2021 Reports of the Auditor General of Canada to the Parliament of CanadaReport 14—Regional Relief and Recovery Fund

Independent Auditor’s Report

Table of Contents

- Introduction

- Findings, Recommendations, and Responses

- Developing and delivering the Regional Relief and Recovery Fund

- Achieving objectives and reporting on results

- Conclusion

- About the Audit

- List of Recommendations

- Exhibits:

- 14.1—How the Regional Relief and Recovery Fund delivered funding

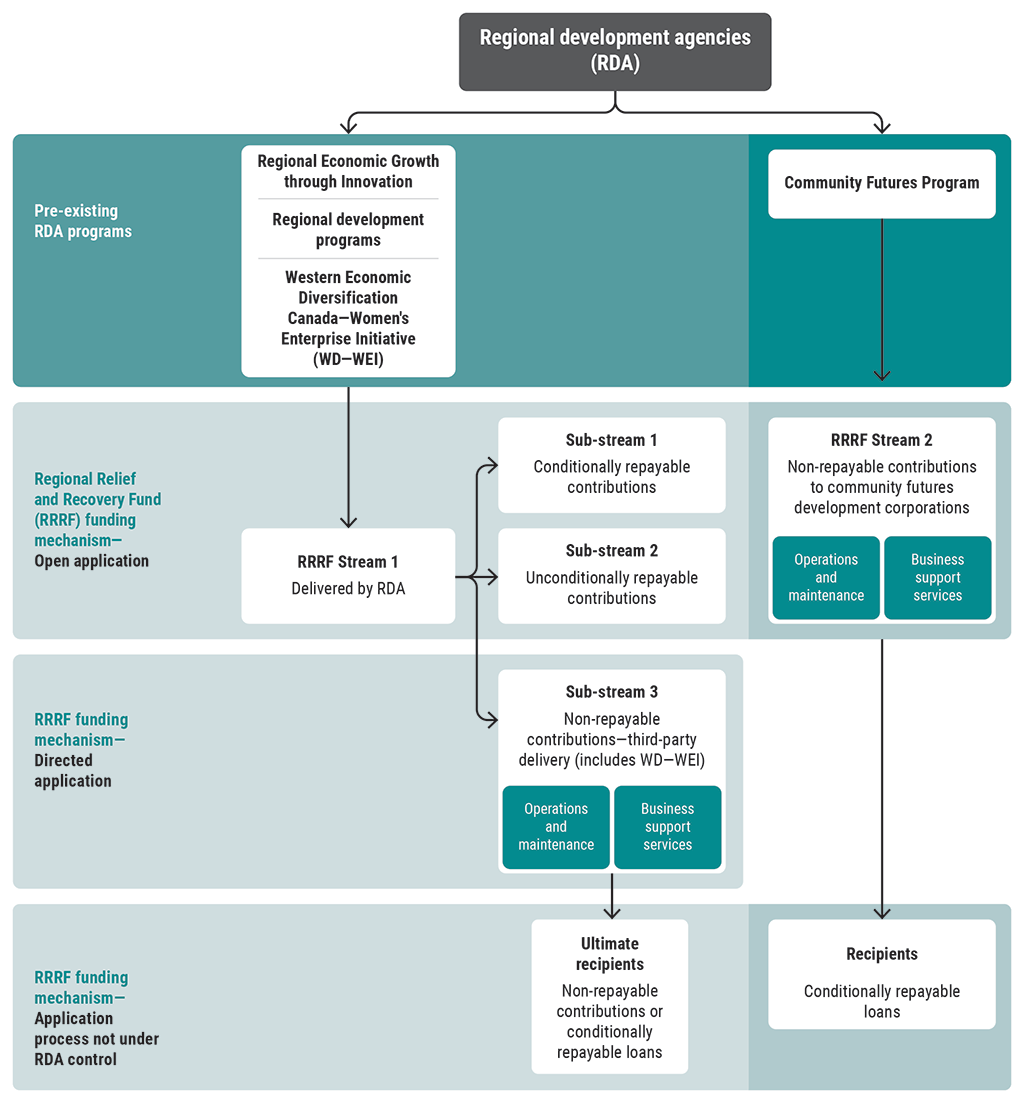

- 14.2—The Regional Relief and Recovery Program allocated funds to the regional development agencies

- 14.3—The volume of applications varied by regional development agency

- 14.4—Businesses led by members of under-represented groups made up various proportions of approved applicants

- 14.5—Agencies reported funding for the tourism sector that almost met the program target of 25%

Introduction

Background

14.1 In 2020, as part of its response to the coronavirus disease (COVID‑19)Definition 1 pandemic, the federal government announced a wide range of new programs along with additional funding for existing programs. Departments delivering these COVID‑19 economic response programs were required to roll them out as quickly as possible to provide assistance to Canadians, as well as to businesses and other organizations in need. One of the new programs was the Regional Relief and Recovery Fund, announced on 17 April 2020. The program offered support for businesses and organizations that were unable to access other federal pandemic support programs and emergency funding or that required additional assistance. In total, the government allocated more than $2 billion to the program.

14.2 The program’s objective was to mitigate financial pressures on businesses and organizations by funding eligible expenses incurred in any 12‑month period falling between 15 March 2020 and 30 September 2021. When an applicant met the eligibility criteria, the program provided funds in the form of a non‑repayable, partially repayable, or unconditionally repayable contributionDefinition 2.

