments and agencies are required to do for direct program spending. These evaluations should include

- assessing the measure’s ongoing relevance and appropriateness;

- determining whether the tax system is the most effective and efficient way to meet policy objectives and deliver outcomes; and

- establishing whether to abolish, modify, replace, or retain the tax-based expenditure.

The Department’s response. Agreed. The Department of Finance Canada agrees that tax expenditures should be properly evaluated. Consistent with the Department’s responsibility of supporting the Minister of Finance in the development of tax policy, the Department analyzes all key aspects of all measures prior to their implementation and monitors and evaluates the key aspects of existing tax expenditures on an ongoing basis.

Since 2006, more than one third of all existing income tax expenditures were either adopted or modified to some extent.

Tax expenditures differ from spending programs. The Department’s approach to the evaluation of tax expenditures is tailored to their characteristics, and takes into consideration how these interact with the overall tax system, notably interactions among tax measures, tax policy objectives—for example, fairness, competitiveness, and simplicity—as well as provincial and international considerations, fiscal implications, potential market reactions, and system integrity.

Going forward, the Department will document the process by which it regularly and systematically reviews all tax expenditures. Evaluations will be prioritized on the basis of any gaps identified in the analysis conducted by the Department.

3.62 Published research information on tax expenditures. The Department publishes some of its research in the Tax Expenditures and Evaluations report. For the eight measures we audited, one research paper has been released in the Tax Expenditures and Evaluations report since 2008. The document on accelerated capital cost allowance (CCA) attempted to estimate tax expenditures related to accelerated CCA for assets in Class 43.1 and 43.2. This document did not, however, evaluate the measure. Since 2009, the Department of Finance Canada has published one evaluation in the annual report not related to our sample of measures. In addition, the Expert Panel on Research and Development, mandated by the government, published a report that included an evaluation of the Scientific Research and Experimental Development Investment Tax Credit in 2011.

3.63 Recommendation. Similar to reporting for direct program spending evaluations, the Department should publish, in a timely manner, pertinent information for all tax-based expenditure programs that have been evaluated to facilitate consideration by parliamentarians and Canadians on the ongoing relevance and performance of tax-based expenditures.

The Department’s response. Agreed. The Department of Finance Canada agrees with the objective of continuously improving the public information available on tax expenditures. The Department has been proactive in providing valuable and detailed information on tax expenditures to parliamentarians and the public at large, in particular through its Tax Expenditures and Evaluations report. In recent years, the Department published five analytical papers on the eight tax expenditures that the audit team reviewed. Evaluations of the administrative aspects of tax expenditures are also made public by the Department and the Canada Revenue Agency. Canada is one of a handful of countries that publishes evaluations of tax expenditures on a regular basis.

The Department will make sure that high-quality analyses and evaluations of tax expenditures continue to be performed and that pertinent information be made available to the public as appropriate.

Monitoring costs and sharing information

The Canada Revenue Agency monitors costs and shares information with the Department of Finance Canada

3.64 Overall, we found that the Canada Revenue Agency (CRA) monitors costs to implement new measures, including the impact of the measure on provincial or territorial administrations, on its own internal operations, or on its publications. It also monitors compliance issues and shares relevant information with the Department of Finance Canada on an ongoing basis.

3.65 This finding is important because policy makers need to consider administrative costs and compliance issues when making decisions about tax policies. The ongoing exchange of information, on a timely basis, is critical to ensure that tax-based expenditures are designed properly and minimize administrative costs and compliance issues.

3.66 Our analysis supporting this finding presents what we examined and discusses

- monitoring administrative and compliance issues, and

- providing advice to the Department of Finance Canada.

3.67 The design and implementation of a new tax measure can directly affect the tax system’s complexity and the costs of administration and compliance.

