2022 Reports 9 and 10 of the Auditor General of Canada to the Parliament of CanadaReport 10—Specific COVID-19 Benefits

Independent Auditor’s Report

Table of Contents

Part 1—Key Findings

- Introduction

- Findings and Recommendations

- Conclusion

- Exhibits:

- 10.1—Periods of availability of COVID‑19 program benefits

- 10.2—Payments to recipients for COVID‑19 benefit programs

- 10.3—Simplified COVID‑19 benefit application process for individuals and employers

- 10.4—After a 17% reduction in 2020, economic activity bounced back to its pre‑COVID‑19 level by November 2021

- 10.5—After a major decrease between February and April 2020, the number of hours worked went back to pre‑COVID‑19 level as of May 2021, with some service industries still affected

- 10.6—Annual after‑tax income increased among the lowest‑income earners between 2019 and 2020 due to government payments for COVID‑19 benefits

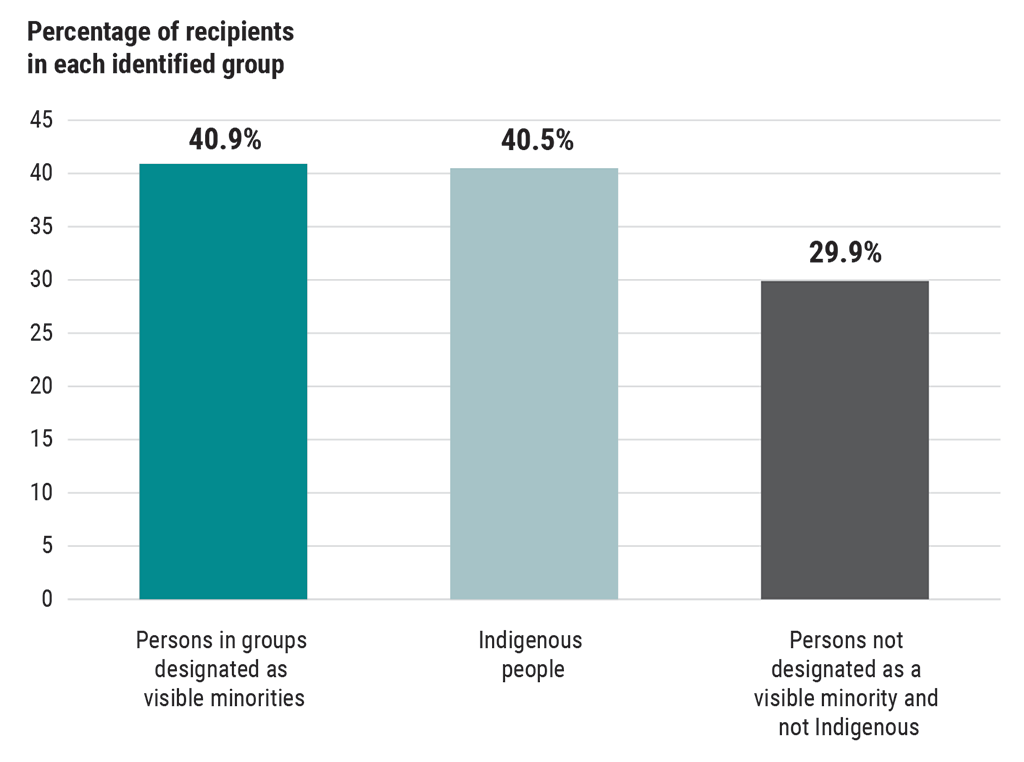

- 10.7—A higher proportion of people in visible minority and Indigenous groups received benefits than in groups not designated as such

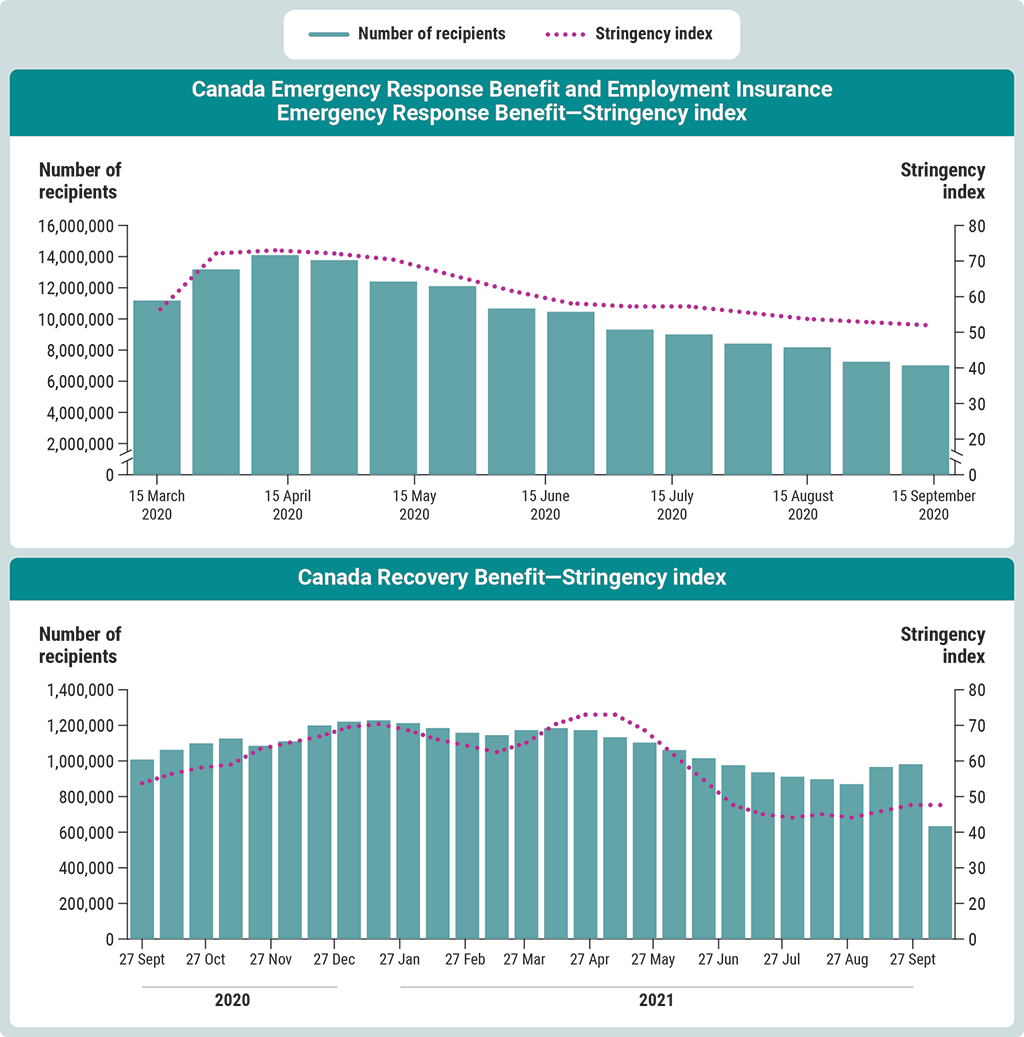

- 10.8—The trend in the number of people receiving benefits aligned with the level of severity of COVID‑19–related restrictions

- 10.9—Benefit and subsidy amounts paid to ineligible recipients or recipients that should be investigated further

- 10.10—Status of post‑payment verifications for the Canada Emergency Wage Subsidy

Part 2—Additional Information and Findings on Specific COVID‑19 Programs

- A—Canada Emergency Response Benefit

- B—Canada Recovery Benefit

- C—Canada Recovery Caregiving Benefit

- D—Canada Recovery Sickness Benefit

- E—Canada Worker Lockdown Benefit

- F—Canada Emergency Wage Subsidy

- About the Audit

- Recommendations and Responses

- Exhibits:

- 10.A‑1—Summary of pre‑payment controls for eligibility criteria for the Canada Emergency Response Benefit (CERB) and the Employment Insurance Emergency Response Benefit (EI‑ERB)

- 10.A‑2—Summary information for the Canada Emergency Response Benefit program

- 10.A‑3—Demographic information about recipients of the Canada Emergency Response Benefit as at 31 March 2022

- 10.B‑1—Summary of pre‑payment controls for eligibility criteria for the Canada Recovery Benefit

- 10.B‑2—Summary information for the Canada Recovery Benefit

- 10.B‑3—Demographic information about recipients of the Canada Recovery Benefit as at 31 March 2022

- 10.C‑1—Summary of pre‑payment controls for eligibility criteria for the Canada Recovery Caregiving Benefit

- 10.C‑2—Summary information for the Canada Recovery Caregiving Benefit

- 10.C‑3—Demographic information about recipients of the Canada Recovery Caregiving Benefit (as at 31 March 2022)

- 10.D‑1—Summary of pre‑payment controls for eligibility criteria for the Canada Recovery Sickness Benefit

- 10.D‑2—Summary information for the Canada Recovery Sickness Benefit

- 10.D‑3—Demographic information about recipients of the Canada Recovery Sickness Benefit (as at 31 March 2022)

- 10.E‑1—Summary of pre‑payment controls for eligibility criteria for the Canada Worker Lockdown Benefit

- 10.E‑2—Summary information for the Canada Worker Lockdown Benefit

- 10.E‑3—Demographic information about recipients of the Canada Worker Lockdown Benefit (as at 31 March 2022)

- 10.F‑1—Summary information of applications for the Canada Emergency Wage Subsidy

- 10.F‑2—Breakdown of Canada Emergency Wage Subsidy recipients by employer size

- 10.F‑3—Canada Emergency Wage Subsidy recipients and goods and services taxGST/harmonized sales taxHST filing frequency

- 10.F‑4—Stages of pre‑payment controls for Canada Emergency Wage Subsidy applications

- 10.F‑5—Summary of eligibility criteria, pre‑payment controls, and audit findings for the Canada Emergency Wage Subsidy program

- 10.F‑6—Allocation of the Canada Revenue Agency’s post‑verification audits of the Canada Emergency Wage Subsidy program by employer size

- 10.F‑7—Post‑payment verification and collections for the Canada Emergency Wage Subsidy program

Part 1—Key Findings

Introduction

Background

10.1 In March 2020, Canada faced the global coronavirus disease (COVID‑19) pandemic. To protect Canada’s population and help prevent the spread of the disease, all levels of government asked Canadians to isolate and many employers in Canada to close their doors to face‑to‑face services or to adopt a work‑from‑home model when possible. These prevention efforts resulted in business closures and slowdowns, which led to reduced working hours or unemployment for many Canadians.