14.3 Intended program recipients included the following organizations, among others:

- incorporated businesses with 1 to 499 full-time-equivalent employees

- not‑for‑profit organizations providing technical support to businesses and helping them mitigate the effects of the COVID‑19 pandemic

- tourism operators

- economic development organizations, such as chambers of commerce

- organizations supporting businesses in particular sectors or under-represented groups

14.4 The entities responsible for the program were the federal government’s 6 regional development agencies, including 1 operating under Innovation, Science and Economic Development Canada. These agencies designed, implemented, delivered, and reported on the program. For this audit, our examination focused on 3 of the agencies:

- Western Economic Diversification Canada, covering Manitoba, Saskatchewan, Alberta, and British Columbia

- the Federal Economic Development Agency for Southern Ontario

- the Federal Economic Development Initiative for Northern Ontario, which operated under Innovation, Science and Economic Development Canada

14.5 In August 2021, the regional development agency structure was modified. Western Economic Diversification Canada would henceforth be represented by Prairies Economic Development Canada, which included Manitoba, Saskatchewan, and Alberta. Pacific Economic Development Canada represented British Columbia. As a result, there are now 7 regional development agencies. Because our audit covered a period prior to the agencies’ structural modifications, this report refers to Pacific Economic Development Canada and Prairies Economic Development Canada as Western Economic Diversification Canada in all text except for the recommendations. Also in August 2021, the Federal Economic Development Initiative for Northern Ontario became a stand-alone agency called the Federal Economic Development Agency for Northern Ontario.

14.6 To better support businesses and organizations in rural communities, the agencies distributed funding using the existing Community Futures Program through the 268 local community futures development corporations across Canada. The community futures development corporations are mandated to provide targeted funding and support services to rural businesses, including sole proprietorships. The regional development agencies also worked with not‑for‑profit organizations that assisted in 2 areas:

- redistributing program funding to ultimate recipients

- delivering business support services

Focus of the audit

14.7 This audit focused on whether selected regional development agencies and the Federal Economic Development Initiative for Northern Ontario (under Innovation, Science and Economic Development Canada) designed, delivered, and managed the Regional Relief and Recovery Fund program effectively and efficiently to support businesses and organizations through the pandemic and whether they reported on the program’s results.

14.8 More details about the audit objective, scope, approach, and criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Overall message

14.9 Overall, the Regional Relief and Recovery Fund was successful at providing last-resort assistance to thousands of businesses and organizations affected by the COVID‑19 pandemic. We found that the regional development agencies worked together to launch the program much faster than what is usually seen in normal policy development and program implementation. According to data provided by the regional development agencies, the program will likely succeed in reaching the objective of providing at least 25% of its funds to the tourism sector. However, the full impact of the program will not be known for a few years. In particular, the impact on jobs maintained will be difficult to measure, notably because of the poor quality of data reported.

14.10 In order to process applications quickly, regional development agencies leveraged their experience, systems, and knowledge and relied heavily on the information provided by applicants. However, the management of the program was weakened by a lack of efficiency, fairness, and transparency that may have resulted from the efforts to administer the program quickly. Applicants from different regions of the country faced different requirements because of the various approaches taken by regional development agencies and the different interpretations of the eligibility criteria. We found many instances where funding was awarded to applicants who did not meet all of the eligibility criteria or where ineligible expenses were funded.

14.11 The Regional Relief and Recovery Fund was designed as a backstop program and, as such, contained greater risks. To rapidly achieve the program’s objectives, agencies applied controls in a flexible manner. As a result, it is expected that between 25% and 42% of the total amount of repayable contributions granted will not be repaid.

Developing and delivering the Regional Relief and Recovery Fund

14.12 The Regional Relief and Recovery Fund program delivered funding through the regional development agencies (Stream 1) and the community futures development corporations (Stream 2). The agencies could choose to administer Stream 1 funding through different sub‑streams, depending on the size and type of contributions and recipients (Exhibit 14.1).

Exhibit 14.1—How the Regional Relief and Recovery Fund delivered funding

Source: Based on information provided by the regional development agencies

Exhibit 14.1—text version

This flow chart shows how the Regional Relief and Recovery Fund delivered funding to recipients.

The regional development had pre-existing mechanisms in place for the following programs: Regional Economic Growth through Innovation, regional development programs, the Women’s Enterprise Initiative under Western Economic Diversification Canada, and the Community Futures Program.

In addition to the pre‑existing agency programs, the Regional Relief and Recovery Fund delivered funding through 3 funding mechanisms: open application, directed application, and an application process not under the control of the regional development agencies.

In the open application process, the Regional Relief and Recovery Fund delivered funding through 2 streams. Stream 1 provided funding through the regional development agencies, and Stream 2 provided funding through community futures development corporations.

The regional development agencies delivered funding from Stream 1 of the Regional Relief and Recovery Fund through 3 sub‑streams:

- Sub‑stream 1 used an open application mechanism to provide conditionally repayable contributions.

- Sub‑stream 2 used an open application mechanism to provide unconditionally repayable contributions.

- Sub‑stream 3 used a directed application mechanism to provide non‑repayable contributions that were delivered by third parties (including the Women’s Enterprise Initiative). These contributions could be used for operations and maintenance or business support services. The regional development agencies did not control the application process for the ultimate recipients of the non‑repayable or conditionally repayable contributions from the third parties.

The Communities Futures Program administered Regional Relief and Recovery Fund Stream 2, which provided non‑repayable contributions to community futures development corporations for operations and maintenance and for business support services. The program used an open application funding mechanism. The regional development agencies did not control the application process for the recipients of the conditionally repayable loans from the community futures development corporations.

14.13 Under Stream 1, the agencies delivered funding under 3 sub‑streams:

- conditionally repayable contributions—contributions of up to $60,000, with a portion to be forgiven (to a maximum of $20,000) if a contribution was repaid by 31 December 2022

- unconditionally repayable contributions—contributions of up to $1 million, to be repaid in full with no portion forgiven

- non‑repayable contributions—amounts to directly support liquidity, for redistribution to other recipients (non‑repayable contributions or conditionally repayable loans), or to support business services. In some cases, the funding included a portion for administrative costs. Recipients that redistributed funds established eligibility criteria, as well as application processes in line with overall program criteria

14.14 The regional development agencies had an open application process for funding in the first and second sub‑streams for conditionally or unconditionally repayable contributions. In contrast, in the third sub‑stream (non‑repayable contributions), funding was mostly available to potential recipients who were invited by the agencies to submit funding proposals.

14.15 Community futures development corporations received funding from the regional development agencies. They, in turn, redistributed funding to small businesses in rural locations in the form of loans of up to $60,000 on terms similar to those used by the agencies to deliver funding.

14.16 Initially, the program received approximately $962 million in funding. In its 2020 Fall Economic Statement, the government increased that amount to more than $2 billion and extended the program into the 2021–22 fiscal year (Exhibit 14.2). Recognizing that the pandemic had severely affected the tourism sector, the government decided to target at least 25%—or more than $525 million—of the program’s total funding to prevent business shutdowns and job losses in this sector. The program funding was allocated on the basis of regional demographic and economic factors.

Exhibit 14.2—The Regional Relief and Recovery Program allocated funds to the regional development agencies

| Regional development agencies | Amounts allocated ($ millions) | |||

|---|---|---|---|---|

| May 2020 | October 2020 | December 2020 | Totals received | |

| Atlantic Canada Opportunities Agency | $110.1 | $60.2 | $83.4 | $253.7 |

| Canada Economic Development for Quebec Regions | $211.4 | $69.8 | $46.1 | $327.3 |

| Canadian Northern Economic Development Agency | $34.3 | $0 | $4.0 | $38.3 |

| Federal Economic Development Agency for Southern OntarioNote 1 | $252.4 | $184 | $100 | $536.4 |

| Innovation, Science and Economic Development Canada—Federal Economic Development Initiative for Northern OntarioNote 1 | $49.5 | $22.3 | $40.0 | $111.8 |

| Western Economic Diversification CanadaNote 1 | $304.2 | $263.7 | $309.7 | $877.6 |

| Total amount | $961.9 | $600 | $583.2 | $2,145.1 |

| Amounts allocated from the agencies to the community futures development corporations (included in total amount) | $287.0 | $177.7 | $177.0 | $641.7 |

Source: Based on information provided by the regional development agencies

14.17 We summarized the number of applications received by the 3 regional development agencies and the number of applications approved, rejected, and under review (Exhibit 14.3). Of the 3 regional development agencies that we examined for the period from 13 May 2020 to 31 March 2021, Western Economic Diversification Canada received the most applications by far. In comparison, the Federal Economic Development Agency for Southern Ontario received less than one third of the applications. The Federal Economic Development Initiative for Northern Ontario received the fewest applications and had the highest approval rate.

Exhibit 14.3—The volume of applications varied by regional development agency

| Application status | Federal Economic Development Initiative for Northern Ontario | Federal Economic Development Agency for Southern Ontario | Western Economic Diversification Canada |

|---|---|---|---|

| Applications received—number | 305 | 2,905 | 10,880 |

| Applications approved—number (percentage) | 178 (58%) | 1,195 (41%) | 4,593 (42%) |

| Applications rejected—number (percentage) | 112 (37%) | 1,401 (48%) | 4,428 (41%) |

| Applications under review—number (percentage) | 15 (5%) | 309 (11%) | 1,859 (17%) |

Note: Figures are for the period from 13 May 2020 to 31 March 2021.

Source: Analysis based on information provided by the regional development agencies

14.18 To be eligible for funding from the program, a potential recipient had to be incorporated under Canadian federal or provincial law and be engaged in commercial activities. Alternatively, applicants could be chambers of commerce, business or sector associations, or other economic development organizations that provided support to businesses. Applicants had to meet all the following eligibility criteria:

- have between 1 and 499 full-time-equivalent employees

- have been in operation before March 2020 and intend to continue operations

- be financially viable

- have suffered financially as a result of the COVID‑19 pandemic

- have applied for other federal COVID‑19 relief programs but were determined to be ineligible or were provided with amounts that did not fully cover the applicants’ needs

- have an active business chequing account

14.19 Potential recipients could apply for funding through the website of the agency for the region where the business was located or through the website of a community futures development corporation in that area. For each application received by an agency, an officer assessed the information provided and made a recommendation. Once an application was approved, a contribution agreement was prepared for the applicant to sign.

14.20 The program closed its application intake on 30 June 2021.

14.21 To review this program, we used representative sampling to examine applications that these agencies had accepted and applications that they had rejected.

The program design suited the objective of mitigating financial pressures on funding recipients

14.22 The Regional Relief and Recovery Fund was intended to help businesses and organizations mitigate the effects of the COVID‑19 pandemic, address gaps left by other COVID‑19 economic relief programs, and provide assistance tailored to regional priorities. We found that the program design met these objectives but did not sufficiently prioritize the United Nations’ Sustainable Development Goals and gender-based analysis plusDefinition 3.

14.23 The analysis supporting this finding discusses the following topics:

- Attention to gaps, needs, and priorities in the design of the program

- Missed opportunity to promote Sustainable Development Goals and gender-based analysis plus

14.24 This finding matters because proper program design maximizes the benefits of public spending for the intended recipients.

14.25 Our recommendation in this area of examination appears at paragraph 14.32.

Attention to gaps, needs, and priorities in the design of the program

14.26 We found that the Regional Relief and Recovery Fund program aligned with the federal government’s objective of rapidly responding to the impact of the COVID‑19 pandemic in order to ensure that businesses remained viable and were positioned for recovery. The program was designed for businesses and organizations not covered by other federal COVID‑19 funding programs, such as the Canada Emergency Business Account, the Canada Emergency Wage Subsidy, or the Canada Emergency Rent Subsidy. Applicants were often higher-risk businesses that had no other program to turn to for additional funding. To deliver funding to successful applicants quickly, the regional development agencies used the established transfer payment programs.

14.27 Agencies identified sectors that needed support in their region and ensured that the program design reflected those needs. Some agencies set priorities according to the challenges that businesses in their regions faced.

14.28 Agencies were able to provide funding to small and medium-sized enterprises operating in sectors heavily affected by the pandemic, including businesses that played key roles in the local economy. For example, 1 agency provided substantial support to small businesses operating in accommodation and food services and in manufacturing. Another agency responded to the regional economic situation by providing funding to businesses operating in professional, scientific, and technical services.

Missed opportunity to promote Sustainable Development Goals and gender-based analysis plus

14.29 The pandemic stalled or reversed economic growth and heavily affected employment. In these circumstances, simply preventing job losses and keeping the local economy going required major efforts. These efforts aligned with the United Nations’ Sustainable Development Goal 8 , concerning sustained and inclusive economic growth and employment. Despite these efforts, the Regional Relief and Recovery Fund program’s impact on the local economy will probably not be able to be measured until after the end of the repayment period.

14.30 The program design considered information on gender equality and diversity, which pertains to Sustainable Development Goal 5 (promoting equal rights to economic resources), and on gender-based analysis plus. For the regional development agencies we examined, all application forms allowed the applicant to self-identify as a member of an under-represented group. One agency set aside $21.7 million of program funding for women-owned businesses, and 2 agencies included self-identification information in their assessment process. The information collected indicated the level of participation of different groups in the program (Exhibit 14.4).

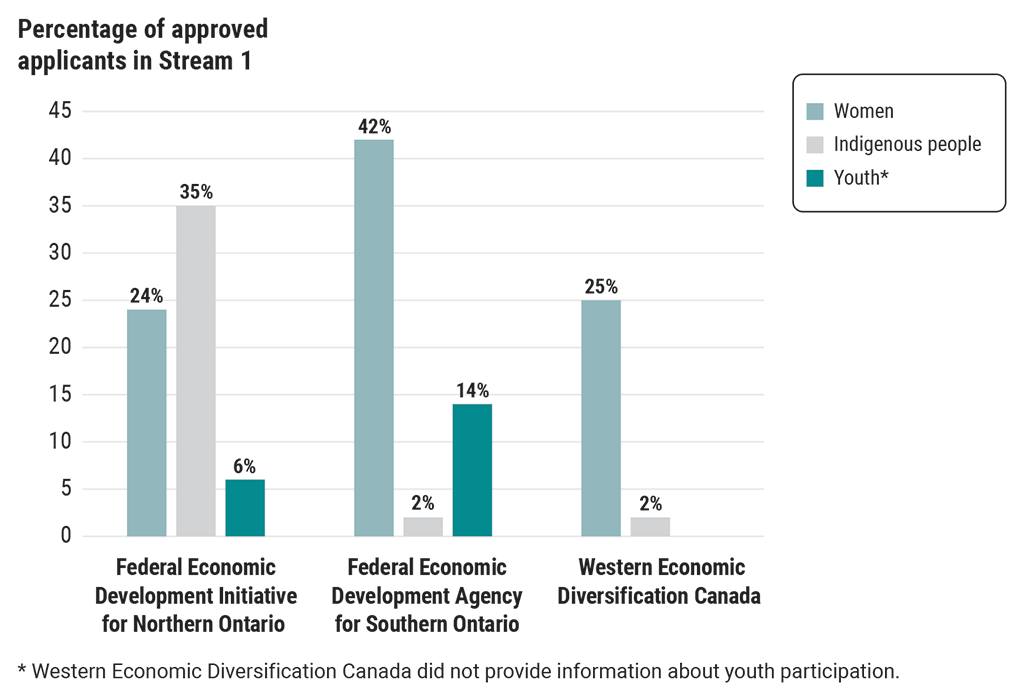

Exhibit 14.4—Businesses led by members of under-represented groups made up various proportions of approved applicants

Source: Analysis based on information provided by potential recipients in application forms submitted to the 3 regional development agencies, 13 May 2020 to 31 March 2021

Exhibit 14.4—text version

This bar chart shows the percentages of applicants approved for funding by 3 regional development agencies under Stream 1 of the Regional Relief and Recovery Fund. The approved applicants were businesses led by members of under-represented groups. The chart shows 3 categories of applicants approved for funding: women, Indigenous people, and youth. The chart also shows 3 regional development agencies that delivered the funding under Stream 1 of the Regional Relief and Recovery Fund: the Federal Economic Development Initiative for Northern Ontario, the Federal Economic Development Agency for Southern Ontario, and Western Economic Diversification Canada.

For the Federal Economic Development Initiative for Northern Ontario, which operated under Innovation, Science and Economic Development Canada, 24% of businesses approved for funding were led by women, 35% were led by Indigenous people, and 6% were led by youth.

For the Federal Economic Development Agency for Southern Ontario, 42% of businesses approved for funding were led by women, 2% were led by Indigenous people, and 14% were led by youth.

For Western Economic Diversification Canada, 25% of businesses approved for funding were led by women and 2% were led by Indigenous people. The agency did not provide information about youth participation.

14.31 However, we found that unlike the tourism sector, the agencies did not establish a specific target for the proportion or value of contributions to be provided in support of under-represented groups. The program did not use the information shown in Exhibit 14.4 to inform decision making and achieve adequate levels of support.

14.32 Recommendation. For future programs, the Federal Economic Development Agency for Northern Ontario, the Federal Economic Development Agency for Southern Ontario, Prairies Economic Development Canada, Pacific Economic Development Canada, and the other regional development agencies should establish targeted levels of support for under-represented groups and ensure that information collected is used to inform decision making.

The agencies’ response. Partially agreed. The regional development agencies audited agree that gender-based analysis plus and other data needs to be collected to inform decision making on the needs of under-represented groups for future programs.

Regional development agencies recognize that under-represented groups were disproportionately impacted by the pandemic. The Regional Relief and Recovery Fund was designed to provide funds to all small businesses unable to access adequate funding elsewhere. The agencies agree that for every program considered, efforts are needed to help ensure that the distribution of supports are inclusive and reflective of the populations in the context of the program objectives. In the case of the Regional Relief and Recovery Fund, targets for under-represented groups could have limited the ability of the regional development agencies to adjust and provide support to those that needed it the most.

Results for this program show that funding was provided to the businesses that needed it the most, with significant support provided to under-represented groups.

Using the model of existing programs allowed agencies to deliver the Regional Relief and Recovery Fund quickly

14.33 We found that the regional development agencies used and adapted existing tools and programs that they had available and learned from their experience in delivering similar transfer payment programs. This enabled them to quickly implement the Regional Relief and Recovery Fund.

14.34 The analysis supporting this finding discusses the following topic:

14.35 This finding matters because the duration of the COVID‑19 pandemic and its effects on the economy were unknown at the outset. The quick release of program funds enabled recipients to deal with health restrictions and contribute to their regions’ economies.

14.36 Given the urgent need for action, government organizations had to adapt and deliver COVID‑19 support programs within weeks from the date of their approval. The regional development agencies turned to existing tools, used systems developed for other programs, and drew on the experience they had gained from delivering those programs. This enabled the agencies to meet the needs of Canadian businesses and organizations in a time of crisis. In accordance with the information received from the Secretary of the Treasury Board and in view of the need for financial assistance to reach businesses and organizations quickly, the agencies applied controls in a flexible manner.

14.37 We made no recommendations in this area of examination.

Rapid delivery process, relying on available tools

14.38 We found that the regional development agencies were able to roll out the Regional Relief and Recovery Fund quickly because they leveraged their experience and knowledge and the systems and processes they used in delivering already existing programs.

14.39 Agencies were accustomed to receiving and processing applications. They were able to mobilize experienced staff to deliver the program. Their experience saved time in the rollout. Approximately 7 weeks passed from the date that the program was initially proposed to the date that staff at the 3 audited regional development agencies began processing applications.

14.40 Agencies used the network of community futures development corporations by drawing on their expertise and knowledge of local businesses. This approach made it possible to quickly direct financial assistance in rural communities. The community futures development corporations assessed applications for loans of up to $60,000 and delivered the funds to applicants that met the eligibility criteria. Each community futures development corporation could have its own application form and timeline for receiving and processing applications and for setting up a loan agreement.

14.41 The regional development agencies had a long history of providing funding to rural communities through the community futures development corporations. In accordance with the terms and conditions of the Community Futures Program, the agencies relied on the controls already established by the community futures development corporations to assess applications, distribute funds, monitor compliance, and collect loans due to be repaid. Contribution agreements authorized the agencies to undertake additional oversight procedures if they saw a need to do that.

Program management had weaknesses in terms of efficiency and fairness

14.42 We found that the efficiency of this national program was lessened because of inconsistencies in the information requested and the assessment processes of the different regional development agencies. Applicants in different parts of the country faced different requirements as a result of the agencies’ various approaches when implementing the Regional Relief and Recovery Fund program. These could be the result of a quick launch of the program.

14.43 We found that the fairness of the program was negatively affected by the agencies’ different interpretations of the eligibility criteria. We also found that access to non‑repayable contributions was not always transparent. In some cases, not‑for‑profit organizations received preferential treatment in the form of an invitation to apply for significant amounts of funding. We acknowledge that the approach might have varied because of regional differences. Nevertheless, we expected certain common elements to promote fairness.

14.44 The analysis supporting this finding discusses the following topic:

14.45 This finding matters because the Treasury Board’s Policy on Transfer Payments requires programs to establish a uniform, efficient process that gives applicants across Canada fair and transparent access to funding.

14.46 Our recommendation in this area of examination appears at paragraph 14.55.

Efficiency and fairness affected by non‑harmonized procedures and treatment of funding requests

14.47 We found that each regional development agency developed its own application form and used different criteria to assess funding applications to the Regional Relief and Recovery Fund. For example, agencies asked for different information about equality and diversity, previous rejections by other federal COVID‑19 funding programs, and documentation of revenues and expenses. Only 1 agency asked applicants how much money they needed to continue operating, while others determined the amount of funding to provide by calculating the applicant’s estimated net revenue. Many of the 268 community futures development corporations across Canada created their own application forms for the program, which added further complexity.

14.48 The applications considered to be eligible varied from one regional development agency to another, which affected efficiency and fairness. We identified the following examples, which showed different decisions about eligibility depending on which regional development agency was making the decision:

- non‑incorporated businesses

- non‑profit organizations and provincial agencies

- inclusion of employees outside Canada

- businesses located outside the region

14.49 In our samples, we found the following examples where funding was provided, but the applications should have been rejected because they did not satisfy the program’s eligibility criteria:

- cases of businesses that had no employees

- cases of applicants that had not previously applied to all other federal COVID‑19 funding programs

- cases of applicants that were not in operation before March 2020

14.50 We found cases of ineligible expenses that were approved—for example:

- repayment of shareholder loans

- financial support to family members

- purchase of a new vehicle

14.51 We found that an agency did not always request and validate proof of incorporation. We also found cases where funding was granted to businesses on the basis of the financial information provided with their application, even though these businesses were unviable.

14.52 We found that the program had been operating for some time before the agencies took additional steps to verify whether an applicant had applied for or received funding from another program, which was an eligibility condition of the program. Our review found that some applicants indicated that they did not receive funds from another COVID‑19 funding program, but in fact, did receive such funds. The funding from other programs should have been deducted from the amount of the contribution offered under the Regional Relief and Recovery Fund. As a result, some businesses received more funding than they were entitled to.

14.53 We found that each agency had its own method of selecting and approving funding for not‑for‑profit organizations. In our opinion, this created a lack of openness and transparency. For example, 1 agency identified and invited only certain organizations to apply for funding, and it approved all proposals from the invited organizations. Some agencies did not consistently follow the general practice of using scoring templates to assess applications from not‑for‑profit organizations, and there were no pre‑set funding limits for some redistribution agreements.

14.54 Finally, 1 agency detected cases of possible misuse of the program. It performed additional analyses to verify the number of cases concerned. The agency referred these cases to the proper authorities for further investigation. It also implemented additional verification procedures to prevent similar occurrences.

14.55 Recommendation. To foster greater compliance with transfer payment policies and ensure efficiency, fairness, and transparency in delivering future programs, the Federal Economic Development Agency for Northern Ontario, the Federal Economic Development Agency for Southern Ontario, Prairies Economic Development Canada, and Pacific Economic Development Canada, along with the other regional development agencies, should ensure

- a common approach to program delivery and to assessment and approval of funding requests

- an open and transparent application process for all funding

The agencies’ response. Partially agreed. The regional development agencies audited agree that transparency was not perfectly served because of the emergency nature of the program. This was in line with guidance from the Secretary of the Treasury Board to all deputy heads to put a priority focus on achieving the intended results of the government’s response measures and to use their sound judgment for maximum flexibility in applying Treasury Board policies and exercising authorities. The agencies agree that it would be helpful to examine practical ways to improve transparency in the future.

The regional development agencies audited do not agree that common delivery of funding programs is appropriate in all instances. Regional development agencies were expressly established to be place-based and reflective of the region they operate in and deliver national programs such as the Regional Relief and Recovery Fund in a nationally coordinated, regionally tailored fashion.

Complementarity with provincial and other levels of government programs is typically more important to the agencies’ clients than consistency with programs being delivered in a different context in other parts of the country.

Achieving objectives and reporting on results

14.56 According to Treasury Board policy, members of Parliament and the public should have access to transparent, clear, and useful information on the results achieved by federal departments and agencies. To be able to report on its performance against program goals, an organization must have accurate data.

14.57 To comply with reporting requirements for the Regional Relief and Recovery Fund program, each regional development agency had to send weekly statistics in a prescribed format to a secretariat located within Innovation, Science and Economic Development Canada. The secretariat was responsible for coordinating reporting on the program, compiling the information provided by the 6 agencies, and transmitting the results to the Privy Council Office.

Reported results contained inaccurate information

14.58 At the end of July 2021, we noted that the Regional Relief and Recovery Fund appeared to have almost met its target of providing at least 25% of its total funding to the tourism sector. However, we found that the secretariat coordinating reporting relied on inaccurate information to measure this outcome. After consulting with regional development agencies, Innovation, Science and Economic Development Canada had provided guidelines, including the definition of tourism. While this would have allowed for a consistent approach, we found differences in the way agencies applied the guidelines to identify businesses or not‑for‑profit organizations as being in the tourism sector.

14.59 We also noted various anomalies in the data used to report on the number of jobs maintained. Reported data was based on information provided by applicants. The data related to jobs maintained was not verified and thus was subject to error and subjectivity. Therefore, we could not confirm the reported numbers of jobs maintained on the basis of the information provided.

14.60 The analysis supporting this finding discusses the following topics:

14.61 This finding matters because the success of a program is measured by comparing its reported results against its objectives. When the reported information is unreliable and inaccurate, progress or success cannot be measured.

14.62 Our recommendation in this area of examination appears at paragraph 14.68.

Inaccuracies in reported data

14.63 We found that each regional development agency had its own administration and systems for collecting information on the results of the Regional Relief and Recovery Fund. The coordinating secretariat was responsible for collecting and compiling the results received from the agencies and for transmitting them to the Privy Council Office. Each agency used a standardized template to prepare and send results to the secretariat on a weekly basis. Each agency was accountable for the accuracy and timeliness of the data it reported to the secretariat.

14.64 We found contradictions in some data transmitted to the secretariat from week to week. For example, some weekly reports included lower numbers and values for approved contributions than what had been transmitted in previous reports. We would have expected incremental increases.

14.65 We found that the agencies had different ways of classifying businesses and organizations as being in the tourism sector, which was targeted to receive at least 25% of the total program funding (Exhibit 14.5). In our view, these discrepancies affected the quality of reporting and could have provided misleading information about the real impact of the program on this sector.

Exhibit 14.5—Agencies reported funding for the tourism sector that almost met the program target of 25%

| Regional development agency | Value of assistance approved | Funding for tourism sector | Funding for tourism sector as percentage of assistance approved |

|---|---|---|---|

| Federal Economic Development Agency for Southern Ontario | $489,456,319 | $125,030,627 | 26% |

| Federal Economic Development Initiative for Northern Ontario | $95,105,874 | $30,892,652 | 32% |

| Western Economic Diversification Canada | $665,421,192 | $119,662,514 | 18% |

| All 6 agencies | $1,813,666,651 | $431,281,741 | 24% |

Note: Figures as of 29 July 2021

Source: Analysis based on data provided by the regional development agencies

Unreliable figures for the number of jobs maintained

14.66 We found inconsistencies in the way the regional development agencies calculated the number of full-time-equivalent employees, leading to inaccurate reporting of the number of jobs maintained. In defining who qualified as a full-time employee, agencies did not all use the same requirements, such as how many hours a full-time employee had to work, how to report part-time employees, or whether to include contract workers in their report. In some approved applications to the Regional Relief and Recovery Fund, the jobs estimated as maintained were not limited to jobs within Canada. These inconsistencies raised concerns about the quality of the reported data.

14.67 We found the following examples, which illustrate the potential overstatement in reporting on the number of jobs maintained:

- One agency’s application form did not ask about the expected number of jobs to be maintained, in the case of applications for funding up to $60,000. The agency simply reported the number of jobs as the total number of employees of the business receiving funding.

- In another case, an agency indicated over 200 jobs would be maintained for a recipient of funding of less than $60,000.

- Finally, all 3 agencies had approved applications indicating a higher number of jobs maintained than the number of reported employees.

14.68 Recommendation. For future funding programs, Innovation, Science and Economic Development Canada, the Federal Economic Development Agency for Northern Ontario, the Federal Economic Development Agency for Southern Ontario, Prairies Economic Development Canada, and Pacific Economic Development Canada, as well as other regional development agencies, should review and harmonize their processes to accurately report on program outcomes.

The department’s and agencies’ response. Agreed. Innovation, Science and Economic Development Canada and the regional development agencies audited agree that the consistency of measurement reporting could be improved. The department and the agencies agree that this is an area for further work. The department and the agencies agree with the importance of continuous improvement. Lessons learned from previous programming will inform the design of performance measurement strategies for future initiatives.

The agencies faced uncertainty regarding contribution repayments and post-payment activities

14.69 We found that the regional development agencies expected that the default rate for repayable contributions under the Regional Relief and Recovery Fund would range from 25% to 42%. This estimate was higher than the default rates expected for other programs that the agencies managed. We also found that, in view of the high risk of default, the agencies took steps to access the resources necessary to manage the process of collecting repayments from recipients.

14.70 The analysis supporting this finding discusses the following topic:

14.71 This finding matters because the remaining tasks of post-payment verification and collection of repayable contributions are necessary for the sound management of public funds.

14.72 We made no recommendations in this area of examination.

High estimated losses and risks related to the capacity to manage repayments

14.73 Regional development agencies were required to estimate the value of the allowance for doubtful accounts on the basis of the amount of outstanding repayable contributions. The Regional Relief and Recovery Fund was a backstop program, meaning that the businesses must have applied to other programs such as the Canada Emergency Business Account. The agencies estimated that between 25% and 42% of the outstanding repayable contributions would not be repaid. These estimates are higher than the default rates expected for other programs of the agencies. A low level of repayment may be seen as an indicator of failure. In this case, however, given the nature of the program, the expected default rate was not a surprise.

14.74 Management of the Regional Relief and Recovery Fund did not come to an end when all of the funds had been distributed. The program’s full life cycle included the management of contribution repayments and collections. Given the high number of repayable contributions granted, the debt load of many small businesses, and the uncertain economic recovery, management of repayable contributions will become an important issue for agencies beyond 2022. We found that the agencies were well aware of this situation, had started to plan their available resources accordingly, and had taken the necessary steps with the central agencies to secure the level of resources appropriate for the sound management of the program. In general, the more time required for taking action on an overdue payment, the poorer the chances of recovering the outstanding debt.

Conclusion

14.75 We concluded that the regional development agencies and Innovation, Science and Economic Development Canada quickly designed and delivered the Regional Relief and Recovery Fund to mitigate financial pressures for businesses and organizations under the impact of the COVID‑19 pandemic. They succeeded in doing so by drawing on the model of their already existing programs and by relying on information obtained from applicants.

14.76 At the same time, several weaknesses in program management lessened its efficiency, fairness, and transparency—which might be the consequences of the quick program delivery. The weaknesses affected the regional development agencies’ capacity to mitigate risks and ensure compliance with government requirements and policies.

14.77 We also concluded that, although regional development agencies had put some reporting mechanisms in place, those mechanisms did not ensure accurate reporting on program results.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada on the Regional Relief and Recovery Fund, administered by the regional development agencies. Our responsibility was to provide objective information, advice, and assurance to assist Parliament in its scrutiny of the government’s management of resources and programs, and to conclude on whether the Regional Relief and Recovery Fund complied in all significant respects with the applicable criteria.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard on Assurance Engagements (CSAE) 3001—Direct Engagements, set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office of the Auditor General of Canada applies the Canadian Standard on Quality Control 1 and, accordingly, maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from entity management:

- confirmation of management’s responsibility for the subject under audit

- acknowledgement of the suitability of the criteria used in the audit

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided

- confirmation that the audit report is factually accurate

Audit objective

The objective of this audit was to determine whether selected regional development agencies and Innovation, Science and Economic Development Canada (as responsible for the Federal Economic Development Initiative for Northern Ontario) designed, delivered, and managed the Regional Relief and Recovery Fund program effectively and efficiently to support businesses and organizations through the pandemic and reported on the program’s results.

Scope and approach

The scope of the audit included the Federal Economic Development Initiative for Northern Ontario, the Federal Economic Development Agency for Southern Ontario, and Western Economic Diversification Canada. Innovation, Science and Economic Development Canada was also included in the audit in view of its responsibility for the Federal Economic Development Initiative for Northern Ontario, as well as the support it provided in the design and delivery of the program, including the coordination of the reporting of program results.

In order to provide Parliament with assurance that the Regional Relief and Recovery Fund program met its objectives, the audit reviewed its design, delivery, management, and reporting of results. The audit also considered the broader context of the federal government’s economic response to the COVID‑19 pandemic, other relief and income support programs for businesses and organizations, ongoing economic development strategies, and Canada’s international commitments to sustainable development.

The approach for this audit included

- review of documentation supporting the design of the program

- review of controls surrounding the delivery of the program in place

- examination of the oversight of third parties or affiliates

- sampling of program applications to determine whether they were appropriately reviewed, approved for funding, and processed in a timely manner

- analysis and review of the mechanism for reporting on the program’s objectives and selected sustainable development goals

- interviews with parties involved in the program design, delivery, and reporting

For our examination, we selected representative cases of applications received from the program’s case files:

- accepted applications from each of the selected regions

- applications that were rejected

Where representative sampling was used, samples were sufficient in size to conclude on the sampled population with a confidence level of 90% and a margin of error (confidence interval) of ±10%.

We interviewed employees of regional development agencies who were involved in the design, delivery, and reporting of the Regional Relief and Recovery Fund program.

We did not examine the related programs managed by the Atlantic Canada Opportunities Agency, Canada Economic Development for Quebec Regions, or the Canadian Northern Economic Development Agency. We also did not examine provincial or municipal programs offered to help businesses or organizations deal with the impacts of the COVID‑19 pandemic.

Criteria

We used the following criteria to determine whether selected regional development agencies and Innovation, Science and Economic Development Canada (as responsible for the Federal Economic Development Initiative for Northern Ontario) designed, delivered, and managed the Regional Relief and Recovery Fund program effectively and efficiently to support businesses and organizations through the pandemic and reported on the program’s results.

| Criteria | Sources |

|---|---|

|

The agencies and the department ensure that the program design considers other COVID‑19 relief and income support programs for businesses and organizations, ongoing economic development strategies, and Canada’s federal sustainable development commitments. |

|

|

The agencies and the department properly assess applications against the eligibility criteria and fund recipients at an appropriate level. |

|

|

The agencies and the department develop and apply effective controls and oversight to manage the program according to the government’s policy requirements. |

|

|

The agencies and the department develop reporting measures to accurately monitor the program’s outcomes. |

|

Period covered by the audit

The audit covered the period from 15 March 2020 to 30 June 2021. This is the period to which the audit conclusion applies.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 1 November 2021, in Ottawa, Canada.

Audit team

Principal: Philippe Le Goff

Director: Lucie Després

Marc Brown

Philippe‑Antoine Charbonneau

Rebecca McNie

Mohamed Moubarak

Jeff Stephenson

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report, and the numbers in parentheses indicate the location of the related discussion.

Developing and delivering the Regional Relief and Recovery Fund

| Recommendation | Response |

|---|---|

|

14.32 For future programs, the Federal Economic Development Agency for Northern Ontario, the Federal Economic Development Agency for Southern Ontario, Prairies Economic Development Canada, Pacific Economic Development Canada, and the other regional development agencies should establish targeted levels of support for under-represented groups and ensure that information collected is used to inform decision making. (14.29 to 14.31) |

The agencies’ response. Partially agreed. The regional development agencies audited agree that gender-based analysis plus and other data needs to be collected to inform decision making on the needs of under-represented groups for future programs. Regional development agencies recognize that under-represented groups were disproportionately impacted by the pandemic. The Regional Relief and Recovery Fund was designed to provide funds to all small businesses unable to access adequate funding elsewhere. The agencies agree that for every program considered, efforts are needed to help ensure that the distribution of supports are inclusive and reflective of the populations in the context of the program objectives. In the case of the Regional Relief and Recovery Fund, targets for under-represented groups could have limited the ability of the regional development agencies to adjust and provide support to those that needed it the most. Results for this program show that funding was provided to the businesses that needed it the most, with significant support provided to under-represented groups. |

|

14.55 To foster greater compliance with transfer payment policies and ensure efficiency, fairness, and transparency in delivering future programs, the Federal Economic Development Agency for Northern Ontario, the Federal Economic Development Agency for Southern Ontario, Prairies Economic Development Canada, and Pacific Economic Development Canada, along with the other regional development agencies, should ensure

|

The agencies’ response. Partially agreed. The regional development agencies audited agree that transparency was not perfectly served because of the emergency nature of the program. This was in line with guidance from the Secretary of the Treasury Board to all deputy heads to put a priority focus on achieving the intended results of the government’s response measures and to use their sound judgment for maximum flexibility in applying Treasury Board policies and exercising authorities. The agencies agree that it would be helpful to examine practical ways to improve transparency in the future. The regional development agencies audited do not agree that common delivery of funding programs is appropriate in all instances. Regional development agencies were expressly established to be place-based and reflective of the region they operate in and deliver national programs such as the Regional Relief and Recovery Fund in a nationally coordinated, regionally tailored fashion. Complementarity with provincial and other levels of government programs is typically more important to the agencies’ clients than consistency with programs being delivered in a different context in other parts of the country. |

Achieving objectives and reporting on results

| Recommendation | Response |

|---|---|

|

14.68 For future funding programs, Innovation, Science and Economic Development Canada, the Federal Economic Development Agency for Northern Ontario, the Federal Economic Development Agency for Southern Ontario, Prairies Economic Development Canada, and Pacific Economic Development Canada, as well as other regional development agencies should review and harmonize their processes to accurately report on program outcomes. (14.63 to 14.67) |

The department’s and agencies’ response. Agreed. Innovation, Science and Economic Development Canada and the regional development agencies audited agree that the consistency of measurement reporting could be improved. The department and the agencies agree that this is an area for further work. The department and the agencies agree with the importance of continuous improvement. Lessons learned from previous programming will inform the design of performance measurement strategies for future initiatives. |