3.68 When the Department of Finance Canada is developing a new tax-based expenditure, the CRA evaluates whether the Agency needs supplementary funding to cover additional administrative costs or whether it can simply absorb the costs. The Agency requests additional funding when incremental costs exceed its ability to manage the new tax measure within existing funding levels. In these cases, Agency officials examine the possibility of obtaining additional funding through the regular Treasury Board submission process. In many cases, the additional funding comes from modifications to existing tax measures and is requested through Treasury Board omnibus submissions. These submissions are part of the government’s budget for a given year.

3.69 We made no recommendations in this area of examination.

3.70 What we examined. We examined whether the Department of Finance Canada, with the support of the Canada Revenue Agency and consistent with their respective roles and responsibilities, assessed administrative and compliance issues as well as enforceability before putting tax-based expenditures in place. We also examined whether the Department of Finance Canada, with the support of the Canada Revenue Agency and consistent with their respective responsibilities, considered information about potential compliance issues and implementation costs of tax-based expenditures.

3.71 Monitoring administrative and compliance issues. We found that the Canada Revenue Agency monitors administrative and compliance issues for the tax administration concerning specific tax-based expenditures and shares information with the Department of Finance Canada on an ongoing basis.

3.72 We found that the Canada Revenue Agency examines the impacts of changes to tax measures on a number of operational aspects. For instance, the Agency examines the impact of the measure on provincial or territorial administrations, on its own internal operations, or on its publications. The Canada Revenue Agency also examines required changes to its IT systems, the number of taxpayers affected, and the expected number of inquiries the tax measure change will generate.

3.73 According to the Canada Revenue Agency, adding just one line to the T1 tax return related to a new non-refundable tax credit can involve significant effort and costs the Agency up to $1 million, based on similar costs for other standard tax measures. This expense is due to additional work, such as

- the information technology (IT) coding requirements to create the necessary data fields, and

- the administration of the additional information that helps the Agency collect data and process claims.

As well, incremental costs may result from measures that involve a high number of claimants (such as additional general enquiries, verification activities, objections, appeals).

3.74 Providing advice to the Department of Finance Canada. We found that Canada Revenue Agency officials suggested modifications and design improvements and advised on certain measures where applicable or answered queries about these measures.

3.75 Most exchanges regarding new tax measures or amendments to existing ones take place under tight timelines in the pre-Budget period. These exchanges typically occur informally, but in some cases, the Canada Revenue Agency prepares a more thorough analysis to formulate advice, suggest changes to a specific measure, or make a recommendation to the Department of Finance Canada.

3.76 After a tax measure has been implemented, the Canada Revenue Agency usually provides the Department of Finance Canada with comments and analysis on unforeseen effects such as compliance issues or additional costs related to the tax measure.

Conclusion

3.77 While the Department of Finance Canada had appropriate practices to analyze new tax measures, to monitor existing tax-based expenditures, and to share information with the Canada Revenue Agency, overall we concluded that the Department fell short on managing tax-based expenditures. We reached this conclusion because these expenditures were not systematically evaluated and the information reported did not adequately support parliamentary oversight.

About the Audit

The Office of the Auditor General’s responsibility was to conduct an independent examination of tax-based expenditures to provide objective information, advice, and assurance to assist Parliament in its scrutiny of the government’s management of resources and programs.

All of the audit work in this report was conducted in accordance with the standards for assurance engagements set out by the Chartered Professional Accountants of Canada (CPA) in the CPA Canada Handbook—Assurance. While the Office adopts these standards as the minimum requirement for our audits, we also draw upon the standards and practices of other disciplines.

Objectives

The audit examined whether the Department of Finance Canada, with the support of the Canada Revenue Agency and consistent with their respective roles and responsibilities, properly manages tax-based expenditures. As part of this objective, we sought

- to determine whether the Department of Finance Canada, with the support of the Canada Revenue Agency and consistent with their respective roles and responsibilities, appropriately analyzed tax-based expenditures before their implementation;

- to determine whether the Department of Finance Canada, with the support of the Canada Revenue Agency and consistent with their respective roles and responsibilities, appropriately monitored and evaluated existing tax-based expenditures; and

- to determine whether the Department of Finance Canada reported clear and useful information on tax-based expenditures.

