2018 Spring Reports of the Auditor General of Canada to the Parliament of Canada Independent Auditor’s ReportReport 2—Disposing of Government Surplus Goods and Equipment

2018 Spring Reports of the Auditor General of Canada to the Parliament of CanadaReport 2—Disposing of Government Surplus Goods and Equipment

Independent Auditor’s Report

Introduction

Background

2.1 All Government of Canada departments and agencies have movable assets (materiel), including vehicles, furniture, machinery, and other goods and equipment. When a federal organization no longer requires assets, it can dispose of these surplus assets by either transferring them to other departments or agencies, or selling, donating, recycling, or scrapping them.

2.2 The following federal legislation and policy govern the disposal of government surplus movable assets:

- the Financial Administration Act;

- the Surplus Crown Assets Act; and

- the Policy on Management of Materiel, which includes directives on surplus materiel.

2.3 Under the Surplus Crown Assets Act, Public Services and Procurement Canada is responsible for the disposal of all surplus assets unless authority has been given to another department or agency.

2.4 Treasury Board policy. Under the Policy on Management of Materiel, federal organizations are responsible for managing federal assets “in a sustainable and financially responsible manner that supports the cost-effective and efficient delivery of government programs.”

2.5 The same policy requires that deputy heads of federal organizations ensure that surplus movable assets are disposed of quickly and effectively, in a manner that obtains the highest net value for the Crown. Assets must be disposed of in compliance with the Treasury Board Directive on Disposal of Surplus Materiel. If the expected cost of selling an asset is more than the expected selling price, then the sale would have no net value. In such a case, the directive indicates that the organization must consider other disposal methods, such as donating, transferring, or recycling.

2.6 The Canada Revenue Agency is not subject to the Treasury Board policy. The Agency manages its disposal of assets in compliance with internal policies and directives, which are similar to Treasury Board policies.

2.7 GCSurplus. Public Services and Procurement Canada is responsible for providing strategic, procedural, and technical advice on the disposal of surplus assets for the Government of Canada and offers these services through GCSurplus. GCSurplus helps the government dispose of its surplus movable assets, such as working electronics, office equipment, vehicles, ships, and planes. GCSurplus provides online marketplaces for sales by auction (GCSurplus.ca); interdepartmental transfers (GCTransfer); and sales of controlled assets (GCMil), such as military equipment and ammunition, to preapproved and qualified bidders.

2.8 GCSurplus operates on a cost-recovery model and charges commissions for the sales it manages for federal organizations. Commissions are fixed by asset type, such as furniture or photography equipment, and they reflect the effort required to sell an item of that type. GCSurplus can spend commission revenue in the fiscal year in which it earned the revenue.

2.9 GCTransfer. Federal organizations can use this online platform to dispose of surplus assets by transferring them to other federal departments or agencies. GCSurplus provides the service at no cost, and the recipient organization pays any shipping costs. GCTransfer came online in April 2015.

Focus of the audit

2.10 This audit focused on whether selected federal organizations disposed of surplus goods and equipment at the appropriate time in a manner that maximized benefits. These benefits include selling assets for the best possible return, reusing or refurbishing assets that were still in good condition, donating assets to organizations that could benefit from them, and disposing of assets in an environmentally sustainable way.

2.11 The federal organizations we selected were the Canada Revenue Agency, Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada. We chose these federal organizations on the basis of size and GCSurplus usage. Public Services and Procurement Canada was also chosen because it provides surplus asset disposal services to other federal organizations.

2.12 This audit is important because federal organizations own large numbers of assets and have a responsibility to Canadian taxpayers for managing and disposing of these assets in an efficient, cost-effective, and responsible manner. This responsibility includes considering the financial and environmental impacts of disposal decisions on the Government of Canada as a whole and not just on an individual department or agency.

2.13 This audit is also important because the practices of the four federal organizations we selected provide some insight into how the government as a whole is using and disposing of its assets.

2.14 We did not examine the disposal of controlled goods (such as military equipment and ammunition), real property (real estate), seized goods, surplus books, or the Computers for Schools program.

2.15 More details about the audit objective, scope, approach, and criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Selling and transferring assets

Overall message

2.16 Overall, we found that the Government of Canada’s accounting suggested that federal departments and agencies sold their surplus assets for less than two thirds of the value estimated as the remaining future benefit of the assets to the government. On the basis of our analysis, we found that all federal organizations chose to sell surplus assets rather than transfer them to other federal organizations to extend the assets’ use. In addition, most of the organizations we selected did not always do a cost analysis to justify the decision of selling assets instead of choosing another disposal method.

2.17 We also found that the Canada Revenue Agency had adopted practices to reuse its own assets. These practices resulted in savings of more than $4.5 million over three years.

2.18 These findings matter because other organizations, both inside and outside the federal government, might be able to use assets that are no longer of use to a department or agency or to a program. The cost of reusing assets can be lower than the cost of selling them or of buying new ones. Transferring assets, when possible, can save time and money and is therefore in the best interest of Canadian taxpayers.

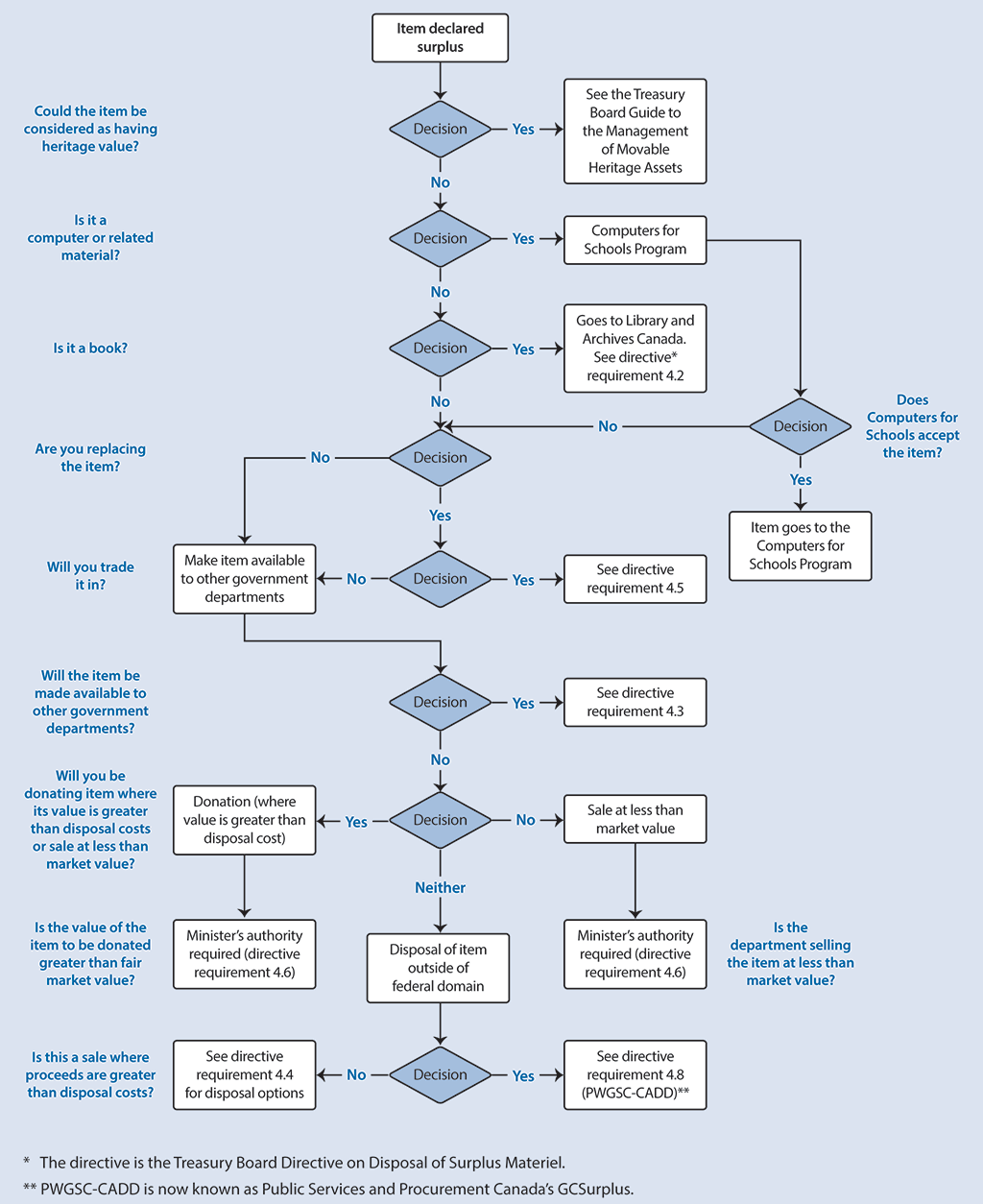

2.19 When a federal asset is declared surplus, a materiel management officer can follow a logic model to determine what to do with the item (Exhibit 2.1). This model summarizes the requirements of the Treasury Board Directive on Disposal of Surplus Materiel. The directive indicates that if the expected cost of selling an item is more than the expected selling price, then the item should be transferred, donated, or scrapped.

Exhibit 2.1—A materiel management officer can follow a logic model to guide decisions about how to dispose of government surplus goods and equipment

Source: Guide to Management of Materiel, Treasury Board of Canada Secretariat

Exhibit 2.1—text version

This flow chart shows the steps of a logic model that a materiel management officer can follow to guide decisions about how to dispose of government surplus goods and equipment.

Once an item is declared surplus, an officer can ask the following question: Could the item be considered as having heritage value?

If the answer is yes (that is, the item could be considered as having heritage value), then the officer should see the Treasury Board Guide to the Management of Movable Heritage Assets.

If the answer is no (that is, the item could not be considered as having heritage value), then the officer can ask the following question: Is the item a computer or related material?

If the answer is yes (that is, the item is a computer or related material), then the officer can ask the following question: Does the Computers for Schools program accept the item? If the answer is yes (that is, the Computer for Schools program accepts the item), then the item goes to the Computers for Schools program.

If the item is not a computer or related material, then the officer can ask the following question: Is it a book?

If the answer is yes (that is, the item is a book), then the item goes to Library and Archives Canada, and the officer should see Treasury Board Directive on Disposal of Surplus Materiel requirement 4.2.

If the item is not a book or if the Computers for Schools program does not accept the item, then the officer can ask the following question: Are you replacing the item?

If the answer is yes (that is, the item is being replaced), then the officer can ask the following question: Will you trade it in? If the answer is yes (that is, the item will be traded in), then the officer should see Treasury Board Directive on Disposal of Surplus Materiel requirement 4.5.

If the item is not being replaced or is not being traded in, then the officer can ask the following question: Will the item be made available to other government departments?

If the answer is yes (that is, the item will be made available to other government departments), then the officer should see Treasury Board Directive on Disposal of Surplus Materiel requirement 4.3.

If the answer is no (that is, the item will not be made available to other government departments), then the officer can ask the following question: Will you be donating the item where its value is greater than disposal costs or selling it at less than market value?

If the item to be donated has value that is greater than disposal costs or the item will be sold at less than market value, then the Minister’s authority is required. The officer should see Treasury Board Directive on Disposal of Surplus Materiel requirement 4.6.

If the item will not be donated or will not be sold at less than market value, then the item can be disposed of outside of the federal domain. The officer can ask the following question: Is this a sale where proceeds are greater than disposal costs?

If the answer is yes (that is, the proceeds of the sale will be greater than disposal costs), then the officer should see Treasury Board Directive on Disposal of Surplus Materiel requirement 4.8, which discusses Public Works and Government Services Canada–Crown Assets Distribution DirectoratePWGSC-CADD, now known as Public Services and Procurement Canada’s GCSurplus.

If the answer if no (that is, the proceeds of the sale will not be greater than disposal costs), then the officer should see Treasury Board Directive on Disposal of Surplus Materiel requirement 4.4 for disposal options.

The source of this exhibit is the Guide to Management of Materiel from the Treasury Board of Canada Secretariat.

2.20 Federal organizations wishing to transfer assets do so by posting a “request to transfer” on GCTransfer. A similar process is followed to post assets for sale on GCSurplus. A single request can include one, several, or many assets.

2.21 Federal organizations can spend the proceeds they receive from the sale of a surplus asset on anything but transfer payments, which include government-to-government transfer payments. They must spend the proceeds in the fiscal year in which they are recorded or the next fiscal year.

Federal organizations chose to sell surplus assets rather than dispose of them through other methods

2.22 We found that federal organizations preferred to sell surplus assets rather than to transfer them and that the organizations generally received less from the sale of assets than the value estimated as the assets’ remaining future benefit to the government. The organizations rarely used GCTransfer and donations to help the Government of Canada get the full benefits from assets that the organizations considered to be surplus. Instead, they chose to sell assets through GCSurplus to generate revenue.

2.23 We also found that, in 2001, the Canada Revenue Agency had implemented an internal website for transferring assets. In July 2014, the Agency introduced a moratorium that limited the purchasing of new furniture and required managers to reuse and refurbish furniture internally before making any purchases. This produced savings of more than $4.5 million over three years.

2.24 Our analysis supporting this finding presents what we examined and discusses the following topics:

- Value of assets

- Transfer of assets compared with sales

- Canada Revenue Agency case study

- Donation of assets

2.25 This finding matters because the Government of Canada as a whole is required to use its assets to their fullest. Assets that are surplus to one program, office, or department or agency could still be useful to another. The cost of transferring or refurbishing assets can be less than the cost of purchasing new assets or selling old assets.

2.26 In addition, the Canada Revenue Agency’s practices showed that the Agency was reusing assets and refurbishing furniture to extend their use. This success shows that it is possible to reuse assets internally to generate cost savings. If more federal organizations adopted a similar approach, the Government of Canada could increase cost savings and the benefit to Canadian taxpayers.

2.27 Furthermore, donations or transfers can extend the use of assets and provide benefits to non-profit organizations and other levels of government in Canada. For example, the federal government’s Computers for Schools program refurbishes donated computers and distributes them to schools, libraries, Indigenous communities, and other non-profit organizations.

2.28 Our recommendations in this area of examination appear at paragraphs 2.40 and 2.41.

2.29 What we examined. We examined the Public Accounts of Canada, which contain the financial statements of the Government of Canada. We also looked at documents related to the disposal of assets from the four federal organizations we selected. To gain insight into current disposal practices, we conducted a survey of all federal organizations, which was directed at officials responsible for disposal practices. More information about the survey is in About the Audit at the end of this report. In addition, we reviewed data from GCSurplus and GCTransfer for the period covered by the audit.

2.30 Value of assets. The net book value of an asset represents the estimated remaining future benefit of that asset. This value is calculated by taking the original cost of the asset and subtracting an estimate of the asset’s use. According to the Public Accounts of Canada 2015–2016 and departmental financial information, the Government of Canada estimated that the net book value of all vehicles and machinery and equipment disposed of in that year was $67 million. The government received approximately $42 million in proceeds from the disposal of those assets. Similarly, for the 2016–17 fiscal year, the government estimated a net book value of $82 million and proceeds from sales of $50 million. In both years, the proceeds represented less than two thirds of the assets’ estimated remaining future benefits. These estimates suggest that federal organizations disposed of assets that still had benefits and could have been used by other federal organizations. The estimates excluded controlled goods at National Defence and movable assets that were purchased for less than $10,000.

2.31 Transfer of assets compared with sales. We found that of the assets sent to GCSurplus or GCTransfer for disposal, the vast majority were posted for sale. During the period covered by the audit, the four federal organizations we selected made efforts to transfer only about 6% of those surplus assets through GCTransfer (Exhibit 2.2). This rate was about 4% across all federal organizations.

Exhibit 2.2—Federal organizations chose to sell their assets using GCSurplus instead of transferring them using GCTransfer

|

Federal organization |

GCTransfer Requests to transfer |

GCSurplus Requests to sell |

Total Requests to transfer or sell |

|---|---|---|---|

| Canada Revenue Agency | 403 | 2,073 | 2,476 |

| Public Services and Procurement Canada | 87 | 2,164 | 2,251 |

| Royal Canadian Mounted Police | 34 | 4,542 | 4,576 |

| Shared Services Canada | 13 | 38 | 51 |

| Total | 537 | 8,817 | 9,354 |

| Government-wide | 2,486 | 58,104 | 60,590 |

2.32 Furthermore, we found that during the period covered by the audit, approximately one quarter of sales lots (items sold individually or grouped together) sold for less than $100 each. It is unclear in these instances whether selling was the best disposal method. In our view, federal organizations must consider transferring, donating, or recycling these low-value assets in line with the Directive on Disposal of Surplus Materiel.

2.33 In our survey of all federal organizations, we found that only 30% of respondents frequently or occasionally used GCTransfer to dispose of assets. For the period from 1 April 2015 to 30 June 2017, we found that fewer than 7% of requests posted to GCTransfer were successfully transferred. We found similar results in the four federal organizations we selected.

2.34 Interviews with officials responsible for disposal in the selected federal organizations confirmed that they occasionally used informal channels outside of GCTransfer to transfer assets to other federal organizations. In our view, GCTransfer was not used enough to dispose of and reuse useful assets. Survey respondents told us that they did not use it because demand for used assets was low, and few assets were posted for transfer. In our view, this pointed to a whole-of-government practice that focused on buying new assets and selling assets rather than reusing assets through transfers. In order for GCTransfer to be successful, both disposal and procurement officials must be aware of and use GCTransfer.

2.35 Canada Revenue Agency case study. The Canada Revenue Agency is not governed by the Surplus Crown Assets Act and developed its own asset disposal policies. In 2001, the Agency implemented an internal website for transferring assets to extend the lives of assets and encourage all employees to reuse assets internally.

2.36 In July 2014, the Canada Revenue Agency introduced a moratorium that limited the purchasing of new office furniture. Before purchases could be approved, buyers had to show that the asset transfer website did not offer anything that served their needs. The Agency expected to save approximately $2.3 million over three years through this initiative. Instead, the Agency saved more than $4.5 million over three years.

2.37 The Agency’s success in reusing furniture happened in large part because the moratorium focused on the whole asset life-cycle process, including procurement. In our view, this was a good practice that could be applied to other federal organizations. The Agency’s approach aligned with Treasury Board policies and suggested to us that other government organizations could overcome barriers that prevent them from transferring and reusing assets.

2.38 Donation of assets. We examined the donation of assets by department or agency, not including the Computers for Schools program or the Community Volunteer Income Tax Program, a Canada Revenue Agency initiative. We found that the four federal organizations we selected made 20 donations to other organizations during the period covered by the audit. By contrast, they made more than 9,000 requests to sell or transfer assets over the same period.

2.39 In our survey of all federal organizations, we found that 84% rarely or never donated assets. Officials in the selected federal organizations also told us that internal processes to donate assets were cumbersome.

2.40 Recommendation. Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada should review their asset life-cycle processes, including procurement, to facilitate and encourage the transfer and reuse of assets.

Public Services and Procurement Canada’s response. Agreed. Public Services and Procurement Canada will review its asset life cycle processes to ensure that the disposal of valuable assets meets the criteria identified in this report in the most cost-effective manner. This review will include the consideration of the transfer, reuse, and donation of assets, with the proper documentation supporting the decision making. The review is expected to be completed by spring 2019.

The Royal Canadian Mounted Police’s response. Agreed. The Royal Canadian Mounted Police (RCMP) will review the asset life cycle processes in consultation with materiel managers across the RCMP to facilitate and encourage the transfer and reuse of assets. Throughout this review, particularly for the disposal phase of the life cycle, the RCMP will focus on disposal methods that obtain the highest net value for the Crown as per the Treasury Board Policy on Management of Materiel. The RCMP must also consider the uniqueness of the obligations it has with its contract partners while conducting the review. This review is scheduled to be completed by the end of the 2018–19 fiscal year.

Shared Services Canada’s response. Agreed. Shared Services Canada has initiated work to properly define the full life cycle of materiel management, including the development of a target operating model. This will result in a singular view of asset management across the Department’s service lines with defined activities, interdependencies, performance metrics, and transfer and disposal strategies, including the Computers for Schools program. Development of the target operating model and an implementation roadmap will be completed in spring 2018.

2.41 Recommendation. The Canada Revenue Agency, Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada should review internal processes to facilitate the donation of surplus assets.

The Canada Revenue Agency’s response. Agreed. The Canada Revenue Agency will review its internal processes to facilitate the donation of surplus assets. The Agency will complete its review by September 2019. However, a broader, integrated horizontal approach across government would facilitate an efficient, fair, and transparent donation process for both the donor departments and agencies and the receiving organizations.

Public Services and Procurement Canada’s response. Agreed. Public Services and Procurement Canada will review its internal processes, in close collaboration with GCSurplus and the Treasury Board of Canada Secretariat, to identify a mechanism to donate surplus assets in a fair and transparent manner while ensuring cost-effectiveness and the best value for the Crown. This review is expected to be completed by spring 2019.

The Royal Canadian Mounted Police’s response. Agreed. The Royal Canadian Mounted Police (RCMP) will review its internal processes with the objective of facilitating the donation of surplus assets. Additionally, the RCMP will open a dialogue on this subject with the Treasury Board of Canada Secretariat through ongoing committee work to identify potential changes to policy requirements that would facilitate the donation of surplus assets. The review and dialogue are scheduled to be completed by the end of the 2018–19 fiscal year.

Shared Services Canada’s response. Agreed. Shared Services Canada has an approved standard for materiel transfer, loan, and donation, which outlines the process and parameters that cost centre managers must follow for information technology materiel and equipment. The Department will review the standard to identify opportunities for improvement. The Department will communicate instructions to cost centre managers and provide training on the disposal processes in the summer of 2018.

Three of the four federal organizations did not keep detailed records to support disposal decisions

2.42 We found that Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada did not always have sufficient documentation to justify the disposal methods they chose.

2.43 We found that the Canada Revenue Agency had sufficient documentation to justify the disposal method it selected for all assets.

2.44 We also found that there was insufficient documentation to determine whether all four organizations had disposed of assets in a timely manner.

2.45 Our analysis supporting this finding presents what we examined and discusses the following topic:

2.46 This finding matters because keeping auditable records encourages transparency and accountability in the disposal process. These records offer Canadian taxpayers evidence that federal organizations are acting in the best interest of Canadians. According to government policy, Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada are required to keep auditable records.

2.47 Our recommendation in this area of examination appears at paragraph 2.53.

2.48 What we examined. We examined files maintained by the four federal organizations we selected to find evidence of documentation that would support decisions made to dispose of assets through selling, transferring, donating, recycling, or scrapping. We examined whether the departments and agencies considered the

- value of an asset,

- possibilities for reuse,

- available methods of disposal,

- cost of disposal, and

- environmental impacts of disposal.

In addition, we examined how much time it took to dispose of an asset.

2.49 Documentation to support disposal decisions. Federal organizations are required to keep auditable records to justify their disposal decisions. We found that Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada did not have sufficient documentation to support the decisions they made to dispose of assets. Out of 150 transactions we tested at these three organizations, 65% did not have costing analyses to justify the disposal methods selected. Costing analyses include the net book value of an asset, the expected resale value, possibilities for reuse, and the estimated cost of disposal. Without this information, the person recommending or approving the selected disposal method might not have made the best decision.

2.50 At the Canada Revenue Agency, on the other hand, we found that all 50 files we tested included a costing analysis.

2.51 We also found that documentation that tracked disposal decisions was more complete for federal organizations that consistently used standardized forms and templates. In addition, we found that all assets in our sample were disposed of in an environmentally sustainable manner.

2.52 We found, however, that there was insufficient documentation to determine whether the selected federal organizations disposed of surplus goods and equipment at the appropriate times. We were thus unable to assess whether surplus assets were losing value while waiting to be disposed of.

2.53 Recommendation. Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada should keep sufficient documentation to justify the disposal methods that they selected. The organizations should consider standardizing their forms to ensure consistency, and consider all factors when making disposal decisions, such as disposal cost, asset value, and environmental impact.

Public Services and Procurement Canada’s response. Agreed. Public Services and Procurement Canada will implement a standardized process to document disposal decisions. The extent of documentation will take into account the remaining value of the asset. This process is expected to be implemented by spring 2019.

The Royal Canadian Mounted Police’s response. Agreed. Prior to this audit, the RCMP Materiel Policy Center had identified areas of improvement relating to the disposal process and documentation. A new form is in development, and the feasibility of an electronic application is also being assessed. The new form would enable standardization, identify factors to be considered when making disposal decisions, strengthen approval processes, and provide the capability for performance measurement and reporting (that isi.e., timely disposal). This new form is scheduled to be completed by the end of the 2018–19 fiscal year. If an electronic solution is feasible, implementation of the electronic application would begin in the 2019–20 fiscal year.

Shared Services Canada’s response. Agreed. As part of Shared Services Canada’s development of the target operating model, a review of existing processes, practices, and tools such as forms for both non–information technology (IT) and IT assets is being conducted. The review will provide recommendations on improvements to move the Department to standardized industry practices and delivery models. Communications and training activities will be undertaken to raise awareness among cost centre managers related to their responsibilities in making disposal decisions. This will be completed in the summer of 2018.

GCSurplus operations

GCSurplus was effective at sales but could have done more to encourage the reuse of assets

Overall message

2.54 Overall, we found that Public Services and Procurement Canada was effective at selling the goods that it received through GCSurplus. However, we found that the Department had little incentive to pursue other disposal methods because the Department depended entirely on commissions from the sale of government assets to operate GCSurplus.

2.55 This finding matters because GCSurplus is uniquely positioned to dispose of assets on behalf of the Government of Canada. By offering more services that encourage the donation and reuse of assets, GCSurplus could further maximize the benefits from the disposal of surplus assets for both the federal government and Canadian taxpayers.

2.56 Our analysis supporting this finding presents what we examined and discusses the following topic:

2.57 Our recommendation in this area of examination appears at paragraph 2.61.

2.58 What we examined. We examined data from GCSurplus and GCTransfer, including the number of sales and transfers. We interviewed senior management at GCSurplus to obtain information on its operations.

2.59 GCSurplus sales. We found that GCSurplus was effective at selling (Exhibit 2.2) and depended entirely on commissions from the sales of government assets to operate. In our view, this dependence created little incentive to promote other possible disposal methods, such as transferring or donating, which would result in no revenue for GCSurplus. We also noted that GCSurplus could not carry money over from year to year. It was thus difficult for GCSurplus to invest in multi-year projects, such as modernizing its online presence with real-time bidding, planning for warehouse relocations, or improving the functionality of GCTransfer.

2.60 We also found that during the period covered by the audit, GCSurplus processed over 3,000 sales requests that sold for less than $20 each. The Treasury Board directive indicates that if the expected cost of selling an asset is more than the expected selling price, then other methods of disposal must be considered, such as donating, transferring, or recycling. In our view, it is unlikely that the proceeds exceeded the cost of conducting such sales.

2.61 Recommendation. As a common service provider of disposal services to the Government of Canada, Public Services and Procurement Canada should assess whether it can expand the services it offers to all federal organizations and it should encourage the donation and reuse of assets across government.

Public Services and Procurement Canada’s response. Agreed. As the common service provider of GCSurplus, Public Services and Procurement Canada will conduct an analysis of assets by class to determine whether they can be transferred for donation or reuse. The Department will engage with the materiel management community to increase awareness of the GCTransfer tool.

Regarding donations, the Department will engage with the Treasury Board of Canada Secretariat as the policy owner to understand how GCSurplus in its unique situation might broker donation transactions.

Collectively, these actions are expected to be completed by spring 2020.

Conclusion

2.62 We concluded that the selected federal organizations did not always dispose of surplus goods and equipment in a manner that maximized benefits. The incentives to sell surplus assets outweighed other methods, such as reusing, refurbishing, and donating. There are more opportunities inside and outside the Government of Canada to reuse assets and maximize their use. The Canada Revenue Agency is one example of how to increase the reuse and refurbishment of assets within one federal organization.

2.63 We were unable to conclude on whether the selected federal organizations disposed of surplus goods and equipment at the appropriate time because organizations did not maintain sufficient documentation.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada on the disposal of government surplus goods and equipment. Our responsibility was to provide objective information, advice, and assurance to assist Parliament in its scrutiny of the government’s management of resources and programs, and to conclude on whether the disposal of government surplus goods and equipment complied in all significant respects with the applicable criteria.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard for Assurance Engagements (CSAE) 3001—Direct Engagements set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office applies Canadian Standard on Quality Control 1 and, accordingly, maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we have complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from entity management:

- confirmation of management’s responsibility for the subject under audit;

- acknowledgement of the suitability of the criteria used in the audit;

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided; and

- confirmation that the audit report is factually accurate.

Audit objective

The objective of this audit was to determine whether selected federal organizations disposed of surplus goods and equipment at the appropriate time in a manner that maximized benefits.

Scope and approach

We selected the following four federal organizations for this audit:

- the Canada Revenue Agency,

- Public Services and Procurement Canada,

- the Royal Canadian Mounted Police, and

- Shared Services Canada.

We did not examine the disposal of the following:

- Controlled goods. These goods are governed by a unique directive. They are not available for sale through public auction and are managed through controlled processes. Examples include military equipment and ammunition.

- Real property. The Canada Lands Company Limited is responsible for the sale of federal government surplus properties that possess significant developmental potential.

- Seized goods. These goods are under the jurisdiction of the Seized Property Management Act. The disposal of these goods is governed by the Seized Property Disposition Regulations. The goods are managed by the internal policies of the relevant departments or agencies.

- Surplus books. These books are placed in the care and custody of Library and Archives Canada.

- Computers for Schools program. This program accepts selected personal information technology assets from federal government organizations and private sector sources, and refurbishes and distributes them to schools, libraries, Indigenous communities, and other not-for-profit organizations.

- Community Volunteer Income Tax Program. This program is a Canada Revenue Agency initiative that provides computers to organizations that prepare income tax declarations for individuals of a modest income and in a simple tax situation.

Public Services and Procurement Canada was included in the scope as both an owner of assets and the service provider for all disposals in federal organizations. The Department is responsible under the Surplus Crown Assets Act for disposal of all surplus movable assets for which authority has not been given either by legislation or by the Treasury Board to another department or agency. The Department is also responsible for providing strategic, procedural, and technical advice on the disposal of surplus materiel. The Department fulfills these responsibilities through GCSurplus.

We met with officials from the four federal organizations in the National Capital Region and in several regions across Canada. We chose a targeted sample of disposal files from the four federal organizations. In total, we selected 200 files for testing, a total of 50 from each organization.

Our audit work included a survey of all federal organizations identified in Schedules I, I.1, and II of the Financial Administration Act. We solicited contacts from the federal organizations listed in these schedules and sent the survey to the 71 organizations for which we received a contact. Across the 71 departments and agencies, we received 195 responses. Organizations were divided into three groups, according to the number of full-time employees: small organizations had fewer than 1,000 employees, medium had between 1,000 and 5,000, and large had more than 5,000.

We requested that any individuals involved in disposals answer the survey, and we received the following numbers of respondents:

| Size of organization | Respondents |

|---|---|

| Small | 47 |

| Medium | 28 |

| Large | 120 |

| Total | 195 |

Criteria

To determine whether selected federal organizations disposed of surplus goods and equipment at the appropriate time in a manner that maximized benefits, we used the following criteria:

| Criteria | Sources |

|---|---|

|

Entities identify, prepare, and dispose of the right assets as soon as possible in a manner that maximizes benefits for the Crown. |

|

|

GCSurplus disposes of assets as soon as possible in a manner that maximizes benefits for the Crown. |

|

|

Entities identify the right assets for disposal and dispose of them in a manner that minimizes costs and maximizes benefits for the Crown. |

|

|

GCSurplus disposes of assets received from entities in a manner that is cost-effective and yields maximum benefits for the Crown. |

|

Period covered by the audit

The audit covered the period between 1 April 2015 and 30 June 2017. This is the period to which the audit conclusion applies. However, to gain a more complete understanding of the subject matter of the audit, we also examined certain matters that preceded the starting date of this period.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 15 March 2018, in Ottawa, Canada.

Audit team

Principal: Martin Dompierre

Director: Gabriel Lombardi

Melissa Cross

Alexandra MacDonald

Suzanne Moorhead

Acknowledgement

We would like to acknowledge the contribution of Nancy Cheng, Assistant Auditor General, to the production of this report.

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report, and the numbers in parentheses indicate the location of the related discussion.

Selling and transferring assets

| Recommendation | Response |

|---|---|

|

2.40 Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada should review their asset life-cycle processes, including procurement, to facilitate and encourage the transfer and reuse of assets. (2.22 to 2.39) |

Public Services and Procurement Canada’s response. Agreed. Public Services and Procurement Canada will review its asset life cycle processes to ensure that the disposal of valuable assets meets the criteria identified in this report in the most cost-effective manner. This review will include the consideration of the transfer, reuse, and donation of assets, with the proper documentation supporting the decision making. The review is expected to be completed by spring 2019. The Royal Canadian Mounted Police’s response. Agreed. The Royal Canadian Mounted Police (RCMP) will review the asset life cycle processes in consultation with materiel managers across the RCMP to facilitate and encourage the transfer and reuse of assets. Throughout this review, particularly for the disposal phase of the life cycle, the RCMP will focus on disposal methods that obtain the highest net value for the Crown as per the Treasury Board Policy on Management of Materiel. The RCMP must also consider the uniqueness of the obligations it has with its contract partners while conducting the review. This review is scheduled to be completed by the end of the 2018–19 fiscal year. Shared Services Canada’s response. Agreed. Shared Services Canada has initiated work to properly define the full life cycle of materiel management, including the development of a target operating model. This will result in a singular view of asset management across the Department’s service lines with defined activities, interdependencies, performance metrics, and transfer and disposal strategies, including the Computers for Schools program. Development of the target operating model and an implementation roadmap will be completed in spring 2018. |

|

2.41 The Canada Revenue Agency, Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada should review internal processes to facilitate the donation of surplus assets. (2.22 to 2.39) |

The Canada Revenue Agency’s response. Agreed. The Canada Revenue Agency will review its internal processes to facilitate the donation of surplus assets. The Agency will complete its review by September 2019. However, a broader, integrated horizontal approach across government would facilitate an efficient, fair, and transparent donation process for both the donor departments and agencies and the receiving organizations. Public Services and Procurement Canada’s response. Agreed. Public Services and Procurement Canada will review its internal processes, in close collaboration with GCSurplus and the Treasury Board of Canada Secretariat, to identify a mechanism to donate surplus assets in a fair and transparent manner while ensuring cost-effectiveness and the best value for the Crown. This review is expected to be completed by spring 2019. The Royal Canadian Mounted Police’s response. Agreed. The Royal Canadian Mounted Police (RCMP) will review its internal processes with the objective of facilitating the donation of surplus assets. Additionally, the RCMP will open a dialogue on this subject with the Treasury Board of Canada Secretariat through ongoing committee work to identify potential changes to policy requirements that would facilitate the donation of surplus assets. The review and dialogue are scheduled to be completed by the end of the 2018–19 fiscal year. Shared Services Canada’s response. Agreed. Shared Services Canada has an approved standard for materiel transfer, loan, and donation, which outlines the process and parameters that cost centre managers must follow for information technology materiel and equipment. The Department will review the standard to identify opportunities for improvement. The Department will communicate instructions to cost centre managers and provide training on the disposal processes in the summer of 2018. |

|

2.53 Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada should keep sufficient documentation to justify the disposal methods that they selected. The organizations should consider standardizing their forms to ensure consistency, and consider all factors when making disposal decisions, such as disposal cost, asset value, and environmental impact. (2.42 to 2.52) |

Public Services and Procurement Canada’s response. Agreed. Public Services and Procurement Canada will implement a standardized process to document disposal decisions. The extent of documentation will take into account the remaining value of the asset. This process is expected to be implemented by spring 2019. The Royal Canadian Mounted Police’s response. Agreed. Prior to this audit, the RCMP Materiel Policy Center had identified areas of improvement relating to the disposal process and documentation. A new form is in development, and the feasibility of an electronic application is also being assessed. The new form would enable standardization, identify factors to be considered when making disposal decisions, strengthen approval processes, and provide the capability for performance measurement and reporting (i.e., timely disposal). This new form is scheduled to be completed by the end of the 2018–19 fiscal year. If an electronic solution is feasible, implementation of the electronic application would begin in the 2019–20 fiscal year. Shared Services Canada’s response. Agreed. As part of Shared Services Canada’s development of the target operating model, a review of existing processes, practices, and tools such as forms for both non–information technology (IT) and IT assets is being conducted. The review will provide recommendations on improvements to move the Department to standardized industry practices and delivery models. Communications and training activities will be undertaken to raise awareness among cost centre managers related to their responsibilities in making disposal decisions. This will be completed in the summer of 2018. |

GCSurplus operations

| Recommendation | Response |

|---|---|

|

2.61 As a common service provider of disposal services to the Government of Canada, Public Services and Procurement Canada should assess whether it can expand the services it offers to all federal organizations and it should encourage the donation and reuse of assets across government. (2.54 to 2.60) |

Public Services and Procurement Canada’s response. Agreed. As the common service provider of GCSurplus, Public Services and Procurement Canada will conduct an analysis of assets by class to determine whether they can be transferred for donation or reuse. The Department will engage with the materiel management community to increase awareness of the GCTransfer tool. Regarding donations, the Department will engage with the Treasury Board of Canada Secretariat as the policy owner to understand how GCSurplus in its unique situation might broker donation transactions. Collectively, these actions are expected to be completed by spring 2020. |