2018 Fall Reports of the Auditor General of Canada to the Parliament of Canada Independent Auditor’s ReportReport 7—Compliance Activities—Canada Revenue Agency

2018 Fall Reports of the Auditor General of Canada to the Parliament of CanadaReport 7—Compliance Activities—Canada Revenue Agency

Independent Auditor’s Report

Table of Contents

- Introduction

- Findings, Recommendations, and Responses

- Conclusion

- About the Audit

- List of Recommendations

- Exhibits:

- 7.1—Between the 2013–14 and 2017–18 fiscal years, the average time to complete an audit varied, depending on the program and region

- 7.2—The Canada Revenue Agency usually exceeded targets for additional revenues from audit activities, indicating that the targets may have been set too low

- 7.3—Between 1 April 2013 and 31 March 2018, assessments of additional revenues ramped up as target deadlines approached

- 7.4—Between 1 April 2013 and 31 March 2018, the Canada Revenue Agency wrote off over $16 billion in uncollected taxes

Introduction

Background

7.1 The Canada Revenue Agency administers taxes for the Government of Canada and for most provinces and territories.

7.2 Canada’s income tax system is based on self-assessment. This means that taxpayers must submit income tax returns to report their annual income, and they can claim deductions or credits that apply to their situations.

7.3 Part of the Agency’s mandate is to ensure that taxpayers comply with the income reporting requirements of the Income Tax Act. The Agency aims to protect the integrity of the tax system by identifying and deterring those who do not comply.

7.4 Enforcing compliance with the Income Tax Act. The Canada Revenue Agency supports taxpayer compliance by clarifying the requirements of the Income Tax Act and offering education to make it easier for taxpayers to comply. However, taxpayers may fail to comply—either deliberately, unknowingly, or in error.

7.5 It can be challenging for the Agency to identify unreported income or ineligible expenses, assess their impact on taxable income, find the evidence to support the assessment, calculate the amount of taxes due, respond to taxpayers’ objections to the assessed amount, and ultimately collect the taxes due.

7.6 The Agency develops strategies to identify which taxpayers are more likely to breach the Income Tax Act. Those taxpayers may then be subject to the Agency’s compliance activities.

7.7 Types of compliance activities. Compliance activities may include a thorough audit of the taxpayer’s books and records to ensure that the correct amounts were calculated and reported. Alternatively, the Canada Revenue Agency may conduct a more narrow review to verify a line item on an income tax return—such as a specific income amount, deduction, or credit. As part of the compliance activities, the Agency may compare information from third parties to determine whether taxpayers accurately reported income. Additionally, if a taxpayer requests adjustments to previously reported income tax, the Agency would review the information provided by the taxpayer and complete a reassessment.

7.8 Reassessments. One of the ways the Agency assesses, monitors, and reports on the effectiveness of its compliance activities is by measuring and reporting on fiscal impact. Fiscal impact is made up of two components. The main component is the additional revenues generated from reassessments completed during compliance activities, which the Agency refers to as “tax earned by audit.” The second component includes other items such as interest and penalties. In this report, the term “additional revenues” refers to the estimated additional revenues generated from compliance activities.

7.9 After conducting compliance activities, the Agency may carry out other processes, such as objections, appeals, and collections.

7.10 Taxpayer Bill of Rights. The Canada Revenue Agency’s Taxpayer Bill of Rights describes and defines 16 taxpayer rights, and builds on the Agency’s corporate values of professionalism, respect, integrity, and collaboration. It describes the treatment taxpayers are entitled to when they interact with the Agency. It is intended to protect taxpayers from inappropriate treatment and to protect the integrity of the tax system. When dealing with taxpayers, the Agency takes their particular circumstances into account as allowed by law.

7.11 Budgets 2016 and 2017 gave the Canada Revenue Agency almost $1 billion in additional resources to help enforce taxpayer compliance, with expectations of generating about $5 billion in additional revenues within five years. These funds would be used, for example, to hire additional specialists, enhance business intelligence, and deter tax evasion.

Focus of the audit

7.12 This audit focused on whether the Canada Revenue Agency applied the Income Tax Act consistently during compliance activities and accurately reported the results of its compliance activities. We examined how consistently the Agency applied its compliance activities for various types of taxpayers across Canada. We also examined the performance indicators for compliance activities and how they were measured, monitored, and reported to Parliament.

7.13 This audit is important because the Agency’s own Taxpayer Bill of Rights gives all taxpayers the right to have the law applied consistently. It also gives all taxpayers the right to receive entitlements, such as benefits, credits, and refunds, and to pay no more and no less than what is required by law.

7.14 It is also important for parliamentarians and the public to have complete and transparent information. They need to assess whether the Agency is meeting the government’s objective to crack down on non-compliant taxpayers, so that all taxpayers pay the right amount of taxes.

7.15 We did not examine the Agency’s compliance programs for criminal investigations, scientific research and development tax credits, and the goods and services tax and harmonized sales taxes. We also did not examine whether the Agency’s assessments were in accordance with the Income Tax Act.

7.16 More details about the audit objective, scope, approach, and criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Overall message

7.17 We found that the Canada Revenue Agency did not consistently apply tax rules when it audited or reviewed taxpayers’ files, even though the Taxpayer Bill of Rights includes the right to have the law applied consistently.

7.18 There were a number of reasons for these inconsistencies. They included the judgment of Agency staff conducting compliance activities; the region where the file was reassessed; and the type of taxpayer—for example, a small business or a large corporation. Taxpayers in one region waited an average of 7 months longer than those in another region for the Agency to complete an audit. In one region, it took the Agency more than 40 weeks to process taxpayers’ requests for adjustments, while in another region, the Agency took 12 weeks.

7.19 We also found that the additional revenue the Agency reported as a result of its compliance activities reflected taxes owed by taxpayers but did not reflect the taxes that it could not collect from taxpayers. This means that the impact on the government’s fiscal results was significantly less than what the Agency estimated. Furthermore, the Agency’s targets for additional revenue it can earn from compliance activities have increased over the past few years, which indicates that there were still significant areas where taxpayers either did not comply or did not know how to comply.

Performing compliance activities

The Agency gave taxpayers different times to provide information and waived penalties and interest inconsistently

7.20 We found that when conducting its compliance activities, the Canada Revenue Agency treated taxpayers differently, depending on the type of taxpayer and the region in which their files were reassessed.

7.21 We also found that while the Agency proactively waived interest and penalties for some taxpayers, it did not do so for others—even when the Agency had caused the delays in processing a taxpayer’s file. In addition, we found that even though the Agency’s own policies allowed it, the Agency waived $17 million in interest and penalties, despite the fact that the taxpayers were identified as at risk for non-compliance and were undergoing an audit at the time they asked for relief.

7.22 Our analysis supporting this finding presents what we examined and discusses the following topics:

- Inconsistent time given to respond to requests for information

- Inconsistent offering of proactive relief to taxpayers

- Inconsistent waiving of penalties and interest

- Different audit completion times across Canada

- Untimely and incomplete processing of results of compliance activities

7.23 This finding matters because the Agency’s own Taxpayer Bill of Rights entitles all taxpayers to

- have the law applied consistently,

- receive lawful entitlements,

- pay no more and no less than what is required by law, and

- obtain relief from penalties and interest under tax legislation because of extraordinary circumstances.

7.24 In addition, if the Agency conducts its compliance activities inconsistently, it can miss additional revenues, which can harm all taxpayers.

7.25 Each year, the Agency conducts compliance activities to ensure that taxpayers fulfill their tax obligations and receive applicable credits and benefits. Compliance activities often result in adjustments to taxes payable or receivable. When taxes are owing, sometimes interest or penalties, or both, are charged for a number of reasons. For example, the gross negligence penalty may be applied if a taxpayer knowingly does not report income or overstates expenses.

7.26 The Income Tax Act entitles taxpayers to “relief”—that is, to having the Agency waive penalties and interest—under certain circumstances, including the following:

- Taxpayers may request relief if extraordinary circumstances, such as illness or financial hardship, prevented them from meeting their tax obligations.

- In some cases, the Agency may proactively offer relief without taxpayers’ requests—for example, if the Agency was responsible for undue delays in processing a taxpayer’s file.

- Under the Agency’s Voluntary Disclosures Program, taxpayers have a second chance to file a tax return, or to correct a previously filed tax return, without being charged penalties and interest.

7.27 The Agency conducts compliance activities across Canada for various groups of taxpayers. It has defined various taxpayer categories and designed compliance programs, including those for

- international and large businesses with revenues over $250 million,

- taxpayers with offshore investments or assets in another country,

- small and medium-sized enterprises with revenues under $250 million, and

- individuals.

7.28 Our recommendations in this area of examination appear at paragraphs 7.35, 7.43, 7.50, 7.53, and 7.58.

7.29 What we examined. We examined whether taxpayers were given adequate time to respond to the Canada Revenue Agency’s requests for information. We also examined whether the Agency proactively waived interest and penalties, without a specific request. Finally, we examined whether compliance activities across Canada treated taxpayers consistently.

7.30 Inconsistent time given to respond to requests for information. We found that the length of time the Canada Revenue Agency gave taxpayers to respond to its requests for information was inconsistent, depending on how the Agency categorized the taxpayer.

7.31 Most taxpayers are individuals with Canadian employment income. We found that the Agency requested information from these taxpayers more quickly, and gave less time to respond, than it did with other taxpayers, such as international and large businesses, and taxpayers with offshore transactions.

7.32 For example, if the Agency asked an individual to provide a receipt to support a claimed expense and the taxpayer did not provide the receipt within 90 days, the Agency would automatically disallow the expense as an eligible income tax deduction. The Agency would assess the taxpayer’s income tax return on the basis of the information it had available and would notify the taxpayer of the taxes due.

7.33 For other taxpayers, such as those with offshore transactions, we found that the time frame to provide information was sometimes extended for months or even years. For example, banks and foreign countries could take months to provide information on the taxpayer’s offshore transactions to the Agency or the taxpayer. Sometimes, the Agency did not obtain information at all, and the file was closed without any taxes assessed. We found that over the past five years ending 31 March 2018, the Agency took, on average, more than a year and a half to complete audits of offshore transactions.

7.34 As we noted in the 2013 Spring Report of the Auditor General of Canada, Chapter 3, Status Report on Collecting Tax Debts—Canada Revenue Agency, the longer it took the Agency to enforce compliance, the less likely it could collect the taxes due. This was especially true for taxpayers with offshore assets, who may have been inclined to liquidate assets or transfer funds to make it more difficult for the Agency to obtain information and collect taxes due. On the other hand, for individuals and domestic businesses, the Agency had a better likelihood of collection by garnishing wages and seizing assets.

7.35 Recommendation. The Canada Revenue Agency should set time limits for all audit workloads to provide information requested and should consistently enforce the provisions of the Income Tax Act to compel taxpayers to produce information once those time limits have passed.

The Agency’s response. Agreed. The complexity of the request drives the time provided to respond, and legislation prescribes the time allowed for the Canada Revenue Agency to finalize compliance work. The Office of the Auditor General of Canada identified a lack of fixed timelines for more complex Agency requests in which auditors have to use their judgment and court action is more likely to be required to secure cooperation. The Agency, for audit workloads, will set timelines for information to be provided, criteria for extensions, and more formal deadlines, past which the Agency would move to the courts to compel cooperation, by March 2020.

7.36 Inconsistent offering of proactive relief to taxpayers. There were two ways a taxpayer could obtain relief from interest and penalties: The taxpayer could ask for it, or the Canada Revenue Agency could proactively offer it to them without its being requested. We found that the Agency offered to waive interest and penalties for taxpayers in some compliance activities but not others—even when the Agency had caused the delays.

7.37 The Agency may waive or cancel interest and penalties because of its own actions, such as

- processing delays, which prevent the taxpayer from being informed within a reasonable time of an amount owing;

- errors in publicly available income tax guidance, which cause a taxpayer to file a return or make a payment on the basis of incorrect information;

- incorrect information provided to a taxpayer;

- data processing errors, which prevent a taxpayer from making the appropriate instalment or arrears payments; or

- a lengthy time to resolve an objection or an appeal, or to complete an audit.

7.38 We found that the Agency did not proactively consider waiving penalties and interest consistently for all taxpayers. The Agency’s compliance activity for individuals was typically to review specific items and request receipts and other documentation to support their income tax returns. For them, the Agency did not proactively offer relief from interest and penalties—even when the Agency had caused the delays.

7.39 However, for small and medium-sized enterprises, international and large businesses, and taxpayers with offshore transactions, the Agency’s compliance activity was more likely an audit. In those cases, the Agency required its auditors to consider offering relief without taxpayer requests.

7.40 The Agency told us that it did not consider proactively offering relief for some taxpayers because the Agency caused only infrequent delays, and any resulting interest charged would be minimal. Yet we found that some taxpayers experienced delays of over 120 days during compliance activities because of Agency information technology issues. These taxpayers were not proactively offered relief.

7.41 We also found that Agency policies and procedures defined circumstances to waive or cancel interest, but did not define the period of time considered to be an undue delay. The Agency left this to the auditors’ discretion. This may have resulted in inconsistent application of relief, contradicting the Taxpayer Bill of Rights.

7.42 Agency officials also told us that proactively offering to waive penalties and interest for all taxpayers would impose an administrative burden on the Agency, with minimal impact on the interest and penalties waived or cancelled. Yet, in our view, the administrative burden could be lessened by placing a dollar threshold and time limit on relief procedures, similar to the Agency’s current policy of not charging or refunding amounts less than $2 for income tax returns. The Agency could also define the time frame it considers to be undue delay before considering relief. Such measures would support more consistent treatment of taxpayers while still limiting the administrative burden.

7.43 Recommendation. The Canada Revenue Agency should

- review its criteria and procedures and consider proactive relief for taxpayers in all types of compliance activities; and

- provide further guidance to staff to establish what it considers to be an “undue delay” in various compliance activities, on the basis of factors such as time, complexity, and taxpayer actions.

The Agency’s response. Agreed. The Canada Revenue Agency, in response to the Internal Audit—Application of the Taxpayer Relief Provisions, has already committed to reviewing the governance for the administration of all taxpayer relief provisions. The review will include an analysis of criteria used and current procedures to determine the feasibility for the consideration of proactive relief for taxpayers in the conduct of the various compliance activities and will be completed by April 2019.

The Agency will conduct a review and analysis of the various compliance activities by the end of March 2020 and, where reasonable, define the appropriate criteria to determine what it considers to be an “undue delay.” The development of any guidance will also ensure that all relevant factors continue to be considered in accordance with the legislation.

7.44 Inconsistent waiving of penalties and interest. We found that waiving or cancelling interest and penalties was inconsistent. For example, some of the Canada Revenue Agency’s auditors waived interest and penalties for the time it took them to get information from taxpayers’ banks. Other auditors charged interest and penalties because they considered that time to be the taxpayers’ fault for not providing the information. This resulted in inconsistent treatment of taxpayers in similar situations. Furthermore, the Agency’s procedures for waiving interest and penalties did not clearly specify whether bank delays should be attributed to the Agency or to the taxpayers.

7.45 According to the Income Tax Act, taxpayers must keep all required records and supporting documents for a period of six years from the end of the last tax year they relate to. There are exceptions where specific records are required to be kept for an additional period of time. However, audits can go back even further than the required period to keep documents. In some cases, we found audits on files older than seven years, for which the taxpayer was not required to retain documentation. If such taxpayers needed to track down information, delays could be lengthy. Yet we found that the Agency lacked clear guidance to determine who was responsible for those delays.

7.46 According to the Agency’s own internal audit, completed in March 2018, the Agency risked applying and administering taxpayer relief from penalties and interest inconsistently. The Agency waived penalties and interest differently, depending on where the file was processed. Moreover, staff from different program areas considered different criteria for similar situations when granting requests for taxpayer relief.

7.47 Another way taxpayers could have penalties waived was through the Voluntary Disclosures Program. This program enables taxpayers to correct inaccurate or incomplete information, or disclose information not reported previously. If eligible, the taxpayer can avoid penalties or prosecution but is still required to pay the taxes owed.

7.48 We analyzed over 86,000 records of applications for the Voluntary Disclosures Program that were closed between 1 April 2013 and 31 March 2018. In 140 cases, we found that the taxpayers were under audit when submitting their applications, yet the applications were still accepted. These cases represented about $17 million in interest and penalties waived. According to the Agency’s policy, relief from penalties and interest under the program was legitimate in some cases, despite an ongoing audit. In our opinion, the Agency should have delayed processing the application for relief until it completed the audit.

7.49 We noted that effective 1 March 2018, the Agency revised its Voluntary Disclosures Program to narrow the eligibility criteria, including the conditions for an application to be considered. This imposed additional conditions on applicants, making it more difficult for those who intentionally avoided their tax obligations to benefit from relief of interest and penalties. Since these changes did not apply to any files closed within our audit period, we did not examine the impact of these program revisions.

7.50 Recommendation. The Canada Revenue Agency should ensure that taxpayers are treated consistently by

- clarifying its guidance and procedures to determine whether the Agency or the taxpayer is responsible for delays in completing compliance activities, and

- ensuring that eligibility criteria are fully met before approving applications for all relief programs.

The Agency’s response. Agreed. The Canada Revenue Agency will clarify what is considered to be delays attributed to the Agency (within the Agency’s control) and delays attributed to the taxpayer (within the taxpayer’s control) in the conduct of the various compliance activities by the end of March 2020, considering the discretionary nature of the provision.

The Canada Revenue Agency is committed to providing fair relief and to not rewarding non-compliance. In order to mitigate any inconsistent application or administration of the taxpayer relief provisions, the Agency will ensure the harmonization of policies, procedures, guidelines, and training materials as publicly stated in the recent Internal Audit—Application of the Taxpayer Relief Provisions. The target completion date for this action plan is April 2020.

The Agency takes note of the Office of the Auditor General of Canada’s finding that the Agency conformed to its policies and procedures in the application of the Voluntary Disclosures Program. Up until March 2018, the program’s policy allowed the Agency to accept a voluntary disclosure even when an audit was already under way. In December 2017, the Agency announced it would amend the program’s policy to address this possibility. While the Office of the Auditor General of Canada may consider whether the Agency appropriately applied its policy in force at a given time, it is not within the scope of this audit to comment on the policy itself.

7.51 Different audit completion times across Canada. The Canada Revenue Agency conducts compliance activities through several regional offices across Canada. We found differences in the time it took these regional offices to complete audits. For example, we found that for the offshore and aggressive tax planning compliance program, audited taxpayers in one region of Canada waited an average of 541 days. For that same program, taxpayers in another region waited 323 days and were served 218 days faster. We found similar results for international and large businesses. For small and medium-sized enterprises, the variance between regions was much smaller. Exhibit 7.1 summarizes the average audit times for different compliance programs by region.

Exhibit 7.1—Between the 2013–14 and 2017–18 fiscal years, the average time to complete an audit varied, depending on the program and region

| Compliance program | Shortest average number of days for a given region | Longest average number of days for a given region | Variance in days |

|---|---|---|---|

| International and Large Business | 279 | 425 | 146 |

| Offshore and Aggressive Tax Planning | 323 | 541 | 218 |

| Small and Medium Enterprises | 213 | 251 | 38 |

Source: Compiled with data from the Canada Revenue Agency

7.52 Delays to complete audits could cost both the Agency and the taxpayer time and money. The Agency spent over $1 billion in salaries and associated costs for compliance activities in the 2016–17 fiscal year. For taxpayers, Agency delays could cost the taxpayer the time to provide information and the money to hire tax representatives. Furthermore, if taxpayers objected to the amount reassessed and wanted to avoid interest and penalties, they were still required to pay it up front. This tied up funds taxpayers could have used for other purposes.

7.53 Recommendation. The Canada Revenue Agency should determine the reasons for regional variations in the time to complete compliance activities and should implement a plan to reduce those differences.

The Agency’s response. Agreed. The Canada Revenue Agency will conduct a review to understand the possible reasons for the regional variances and create a plan to address any problematic issues identified by the review by the end of March 2020. This work will need to take into account that workloads vary across regions in terms of their complexity and sector composition.

7.54 Untimely and incomplete processing of results of compliance activities. When the Canada Revenue Agency conducts compliance activities, such as an audit, the auditor determines the amount of income or expenses to adjust. Then, the file is sent to another section of the Agency, where taxes owing are calculated and adjusted.

7.55 We found that after the Agency completed its compliance activities, it did not always calculate and adjust taxes owing on a timely basis. For example, one region’s tax centre took an average of 41 weeks to process taxpayers’ requests for adjustments, whereas another region’s tax centre took an average of only 12 weeks. For the compliance activities relating to an audit reassessment, the Agency did not track the time it took to process the reassessment. Until the Agency completed its reassessments, it charged interest on any additional taxes that would eventually be assessed but were not yet paid. The interest was charged from the time the taxes were originally due. Yet taxpayers did not know if additional taxes were owing, or how much was owed, until almost a year after the compliance activity was completed.

7.56 Compliance activities for the Voluntary Disclosures Program were also not timely or complete. In fact, we found instances in which the reassessments were not yet completed by the end of the period covered by the audit. In a representative sample of Voluntary Disclosures Program files under review between 1 April 2013 and 31 March 2018, we found that almost 5% of files were not reassessed by 31 March 2018. In these cases, the taxes owing were not reassessed, so the Agency did not collect any amounts that might have been due as of 31 March 2018.

7.57 We also found that the Agency did not follow through with taxpayers who had used the Voluntary Disclosures Program to ensure that they continued to comply. For example, if a taxpayer had an offshore investment and used the program to avoid paying interest on undeclared past income, the Agency did not follow up on whether the taxpayer still owned the investment and declared that income on later tax filings.

7.58 Recommendation. The Canada Revenue Agency should

- develop a formal tracking process to monitor the time to process assessments,

- take necessary steps to improve timeliness and complete files, and

- have a plan to follow up with taxpayers who have used the Voluntary Disclosures Program to verify their future compliance.

The Agency’s response. Agreed. The Canada Revenue Agency will develop a formal tracking process to monitor the time to process assessments resulting from compliance actions and, where necessary, improve timeliness of reassessment processes. The Agency also agrees to conduct a review to determine the impact of disclosures on future compliance risk by the end of March 2020.

Managing and reporting on results

The Agency could not fully determine the results of its income tax compliance activities

7.59 We found that the Canada Revenue Agency did not know the full results of its compliance activities. Its calculation of the additional revenues generated from compliance activities, beyond the initial taxes assessed, was incomplete. It did not know how much money it wrote off as uncollectible in its compliance reassessments. The amount it reported to Parliament as additional revenues resulting from extra funding for compliance activities was only an estimate.

7.60 The Agency’s targets for additional revenue may have influenced how it conducted its compliance activities, such as the timing to complete audits. We found that each year, these targets increased, although they would be expected to decrease if the compliance activities were effective. The Agency usually met or exceeded its targets.

7.61 Our analysis supporting these findings presents what we examined and discusses the following topics:

- Unclear methodology to establish targets for additional revenues

- Closure of most audit files near year-end

- Aggregated tracking of the use of budgetary funding

- Incomplete reporting

7.62 This finding matters because parliamentarians and the public need complete and transparent information to assess whether the Agency is successfully cracking down on tax evasion and tax avoidance. Ultimately, compliance activities should be a deterrent, resulting in less non-compliance.

7.63 Compliance activities are only one step in ensuring that all taxpayers pay the right amount of income taxes. Once a file is assessed and the taxes owing are calculated, other factors influence whether the taxes reassessed through compliance activities are paid. For example, taxpayers are entitled by law to object to taxes assessed, either by filing an objection directly with the Agency or by appealing the tax assessment through the courts.

7.64 In certain circumstances, the Agency is not able to collect taxes owing and may write off the amount of taxes assessed because it has determined that they are not collectible.

7.65 For the Agency to determine whether its compliance activities were successful, it needs to consider all steps from reassessment to collection.

7.66 Our recommendations in this area of examination appear at paragraphs 7.74, 7.86, and 7.91.

7.67 What we examined. We examined whether the Canada Revenue Agency used sound analysis to set targets for additional revenues from compliance activities and whether they were met. More specifically, we looked at trends in results that might explain how targets for additional revenues might have affected the Agency’s compliance activities. Finally, we examined whether the Agency accurately reported the results of compliance activities between 1 April 2013 and 31 March 2018.

7.68 Unclear methodology to establish targets for additional revenues. We found that the Canada Revenue Agency was unable to clearly demonstrate how it set its targets for additional revenues each year. The Agency confirmed that it generally established targets through

- past targets for additional revenues,

- previous years’ actual additional revenues,

- senior management direction, and

- budget commitments and consultations with branches and regions.

However, the Agency was unable to provide us with the source data to recalculate how it determined targets for additional revenues.

7.69 Without a complete and documented methodology to determine targets, the Agency risked setting the targets too low or too high. If targets are set too low, auditors may not have the incentive to conduct audits or complete them in a timely manner. If targets are set too high, auditors may be too aggressive in attempting to achieve their targets and may close files as deadlines approach, even with outstanding questions about the file.

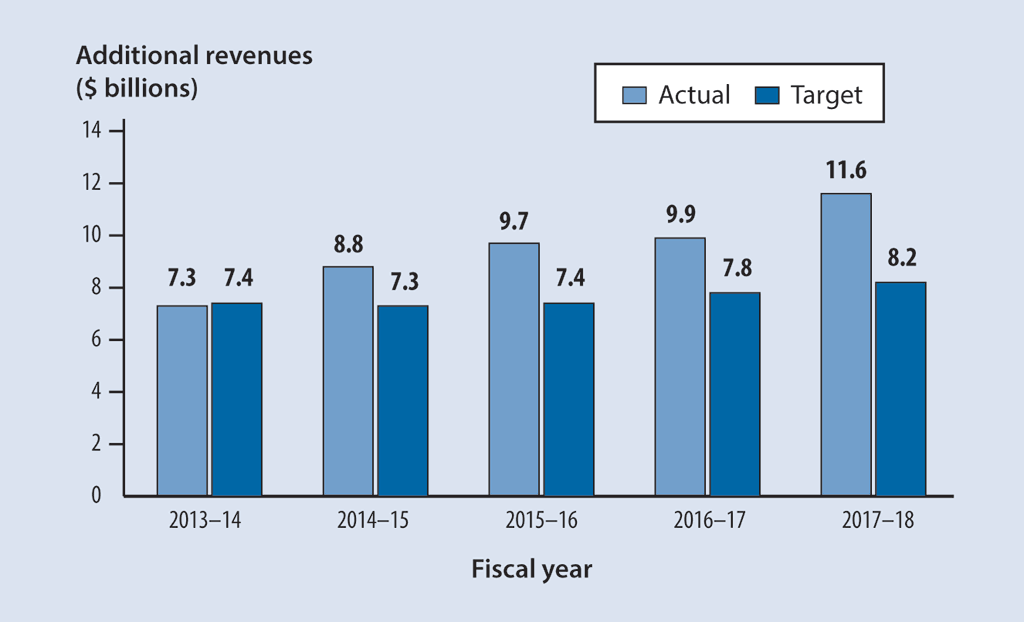

7.70 We found that the targets for additional revenues from the Agency’s audit activities for all programs were almost always met or exceeded during the period covered by our audit, indicating that the targets may have been set too low (Exhibit 7.2).

Exhibit 7.2—The Canada Revenue Agency usually exceeded targets for additional revenues from audit activities, indicating that the targets may have been set too low

Source: Compiled with data from the Canada Revenue Agency for its audit activities for all programs

Exhibit 7.2—text version

This bar graph shows the Canada Revenue Agency’s actual and targeted additional revenues from audit activities for the 2013–14 to 2017–18 fiscal years. The additional revenues exceeded targets for the last 4 of these 5 fiscal years.

| Fiscal year | Actual additional revenues from audit activities ($ billions) |

Target for additional revenues from audit activities ($ billions) |

|---|---|---|

| 2013–14 | 7.3 | 7.4 |

| 2014–15 | 8.8 | 7.3 |

| 2015–16 | 9.7 | 7.4 |

| 2016–17 | 9.9 | 7.8 |

| 2017–18 | 11.6 | 8.2 |

Source: Compiled with data from the Canada Revenue Agency for its audit activities for all programs

7.71 At some point, targets should be harder to achieve, and should start to decrease, if the Agency’s compliance activities effectively promote taxpayer compliance. Yet the Agency’s documentation did not indicate why the Agency exceeded its targets every year.

7.72 Targets for additional revenues that are increased and are then met, or exceeded, may not be sufficiently challenging. We found that the actual additional revenues that the Agency reported in the 2017–18 fiscal year were almost 60% higher than in the 2013–14 fiscal year. In our opinion, that could indicate that

- taxpayers became much worse at complying with the Income Tax Act,

- taxpayers were able to underpay their income taxes in 2013 as compared with 2017 because the Agency did not allocate enough resources to assessments and audits, or

- the Agency’s risk assessment process improved.

7.73 This increase in additional revenues reported could also indicate that there was an opportunity to increase the targets or that the Agency was unsuccessful in deterring non-compliance.

7.74 Recommendation. The Canada Revenue Agency should clearly document how it sets its targets for additional revenues, also known as tax earned by audit. The targets should be supported by an analysis of trends in its targets and results.

The Agency’s response. Agreed. The Canada Revenue Agency will more clearly document the process used to establish revenue projections. Given the material increase in the Agency’s gross revenue impact over the past four years, now is an opportune time to conduct more in-depth analysis of trends in the targets and results. This analysis will be completed by March 2020.

7.75 Closure of most audit files near year-end. We found a trend to close files and assess additional taxes toward year-end (Exhibit 7.3). The majority of audit files were closed between December and March, coinciding with the Canada Revenue Agency’s deadline to meet its annual targets for additional revenues by 31 March.

Exhibit 7.3—Between 1 April 2013 and 31 March 2018, assessments of additional revenues ramped up as target deadlines approached

Source: Compiled with data from the Canada Revenue Agency

Exhibit 7.3—text version

This bar graph shows the percentages of additional revenues that the Canada Revenue Agency assessed each month, as averaged over the 5 fiscal years between 1 April 2013 and 31 March 2018. Percentages for the last 4 months of the fiscal year were much higher than those for previous months.

| Month | Percentage (%) of additional revenues assessed (based on monthly average from 1 April 2013 to 31 March 2018) |

|---|---|

| April | 3.7 |

| May | 2.3 |

| June | 6.6 |

| July | 5.8 |

| August | 5.7 |

| September | 6.6 |

| October | 5.9 |

| November | 4.6 |

| December | 11.3 |

| January | 8.1 |

| February | 20.3 |

| March | 19.1 |

Source: Compiled with data from the Canada Revenue Agency

7.76 Because the calculations of additional revenues were not adjusted if assessments were overturned or revenues were not collected, targets may have pushed auditors to close files early. The Agency was unable to tell us the amounts of additional revenues reported that were actually collected from year to year.

7.77 We found that the Agency had limited feedback mechanisms to allow auditors to learn from their assessment work. However, since our 2016 audit of income tax objections, we found some improved feedback on objection results for compliance programs.

7.78 The 2016 Fall Reports of the Auditor General of Canada, Report 2, Income Tax Objections—Canada Revenue Agency included a recommendation that the Agency “ensure that decisions on objections and appeals are shared within the Agency in such a way that those performing assessments can use that information to improve future assessments.” To address this recommendation, the Agency determined that it would share the results of objections and appeals with the assessing and audit areas.

7.79 However, we found that many internal reports shared with the assessing and audit areas were not detailed enough for the reader to understand the reasons for any changes. We compared results of objections to compliance activities that were fully or partially in favour of the taxpayers for a five-year period ending 31 March 2018. We found some progress as compared with the five-year period ending 31 March 2016, as there was a 5% increase in the Agency’s success in upholding its assessments when taxpayers objected.

7.80 According to the Agency’s detailed action plan to the House of Commons Standing Committee on Public Accounts, the work on sharing information on objections was still ongoing, and no specific completion date was indicated.

7.81 Aggregated tracking of the use of budgetary funding. In 2016 and 2017, the government focused on improving compliance to help ensure that all taxpayers would pay the right amount of taxes. Budget 2016 gave the Canada Revenue Agency $444 million over five years to help reduce tax evasion and tax avoidance, specifically by allowing the Agency to

- hire more auditors and specialists,

- develop robust business intelligence infrastructure,

- increase verification activities, and

- improve investigative work that targets criminal tax evaders.

Budget 2016 included a prediction that these measures would increase revenue by $2.6 billion over five years.

7.82 Budget 2017 invested an additional $524 million over five years to reduce tax evasion and improve tax compliance. The investment was to fund new initiatives and extend existing programs to ensure an equitable tax system for all Canadians. Budget 2017 included a prediction that these measures would increase revenue by another $2.5 billion over five years. The total budgetary funding in 2016 and 2017 of almost $1 billion was intended to generate more than $5 billion over five years.

7.83 However, we determined that the Agency could not track the exact amount of additional revenues resulting from this funding. Instead, the Agency used a proportional—or pro-rated—approach to measure the results of compliance activities funded through recent federal budgets. This approach did not provide details on the hundreds of thousands of compliance reassessments and related spending associated with the work of hundreds of compliance staff members. Agency officials told us that tracking detailed results would be overly cumbersome because of its cost and complexity. In our opinion, a greater degree of precision in tracking the spending of budget funding would provide additional assurances that the Agency was meeting its commitments to increase tax revenues.

7.84 We found that in measuring the results of its compliance activities, the Agency could not differentiate between additional revenues resulting from ongoing funding and those resulting from budgetary funding. Its pro-rated approach measured the return on investment from budgetary funding. Consequently, the Agency was unable to precisely demonstrate whether it fulfilled all of its commitments to increase tax revenues, as stated in the recent budgets.

7.85 The Agency told us that it had implemented measures to track the direct impact of additional budgetary funding from 2016 and 2017. However, midway through the 2017–18 fiscal year, the Agency developed a plan to change back to a pro-rated approach.

7.86 Recommendation. The Canada Revenue Agency should analyze whether there are more accurate measures to track additional revenue generated from budgetary funding.

The Agency’s response. Agreed. While both the Treasury Board of Canada Secretariat and the Department of Finance Canada are satisfied with the Canada Revenue Agency’s current reporting methodology for tracking additional revenue generated from budgetary funding, the Agency will analyze the accuracy of its performance measures for return on investment of budget investments and include any proposed new measures in the performance measurement framework to be developed by March 2020.

7.87 Incomplete reporting. We found that to calculate additional revenue, the Canada Revenue Agency measured results partway through the revenue cycle. This measurement did not reflect the impact of compliance activities on the final taxes collected. It did not take into account

- taxpayers who filed an objection with the Agency or appealed through the court system, or

- taxes assessed that were never collected.

Without accounting for objections, appeals, and write-offs, the Agency’s calculation of taxes collected was incomplete.

7.88 For example, we found that at least $1.3 billion in previously reported additional revenues was never collected. This previously reported additional revenue will never be collected because the assessments were overturned through the objection process. Between 1 April 2013 and 31 March 2018, 60% of decisions about objections to audits were fully or partially in favour of the taxpayers. In addition, other taxpayers could have appealed audit assessments through the court system and may have had their taxes owing reduced as well.

7.89 We also found that additional revenues the Agency reported did not include write-offs for uncollectible accounts after reassessments. The Agency was unable to provide us with the value of write-offs from compliance activities, but in the 2017–18 fiscal year, the Agency’s total write-offs were $3.3 billion. The Agency’s database did not track the total amount collected from each reassessment. Exhibit 7.4 shows write-offs for all taxes.

Exhibit 7.4—Between 1 April 2013 and 31 March 2018, the Canada Revenue Agency wrote off over $16 billion in uncollected taxes

Canada Revenue Agency write-offs by fiscal year

(in $ billions)

| 2013–14 | 2014–15 | 2015–16 | 2016–17 | 2017–18 |

|---|---|---|---|---|

| $3.5 | $3.6 | $3.2 | $2.5 | $3.3 |

Sources: The Canada Revenue Agency’s 2013–14 and 2014–15 annual reports to Parliament, its 2015–16 Departmental Performance Report, and its 2016–17 and 2017–18 departmental results reports

7.90 In addition, the Agency could not provide detailed source data or accurate information to support some of the additional revenue published in its annual public reports. Instead, the Agency gave us summary reports. The Agency told us that it would not be able to provide the full data we requested in time for the publication of this report.

7.91 Recommendation. The Canada Revenue Agency should enhance its performance indicators so that it can fully measure and report on compliance activities’ results and actual collected tax revenues.

The Agency’s response. Agreed. The Canada Revenue Agency has, and will retain, tactical measures such as gross revenue impact, change rate, rate of return, quality, and coverage rates; these inform year-to-year, office-to-office, and file-to-file decisions.

To supplement these, following recommendations from a recent internal evaluation, the Agency has started working on new horizontal performance measures to provide a more comprehensive measure of program outcomes. In addition, it has launched tax gap estimates in 2016 and piloted a new measurement related to tax compliance in the large business population in the 2017–18 fiscal year.

The Agency agrees to develop additional strategic measures that will estimate the impact of litigation, collections, and deterrence impact. The Agency will develop a performance measurement framework for its compliance programs, including measures that factor litigation and collections, by March 2020.

Conclusion

7.92 We concluded that the Canada Revenue Agency did not apply the Income Tax Act consistently during its compliance activities. It treated taxpayers in similar situations in different ways. The Agency also did not accurately report the results of its compliance activities, and its reporting was incomplete.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada on the Canada Revenue Agency’s compliance activities. Our responsibility was to provide objective information, advice, and assurance to assist Parliament in its scrutiny of the government’s management of resources and programs, and to conclude on whether the compliance activities complied in all significant respects with the applicable criteria.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard for Assurance Engagements (CSAE) 3001—Direct Engagements set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office applies Canadian Standard on Quality Control 1 and, accordingly, maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we have complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from entity management:

- confirmation of management’s responsibility for the subject under audit;

- acknowledgement of the suitability of the criteria used in the audit;

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided; and

- confirmation that the audit report is factually accurate.

Audit objective

The objective of this audit was to determine whether the Canada Revenue Agency applied the Income Tax Act consistently during compliance activities and accurately reported the results of its compliance activities.

Scope and approach

The scope of the audit included individuals, businesses, and trusts (T1, T2, T3) for the Domestic Compliance Programs Branch; the International, Large Business and Investigations Branch; and the Collections and Verification Branch. We examined the consistency of compliance activities over a five-year period ending 31 March 2018. We also examined the Agency’s performance indicators to monitor and report on its compliance activities.

At the Agency, we examined the legislation, policies, and procedures to manage its compliance programs. We interviewed officials at the Agency’s headquarters, as well as those in the tax services offices in Québec, Montréal, Ottawa, London, Toronto Centre, Toronto North, Victoria, Vancouver, Surrey, and Shawinigan. The interviews included meetings with management, auditors, and others involved in managing or coordinating compliance activities.

We analyzed data extracted from the information systems of the Agency to identify and compare information related to compliance activities and income tax objections. Our data included all individual, trust, and business audits, as well as voluntary disclosures and income tax objections resolved over the 2013–14 to 2017–18 fiscal years. We conducted a file review of 99 random samples of these files to assess the quality of the data. Although we noted issues with the integrity of data, we found the data sufficiently reliable for the purpose of our analysis.

Criteria

To determine whether the Canada Revenue Agency applied the Income Tax Act consistently during compliance activities and accurately reported the results of its compliance activities, we used the following criteria:

| Criteria | Sources |

|---|---|

|

The Agency treats taxpayers consistently. |

|

|

The Agency has performance indicators in line with its objective to treat all taxpayers consistently and accurately monitors, measures, and reports on the performance of its compliance activities. |

|

Period covered by the audit

The audit covered the period between 1 April 2013 and 31 March 2018. This is the period to which the audit conclusion applies.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 18 September 2018, in Ottawa, Canada.

Audit team

Principal: Martin Dompierre

Director: Tammy Meagher

Nicholas Brouwer

Philippe-Antoine Charbonneau

Lucie Després

Manav Kapoor

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report, and the numbers in parentheses indicate the location of the related discussion.

Performing compliance activities

| Recommendation | Response |

|---|---|

|

7.35 The Canada Revenue Agency should set time limits for all audit workloads to provide information requested and should consistently enforce the provisions of the Income Tax Act to compel taxpayers to produce information once those time limits have passed. (7.30 to 7.34) |

The Agency’s response. Agreed. The complexity of the request drives the time provided to respond, and legislation prescribes the time allowed for the Canada Revenue Agency to finalize compliance work. The Office of the Auditor General of Canada identified a lack of fixed timelines for more complex Agency requests in which auditors have to use their judgment and court action is more likely to be required to secure cooperation. The Agency, for audit workloads, will set timelines for information to be provided, criteria for extensions, and more formal deadlines, past which the Agency would move to the courts to compel cooperation, by March 2020. |

|

7.43 The Canada Revenue Agency should

|

The Agency’s response. Agreed. The Canada Revenue Agency, in response to the Internal Audit—Application of the Taxpayer Relief Provisions, has already committed to reviewing the governance for the administration of all taxpayer relief provisions. The review will include an analysis of criteria used and current procedures to determine the feasibility for the consideration of proactive relief for taxpayers in the conduct of the various compliance activities and will be completed by April 2019. The Agency will conduct a review and analysis of the various compliance activities by the end of March 2020 and, where reasonable, define the appropriate criteria to determine what it considers to be an “undue delay.” The development of any guidance will also ensure that all relevant factors continue to be considered in accordance with the legislation. |

|

7.50 The Canada Revenue Agency should ensure that taxpayers are treated consistently by

|

The Agency’s response. Agreed. The Canada Revenue Agency will clarify what is considered to be delays attributed to the Agency (within the Agency’s control) and delays attributed to the taxpayer (within the taxpayer’s control) in the conduct of the various compliance activities by the end of March 2020, considering the discretionary nature of the provision. The Canada Revenue Agency is committed to providing fair relief and to not rewarding non-compliance. In order to mitigate any inconsistent application or administration of the taxpayer relief provisions, the Agency will ensure the harmonization of policies, procedures, guidelines, and training materials as publicly stated in the recent Internal Audit—Application of the Taxpayer Relief Provisions. The target completion date for this action plan is April 2020. The Agency takes note of the Office of the Auditor General of Canada’s finding that the Agency conformed to its policies and procedures in the application of the Voluntary Disclosures Program. Up until March 2018, the program’s policy allowed the Agency to accept a voluntary disclosure even when an audit was already under way. In December 2017, the Agency announced it would amend the program’s policy to address this possibility. While the Office of the Auditor General of Canada may consider whether the Agency appropriately applied its policy in force at a given time, it is not within the scope of this audit to comment on the policy itself. |

|

7.53 The Canada Revenue Agency should determine the reasons for regional variations in the time to complete compliance activities and should implement a plan to reduce those differences. (7.51 to 7.52) |

The Agency’s response. Agreed. The Canada Revenue Agency will conduct a review to understand the possible reasons for the regional variances and create a plan to address any problematic issues identified by the review by the end of March 2020. This work will need to take into account that workloads vary across regions in terms of their complexity and sector composition. |

|

7.58 The Canada Revenue Agency should

|

The Agency’s response. Agreed. The Canada Revenue Agency will develop a formal tracking process to monitor the time to process assessments resulting from compliance actions and, where necessary, improve timeliness of reassessment processes. The Agency also agrees to conduct a review to determine the impact of disclosures on future compliance risk by the end of March 2020. |

Managing and reporting on results

| Recommendation | Response |

|---|---|

|

7.74 The Canada Revenue Agency should clearly document how it sets its targets for additional revenues, also known as tax earned by audit. The targets should be supported by an analysis of trends in its targets and results. (7.68 to 7.73) |

The Agency’s response. Agreed. The Canada Revenue Agency will more clearly document the process used to establish revenue projections. Given the material increase in the Agency’s gross revenue impact over the past four years, now is an opportune time to conduct more in-depth analysis of trends in the targets and results. This analysis will be completed by March 2020. |

|

7.86 The Canada Revenue Agency should analyze whether there are more accurate measures to track additional revenue generated from budgetary funding. (7.81 to 7.85) |

The Agency’s response. Agreed. While both the Treasury Board of Canada Secretariat and the Department of Finance Canada are satisfied with the Canada Revenue Agency’s current reporting methodology for tracking additional revenue generated from budgetary funding, the Agency will analyze the accuracy of its performance measures for return on investment of budget investments and include any proposed new measures in the performance measurement framework to be developed by March 2020. |

|

7.91 The Canada Revenue Agency should enhance its performance indicators so that it can fully measure and report on compliance activities’ results and actual collected tax revenues. (7.87 to 7.90) |

The Agency’s response. Agreed. The Canada Revenue Agency has, and will retain, tactical measures such as gross revenue impact, change rate, rate of return, quality, and coverage rates; these inform year-to-year, office-to-office, and file-to-file decisions. To supplement these, following recommendations from a recent internal evaluation, the Agency has started working on new horizontal performance measures to provide a more comprehensive measure of program outcomes. In addition, it has launched tax gap estimates in 2016 and piloted a new measurement related to tax compliance in the large business population in the 2017–18 fiscal year. The Agency agrees to develop additional strategic measures that will estimate the impact of litigation, collections, and deterrence impact. The Agency will develop a performance measurement framework for its compliance programs, including measures that factor litigation and collections, by March 2020. |