Scope and approach

The scope of this audit included the Tax Policy Branch of the Department of Finance Canada and the Canada Revenue Agency. The scope was limited to personal and corporate income tax measures involving tax-based expenditures. The audit excluded tax expenditures related to the goods and services tax (GST) and omitted measures that are, in our view, structural or internal to the tax system (for example, tax-free savings accounts and pension income splitting). Finally, the audit did not examine the models used by the Department of Finance Canada to determine the estimated or projected costs of particular tax expenditures.

We looked at how the need for tax-based expenditures was identified and how they were analyzed. The audit examined how the Department of Finance Canada considered alternative spending options as well as effectiveness, equity, efficiency, and forgone revenues. The audit also examined how the Canada Revenue Agency exchanged information with the Department of Finance Canada regarding implementation costs of new tax measures and related compliance issues.

We examined whether tax-based expenditures were monitored on an ongoing basis and were periodically evaluated following implementation.

We also examined the reporting of information on tax-based expenditures.

For the Department and the Agency to demonstrate that tax-based expenditures are managed properly, we sought information and analyses regarding the following tax measures:

- First-Time Home Buyers’ Tax Credit,

- Children’s Fitness Tax Credit,

- Mineral Exploration Tax Credit for Flow-Through Share Investors,

- Age Credit,

- Textbook Tax Credit,

- Search and Rescue Volunteers Tax Credit,

- Special tax rate for credit unions,

- Class 43.1 and 43.2: material to produce energy from alternative renewable sources, and

- Scientific Research and Experimental Development (SR&ED) Investment Tax Credit.

We chose these measures because they are substitutes for direct program spending; they are not structural tax expenditures. Four measures have been developed since 2006, and eight measures have been implemented for more than five years. We were therefore able to select four measures for analysis before their implementation and eight measures for the evaluations.

Criteria

To determine whether the Department of Finance Canada, with the support of the Canada Revenue Agency and consistent with their respective roles and responsibilities, appropriately analyzed tax-based expenditures before their implementation, we used the following criteria:

| Criteria | Sources |

|---|---|

|

The Department of Finance Canada analyzed tax measures against need, efficiency, effectiveness, and equity. |

|

|

The Department of Finance Canada assessed the costs and benefits of delivery options. |

|

|

The Department of Finance Canada assessed forgone revenues. |

|

|

The Department of Finance Canada, with the support of the Canada Revenue Agency, and consistent with their respective roles and responsibilities, assessed administrative and compliance issues as well as enforceability. |

|

To determine whether the Department of Finance Canada, with the support of the Canada Revenue Agency and consistent with their respective roles and responsibilities, appropriately monitored and evaluated existing tax-based expenditures, we used the following criteria:

| Criteria | Sources |

|---|---|

|

The Department of Finance Canada appropriately monitored and evaluated tax-based expenditures on an ongoing basis. |

|

|

The Department of Finance Canada, with the support of the Canada Revenue Agency, and consistent with their respective responsibilities, considered information in regard to potential compliance issues and administrative costs of existing tax-based expenditures. |

|

To determine whether the Department of Finance Canada reported clear and useful information on tax-based expenditures, we used the following criteria:

| Criteria | Sources |

|---|---|

|

The Department of Finance Canada reported clear and useful information on tax-based expenditures (including forgone revenues, evaluation results, and link with direct program spending). |

|

Management reviewed and accepted the suitability of the criteria used in the audit.

Period covered by the audit

The audit covered the period between 1 April 2008 and 31 March 2014. The period under examination was extended back to 1 January 2006 when examining the analysis of tax measures before implementation. Audit work for this report was completed on 22 January 2015.