10.2 To minimize the impacts of the COVID‑19 pandemic on the health of Canada’s population, businesses, and economy, the Government of Canada announced emergency income support programs for Canadian residents and employers in Canada. The federal public service was mandated to develop, implement, and deliver the new COVID‑19 benefit programs, which were unprecedented in size and urgency. Federal organizations responded by relying on their existing systems and processes, which were repurposed to deliver the new COVID‑19 benefit programs. Within weeks, many programs were up and running. Historically, programs of this size would have taken months, if not years, to roll out.

10.3 Like all Canadians and Canadian businesses, the federal public service delivering the COVID‑19 benefit programs had to overcome its own pandemic challenges. For example, federal workplaces had to adjust operations to have hundreds of thousands of employees switch quickly to working from home while continuing to deliver all other programs and services that are part of regular government operations.

10.4 The original programs were expected to last only a few months. However, additional waves of the pandemic occurred, and the government extended existing programs and introduced new support programs. This, in turn, necessitated flexibility and changes to program plans, as benefit payments were made well into 2022. For benefits to individuals, recipients could receive only 1 COVID‑19 benefit per period, while employers had access to multiple emergency relief programs simultaneously.

10.5 To simplify and accelerate the application process for COVID‑19 benefits, both Employment and Social Development Canada and the Canada Revenue Agency—the federal organizations delivering the programs—relied on applicants’ attestations of eligibility. This allowed the government to meet 1 of its goals to quickly get financial support into the hands of those affected by the pandemic. In so doing, the government accepted the risk that some recipients might not be eligible for benefits received. Some pre‑payment controls were built into program designs to confirm eligibility. However, the department and agency made an early decision to put more effort into reviewing eligibility after payments were issued and recovering overpayments or payments to ineligible recipients.

10.6 The Office of the Auditor General of Canada has conducted numerous performance audits related to COVID‑19, including 2 audit reports in spring 2021 on specific benefit programs: Report 6—Canada Emergency Response Benefit and Report 7—Canada Emergency Wage Subsidy.

10.7 On 17 December 2021, An Act to provide further support in response to COVID‑19, also known as Bill C‑2, received royal assent. This act served to extend or create specific benefits and programs related to COVID‑19. The act also required that the Office of the Auditor General of Canada complete a performance audit of specific COVID‑19 benefits during the first year after Bill C‑2 came into force, so no later than 17 December 2022, and submit a report to the Speaker of the House.

10.8 As required by the act, we audited the following COVID‑19 benefit programs for individuals:

- Canada Worker Lockdown Benefit

- Canada Recovery Benefit

- Canada Recovery Sickness Benefit

- Canada Recovery Caregiving Benefit

- Canada Emergency Response Benefit, including the Employment Insurance Emergency Response Benefit

10.9 We also audited, as required by the act, the following COVID‑19 program for employers:

- Canada Emergency Wage Subsidy

10.10 Additional information and some of our findings on each program are provided in Part 2 of this report.

10.11 Employment and Social Development Canada. The department is responsible for

- policy development and program design of the COVID‑19 benefits for individuals

- administration of the Employment Insurance Emergency Response Benefit, including accepting applications, verifying and validating the eligibility of applicants, authorizing payments, and preventing non‑compliance

10.12 The Canada Revenue Agency. The agency is responsible for

- administration, on behalf of Employment and Social Development Canada, of the other COVID‑19 benefit programs for individuals and the Canada Emergency Wage Subsidy, which included accepting applications, verifying and validating the eligibility of applicants, authorizing payments, and preventing non‑compliance

- collection of overpayments and payments made to ineligible recipients for all benefit programs for individuals and employers

Focus of the audit

10.13 This audit focused on whether Employment and Social Development Canada and the Canada Revenue Agency

- ensured that COVID‑19 benefit payments were accurate and paid to eligible applicants

- undertook timely procedures to recover overpayments and payments made to ineligible recipients

The audit also focused on whether the department and the agency

- managed the COVID‑19 programs efficiently

- measured their administrative effectiveness

Finally, the audit examined whether the programs achieved their objectives and provided value‑for‑money outcomes.

10.14 More details about the audit objective, scope, approach, and criteria are in About the Audit at the end of this report.

Findings and Recommendations

Overall message

10.15 With its response to the COVID‑19 pandemic, the Government of Canada set an objective of helping Canadians as quickly as possible. The COVID‑19 emergency programs that we audited achieved that objective. They quickly offered financial relief to individuals and employers, prevented a rise in poverty, mitigated income inequalities, and helped the economy to recover from the effects of the pandemic.

10.16 To expedite issuing payments, the Canada Revenue Agency and Employment and Social Development Canada relied on personal attestations. They decided early on to focus less on confirming the eligibility of applicants up front and more on reviewing eligibility after payments were issued and recovering overpayments or payments made to ineligible recipients. The risk that some recipients might not be eligible for benefits they received made verifying eligibility after payment all the more important.

10.17 We found that the department and agency’s approach to limit pre‑payment controls, as well as the lack of timely data at the time of application, resulted in a significant amount of payments made to recipients who were ineligible or whose eligibility needs to be verified. We found $4.6 billion of overpayments made to ineligible recipients of benefits for individuals. In addition, we estimated that at least $27.4 billion of payments to individuals and employers should be investigated further. A more definitive estimate of payments made to ineligible recipients and amounts to be recovered by the government will be determined only after the agency and the department have completed their post‑payment verifications.

10.18 The department and agency did not develop rigorous and comprehensive plans to verify the eligibility of recipients. We found that their post‑payment verification plans did not include verifying payments made to all identified recipients at risk of being ineligible for all COVID‑19 benefit programs. Given the limited pre‑payment controls and the early decision to focus on post‑payment verifications, we expected the department and the agency to perform extensive post‑payment verifications to identify payments made to ineligible recipients.

10.19 There have also been delays in conducting post‑payment verifications and the collection of amounts owing has just started. The department and agency are at risk of not completing all planned post‑payment verifications within the applicable timelines. This means they may be unable to identify and recover amounts owing. According to the information provided by the department and agency, they have recuperated approximately $2.3 billion.

Outcomes and effectiveness

10.20 The Government of Canada’s COVID‑19 benefit programs were put in place to support Canadians and Canadian businesses throughout the pandemic. Exhibit 10.1 shows when the benefits included in this audit were available to individuals and employers in Canada, including all extension periods.

Exhibit 10.1—Periods of availability of COVID‑19 program benefits

Exhibit 10.1—text version

This chart shows the periods of availability of 6 COVID‑19 program benefits from March 2020 to May 2022:

- The Canada Emergency Wage Subsidy was available from March 2020 to October 2021.

- The Canada Emergency Response Benefit, which includes the Employment Insurance Emergency Response Benefit, was available from March 2020 to October 2020.

- The Canada Recovery Sickness Benefit was available from September 2020 to May 2022.

- The Canada Recovery Caregiving Benefit was available from September 2020 to May 2022.

- The Canada Recovery Benefit was available from September 2020 to October 2021.

- The Canada Worker Lockdown Benefit was available from October 2021 to May 2022.

10.21 Exhibit 10.2 shows the total benefit payments made to recipients for each COVID‑19 subsidy and program.

Exhibit 10.2—Payments to recipients for COVID‑19 benefit programs

| COVID‑19 benefit program | Total payments at program end (in millions) |

|---|---|

| Canada Emergency Wage Subsidy | $100,738 |

| Canada Emergency Response Benefit and Employment Insurance Emergency Response Benefit | $74,815 |

| Canada Recovery Benefit | $28,390 |

| Canada Recovery Caregiving Benefit | $4,370 |

| Canada Recovery Sickness Benefit | $1,500 |

| Canada Worker Lockdown Benefit | $914 |

| Total | $210,727 |

|

Note: Programs ended on different dates, and applications could be submitted for a specific time period once a benefit program ended. This exhibit reflects all payments made for the Canada Emergency Wage Subsidy up to May 2022 and for each benefit program for individuals up to July 2022. Source: The Canada Revenue Agency and Employment and Social Development Canada |

|

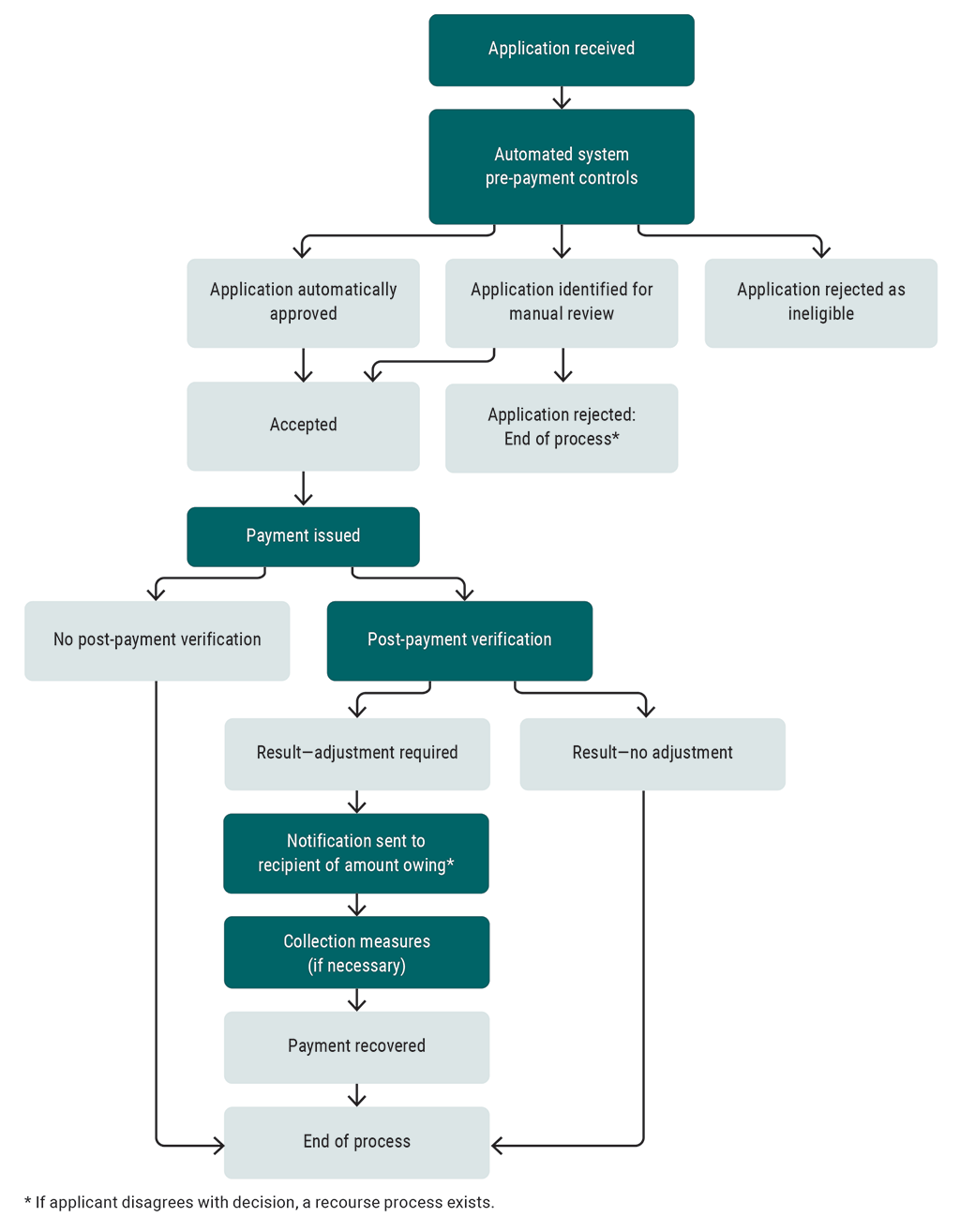

10.22 Exhibit 10.3 provides a simplified overview of the application process for the COVID‑19 subsidy and benefit programs.

Exhibit 10.3—Simplified COVID‑19 benefit application process for individuals and employers

Exhibit 10.3—text version

This flowchart shows a simplified version of the COVID‑19 benefit application process for individuals and employers.

The application is received.

An automated system performs pre-payment controls.

The application can be

- automatically approved

- identified for manual review

- rejected as ineligible

If the application is automatically approved, it is accepted, after which a payment is issued.

If, after the manual review, the application is accepted, a payment is issued.

If, after the manual review, the application is rejected, the application process ends. If the applicant disagrees with the decision, a recourse process exists.

If the application is rejected as ineligible, the application process ends.

For the applications that are accepted and payments issued, some applications undergo post-payment verification and some do not.

If an application does not undergo post-payment verification, the process ends.

If an application undergoes post-payment verification, the result could be no adjustment, and the process ends.

But, for some applications, an adjustment is required. In this case, a notification is sent to the recipient stating the amount owing. If the recipient disagrees with the decision, a recourse process exists.

Collection measures are taken if necessary.

When the payment has been recovered, the process ends.

COVID‑19 programs supported Canada’s economic recovery

10.23 We found that the COVID‑19 programs achieved their objective to help Canada avoid a more severe contraction of the economy and the social consequences of, for example, a significant increase in poverty. This financial support allowed the economy to rebound and return to its pre‑pandemic level.

10.24 The analysis supporting this finding discusses the following topics:

10.25 This finding matters because it is important that the government demonstrates that the COVID‑19 benefit programs supported Canadians and employers in need.

10.26 The objective of the COVID‑19 benefit programs for individuals was to directly support individuals who lost income as a result of the COVID‑19 pandemic. For example, the programs were intended to help affected workers meet their financial obligations while reducing the disease’s toll on individuals and the health care system.

10.27 Along with the benefit programs for individuals, the government introduced COVID‑19 support for employers, including the Canada Emergency Wage Subsidy. This program’s objective was to

- help employers retain their employees during the pandemic

- ensure that workers were able to count on a source of income despite some sectors of the economy being shut down

- encourage employers to rehire workers who were laid off as a result of the pandemic

- help position employers to resume normal operations more easily when economic activity fully resumed

Economic rebound

10.28 Statistics Canada reported that between February and April 2020, Canada’s gross domestic productDefinition 1 decreased, after adjusting for inflation, by $350 billion—a 17% reduction in economic activity. But by November 2021, 20 months after the beginning of the pandemic, economic activity was back to its pre‑pandemic level (Exhibit 10.4). In terms of magnitude, the reduction of gross domestic product caused by the pandemic was thus not comparable to the most recent economic recession of 2008–09.

Exhibit 10.4—After a 17% reduction in 2020, economic activity bounced back to its pre‑COVID‑19 level by November 2021

Source: Statistics Canada data, released August 31, 2022

Exhibit 10.4—text version

This graph shows gross domestic product (GDP) in billions of dollars (2012 dollar values) from January 2008 to June 2022. After a decrease in 2009, GDP increased steadily until March 2020, at the start of the COVID‑19 pandemic, when GDP decreased sharply. After this decline in March and April 2020, GDP increased again, and in November 2021 returned to its pre-pandemic level. Following are the yearly amounts of GDP:

- In January 2008, GDP was $1,620 billion.

- In January 2009, GDP was $1,584 billion.

- In January 2010, GDP was $1,598 billion.

- In January 2011, GDP was $1,663 billion.

- In January 2012, GDP was $1,702 billion.

- In January 2013, GDP was $1,730 billion.

- In January 2014, GDP was $1,773 billion.

- In January 2015, GDP was $1,818 billion.

- In January 2016, GDP was $1,838 billion.

- In January 2017, GDP was $1,868 billion.

- In January 2018, GDP was $1,923 billion.

- In January 2019, GDP was $1,966 billion.

- In January 2020, GDP was $2,005 billion.

- In March 2020, GDP was $1,861 billion.

- In April 2020, GDP was $1,658 billion.

- In January 2021, GDP was $1,948 billion.

- In November 2021, GDP was $2,016 billion.

- In January 2022, GDP was $2,016 billion.

- In June 2022, GDP was $2,055 billion.

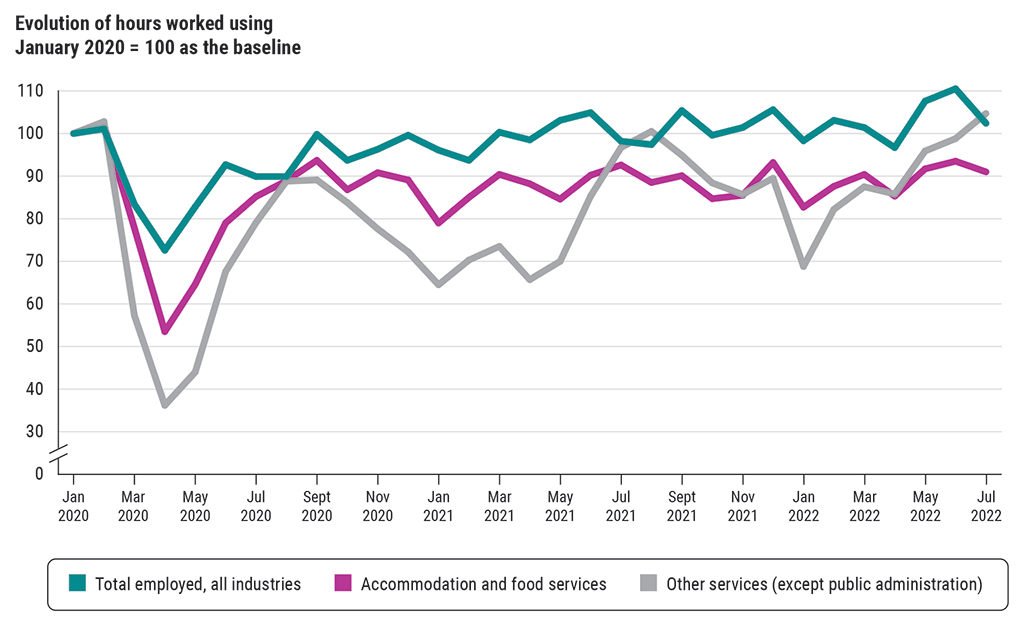

10.29 With health measures put in place to limit the spread of the virus that causes COVID‑19, many Canadians transitioned to working from home. Others were unable to work. This explained a reduction in the number of hours worked and highlighted the importance of these programs supporting workers who lost income. Hours worked diminished by 28% between February and April 2020 (Exhibit 10.5) but returned to their pre‑COVID‑19 level by May 2021. The most significant impacts were concentrated in the service sector, such as accommodation and food services, where non‑essential business activities were closed and where physical distancing and alternative work arrangements were more difficult or impossible.

Exhibit 10.5—After a major decrease between February and April 2020, the number of hours worked went back to pre‑COVID‑19 level as of May 2021, with some service industries still affected

Note: We used Statistics Canada data and established an index number (January 2020 = 100, which is a statistical technique for measuring changes in the magnitude of a group of related variables) to measure the change from a point in time. “Other services” include activities not classified to any other sector, such as personal care services, funeral services, and car repair and maintenance. For a complete definition, see Statistics Canada.

Source: Statistics Canada

Exhibit 10.5—text version

This graph shows the changes in the number of hours worked from January 2020 to July 2022 in 3 categories of industries. After a decline in March and April 2020, the hours worked returned to pre-pandemic levels, with the exception of some service industries.

The chart shows the following 3 categories of industries:

- total employed for all industries

- accommodation and food services

- other services (except public administration)—“Other services” include activities not classified in any other sector, such as personal care services, funeral services, and car repair and maintenance. For a complete definition, see Statistics Canada.

To determine the evolution of hours worked, we established an index number, which was January 2020 equals 100. This index number was the baseline used to measure changes from that point in time. Using an index number is a statistical technique for measuring changes in the magnitude of a group of related variables. We used Statistics Canada data.

Following are the number of hours worked in all industries from January 2020 to July 2022:

- In January 2020, the number of hours worked was 100.0.

- In March 2020, the number of hours worked was 83.4.

- In May 2020, the number of hours worked was 82.8.

- In July 2020, the number of hours worked was 89.9.

- In September 2020, the number of hours worked was 99.8.

- In November 2020, the number of hours worked was 96.3.

- In January 2021, the number of hours worked was 96.1.

- In March 2021, the number of hours worked was 100.3.

- In May 2021, the number of hours worked was 103.1.

- In July 2021, the number of hours worked was 98.2.

- In September 2021, the number of hours worked was 105.4.

- In November 2021, the number of hours worked was 101.4.

- In January 2022, the number of hours worked was 98.3.

- In March 2022, the number of hours worked was 101.4.

- In May 2022, the number of hours worked was 107.6.

- In July 2022, the number of hours worked was 102.4.

Following are the number of hours worked in accommodation and food services from January 2020 to July 2022:

- In January 2020, the number of hours worked was 100.0.

- In March 2020, the number of hours worked was 57.3.

- In May 2020, the number of hours worked was 44.0.

- In July 2020, the number of hours worked was 79.1.

- In September 2020, the number of hours worked was 89.1.

- In November 2020, the number of hours worked was 77.6.

- In January 2021, the number of hours worked was 64.5.

- In March 2021, the number of hours worked was 73.5.

- In May 2021, the number of hours worked was 70.0.

- In July 2021, the number of hours worked was 96.7.

- In September 2021, the number of hours worked was 94.9.

- In November 2021, the number of hours worked was 85.7.

- In January 2022, the number of hours worked was 68.8.

- In March 2022, the number of hours worked was 87.5.

- In May 2022, the number of hours worked was 95.9.

- In July 2022, the number of hours worked was 104.7.

Following are the number of hours worked in other services (except public administration) from January 2020 to July 2022:

- In January 2020, the number of hours worked was 100.0.

- In March 2020, the number of hours worked was 77.8.

- In May 2020, the number of hours worked was 64.6.

- In July 2020, the number of hours worked was 85.2.

- In September 2020, the number of hours worked was 93.7.

- In November 2020, the number of hours worked was 90.8.

- In January 2021, the number of hours worked was 79.0.

- In March 2021, the number of hours worked was 90.4.

- In May 2021, the number of hours worked was 84.6.

- In July 2021, the number of hours worked was 92.6.

- In September 2021, the number of hours worked was 90.1.

- In November 2021, the number of hours worked was 85.5.

- In January 2022, the number of hours worked was 82.7

- In March 2022, the number of hours worked was 90.4.

- In May 2022, the number of hours worked was 91.7.

- In July 2022, the number of hours worked was 91.0.

Mitigation of poverty and income inequality

10.30 Statistics Canada data revealed that without benefit programs, the poverty rate in Canada would have reached 11.6% in 2020, more than 5 percentage points higher than the observed 6.4% rate. This data showed that the COVID‑19 benefits had a notable impact on preventing a spike in the poverty rate in 2020.

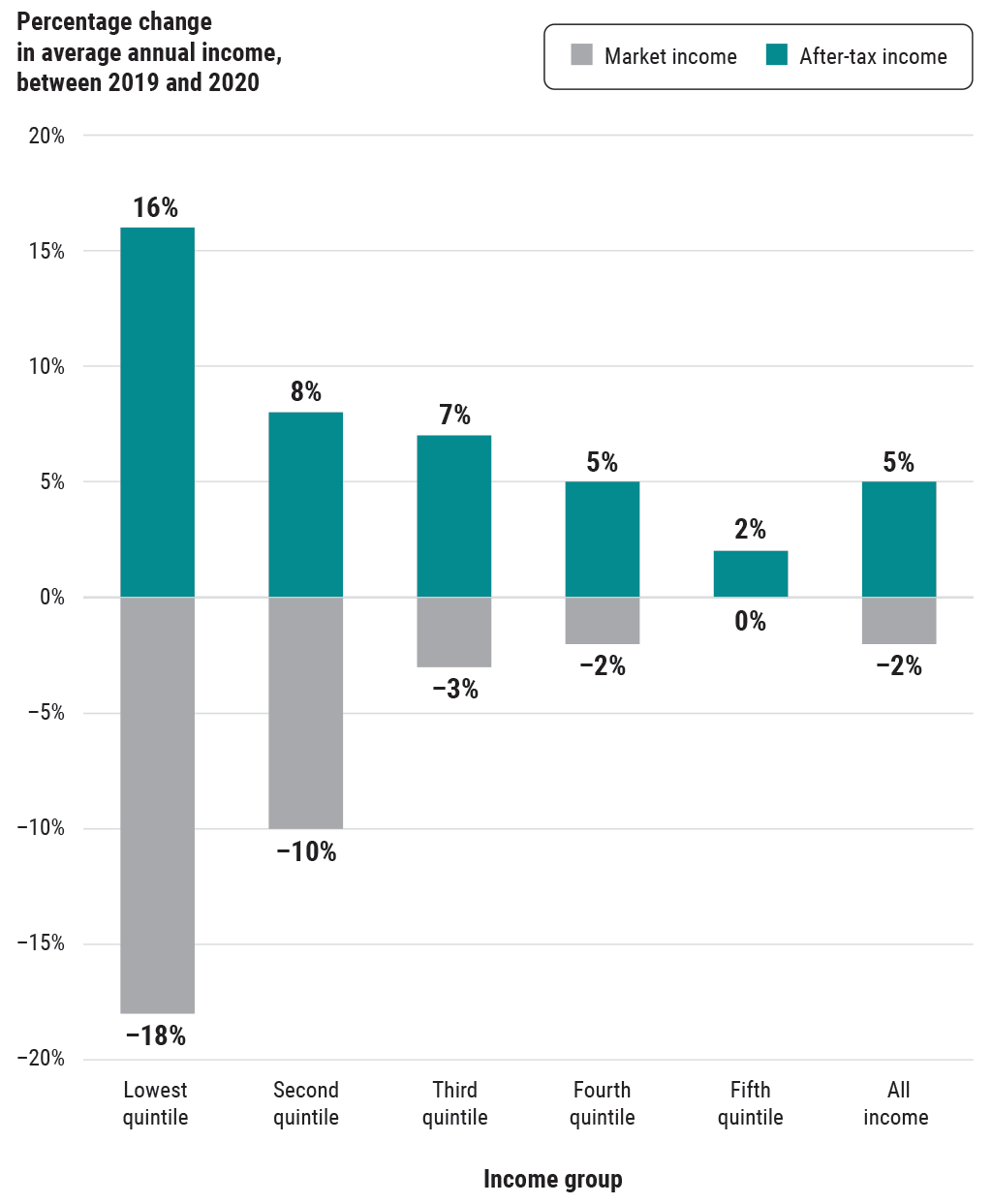

10.31 Statistics Canada data also showed that workers with relatively lower income were among those who received the most benefit payments, which compensated their loss of income. For families with the lowest level of income, their combined income from employment, private pensions, and investments—known as market income—decreased on average by $700 (or 18%) between 2019 and 2020. However, when we combined this income with government transfers (cash benefits such as child benefits, tax credits, as well as emergency response and recovery benefits for 2020)—known as after‑tax income—we saw an annual income increase of $2,900 (or 16%) in the same period. Although individuals from all income groups observed a growth of this income, the increase was substantial for lower‑income families (Exhibit 10.6).

Exhibit 10.6—Annual after‑tax income increased among the lowest‑income earners between 2019 and 2020 due to government payments for COVID‑19 benefits

Note: An income quintile is a measure that divides the population into 5 income groups (from lowest income to highest income) so that approximately 20% of the population is in each group. Market income is employment income and private pensions plus income from investments and other market sources. After‑tax income is the total of market income and government payments, less income tax. For 2020, government transfers included emergency response and recovery benefits.

The exhibit above illustrates that people in the lowest quintile were those who had the highest decrease in their market income. It also illustrates that COVID‑19 benefits represented a higher proportion of the total after‑tax income for the people in the lowest quintile.

Source: Statistics Canada

Exhibit 10.6—text version

This bar chart shows the percentage of change in average annual income for different income groups between 2019 and 2020. The percentage of change was greatest in the group with the lowest average annual incomes—as annual incomes increased, the percentage of change decreased.

The chart shows the percentage of change for both market income and after-tax income. Market income is employment income and private pensions plus income from investments and other market sources. After-tax income is the total of market income and government payments, less income tax. For 2020, government transfers included emergency response and recovery benefits. Although after-tax income increased for all income groups, it increased the most for the lowest-income group. Also, the lowest-income group had the greatest decrease in market income.

The 6 income groups consist of 5 income quintiles and the sixth income group shows all income. An income quintile is a measure that divides the population into 5 income groups (from lowest income to highest income), so that approximately 20% of the population is in each group.

Following are the percentages of change in average annual income for each income quintile between 2019 and 2020:

- For the lowest quintile, the average annual after-tax income increased by 16% and the average annual market income decreased by 18%.

- For the second quintile, the average annual after-tax income increased by 8% and the average annual market income decreased by 10%.

- For the third quintile, the average annual after-tax income increased by 7% and the average annual market income decreased by 3%.

- For the fourth quintile, the average annual after-tax income increased by 5% and the average annual market income decreased by 2%.

- For the fifth quintile, the average annual after-tax income increased by 2% and the average annual market income decreased by 0%.

- For all income, the average annual after-tax income increased by 5% and the average annual market income decreased by 2%.

The exhibit illustrates that people in the lowest quintile were those who had the highest decrease in their market income. It also illustrates that the increase in after-tax income was substantial for lower‑income families and compensated for their loss of income.

Goal 1: End poverty in all its forms everywhere

Source: United NationsFootnote 1

Goal 10: Reduce inequality within and among countries

Source: United Nations

10.32 According to Statistics Canada, from 2019 to 2020, the median incomeDefinition 2 of combined employment, pensions, and investments for Canadians declined by $1,600. However, the median government transfers doubled from $8,200 to $16,400. This was due mainly to COVID‑19 income support programs. Overall, these increases in government transfers to households exceeded losses in wages and salaries and self‑employment income. This income compensation through the COVID‑19 programs helped to financially support the population.

10.33 These findings are aligned with the government’s targets regarding 2 United Nations’ sustainable development goals—Goal 1, No Poverty, and Goal 10, Reduced Inequalities. Thus, we found that the COVID‑19 benefits under audit for individuals contributed to reducing poverty and inequalities in Canada in 2020.

COVID‑19 benefits went to people and employers in the economic sectors most impacted by the pandemic

10.34 We found that individuals from the groups most impacted by the pandemic were able to benefit from the programs. Women, visible minorities, Indigenous groups, and youth aged 15 to 24 accessed programs at slightly higher rates than other groups did. In addition, we found that benefit payments supporting individuals were made in a timely manner, particularly during periods of public health restrictions.

10.35 Regarding the Canada Emergency Wage Subsidy, we found that it supported employers in sectors that suffered the biggest employment declines. However, it was difficult to assess the impact of the program and how effectively the program met its objectives because of the limited information employers were required to provide upon application. For example, the program did not require employers to submit any information on rehiring.

10.36 The analysis supporting this finding discusses the following topics:

- Benefits paid to the most‑impacted Canadians

- Unclear impact on business resilience

- Missing data for assessment of Canada Emergency Wage Subsidy effectiveness

10.37 This finding matters because it is important that the government demonstrates that the COVID‑19 benefit programs—which cost Canadians about $211 billion—supported Canadians and employers that were in need.

Benefits paid to the most‑impacted Canadians

10.38 We found that COVID‑19 programs for individuals provided income support to a large number of people who lost their jobs or had their working hours significantly reduced because of the pandemic. Based on available data from Statistics Canada, mostly on the Canada Emergency Response Benefit, we calculated the following:

- 41.7% of recipients were household major income earners (3.46 million people)

- almost 25% of recipients were sole income earners in their household (1.9 million people)

- 69% of women working in the accommodation and food sector received the Canada Emergency Response Benefit (while women represented 56% of the people employed)

10.39 We also found, based on Statistics Canada information, that a higher proportion of workers who were visible minorities or Indigenous received the benefits compared to those who were not members of a group designated as a visible minority or Indigenous (Exhibit 10.7).

Exhibit 10.7—A higher proportion of people in visible minority and Indigenous groups received benefits than in groups not designated as such

Note: Federal COVID‑19 benefits include the Canada Emergency Response Benefit, the Canada Emergency Student Benefit, the Canada Recovery Benefit, the Canada Recovery Caregiving Benefit, the Canada Recovery Sickness Benefit, and a 1‑time payment made to Canadians with disabilities.

Source: Statistics Canada

Exhibit 10.7—text version

This bar chart shows the percentage of people in 3 groups who received benefits.

A higher percentage of people in visible minority and Indigenous groups received benefits compared with the percentage for the group of recipients not designated as visible minorities or Indigenous people.

Following are the percentages of people in each group who received benefits:

- persons in groups designated as visible minorities: 40.9% of people in this group received benefits

- Indigenous people: 40.5% of people in this group received benefits

- persons not designated as a visible minority and not Indigenous: 29.9% of people in this group received benefits

The federal COVID‑19 benefits included in this chart were the Canada Emergency Response Benefit, the Canada Emergency Student Benefit, the Canada Recovery Benefit, the Canada Recovery Caregiving Benefit, the Canada Recovery Sickness Benefit, and a 1‑time payment made to Canadians with disabilities.

10.40 In the case of the Canada Emergency Response Benefit, we also noted that workers in groups designated as a visible minority or Indigenous received benefits for slightly more weeks than those who were not. For instance,

- people who identify as a visible minority received the benefit for 18.5 weeks on average (compared to 16.2 weeks for people who did not identify as visible minorities)

- Indigenous people received the benefit for 17.4 weeks on average (compared to 16.8 weeks for non‑Indigenous workers)

10.41 We found that Canadians received benefits in a timely manner, notably during lockdown periods. The number of recipients of the benefits was aligned with the severity of public health restrictions in response to COVID‑19, as measured by the stringency indexDefinition 3 (Exhibit 10.8). For the Canada Emergency Response Benefit and the Canada Recovery Benefit, the more severe the health restrictions, the higher the number of recipients. However, as illustrated in the case of the Canada Recovery Benefit, we noted that, starting in June 2021, the number of recipients diminished less quickly with the lifting of restrictive public health measures, showing that individuals did not return to work.

Exhibit 10.8—The trend in the number of people receiving benefits aligned with the level of severity of COVID‑19–related restrictions

Note: The stringency index measures the severity of policies governments put in place to protect people against the transmission of COVID‑19. A higher index score indicates a higher level of COVID‑19–related restrictions on individuals and employers. Values shown for the stringency index are averages of the daily scores for the 2‑week periods for the programs.

Source: Stringency index—Bank of Canada; number of recipients based on data provided by the Canada Revenue Agency and Employment and Social Development Canada

Exhibit 10.8—text version

These 2 charts show the number of recipients of certain COVID‑19 benefit programs compared with the stringency index over certain periods of time. The stringency index measures the severity of policies governments put in place to protect people against the transmission of COVID‑19.

By comparing the number of recipients of benefit programs with the severity of the stringency index, the 2 charts show trends:

- The first chart shows the Canada Emergency Response Benefit and the Employment Insurance Emergency Response Benefit. Over the period from 15 March 2020 to 15 September 2020, the number of recipients of these programs aligned with the stringency index—that is, when the severity of government policies increased to protect against COVID‑19, the number of benefit recipients also increased. And when the severity of government policies decreased, the number of benefit recipients also decreased.

- The second chart shows the Canada Recovery Benefit. Over the period from 27 September 2020 to 27 September 2021, the number of recipients of this program aligned roughly with the stringency index until about June 2021, when the severity of government policies decreased but the number of benefit recipients did not decrease at the same pace.

Following is the detailed data for the first chart about the Canada Emergency Response Benefit and the Employment Insurance Emergency Response Benefit by 2‑week time periods starting from 15 March 2020:

- On 15 March 2020, the number of recipients was 11,174,180 and the stringency index was 52.

- On 29 March 2020, the number of recipients was 13,176,380 and the stringency index was 71.

- On 12 April 2020, the number of recipients was 14,097,180 and the stringency index was 72.

- On 26 April 2020, the number of recipients was 13,769,250 and the stringency index was 71.

- On 10 May 2020, the number of recipients was 12,392,800 and the stringency index was 69.

- On 24 May 2020, the number of recipients was 12,106,650 and the stringency index was 64.

- On 7 June 2020, the number of recipients was 10,665,710 and the stringency index was 59.

- On 21 June 2020, the number of recipients was 10,453,500 and the stringency index was 55.

- On 5 July 2020, the number of recipients was 9,312,350 and the stringency index was 54.

- On 19 July 2020, the number of recipients was 9,000,420 and the stringency index was 54.

- On 2 August 2020, the number of recipients was 8,411,660 and the stringency index was 52.

- On 16 August 2020, the number of recipients was 8,175,200 and the stringency index was 50.

- On 30 August 2020, the number of recipients was 7,250,970 and the stringency index was 49.

- On 13 September 2020, the number of recipients was 7,014,700 and the stringency index was 48.

Following is the detailed data for the second chart about the Canada Recovery Benefit by 2‑week time periods starting from 27 September 2020:

- On 27 September 2020, the number of recipients was 1,007,770 and the stringency index was 50.

- On 11 October 2020, the number of recipients was 1,062,280 and the stringency index was 53.

- On 25 October 2020, the number of recipients was 1,098,890 and the stringency index was 55.

- On 8 November 2020, the number of recipients was 1,125,700 and the stringency index was 56.

- On 22 November 2020, the number of recipients was 1,084,940 and the stringency index was 61.

- On 6 December 2020, the number of recipients was 1,109,840 and the stringency index was 63.

- On 20 December 2020, the number of recipients was 1,199,230 and the stringency index was 65.

- On 3 January 2021, the number of recipients was 1,220,570 and the stringency index was 68.

- On 17 January 2021, the number of recipients was 1,228,120 and the stringency index was 69.

- On 31 January 2021, the number of recipients was 1,212,810 and the stringency index was 67.

- On 14 February 2021, the number of recipients was 1,184,810 and the stringency index was 64.

- On 28 February 2021, the number of recipients was 1,158,480 and the stringency index was 62.

- On 14 March 2021, the number of recipients was 1,145,110 and the stringency index was 60.

- On 28 March 2021, the number of recipients was 1,173,070 and the stringency index was 63.

- On 11 April 2021, the number of recipients was 1,184,410 and the stringency index was 69.

- On 25 April 2021, the number of recipients was 1,173,170 and the stringency index was 72.

- On 9 May 2021, the number of recipients was 1,132,910 and the stringency index was 72.

- On 23 May 2021, the number of recipients was 1,103,160 and the stringency index was 67.

- On 6 June 2021, the number of recipients was 1,061,170 and the stringency index was 59.

- On 20 June 2021, the number of recipients was 1,015,480 and the stringency index was 51.

- On 4 July 2021, the number of recipients was 976,220 and the stringency index was 43.

- On 18 July 2021, the number of recipients was 936,080 and the stringency index was 40.

- On 1 August 2021, the number of recipients was 911,550 and the stringency index was 39.

- On 15 August 2021, the number of recipients was 897,480 and the stringency index was 40.

- On 29 August 2021, the number of recipients was 869,990 and the stringency index was 39.

- On 12 September 2021, the number of recipients was 966,220 and the stringency index was 41.

- On 26 September 2021, the number of recipients was 981,840 and the stringency index was 43.

About the stringency index: A higher index score indicates a higher level of COVID‑19–related restrictions on individuals and employers. Values shown for the stringency index are averages of the daily scores for the 2 week periods for the programs.

10.42 With regard to COVID‑19 support for employers, we also found that the Canada Emergency Wage Subsidy went to sectors in need. Employers and sectors that suffered the biggest employment decline from the introduction of the lockdowns used the Canada Emergency Wage Subsidy the most. About 36% of all active employer businesses received the subsidy. According to Statistics Canada, the top 3 industries that received the subsidy as at June 2021 were

- accommodation and food services (66% of businesses in this industry)

- arts, entertainment, and recreation (56% of businesses in this industry)

- manufacturing (55% of businesses in this industry)

Unclear impact on business resilience

10.43 According to Statistics Canada data released in June 2022, the number of active businesses went back to the pre‑pandemic level in October 2021. However, the influence of the Canada Emergency Wage Subsidy in this resilience is unclear because the businesses that existed pre‑pandemic were different from the businesses that existed as of October 2021.

10.44 Statistics Canada also reported that there were fewer business closures for those businesses that received the Canada Emergency Wage Subsidy. Among the businesses that received the subsidy, 10.3% of them closed by February 2022 compared to 32.8% of businesses that did not receive the subsidy. However, these closure patterns could not be interpreted as reflecting the impact of the Canada Emergency Wage Subsidy because pre‑existing and other emergency support government programs were running at the same time to support businesses through the pandemic. Therefore, we could not conclude on the impact of the subsidy on business resilience.

Missing data for assessment of Canada Emergency Wage Subsidy effectiveness

10.45 We found that the Canada Revenue Agency did not have the data needed to measure the effectiveness of the Canada Emergency Wage Subsidy. For example, the application form did not require employees’ social insurance numbers. These employees were supposed to be the ultimate beneficiaries of this program through their employers. Without data, we could not accurately determine

- the exact number of employees who benefited from this program

- whether employees remained working for the same employers, changed to another employer, or moved to work in another sector

- the exact number of employees who were rehired (as the program aimed to encourage employers to rehire workers who were laid off as a result of the pandemic)

10.46 Sound management of public funds requires that data collection and analysis be a key aspect of program administration. In our view, this missing data highlights a broader issue of missed opportunities to assess the effectiveness of programs, in this case the Canada Emergency Wage Subsidy.

10.47 Recommendation. In the administration of future programs, the Canada Revenue Agency should engage with its partners, such as Statistics Canada and relevant departments, to ensure it collects pertinent data from applicants to better monitor and measure the effectiveness and outcomes of programs.

The agency’s response. Agreed.

See Recommendations and Responses at the end of this report for detailed responses.

Employment and Social Development Canada adjusted benefit programs to try to address disincentives to work

10.48 We found that the government was aware from the onset of the pandemic that the introduction of COVID‑19 benefits to individuals would create a disincentive to work for some recipients. Employment and Social Development Canada announced changes to the Canada Emergency Response Benefit program to counter the disincentive.

10.49 We also found that some lower‑income recipients of the benefits replaced their previous annual earning by more than 100% using the Canada Emergency Response Benefit and by 119% by staying on the Canada Recovery Benefit for all periods. The government assessed the impact and took steps to mitigate these issues. These included introducing incentives to get more people working, especially when the economy was reopening.

10.50 The analysis supporting this finding discusses the following topic:

10.51 This finding matters because, at a time when businesses needed employees, some employees had more income by receiving the COVID‑19 benefits than they would have had by rejoining the workforce.

Benefits’ disincentive to work

10.52 We found that Employment and Social Development Canada did an analysis in June 2020 on the impact of the Canada Emergency Response Benefit on the labour market and made changes to the program. Early on in the pandemic, employers in some sectors were having difficulty finding workers, which was confirmed in the department’s analysis that the Canada Emergency Response Benefit had created a disincentive to work. This benefit was developed to encourage people to stay at home while public health restrictions were in place. The program as initially administered did not allow recipients to have other earnings while receiving benefits. In mid‑April 2020, the department and agency began administering the program so as to allow workers to earn a maximum of $1,000 while still being eligible to receive benefits if they met other program eligibility criteria.

10.53 We looked at the department’s analysis of challenges to the labour market created by the benefits programs. The department’s analysis showed the following:

- Individuals in the lower income brackets—earning less than $500 per week—represented the largest number of applicants to the Canada Emergency Response Benefit.

- The amount of benefit they received could impact their return to work since they could receive an equal or greater income without working.

10.54 The department’s analysis also determined that people whose pre‑pandemic weekly earnings were $500 or less represented 44% of individuals that lost their employment between February and April 2020. However, between April and May 2020, only 11% of people earning $500 or less returned to work. In our view, the department’s analysis showed that the Canada Emergency Response Benefit created a disincentive to go back to work, especially for more than one third of applicants who earned less than $500 per week. For them, the Canada Emergency Response Benefit represented more than 100% of income replacement. This may explain why approximately 2 million people stayed on the benefits for all 7 periods for a total of 28 weeks.

10.55 The Canada Emergency Response Benefit ended in October 2020. The Canada Recovery Benefit succeeded that program for Canadians without Employment Insurance insurable hours. It had the same benefit amount as the Canada Emergency Response Benefit but did not necessarily limit earnings to $1,000. The Canada Recovery Benefit could be collected for a maximum of 54 weeks. For applications for a benefit period beginning before 18 July 2021, the maximum benefit was $500 per week for the first 42 weeks. After this, and as a means to encourage people to return to work, the benefit amount was reduced to $300 per week. These changes applied to new claimants for a benefit period beginning on or after 18 July 2021.

10.56 As with the Canada Emergency Response Benefit, we found that the lowest‑income recipients of the Canada Recovery Benefit could earn more from receiving the benefit than from working. Low‑income earners (with gross earnings of $20,000 or less per year) who received the recovery benefit for all periods (54 weeks) effectively replaced their annual income by 119%.

10.57 In our opinion, the ability for low‑income individuals to earn more on the Canada Recovery Benefit represented a disincentive to work, which impacted some labour markets at a crucial time when the need for employees was trending upwards.

Program delivery and controls

10.58 The urgency of responding to the impacts of the pandemic meant that government programs that would normally have taken months or years to design and implement had to be operational within weeks. Although the original programs were expected to last only a few months, additional waves of the pandemic led to the government extending existing support programs and introducing new ones.

10.59 In our spring 2021 audits, Report 6—Canada Emergency Response Benefit and Report 7—Canada Emergency Wage Subsidy, we found that the design of COVID‑19 benefit programs relied on applicants attesting to eligibility and on some automated and manual pre‑payment controls. This decision allowed for quicker processing times, which, in combination with the short turnaround time, also limited confirmation of eligibility.

10.60 The Canada Revenue Agency and Employment and Social Development Canada decided to put emphasis on verifying recipients’ eligibility after payment to compensate for the initial limited rigour at the pre‑payment stage. This approach is consistent with best practices promoted by the International Public Sector Fraud Forum and its principles for fraud control in emergency management.

The trade‑off between expediency and confirming eligibility resulted in payments to ineligible recipients

10.61 We found that Employment and Social Development Canada and the Canada Revenue Agency’s approach to limit pre‑payment controls and rely on applicants’ attestations to expedite payments meant that a significant amount of payments were made to ineligible recipients or to recipients with high risk indicators of ineligibility for the programs. We found that the government made $4.6 billion of overpayments to ineligible recipients. We also estimated that at least $27.4 billion was paid to recipients that should be investigated further through post‑payment verificationDefinition 4 to confirm eligibility.

10.62 The analysis supporting this finding discusses the following topics:

- Limited pre‑payment controls

- Limited performance standards and measures

- No real‑time business revenue data

- No real‑time payroll data

10.63 This finding matters because the benefit programs to individuals and employers were significant emergency measures that, in order to issue payments within days of receiving an application, relied upon the good faith of Canadians and Canadian employers.

Limited pre‑payment controls

10.64 Despite the fact that the Canada Revenue Agency and Employment and Social Development Canada added some pre‑payment controls over time, there were still eligibility criteria for each program for which no pre‑payment controls were implemented. We found that $4.6 billion was overpaid to ineligible recipients. We also estimated that at least $27.4 billion was paid to recipients that have an indicator of ineligibility and should be investigated further.

10.65 In estimating this amount, we used information available up to March 2022. Much of that information was not available to the agency and department when the payments were issued because it either was not requested on the applications or was not readily available through income tax return information. For example, the $5,000 income criterion could be calculated using earnings from the 12 months prior to the application date. This information was not available to the agency and department unless they contacted the applicants, which would have hindered payment expediency. In addition, during the pandemic, the 2019 income tax return deadline was extended to June 2020, which further delayed the availability of some of the information. Therefore, in most instances, the available data we used in our assessment could not alone confirm ineligibility. In most cases, only post‑payment verifications can establish ineligible amounts, as recipients will need to be contacted to provide additional information.

10.66 See Exhibit 10.9 for a summary of amounts paid to ineligible recipients and recipients that should be investigated further. The exhibit shows payments before individuals and employers repaid an estimated $2.3 billon, as reported by the agency and the department.

Exhibit 10.9—Benefit and subsidy amounts paid to ineligible recipients or recipients that should be investigated further

| Benefit program and amounts paid to ineligible recipients or recipients that should be investigated further | Program requirement not met or at risk of not being metNote 1 | Total payment amount (in billions) |

|---|---|---|

|

Overpayments to ineligible recipients Individual benefit programs |

$4.6 |

|

|

|

|

|

|

|

|

Payments that should be investigated further Individual benefit programs |

$27.44Note 4 |

|

|

|

|

|

|

|

|

Canada Emergency Wage Subsidy |

||

|

|

|

|

Total |

$32 |

|

10.67 We found that the agency added several pre‑payment controls over the course of the COVID‑19 benefit programs for individuals. For example, in July 2020, once most income tax information was available, the agency implemented a check to verify that applicants met the eligibility criterion of a minimum income threshold of $5,000. If the criterion was not met, applicants were prevented from receiving benefits until they provided more information to prove eligibility. While the agency estimated that this pre‑payment control prevented billions in benefit payments to ineligible recipients, we found that this control was ineffective for the following reasons:

- The agency did not request additional information from every identified applicant at risk of being ineligible as soon as they were identified, but did so over many months.

- The agency was limited to using the tax information available at the time, which alone could not confirm eligibility.

10.68 The agency stopped payments and requested additional information from over 544,000 applicants. Based on our analysis using 2019 to 2021 income tax information, we found an additional 366,000 recipients that were not identified by the agency and who did not appear to meet the income threshold of $5,000. These should now be investigated further to confirm eligibility.

10.69 Regarding the Canada Emergency Wage Subsidy, we found that the agency made few additions or improvements to pre‑payment controls to address risks of ineligible payments. This was to maintain the speed of processing applications. For example, prior to payment, the agency did no automated validation of the revenue decline submitted by applicants, which was an eligibility criterion. At a minimum, the agency could have compared the submitted revenue decline against historical goods and services tax/harmonized sales tax (GST/HST) data (even if only on a sample basis). Also, instructions given to pre‑payment reviewers were limited and relied on a reviewers’ discretion in accepting or denying a claim. Multiple opportunities to improve pre‑payment controls were available but not taken when

- the program was extended multiple times

- business intelligence tools were used in December 2020 to identify risks and select recipients for post‑payment audits

- our 2021 audit of the Canada Emergency Wage Subsidy recommended that available information should be better used to improve controls

10.70 In addition to the $4.6 billion in overpayments and $27.4 billion of payments that should be investigated further identified in Exhibit 10.9, we found other limitations to pre‑payment controls that suggest more payments and recipients should be further investigated. In our opinion, the $27.4 billion is the minimum amount that should be investigated. Notably, the following examples were not included in the $27.4 billion either because we could not quantify the amount or because the information had not been validated to confirm its reliability:

- For the Canada Emergency Response Benefit program, we identified 190,254 recipients who received $1.6 billion in payments for which Employment and Social Development Canada has information indicating recipients quit their employment. This information needs to be verified, as quitting may have made them ineligible for benefits. (See additional information on the Canada Emergency Response Benefit program in Part 2 of this report.)

- For the Canada Emergency Wage Subsidy, as noted in our spring 2021 Report 7—Canada Emergency Wage Subsidy, a lack of detailed employee information (for example, not requiring social insurance numbers on application forms) prevented the Canada Revenue Agency from using a control that would have identified instances of businesses inaccurately reporting information about employees (number and remuneration) in their claim and employees who were also claiming individual benefits.

10.71 Our recommendation for this area of examination is in paragraph 10.101.

Limited performance standards and measures

10.72 We found that Employment and Social Development Canada established performance standards by focusing solely on the speed of payment. For all programs for individuals audited, we found that payments were timely, usually within 4 days of the application being received. We also found that the Canada Revenue Agency provided input to the department regarding improving the administrative efficiency of the programs. However, the department’s following performance indicators were, in our view, simply volume metrics:

- total number of unique applicants for the stated benefit

- total number of approved applications for the stated benefit

- total gross dollar value of the stated benefit

10.73 We found that the department did not develop other performance indicators to measure results related to the administrative efficiency, effectiveness, and outcomes of the programs.

No real‑time business revenue data

10.74 We found that the Canada Revenue Agency did not have timely and sufficient data in its systems to reliably assess the Canada Emergency Wage Subsidy eligibility criteria at the time of application. In the absence of real‑time data, we found that the agency did not use the available GST/HST information to assess the eligibility criteria for demonstrating revenue decline.

10.75 GST/HST filing requirements are not in real time and may be submitted monthly, quarterly, or annually. This meant the agency could only do analyses after businesses submitted GST/HST returns, which was not in time to assess employers applying for the subsidy. After the subsidy ended, we analyzed the GST/HST return filings the agency received throughout 2020 and 2021. We estimated $15.5 billion in benefits were paid to recipients whose GST/HST filings did not demonstrate a sufficient revenue decline to be eligible for the subsidy. A more definitive estimate of payments to ineligible recipients and amounts to be recovered by the government will be determined only after the agency has completed its post‑payment verifications.

10.76 Other jurisdictions have implemented electronic invoicing and reporting to collect sales tax information in real time. In Spain, the tax administration receives real‑time data on sales from certain businesses. In Quebec, the sharing of real‑time sales data is being implemented on an industry‑by‑industry basis: for example, sales in the remunerated passenger transportation sector are submitted to Revenu Québec as they happen.

10.77 More broadly, real‑time GST/HST reporting could also

- reduce the reporting burden on businesses

- reduce errors and improve compliance on tax assessments

- help in informing, designing, and assessing public policies

10.78 Recommendation. In order to improve the efficiency of the tax and programs administration and to follow good practices, the Canada Revenue Agency should assess the value of implementing a real‑time business revenue data requirement.

The agency’s response. Agreed.

See Recommendations and Responses at the end of this report for detailed responses.

No real‑time payroll data

10.79 We found that the Canada Revenue Agency and Employment and Social Development Canada did not have a modern real‑time payroll data requirement for businesses. Real‑time data could have been used to assess program eligibility, calculate the benefit payment, and improve the overall efficiency of managing the COVID‑19 programs as reported in the above section on limited pre‑payment controls.

10.80 Other jurisdictions have implemented systems and reporting requirements to collect payroll information in a timely manner. We noted that the United Kingdom and Ireland used their real‑time payroll data to help manage their COVID‑19 benefits.

10.81 More broadly, real‑time payroll data could also

- reduce the reporting burden on businesses

- reduce errors and improve compliance on tax assessments

- help provide benefits for citizens that can adapt more quickly to evolving situations (such as loss of employment)

- support the collection of timely data to better inform, design, and assess public policies

- help the government to more efficiently and accurately manage the benefits it provides to Canadians and Canadian businesses

10.82 We also noted that in 2017, the Employment Insurance Service Quality Review recommended that Employment and Social Development Canada engage with key stakeholders in the co‑creation of a real‑time payroll information‑sharing solution. In the mandate letter to the Minister of National Revenue in 2019, the responsibility to implement a voluntary, real‑time electronic payroll system with an initial focus on small businesses was transferred to the Canada Revenue Agency.

10.83 At the time of our audit, limited progress had been made. The agency planned to develop a business case in 2024 to request additional funding for a real‑time e‑payroll system. According to the agency’s plan, the project was facing delays—for example, the period for official consultations was initially set to end in March 2022 but was extended to March 2023.

10.84 Recommendation. In order to improve its efficiency of delivering benefit programs, the Canada Revenue Agency, with the collaboration of Employment and Social Development Canada, should pursue the development and implementation of a real‑time payroll system with clear timelines and deliverables.

The agency’s response. Agreed.

See Recommendations and Responses at the end of this report for detailed responses.

Post‑payment verification and collection

10.85 The COVID‑19 benefit program design required Employment and Social Development Canada and the Canada Revenue Agency to rely on personal attestations and minimal controls to confirm eligibility before issuing benefit payments. This meant that verifying eligibility after payment became very important. As a result, the department and agency developed plans to verify the eligibility of approved recipients.

10.86 According to legislation, for most COVID‑19 benefit programs, verifications of eligibility must be completed within 36 months after the benefits have been paid. If either the department or the agency suspects that recipients misrepresented information, then the verification time frame could be extended to a maximum of 72 months. To illustrate, for a payment issued in October 2020, in the absence of misrepresentation and other specific circumstances that could extend the timeline, the last possible date to conduct a post‑payment verification is October 2023.

10.87 In 2020, for some of the COVID‑19 individual benefit programs, the department identified eligibility criteria that would not be investigated due to the subjective nature of the criteria, the difficulty of proving eligibility after the fact, and the undue burden investigation could create. Examples of eligibility criteria where no post‑payment verification would be performed are if a recipient

- was caring for ill family members or in self‑isolation due to COVID‑19

- stopped working due to school closures or daycare closures, or voluntarily due to COVID‑19

Employment and Social Development Canada and the Canada Revenue Agency were planning to do few post‑payment verifications

10.88 We found that Employment and Social Development Canada’s and the Canada Revenue Agency’s plans for verifying eligibility of recipients of benefits after payments for individual programs were incomplete. These plans did not include post‑payment verification of all the overpayments or payments to recipients that either were ineligible or should be investigated further to verify eligibility.

10.89 In addition, the department’s and agency’s plans were not aligned with the early decision to focus on verifying eligibility after payment, given the low number of post‑payment verifications to be performed. We also found that, as the COVID‑19 pandemic evolved, the department and agency delayed their post‑payment verifications of recipients’ eligibility. As a result, the department and agency are at risk of not completing planned post‑payment verifications within the legislated time frames.

10.90 We also found that for benefits to individuals, both the department and the agency were delayed in conducting post‑payment verifications and notifying recipients because of the need for legislative changes.

10.91 The analysis supporting these findings discusses the following topics:

Benefits for individuals:

- Incomplete post‑payment verification plans and delays in conducting verifications for individuals

- Low percentage of post‑payment verifications to be performed on programs for individuals

Benefits for employers:

10.92 This finding matters because the government needs strong post‑payment verifications to mitigate the risks created by the limited pre‑payment controls. Post‑payment verifications are also important because they are the means through which the government will confirm whether recipients were eligible for the payments and will identify the amounts to recuperate.

Incomplete post‑payment verification plans and delays in conducting verifications for individuals

10.93 In our spring 2021 Report 6—Canada Emergency Response Benefit, we recommended that Employment and Social Development Canada and the Canada Revenue Agency finalize and implement their post‑verification plans for the benefit. At the time of the audit, we found that this recommendation was not fully addressed, as both organizations’ post‑payment verification plans were incomplete. For example, the following were not included in the plan:

- The agency had identified more than 375,000 recipients for follow‑up because they did not respond to a request for further information regarding their eligibility.

- The department had identified more than 1.8 million recipients of Employment Insurance Emergency Response Benefit lump‑sum payments to be recovered.

10.94 We also found that for COVID‑19 benefit programs for individuals, the agency and the department started post‑payment verification of applicants’ eligibility later than stated in the timelines of their initial plans. The following are examples:

- The agency was delayed in notifying individuals who received more than 1 benefit during a benefit period because it was waiting for legislative amendments. The amendments, which were passed in June 2022 as part of the Budget Implementation Act, 2022, NumberNo. 1, determined how amounts owed were to be calculated for overpayments for this group of recipients. We also found that the follow‑up on these overpayments had not been included in the department’s and agency’s post‑payment verification plans.

- The department’s initial plan for post‑payment verifications for the Employment Insurance Emergency Response Benefit was scheduled to review 44,920 cases in 2021–22. However, the post‑payment verifications only started in 2022–23.

10.95 Such delays mean that the department and the agency will face significant challenges completing all of their verifications before the expiry of the legislated time frames for most of the individual benefits. Given that payments for some of the individual benefit programs started in spring 2020, and considering the delays in starting post‑payment verifications, there is limited time left to conduct post‑payment verifications of cases that do not represent suspected fraud or misrepresentation. Even for cases of fraud or misrepresentation, for which the timeline is extended to 72 months, a significant amount of time has already elapsed and both the department and the agency have just started the post‑payment verifications.

Low percentage of post‑payment verifications to be performed on programs for individuals

10.96 Based on the information obtained during the audit and the agency’s current plans, we estimated that approximately 12% of individuals who received a benefit would be selected for post‑payment verification. In addition, the agency identified $1.5 billion in payments to recipients that received more than 1 benefit for the same period. The agency planned to notify all of these recipients.

10.97 We noted that the Canada Revenue Agency started post‑payment verification work on 1 specific criterion for the Canada Emergency Response Benefit in January 2022 using data available from their Business Intelligence Division. The agency identified over 2.1 million recipients that potentially did not meet this eligibility criterion. However, according to the post‑payment verification plan dated April 2022, only 150,000 recipients of these 2.1 million recipients (or 7%) would be selected for verification. As of 12 May 2022, the agency had contacted around 104,000 recipients requesting additional information but had to pause this work due to a recent decision of an appeal by an Employment Insurance Emergency Response Benefit recipient. This highlighted the need for analysis of the alignment of post‑payment verification activities related to the Canada Emergency Response Benefit and the Employment Insurance Emergency Response Benefit. An additional 150,000 verifications are planned at a later date, across all benefit programs for individuals. However, few details on those additional verifications, such as the criteria to be verified, were included in the agency’s plan.

10.98 For Employment and Social Development Canada, we estimated that around 4% of individuals who received a benefit would be selected for post‑payment verification. The department made Employment Insurance Emergency Response Benefit payments to a total of 3.7 million recipients. We found that the department’s most recent post‑payment verification plan included verifying approximately 130,000 of these recipients. In addition, the department identified $3.1 billion in Employment Insurance Emergency Response Benefit lump‑sum payments. The department planned to notify all recipients of these payments.

10.99 In our opinion, the department and agency had not adopted a rigorous and comprehensive approach to post‑payment verifications considering the limited pre‑payment controls and the decision made at the onset of these programs to focus on verifying eligibility of recipients after payment. We believe that the low number of post‑payment verifications planned was insufficient to address all payments at risk of being ineligible. Given the limited pre‑payment controls in place, we expected the department and the agency to conduct extensive and comprehensive post‑payment verifications.

10.100 According to the International Public Sector Fraud Forum, given the limited ability to implement pre‑payment controls in an emergency situation, it is important that verifications following payment are carried out to uphold the stewardship of public funds. In addition, considering the Treasury Board’s policy on financial management, organizations should follow up and recover payments made in error. Therefore, we are of the view that all cases identified as representing a risk of not meeting program criteria must be followed up and verified for fairness to all recipients and Canadians.

10.101 Recommendation. The Canada Revenue Agency and Employment and Social Development Canada should

- update their post‑payment verification plans to include all activities to identify payments to ineligible recipients of COVID‑19 benefit programs, taking into account the legislated time frames

- increase the extent of post‑payment verifications for COVID‑19 benefit programs for individuals to include all cases identified as being at risk of being ineligible

The agency and department’s response. Partially agreed.

See Recommendations and Responses at the end of this report for detailed responses.

Risk that post‑payment verification will not be completed within the legislated time frame

10.102 While the post‑payment verifications for the Canada Emergency Wage Subsidy started in August 2020, we found that the agency is at risk of not being able to complete all the planned post‑payment verifications. This is because of their complexity, as well as the significant amount of time and effort required to conduct them. Subject to exceptions, the agency normally has 36 or 48 months, depending on the type of recipient, to complete the verifications. See Exhibit 10.10 for the status of post‑payment verifications for the Canada Emergency Wage Subsidy.

Exhibit 10.10—Status of post‑payment verifications for the Canada Emergency Wage Subsidy

The Canada Revenue Agency began the process of verifying the eligibility of recipients of the Canada Emergency Wage Subsidy in August 2020.

In phase 1 of its post‑payment verification plan, the agency selected a total of 730 audits with $1.5 billion in subsidies paid from eligibility periods 1 to 4. Employers to be verified were selected in several ways: through data analytics, manual identification during pre‑payment controls, and random selection. This phase included a limited sample number in order to gain insights and develop a more thorough audit program for the next phase.

Phase 2 verifications began in May 2021. Audits were selected based almost entirely on data analytics (using risk indicators identified in phase 1) and manual identification during pre‑payment controls. A total of 2,770 audits with $10.7 billion in subsidies paid were selected for phase 2 verifications.

As of May 2022, 712 (98%) of phase 1 verifications had been completed. Of completed verifications, 42% resulted in adjustments totalling $81.5 million (6% of the amounts audited). Phase 1 verifications took an average of 341 days to complete. Given the complexity of some audits, 18 were still in progress for phase 1.

As of May 2022, only 487 (18%) phase 2 verifications had been completed, while 49% were in progress and 33% were not started. Of the completed verifications, 61% resulted in adjustments totalling $40 million (13% of the amounts audited). Phase 2 verifications took an average of 195 days to complete.

The agency is planning to conduct an additional phase of verifications depending on the outcomes of current phases and the availability of resources. Considering the above, the agency is at risk of not completing phase 2 and any additional phase within the time frames referred to in paragraph 10.102.

While the number of employers selected for verification in the first 2 phases totalled approximately 0.8% of the unique recipients, the value of subsidies being verified represented about 12% of the value of Canada Emergency Wage Subsidy paid.

(See Part 2 of this report for a breakdown of Canada Emergency Wage Subsidy recipients and verifications by business size.)

The Canada Revenue Agency performed limited collection activities on COVID‑19 programs