Report of the Auditor General of Canada to the Board of Directors of the Windsor-Detroit Bridge Authority—Special Examination—2022

Independent Auditor’s Report

Table of Contents

- Audit Summary

- Introduction

- Findings, Recommendations, and Responses

- Commentary on the United Nations’ Sustainable Development Goals

- Conclusion

- About the Audit

- List of Recommendations

- Exhibits:

- 1—Overall governance structure

- 2—Key timelines of the Gordie Howe International Bridge project

- 3—Overview of the Gordie Howe International Bridge project

- 4—Corporate governance—Key findings and assessment

- 5—Strategic planning—Key findings and assessment

- 6—Corporate risk management—Key findings and assessment

- 7—Management of the project agreement—Key findings and assessment

- 8—Operational readiness—Key findings and assessment

- 9—Stakeholder and shareholder relations—Key findings and assessment

Audit Summary

We examined how the Windsor-Detroit Bridge Authority carried out its corporate management practices and managed its operations for the period covered by the audit. In examining corporate management practices, we found a significant deficiency in board oversight. We also found several areas for improvement in this area, including board appointments, performance measurement and monitoring, and corporate risk management. In examining operations management, we found 3 weaknesses in information management and change management.

Despite the significant deficiency and weaknesses, the corporation reasonably maintained the systems and practices needed to carry out its mandate.

Introduction

Background

1. The Windsor-Detroit Bridge Authority, established in October 2012 by letters patentDefinition 1, is a federal Crown corporation headquartered in Windsor, Ontario. The corporation reports to Parliament through the Minister of Intergovernmental Affairs, Infrastructure and Communities.

2. In June 2012, the Government of Canada and the State of Michigan signed the Crossing Agreement, which established the framework for Canada’s and Michigan’s roles and responsibilities for the binational infrastructure project along the Canada–United States border. The agreement provided a framework for Canada to establish the Crossing Authority to design, construct, finance, operate, and maintain a new international bridge crossing between Windsor, Ontario, and Detroit, Michigan. The Crossing Authority is the Windsor-Detroit Bridge Authority.

3. Under the terms of the supplementary letters patent and the Crossing Agreement, the corporation will construct and eventually operate the crossing, which will be named the Gordie Howe International Bridge.

4. The International Authority established by Canada and the United States monitors compliance with the Crossing Agreement and with the public-private partnership agreement (referred to as the project agreement). The Crossing Agreement states that the International Authority will comprise 6 members, with equal representation from Canada and Michigan. Two members are appointed by Canada, 1 is appointed by the corporation, and 3 are appointed by Michigan.

5. The project agreement was signed in 2018 by the corporation and a private partner, Bridging North America, a consortium of international companies. The private partner is responsible for managing the construction of the crossing.

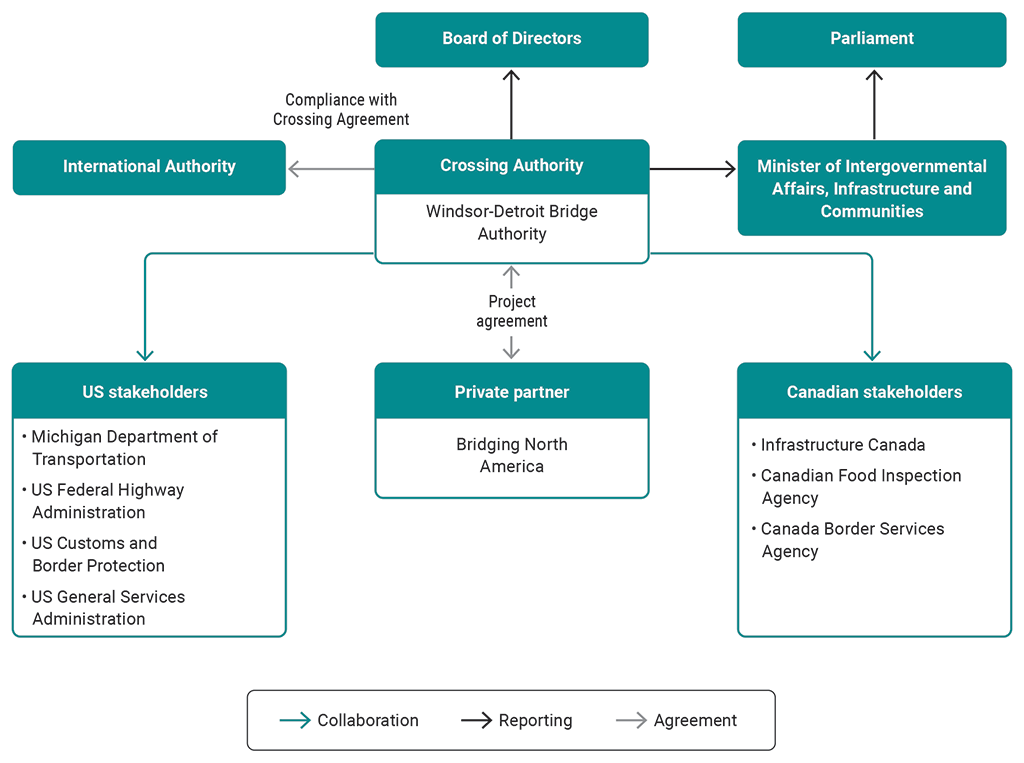

6. An international project of this scale requires involvement from many Canadian federal bodies and United StatesUS state and federal bodies (Exhibit 1).

Exhibit 1—Overall governance structure

Source: Windsor-Detroit Bridge Authority

Exhibit 1—text version

This flow chart shows the governance structure of the Windsor-Detroit Bridge Authority responsible for building the international bridge between Canada and the United States.

The Windsor-Detroit Bridge Authority, the crossing authority, reports to its board of directors and the Minister of Intergovernmental Affairs, Infrastructure and Communities. The Minister then reports to Parliament.

The international authority oversees the corporation’s compliance with the crossing agreement.

The corporation has a project agreement with a private partner, Bridging North America.

The corporation collaborates with several Canadian and United StatesUS stakeholders. The Canadian stakeholders are Infrastructure Canada, the Canadian Food Inspection Agency, and the Canada Border Services Agency. The US stakeholders are the Michigan Department of Transportation, the US Federal Highway Administration, US Customs and Border Protection, and the US General Services Administration.

7. The corporation is responsible for overseeing the private partner during the construction and operation of the new crossing. As operator of the new bridge, the corporation will be responsible for setting and collecting tolls.

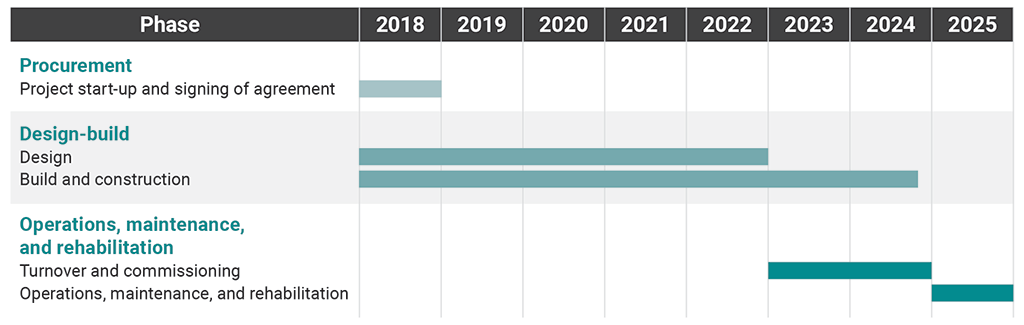

8. The project is currently in the design-build phase, with an estimated substantial completion date of the end of 2024, according to the corporation (Exhibit 2).

Exhibit 2—Key timelines of the Gordie Howe International Bridge project

Source: Windsor-Detroit Bridge Authority

Exhibit 2—text version

This graph shows the key timelines of the Gordie Howe International Bridge project.

During the procurement phase in 2018, the project started and the agreement was signed.

During the design-build phase from 2018 to 2024, the design is from 2018 to the end of 2022, and the build and construction is from 2018 to near the end of 2024.

During the operations, maintenance, and rehabilitation phase from 2023 to 2025, the turnover and commissioning is from 2023 to 2024, and the operations, maintenance, and rehabilitation will begin in 2025.

9. The corporation is funded through appropriations from Parliament. Through its future toll collections, the corporation will be expected to generate enough revenue to cover all of its operations, maintenance, and rehabilitation expenses after the construction phase of the project, as well as the construction costs related to the State of Michigan’s share of the bridge, the United StatesUS Port of Entry, and the Michigan I-75 Interchange. The project agreement includes a 30-year operations and maintenance phase with the private partner.

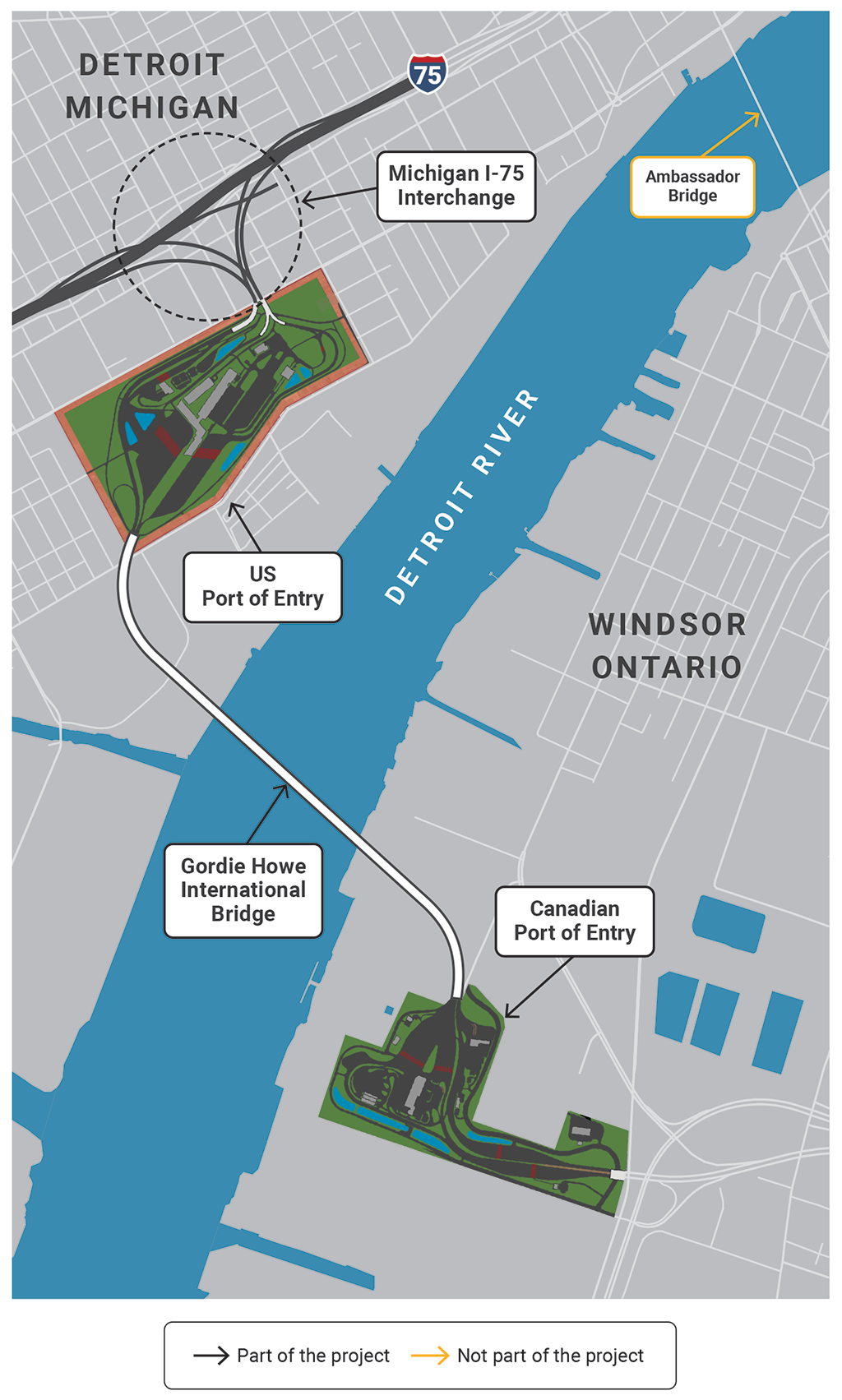

10. The Gordie Howe International Bridge project will provide an additional crossing at one of the busiest Canada–United States commercial border crossings and includes 4 components (Exhibit 3):

- Gordie Howe International Bridge—a 6-lane cable-stayed bridge approximately 2.5 kilometres long with a clear span of 853 metres, making it the longest main span of any cable-stayed bridge in North America. A “clear span” refers to the bridge deck and footings located above the highest water level.

- Canadian Port of Entry—the largest Canadian inspection facility along the Canada–United States border and one of the largest in North America.

- United StatesUS Port of Entry—one of the largest border inspection facilities in North America.

- Michigan I-75 Interchange—the primary connecting ramps to and from the United StatesUS Port of Entry and the United StatesUS Interstate 75.

11. The bridge will be co-owned by the Government of Canada and the State of Michigan, while the Michigan I-75 Interchange will be owned by the State of Michigan.

Exhibit 3—Overview of the Gordie Howe International Bridge project

Source: Windsor-Detroit Bridge Authority

Exhibit 3—text version

This map shows an overview of the Gordie Howe International Bridge project.

The Detroit River flows from the northeast to the southwest, separating Windsor, Ontario, and Detroit, Michigan.

The Michigan I‑75 Interchange is located in the northwestern corner of the map and connects the I‑75 highway to the US port of entry, which is located south of the highway. The Gordie Howe International Bridge crosses perpendicular to the river. The bridge starts at the US port of entry in Detroit, crosses the river, and ends at the Canadian port of entry in Windsor near the southern edge of the map. The highway interchange, bridge, and 2 ports of entry are part of the bridge project.

The Ambassador Bridge, located at the northeastern corner of the map, upstream of the Gordie Howe International Bridge, is not part of the project.

12. The Financial Administration Act requires each parent Crown corporation to have a special examination carried out at least once every 10 years. The statutory deadline for completing and reporting this examination is 9 October 2022, 10 years after the creation of the corporation.

Focus of the audit

13. Our objective for this audit was to determine whether the systems and practices we selected for examination at the Windsor-Detroit Bridge Authority were providing it with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

14. In addition, section 139 of the Financial Administration Act requires that we state an opinion, with respect to the criteria established, on whether there was reasonable assurance that there were no significant deficiencies in the systems and practices we examined. We define and report significant deficiencies when, in our opinion, the corporation could be prevented from having reasonable assurance that its assets are safeguarded and controlled, its resources are managed economically and efficiently, and its operations are carried out effectively.

15. On the basis of our risk assessment, we selected systems and practices in the following areas:

The selected systems and practices, and the criteria used to assess them, are found in the exhibits throughout the report.

16. More details about the audit objective, scope, approach, and sources of criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Corporate management practices

The corporation had a significant deficiency in board oversight and needed improvements in performance measurement, monitoring, and reporting and in corporate risk management systems and practices

17. We found several weaknesses in performance measurement, monitoring, and reporting, as well as in corporate risk management. Combined with the inconsistencies among the corporation’s key governance documents, these amounted to a significant deficiency in board oversight. This significant deficiency affected the quality and completeness of the information the board received, which could reduce its ability to fully perform its oversight role.

18. The analysis supporting this finding discusses the following topics:

19. The corporation is governed by the Board of Directors, which comprises 9 members, including the Chairperson and the Chief Executive Officer.

20. The Chief Executive Officer and the Chairperson are appointed by the Governor in CouncilDefinition 2 for a term that the Governor in Council considers appropriate. The other directors are appointed by the Minister of Intergovernmental Affairs, Infrastructure and Communities, with the approval of the Governor in Council, for a term not exceeding 4 years. All directors are eligible for reappointment when their terms expire.

21. The board is supported by several committees: the Audit Committee, the Governance and Human Resources Committee, the Communications and Outreach Committee, and the Project Oversight Committee.

22. The corporation is subject to Part X of the Financial Administration Act, which requires it to submit an annual corporate plan, including an annual operating budget and an annual capital budget, for government approval.

23. To achieve its mandate, the corporation sets out strategic objectives in its corporate plan. Performance indicators are typically developed to measure progress toward achieving the strategic objectives. These indicators are a means of measuring an output or outcome or of gauging the performance of a program, policy, or initiative.

24. Though the corporation submitted its 2021–22 to 2025–26 corporate plan, the plan had not yet been approved by the Treasury Board at the end of the period covered by the audit. However, the Treasury Board subsequently approved the corporate plan on 9 June 2022.

25. The corporation used a risk management framework (Exhibit 6) that included risk governance, a risk appetite statement, risk tolerance levels, risk management and related policies and procedures, and risk identification and assessment:

- Risk governance refers to processes by which decisions about risks are made and integrated into the day-to-day operations of the corporation.

- A risk appetite statement specifies the level and types of risk that a corporation is willing to take to meet its strategic objectives. It sets the basic goals, parameters, and limits for the risks an organization assumes, which are determined through risk tolerance levels. The board reviews and approves the corporation’s risk appetite statement and risk tolerance levels. The corporation considers its risk appetite under 5 dimensions—quality, cost, schedule, reputation, and safety.

- Risk management policies and procedures outline the guiding principles governing a corporation’s overall values and approach to managing risks.

- Risk identification and assessment refers to the process in which risks are identified, categorized, and assessed on the basis of their potential impact and likelihood of occurrence. The corporation conducts an annual risk assessment of its enterprise risks through its corporate planning process. It also conducts regular risk assessments of its project risks to identify and evaluate risks.

26. Our recommendations in this area of examination appear at paragraphs 30, 37, 38, 44, and 50.

27. Analysis. We found several weaknesses in corporate management practices that, taken together, amounted to a significant deficiency in board oversight. Specifically, there were gaps in the information received by the board on performance reporting, risk management, and appointments and remuneration of officers, as well as on the results of conflict-of-interest processes. Moreover, there were inconsistencies in the corporation’s key governance documents and their application. We also found a weakness in board appointments due to several expired terms for directors (Exhibit 4).

Exhibit 4—Corporate governance—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Board independence |

The board functioned independently. |

All board members, excluding the Chief Executive Officer, were independent from management. The corporation had a code of conduct for board members. Board members completed annual conflict-of-interest declarations and were asked to declare conflicts of interest at board and committee meetings. Independent board members held sessions without the Chief Executive Officer in attendance. |

Check mark in a green circle |

|

Providing strategic direction |

The board provided strategic direction. |

The board provided strategic direction through its annual strategic planning session and by approving the strategic direction in the corporate plan. The corporation’s strategic objectives linked clearly to the mandate and were included in the corporate plan. The board was active in setting the Chief Executive Officer’s annual objectives, which aligned with the corporation’s strategic direction. Independent board members conducted an annual assessment of the Chief Executive Officer’s performance against those objectives. |

Check mark in a green circle |

|

Board appointments and competencies |

The board collectively had capacity and competencies to fulfill its responsibilities. |

The board communicated with the Minister of Intergovernmental Affairs, Infrastructure and Communities about board appointments, including the staggering of terms, renewals, and vacancies. The board determined the skills and expertise it needed to be effective and carry out its responsibilities. Board members performed an annual self-evaluation of their skills, knowledge, and expertise. Weakness At the end of our audit period, there were 4 expired terms for directors on the board. However, there were no vacancies, because these directors continue to serve as members until successors are appointed, as permitted under the Financial Administration Act. |

Exclamation point in a yellow circle |

|

Board oversight |

The board carried out its oversight role over the corporation. |

The board regularly discussed the corporation’s financial status and the progress of the project. The board assessed its own performance annually. The corporation’s internal audit function conducted regular internal audits, which contributed to the board’s oversight. Significant deficiency There were gaps in the information that the board received and inconsistencies between the corporation’s key governance documents, which means the board did not have what it needed for effective oversight and decision making. |

An X in a red circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

28. Weakness—Board appointments. At the end of December 2021, 4 of the 9 positions on the board were held by directors whose terms had expired (a process over which the corporation did not have control). As permitted by the Financial Administration Act, directors with expired terms agreed to continue their duties on the board until they were reappointed or replaced. The board was proactive in communicating its need for reappointments to the minister; however, there was a risk that by mid-2022, there could be as many as 6 positions on the board with expired terms.

29. This weakness matters because if many directors were to be replaced within a short time frame, continuity and corporate memory would be affected. Having significant turnover within a short time could also reduce the effectiveness of the board’s ability to exercise effective oversight.

30. Recommendation. The corporation should engage with the Minister of Intergovernmental Affairs, Infrastructure and Communities to ensure that appropriate appointments to the board are timely and include staggered terms.

The corporation’s response. Agreed. The corporation will continue to engage with the Minister of Intergovernmental Affairs, Infrastructure and Communities and Infrastructure Canada to support decision making on board appointments, the timing of appointments, and the use of staggered terms for board members.

31. Significant deficiency—Board oversight. We found that there were gaps in the information that the board received, which means the board did not have what it needed to oversee the corporation effectively and to make decisions appropriately. The gaps were in the following areas:

- Performance measurement. The board did not receive complete performance information about the corporation’s performance against strategic objectives (detailed under “Performance measurement, monitoring, and reporting” in paragraphs 40 to 43).

- Risk management. The board did not receive important risk information on the assessment of key risks against the corporation’s risk tolerance levels (detailed under “Corporate risk management” in paragraphs 46 to 49).

- Risk mitigation measures. The board did not receive detailed and complete information on risk mitigation measures for risks that were above the corporation’s risk tolerance levels (detailed under “Corporate risk management” in paragraphs 46 to 49).

- Ethical performance. The corporation had several board-approved policies related to values and ethics, including conflict of interest. An annual process was in place for board members and employees to declare their compliance with the policies and to disclose any conflicts of interest. However, the board did not receive reporting on compliance with these policies, on the results of the corporation’s annual conflict-of-interest processes, or on those of the corporation’s private partner responsible for managing the construction of the crossing. In our examination, we found no examples of unethical performance.

32. In addition, we found that the corporation did not have processes to ensure that the board received information on the reasonable remuneration of its officers, which was required by the corporation’s bylaws. Nor did management inform the board why certain officers were placed at certain levels within the salary range. We also found that the corporation’s salary, hiring, and promotion guidelines lacked important elements, such as guidance on salary upon appointment, progression through the salary levels, and choice of staffing processes.

33. Furthermore, we found inconsistencies in 3 key governance documents and their application that support effective board oversight:

- the Financial Administration Act

- the corporation’s bylaws, which are internal rules adopted by the board to regulate the corporation’s operations and internal governance

- the corporation’s delegation of financial authority, which assigns powers or functions from the board to officers of the corporation and to specific positions within the corporation

34. The Financial Administration Act and the bylaws required that officers be appointed by the board. Officers are employees of a corporation who are authorized to act on its behalf. Being officers charges them with authorities and responsibilities far greater than those of a regular employee. We found that 2 appointments had become officers without being appointed by the board before the appointees began their duties in the role of officer.

35. The bylaws defined “officer” as a member of the corporation’s executive team who was appointed as an officer in accordance with the bylaws, other than an officer-director (Chairperson and Chief Executive Officer). All vice-presidents were members of the corporation’s executive team, but not all vice-presidents were officers. The bylaws specified that the board could delegate to an officer the authority to hire employees. In contrast, the delegation of financial authority specified that the Chief Executive Officer and all vice-presidents, including the Vice-President of Human Resources, had authority to hire employees. This was despite the fact that they were not all officers, according to the bylaws. Therefore, in terms of who had the authority to hire, the delegation of financial authority was inconsistent with the bylaws.

36. This significant deficiency matters because the board is responsible for ensuring that the corporation fulfills its mandate and for overseeing the corporation’s business, activities, and affairs. Without complete information, the board cannot be sure that it is receiving the information it needs to oversee the corporation effectively. This could expose the corporation to financial and reputational risks. Furthermore, without consistent key governance documents, the board cannot be sure that it is appropriately exercising its oversight role.

37. Recommendation. The corporation should ensure that the board receives the information it needs for effective oversight and decision making.

The corporation’s response. Agreed. Management will work with the board over the 2022–23 fiscal year to identify key information that will enable strengthened monitoring and reporting on the corporation’s business, activities, and affairs.

38. Recommendation. The corporation should ensure that officers are appointed by the board before they begin their duties. The board should reconsider which authorities and powers it wishes to delegate and ensure that the bylaws and the delegation of financial authority are aligned.

The corporation’s response. Agreed. During 2022, the corporation will establish a process for the appointment of officers by the board and will review its bylaws and delegation of financial authority for alignment and to see if clarity can be added to avoid misinterpretation.

39. Analysis. We found a weakness in performance measurement, monitoring, and reporting. In particular, the corporation had not clearly defined performance indicators and targets related to its strategic objectives or for the key activities and deliverables related to these objectives (Exhibit 5).

Exhibit 5—Strategic planning—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Strategic planning |

The corporation established a strategic plan and strategic objectives that were aligned with its mandate. |

The corporation defined strategic objectives that aligned with its mandate. The corporation had a strategic planning process in place, which included analyzing its strengths, weaknesses, and opportunities, as well as key risks and threats. The corporation considered its internal and external environments and consulted with external stakeholders when preparing its corporate plan. |

Check mark in a green circle |

|

Performance measurement, monitoring, and reporting |

The corporation established performance indicators in support of achieving strategic objectives, monitored them, and reported on progress in achieving its strategic objectives. |

The corporation presented the completion of activities and deliverables as indicators of its achievement of its strategic objectives. The corporation regularly monitored the implementation of the planned activities and deliverables and reported its progress to the board. It formally assessed financial performance each quarter. Weakness The corporation did not clearly define performance indicators and targets for its strategic objectives, its key activities, and its deliverables. |

Exclamation point in a yellow circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

40. Weakness—Performance measurement, monitoring, and reporting. The corporation monitored and reported to the board on its completion of the key activities and deliverables related to its strategic objectives. It established its strategic objectives and described the key activities and deliverables required to achieve them. However, we found that the corporation had not clearly defined performance indicators and targets for these objectives or for the key activities and deliverables related to these objectives. This would have helped it assess whether the activities were an effective means to achieving the objectives.

41. For example, there were no specific performance indicators for the strategic objective of working “towards successful implementation of the Gordie Howe International Bridge project.” The corporation identified “aligning organizational behaviour” as 1 of the key activities that would contribute to achieving this strategic objective. However, it had not set a clear performance indicator and target for measuring whether aligning organizational behaviour was contributing to achieving the objective.

42. Without clear performance indicators and targets for its strategic objectives and activities, the corporation could not fully assess or clearly report on its progress toward achieving its strategic objectives. Instead, it described only the completion of the key activities and deliverables related to the objectives.

43. This weakness matters because improving how it measures its performance would allow the corporation to better assess its progress toward achieving its objectives. Furthermore, clearly reporting to the board on its performance against its strategic objectives would strengthen board oversight, allowing the board to consider in a timely manner whether additional actions and monitoring were needed for the corporation to achieve its strategic objectives.

44. Recommendation. The corporation should develop performance indicators and targets that would allow it to measure, monitor, and report to the board on its progress against strategic objectives and on the effectiveness of its activities and deliverables.

The corporation’s response. Agreed. Management will review the performance indicators for the corporation’s strategic objectives as part of the 2023–24 corporate planning process and improve performance indicators and targets as required. Future planning processes will also incorporate this type of review on its performance measurement reporting framework.

45. Analysis. We found weaknesses in corporate risk management. Specifically, the corporation’s risk management framework lacked important elements and provided limited guidance to support the design of mitigation measures. It also lacked processes to monitor the effectiveness of mitigation measures (Exhibit 6).

Exhibit 6—Corporate risk management—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Risk identification and assessment |

The corporation identified and assessed risks to achieving its strategic objectives. |

The corporation had a board-approved enterprise risk management policy. Weakness The corporation identified and assessed its corporate and project risks. However, its risk management framework lacked important elements. |

Exclamation point in a yellow circle |

|

Risk mitigation |

The corporation defined and implemented risk mitigation measures. |

The corporation had a risk appetite statement that aligned with its strategic objectives. The corporation identified risk owners and implemented mitigation measures for its corporate and project risks. Weakness The corporation’s risk management process did not clearly define how to design and assess effective mitigation measures. |

Exclamation point in a yellow circle |

|

Risk monitoring and reporting |

The corporation monitored and reported on the implementation of risk mitigation measures. |

As a result of its risk monitoring, the corporation regularly revised its risk register to address changes to risk assessments and mitigation measures. Weakness The corporation did not report against risk tolerance levels for key risks. |

Exclamation point in a yellow circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

46. Weaknesses—Corporate risk management. We found that although the corporation’s enterprise risk management framework included processes for risk identification, assessment, and mitigation, it lacked important elements. This situation contributed to a lack of board oversight over risk management processes. We found that

- while the corporation had used risk categories in its risk management framework, they were not defined until November 2021, 2 years after the framework was developed

- key terms such as “current risk level,” “target risk level,” “inherent risk level,” and “risk tolerance,” which were used in assessing and tracking risks, were not well defined or understood throughout the corporation, which caused inconsistencies in reports

- consideration of controls in assessing risks was limited and inconsistent

47. The corporation’s risk management process also provided limited guidance on the design of risk mitigation measures. For example, it did not include guidance on how to assess how well the mitigation measures were designed or on how often to assess the effectiveness of the measures. It also lacked guidance on how to design the measures within the corporation’s established risk appetite.

48. The corporation reported on risk management activities through quarterly reports to some board committees, including for risks related to the environment. However, it did not have a process to report against risk tolerance levels for key risks. The corporation presented risk by dimension (quality, cost, schedule, reputation, and safety) but did not align these dimensions with risk tolerance. Aligning these would ensure that risks were managed within the appropriate risk appetite and risk tolerance levels. Furthermore, the corporation did not define risk tolerance in measurable terms for all dimensions, which meant that it could not assess and report on whether it was exceeding its tolerance for all dimensions.

49. These weaknesses matter because processes to identify, mitigate, monitor, and report risks affect the corporation’s ability to achieve its strategic objectives and priorities and ensure the success of the Gordie Howe International Bridge project.

50. Recommendation. To strengthen risk identification and assessment, risk mitigation, and risk monitoring and reporting, the corporation should review its risk management framework.

The corporation’s response. Agreed. The corporation will review its risk management framework over the 2022–23 fiscal year with a focus on designing, monitoring, and evaluating the effectiveness of mitigation measures.

Management of operations

The corporation generally managed its project agreement, operational readiness, and stakeholder and shareholder relations well, but improvements were needed

51. We found that the corporation generally managed its project agreement, operational readiness, and stakeholder and shareholder relations well. However, we found that it did not obtain an independent report providing assurance over the controls and integrity of the software it used to host and manage all of its project information. We also found it had significant turnover within the executive team, which could lead to a loss of continuity. Moreover, we found that the corporation did not have a complete process, including communications and a training and development plan, to help engage employees in preparation for the operations, maintenance, and rehabilitation phase of the project.

52. The analysis supporting this finding discusses the following topics:

53. In 2018, after signing the project agreement, the Government of Canada established a governance and oversight framework for the corporation. As part of this framework, the government required the corporation to submit quarterly reports to the Minister of Intergovernmental Affairs, Infrastructure and Communities and conduct monthly meetings with Infrastructure Canada, the Michigan Department of Transport, and the United StatesUS Federal Highway Administration. The corporation reports to its stakeholders and shareholder, the Government of Canada, on construction progress, project agreement management, monitoring and reporting on funds, and stakeholder relations management.

54. To help it oversee the project, the corporation engaged with external parties in various technical fields (Exhibit 1). It also contracted an independent company as its Owner’s Engineer to help with project oversight and to use its software to manage its project-related information.

55. The Windsor-Detroit Bridge Authority’s mandate includes 3 phases:

- procurement

- design-build

- operations, maintenance, and rehabilitation

56. From its creation in 2012 until 2018, the corporation was in the procurement phase of its mandate. During this phase, it signed the project agreement with Bridging North America, in September 2018. The corporation is currently in the design-build phase of the bridge and components. Once construction is complete, it will transition to the operations, maintenance, and rehabilitation phase. Each of these phases brings with it new challenges and the need for new competencies.

57. The final phase in the corporation’s mandate will require a profound shift in its focus and skill set and significant effort to plan the transition to operational readiness.

58. The design, construction, and operation of an international bridge have significant implications for Canada and the United States, the cities of Windsor and Detroit, and other levels of government. It also affects businesses, residents, Indigenous peoples, and the environment. The project agreement called for communication and consultation plans, which required the corporation to consult with stakeholders on both sides of the border.

59. The project agreement also called for the delivery of community benefits, which it defined as opportunities that advance economic, social, and environmental conditions for local communities and Indigenous peoples on both sides of the border. Community benefit priorities include the Workforce Development and Participation Strategy and the Neighbourhood Infrastructure Strategy. Accordingly, the corporation engages with its stakeholders and provides regular updates on community benefits to its stakeholders and shareholder.

60. Our recommendations in this area of examination appear at paragraphs 64, 70, and 74.

61. Analysis. We found that the corporation had good systems and practices for managing its project agreement. However, we found a weakness in information management. Specifically, the corporation did not obtain an independent report providing assurance over the operating effectiveness of the controls and the integrity of the software used to host and manage all of the project information (Exhibit 7).

Exhibit 7—Management of the project agreement—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Project agreement oversight |

The corporation had the project management structure and controls in place to implement, oversee, monitor, and report on the status of the project. |

The corporation implemented a robust project governance structure and controls to support it in overseeing the project. The corporation used internal and external reports to assess progress against its strategic objectives, to monitor the project, and to report on the project’s status to its stakeholders and shareholder. |

Check mark in a green circle |

|

Information management |

The corporation managed information to support decision making and compliance with the project agreement. |

The corporation implemented an information governance framework that supported the management of project information and its oversight of the project. The corporation had policies and procedures related to managing information in a way that supported decision making. Weakness The corporation did not obtain an independent report providing assurance over the controls and integrity of the software used to host and manage all of the project information. |

Exclamation point in a yellow circle |

|

Performance monitoring and reporting |

The corporation monitored and reported on its management of the project, project controls, and information management results. |

The corporation provided regular updates to the board and its stakeholders and shareholder on the management of the project, project controls, and information management. The corporation took corrective actions, as needed, as a result of monitoring the project, receiving feedback from its stakeholders and shareholder, and considering the results of analyses. |

Check mark in a green circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

62. Weakness—Information management. The corporation used the Owner’s Engineer’s software to host and manage all of its project information. This information was used to support the corporation’s business processes and inform decision making. We found that the corporation did not obtain assurance that there were appropriate safeguards in place for the software. The Owner’s Engineer obtained controls reports annually, which provided independent assurance over the design and operating effectiveness of the controls around the software. However, the corporation’s contract with the Owner’s Engineer did not include the provision of these reports to the corporation, and the corporation did not request them.

63. This weakness matters because without a controls report, the corporation had no assurance over the safeguards around the software used for its business processes and decision making. Therefore, the corporation was at risk of basing decisions on inaccurate and incomplete information and of losing critical information.

64. Recommendation. The corporation should obtain assurance over the operating effectiveness of the controls and the integrity of the software used to host and manage all of the project information.

The corporation’s response. Agreed. In March 2022, the corporation revised its contract with the Owner’s Engineer to require annual controls reports so that it has assurance over the operating effectiveness of the controls of the software used to manage project information.

65. Analysis. We found that the corporation had significant turnover within the executive team. We also found that it did not have processes to engage employees in preparation for the operations, maintenance, and rehabilitation phase of its mandate (Exhibit 8).

Exhibit 8—Operational readiness—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Operational readiness planning |

The corporation defined and developed operational readiness plans to provide an effective transition to operations and to ensure that the Gordie Howe International Bridge’s first full year of operations was effective. |

The corporation had a board-approved operational readiness management plan that defined the leadership and vision required to transition to the operations phase of its mandate. The corporation established key milestones to assess progress in its transition. |

Check mark in a green circle |

|

Change management |

The corporation managed change to evolve the organizational culture and enable employees to adapt, and it effectively managed the implementation of operational readiness plans. |

The corporation incorporated change management practices into its operational readiness initiative. The corporation had an operational readiness team and assigned a member from Human Resources to facilitate the implementation of operational readiness initiatives. Weaknesses There was significant turnover within the executive team, which could lead to a loss of continuity and reduce the cohesiveness of the executive team. The corporation did not have a complete process to prepare employees for the operations, maintenance, and rehabilitation phase of its mandate. |

Exclamation point in a yellow circle |

|

Performance monitoring and reporting |

The corporation monitored and reported on its operational readiness and change management results. |

The corporation provided updates to the board and senior management on operational readiness and change management. The corporation incorporated changes into its operational readiness plans as a result of monitoring the project and receiving feedback from its stakeholders and shareholder. |

Check mark in a green circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

66. Weakness—Change management. Since March 2021, there has been significant turnover within the executive team due to departures and appointments of vice-presidents to the executive team. In addition to the turnover, there were multiple changes to roles and responsibilities. Since January 2022, there have been additional departures from the executive team, which necessitated reallocation of some responsibilities to the remaining members of the executive team.

67. In August 2021, the member of the executive team who was the project sponsor for the operational readiness initiative departed. Thus, the sponsor for this initiative was reassigned to another executive on an interim basis. In early January 2022, this executive was permanently assigned to sponsor this initiative but subsequently departed. This role was assumed by the Chief Executive Officer from January until May 2022.

68. In a transition as significant as the one facing the corporation, a stable and cohesive executive team is needed to advocate for change and ensure the alignment of messages from leaders to managers and staff. The departure of executives managing the operational readiness initiative and the multiple changes in sponsors led to a loss of continuity on this initiative.

69. This weakness matters because turnover within the executive team could affect leadership buy-in. It could also reduce the cohesiveness of the executive team, compromising its ability to champion the corporation’s transition to the operations, maintenance, and rehabilitation phase of its mandate.

70. Recommendation. The corporation should explore ways to further address and resolve its challenges in retaining its executives.

The corporation’s response. Agreed. As related to executive talent management, the corporation will review its recruitment practices to ensure the suitability of prospective candidates. Over 2022, the corporation will further develop its retention strategies.

71. Weakness—Change management. The corporation created a vision and an operational readiness plan for transitioning to the operations, maintenance, and rehabilitation phase of its mandate. However, we found that the corporation had not communicated this vision, or progress against this plan, to employees. It also had no corporation-wide plan that established what training each employee or group was required to take to prepare for this transition. Furthermore, the corporation did not provide any training on change management that would assist with the transition to the next phase of its mandate.

72. The corporation considered addressing these communication and training needs in future stages of its operational readiness plan. However, in our view, given the significance of the transition, effective communication with employees and change management training in the early stages of the transition are critical to the success of the transition.

73. This weakness matters because without communication of the vision and training on change management, employees are ill-equipped to understand and support the changes and evolve with the corporation. This may hinder the overall progress of the transition.

74. Recommendation. The corporation should implement processes to engage employees in preparation for the operations, maintenance, and rehabilitation phase of its mandate.

The corporation’s response. Agreed. As part of operational readiness planning in 2022, the corporation will develop frequent staff engagement points to convey information regarding progress towards operational readiness. Additionally, as part of the change management plan and employee retention plan, the corporation will begin to assess employee transition options.

75. Analysis. We found that the corporation had good systems and practices to manage its stakeholder and shareholder relations (Exhibit 9).

Exhibit 9—Stakeholder and shareholder relations—Key findings and assessment

| Systems and practices | Criteria used | Key findings | Assessment against the criteria |

|---|---|---|---|

|

Stakeholder and shareholder relations planning and implementation |

The corporation defined and implemented stakeholder and shareholder relations plans to consult with, share information with, and engage its stakeholders and shareholder. |

The corporation identified its stakeholders and shareholder. The corporation considered the needs and expectations of its stakeholders and shareholder when developing plans. |

Check mark in a green circle |

|

Communications and engagement |

The corporation communicated effectively to optimize awareness of the project and to engage its stakeholders and shareholder. |

The corporation established a communications framework to support regular communication and engagement with its stakeholders and shareholder. The corporation implemented a plan to support engagement with Indigenous peoples, which aligned with government priorities. |

Check mark in a green circle |

|

Community benefits and engagement |

The corporation had a community benefits oversight framework in place to meet the requirements of the project agreement and to engage the communities. |

The corporation established a community benefits oversight framework to support the requirements of the project agreement and to engage with communities. |

Check mark in a green circle |

|

Performance monitoring and reporting |

The corporation monitored and reported on its stakeholder and shareholder relations, communications and engagement, and community benefit and engagement results. |

The corporation monitored its stakeholder and shareholder relations, communications, community benefits, and engagement and regularly reported on these topics to the board and its stakeholders and shareholder. The corporation changed its plans, as needed, in response to its monitoring of its stakeholder and shareholder relations and as a result of feedback from its stakeholders and shareholder. |

Check mark in a green circle |

|

Legend—Assessment against the criteria Check mark in a green circle Met the criteria Exclamation point in a yellow circle Met the criteria, with improvement needed An X in a red circle Did not meet the criteria |

|||

Commentary on the United Nations’ Sustainable Development Goals

76. In 2015, Canada and other United Nations member states adopted the 2030 Agenda for Sustainable Development, a vision for partnership, peace, and prosperity for all people and the planet. The 2030 Agenda outlined 17 Sustainable Development Goals that aimed to address current and future social, economic, and environmental challenges. At the national level, the Government of Canada reiterated its commitment to implementing these goals.

77. The government established formal expectations for the integration of the Sustainable Development Goals by federal departments and agencies. As announced in Budget 2021, Canada’s large Crown corporations (those with over $1 billion in assets) will be expected to report on their climate-related financial risks for their financial years, starting in the 2022 calendar year at the latest.

78. In keeping with its Sustainable Development Strategy, the Office of the Auditor General of Canada has committed to reporting on progress toward the Sustainable Development Goals as part of its audit work. As a result, we examined whether the corporation had incorporated the Sustainable Development Goals into its operations.

79. While the corporation is not mandated to follow these requirements, it did launch some initiatives to incorporate sustainable development considerations into its operations and report on them. The corporation contributes to Canada’s long-term sustainability by focusing on Federal Sustainable Development Strategy goals that directly affect the execution of its mandate. The strategy’s goals align with the United Nations’ Sustainable Development Goals. Areas of the strategy that directly affect the execution of the corporation’s mandate include

- effective action on climate change

- greening government

- modern and resilient infrastructure

- pristine lakes and rivers

- healthy wildlife populations

- safe and healthy communities

80. The corporation’s Sustainable Management Framework addresses these areas.

Conclusion

81. In our opinion, on the basis of the criteria established, there was a significant deficiency in the corporation’s board oversight, but there was reasonable assurance that there were no significant deficiencies in the other systems and practices we examined. We concluded that except for this significant deficiency, the Windsor-Detroit Bridge Authority maintained its systems and practices during the period covered by the audit in a manner that provided the reasonable assurance required under section 138 of the Financial Administration Act.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada on the Windsor-Detroit Bridge Authority. Our responsibility was to express

- an opinion on whether there was reasonable assurance that during the period covered by the audit, there were no significant deficiencies in the corporation’s systems and practices we selected for examination

- a conclusion about whether the corporation complied in all significant respects with the applicable criteria

Under section 131 of the Financial Administration Act, the corporation is required to maintain financial and management control and information systems and management practices that provide reasonable assurance of the following:

- Its assets are safeguarded and controlled.

- Its financial, human, and physical resources are managed economically and efficiently.

- Its operations are carried out effectively.

In addition, section 138 of the act requires the corporation to have a special examination of these systems and practices carried out at least once every 10 years.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard on Assurance Engagements (CSAE) 3001—Direct Engagements, set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office of the Auditor General of Canada applies the Canadian Standard on Quality Control 1 and, accordingly, maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from the corporation:

- confirmation of management’s responsibility for the subject under audit

- acknowledgement of the suitability of the criteria used in the audit

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided

- confirmation that the audit report is factually accurate

Audit objective

The objective of this audit was to determine whether the systems and practices we selected for examination at the Windsor-Detroit Bridge Authority were providing it with reasonable assurance that its assets were safeguarded and controlled, its resources were managed economically and efficiently, and its operations were carried out effectively, as required by section 138 of the Financial Administration Act.

Scope and approach

Our audit work examined the Windsor-Detroit Bridge Authority. The scope of the special examination was based on our assessment of the risks the corporation faced that could affect its ability to meet the requirements set out by the Financial Administration Act.

In carrying out the special examination, we reviewed key documents related to the systems and practices selected for examination. We interviewed members of the Board of Directors, senior management, employees of the corporation, and key stakeholders. We tested the systems and practices in place to obtain the required level of audit assurance.

The systems and practices selected for examination for each area of the audit are found in the exhibits throughout the report.

In carrying out the special examination, we did not rely on any internal audits.

Sources of criteria

The criteria used to assess the systems and practices selected for examination are found in the exhibits throughout the report.

Corporate governance

Supplementary Letters Patent, order in councilP.C. 2017-1053

Bylaw Number One, Windsor-Detroit Bridge Authority, 2020

Board of Directors and Management Roles and Responsibilities, Windsor-Detroit Bridge Authority, 2019

Internal Control–Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Practice Guide: Assessing Organizational Governance in the Public Sector, The Institute of Internal Auditors, 2014

Strategic planning

Financial Administration Act

Board of Directors and Management Roles and Responsibilities, Windsor-Detroit Bridge Authority, 2019

Guidance for Crown Corporations on Preparing Corporate Plans and Budgets, Treasury Board of Canada Secretariat, 2019

Recommended Practice Guideline 3, Reporting Service Performance Information, International Public Sector Accounting Standards Board, 2015

Corporate risk management

Board of Directors and Management Roles and Responsibilities, Windsor-Detroit Bridge Authority, 2019

Risk Management Policy, Windsor-Detroit Bridge Authority, 2021

International Organization for StandardizationISO 31000:2018–Risk Management

Internal Control–Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2013

Enterprise Risk Management–Integrated Framework, Committee of Sponsoring Organizations of the Treadway Commission, 2017

Management of the project agreement

Crossing Agreement, 2012

Project Agreement for Gordie Howe International Bridge, 2018

Supplementary Letters Patent, P.C. 2017-1053

A Guide to the Project Management Body of Knowledge (PMBOK® Guide), sixth edition, Project Management Institute IncorporatedInc., 2017

Policy on Service and Digital, Treasury Board, 2020

Directive on Service and Digital, Treasury Board, 2020

Rethinking Data Governance and Data Management, Information Systems Audit and Control AssociationISACA, 2020

Directive on the Management of Projects and Programmes, Treasury Board, 2019

Control Objectives for Information and related TechnologyCOBIT 2019 Framework, ISACA

Operational readiness

Crossing Agreement, 2012

Project Agreement for Gordie Howe International Bridge, 2018

Supplementary Letters Patent, P.C. 2017-1053

A Guide to the Project Management Body of Knowledge (PMBOK® Guide), sixth edition, Project Management Institute Inc., 2017

8 Steps to Accelerate Change in Your Organization, Kotter, 2020

Stakeholder and shareholder relations

Crossing Agreement, 2012

Project Agreement for Gordie Howe International Bridge, 2018

Supplementary Letters Patent, P.C. 2017-1053

A Guide to the Project Management Body of Knowledge (PMBOK® Guide), sixth edition, Project Management Institute Inc., 2017

Recommended Practice Guideline 3, Reporting Service Performance Information, International Public Sector Accounting Standards Board, 2015

Period covered by the audit

The special examination covered the period from 1 February 2021 to 31 December 2021. This is the period to which the audit conclusion applies. However, to gain a more complete understanding of the significant systems and practices, we also examined certain matters that preceded the start date of this period.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 10 June 2022, in Ottawa, Canada.

Audit team

This special examination was completed by a multidisciplinary team from across the Office of the Auditor General of Canada, led by Heather McManaman, Principal. The principal has overall responsibility for audit quality, including conducting the audit in accordance with professional standards, applicable legal and regulatory requirements, and the office’s policies and system of quality management.

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report.

| Recommendation | Response |

|---|---|

|

30 The corporation should engage with the Minister of Intergovernmental Affairs, Infrastructure and Communities to ensure that appropriate appointments to the board are timely and include staggered terms. |

Agreed. The corporation will continue to engage with the Minister of Intergovernmental Affairs, Infrastructure and Communities and Infrastructure Canada to support decision making on board appointments, the timing of appointments, and the use of staggered terms for board members. |

|

37 The corporation should ensure that the board receives the information it needs for effective oversight and decision making. |

Agreed. Management will work with the board over the 2022–23 fiscal year to identify key information that will enable strengthened monitoring and reporting on the corporation’s business, activities, and affairs. |

|

38 The corporation should ensure that officers are appointed by the board before they begin their duties. The board should reconsider which authorities and powers it wishes to delegate and ensure that the bylaws and the delegation of financial authority are aligned. |

Agreed. During 2022, the corporation will establish a process for the appointment of officers by the board and will review its bylaws and delegation of financial authority for alignment and to see if clarity can be added to avoid misinterpretation. |

|

44 The corporation should develop performance indicators and targets that would allow it to measure, monitor, and report to the board on its progress against strategic objectives and on the effectiveness of its activities and deliverables. |

Agreed. Management will review the performance indicators for the corporation’s strategic objectives as part of the 2023–24 corporate planning process and improve performance indicators and targets as required. Future planning processes will also incorporate this type of review on its performance measurement reporting framework. |

|

50 To strengthen risk identification and assessment, risk mitigation, and risk monitoring and reporting, the corporation should review its risk management framework. |

Agreed. The corporation will review its risk management framework over the 2022–23 fiscal year with a focus on designing, monitoring, and evaluating the effectiveness of mitigation measures. |

|

64 The corporation should obtain assurance over the operating effectiveness of the controls and the integrity of the software used to host and manage all of the project information. |

Agreed. In March 2022, the corporation revised its contract with the Owner’s Engineer to require annual controls reports so that it has assurance over the operating effectiveness of the controls of the software used to manage project information. |

|

70 The corporation should explore ways to further address and resolve its challenges in retaining its executives. |

Agreed. As related to executive talent management, the corporation will review its recruitment practices to ensure the suitability of prospective candidates. Over 2022, the corporation will further develop its retention strategies. |

|

74 The corporation should implement processes to engage employees in preparation for the operations, maintenance, and rehabilitation phase of its mandate. |

Agreed. As part of operational readiness planning in 2022, the corporation will develop frequent staff engagement points to convey information regarding progress towards operational readiness. Additionally, as part of the change management plan and employee retention plan, the corporation will begin to assess employee transition options. |