Audit team

Assistant Auditor General: Nancy Y. Cheng

Principal: Richard Domingue

Director: Philippe Le Goff

Sébastien Defoy

Rose Pelletier

List of Recommendations

The following is a list of recommendations found in this report. The number in front of the recommendation indicates the paragraph where it appears in the report. The numbers in parentheses indicate the paragraphs where the topic is discussed.

Informing Canadians on tax-based expenditures

| Recommendation | Response |

|---|---|

|

3.33 To adequately support parliamentary oversight, the Department of Finance Canada should adopt improved reporting practices for tax-based expenditures to provide additional information, including

Also, in order to support parliamentary oversight, the annual Tax Expenditures and Evaluations report should be tabled in Parliament. (3.23–3.32) |

The Department’s response. Agreed. The Department of Finance Canada agrees with the objective of continuously improving the information on tax expenditures that is provided to Canadians. The Government of Canada provides extensive information on tax expenditures through its annual Tax Expenditures and Evaluations report. This report helps inform the public debate on tax expenditures and contributes to transparency and accountability. Along with its companion reference document, Tax Expenditures: Notes to the Estimates/Projections, this report provides valuable information to the public on the objectives, design, and actual and projected costs of federal tax expenditures. International organizations have recognized the quality of Canada’s reporting on tax expenditures. Starting with the next edition of Tax Expenditures and Evaluations, the Department will provide two additional years of cost projections, to the extent that sufficient information exists to develop reasonable projection assumptions. The Department will also add information in the companion reference document, Tax Expenditures: Notes to the Estimates/Projections, to better inform readers on government spending programs. |

Evaluating existing tax-based expenditures

| Recommendation | Response |

|---|---|

|

3.61 The Department of Finance Canada should conduct systematic and ongoing prioritized evaluations of all tax-based expenditures, similar to what all departments and agencies are required to do for direct program spending. These evaluations should include

|

The Department’s response. Agreed. The Department of Finance Canada agrees that tax expenditures should be properly evaluated. Consistent with the Department’s responsibility of supporting the Minister of Finance in the development of tax policy, the Department analyzes all key aspects of all measures prior to their implementation and monitors and evaluates the key aspects of existing tax expenditures on an ongoing basis. Since 2006, more than one third of all existing income tax expenditures were either adopted or modified to some extent. Tax expenditures differ from spending programs. The Department’s approach to the evaluation of tax expenditures is tailored to their characteristics, and takes into consideration how these interact with the overall tax system, notably interactions among tax measures, tax policy objectives—for example, fairness, competitiveness, and simplicity—as well as provincial and international considerations, fiscal implications, potential market reactions, and system integrity. Going forward, the Department will document the process by which it regularly and systematically reviews all tax expenditures. Evaluations will be prioritized on the basis of any gaps identified in the analysis conducted by the Department. |

|

3.63 Similar to reporting for direct program spending evaluations, the Department should publish, in a timely manner, pertinent information for all tax-based expenditure programs that have been evaluated to facilitate consideration by parliamentarians and Canadians on the ongoing relevance and performance of tax-based expenditures. (3.62) |

The Department’s response. Agreed. The Department of Finance Canada agrees with the objective of continuously improving the public information available on tax expenditures. The Department has been proactive in providing valuable and detailed information on tax expenditures to parliamentarians and the public at large, in particular through its Tax Expenditures and Evaluations report. In recent years, the Department published five analytical papers on the eight tax expenditures that the audit team reviewed. Evaluations of the administrative aspects of tax expenditures are also made public by the Department and the Canada Revenue Agency. Canada is one of a handful of countries that publishes evaluations of tax expenditures on a regular basis. The Department will make sure that high-quality analyses and evaluations of tax expenditures continue to be performed and that pertinent information be made available to the public as appropriate. |

PDF Versions

To access the Portable Document Format (PDF) version you must have a PDF reader installed. If you do not already have such a reader, there are numerous PDF readers available for free download or for purchase on the Internet: