2021 Reports of the Auditor General of Canada to the Parliament of CanadaReport 4—Canada Child Benefit—Canada Revenue Agency

Independent Auditor’s Report

Table of Contents

- Introduction

- Findings, Recommendations, and Responses

- Conclusion

- About the Audit

- List of Recommendations

- Exhibits:

- 4.1—Benefit applications reached the Canada Revenue Agency through different channels

- 4.2—A change in marital status or custody arrangement would change the amount of a recipient’s benefit payment

- 4.3—Benefit payments varied according to the net family income and the number of children

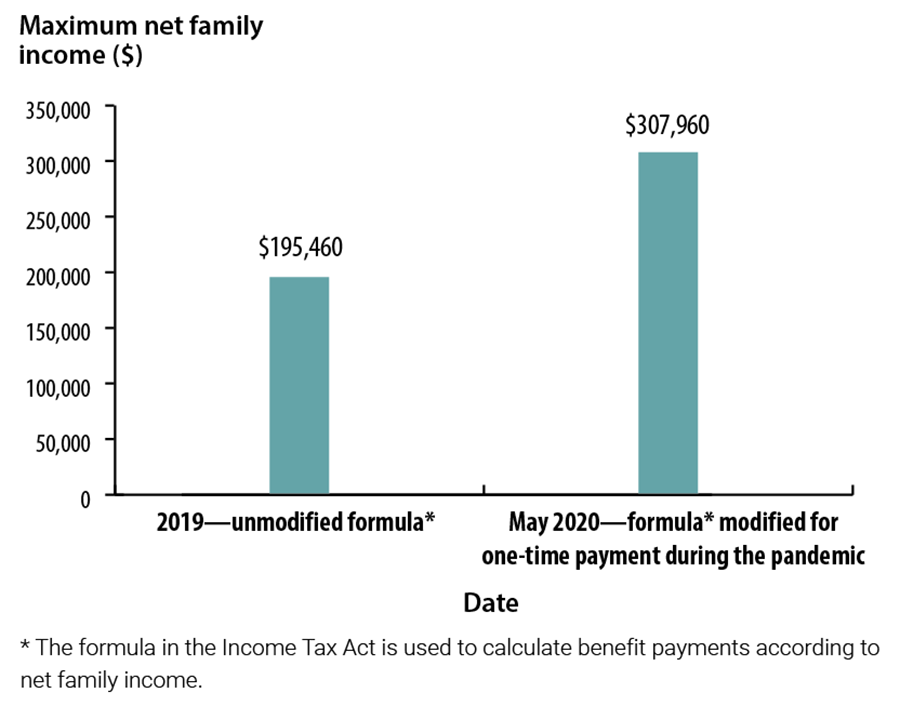

- 4.4—The government raised the maximum net family income allowable for receiving the May 2020 one-time payment during the coronavirus disease (COVID-19) pandemic

Introduction

Background

4.1 The Canada Child Benefit is a Government of Canada program that assists certain families needing financial support to raise their children. The program provides a non-taxable monthly payment to eligible families, based on their net family income. In the 2019–20 fiscal year, the program allocated $24.5 billion to 3.3 million families in Canada responsible for 5.9 million children under the age of 18.

4.2 The government introduced the program in 2016 to replace 3 different benefits:

- the Canada Child Tax Benefit

- the National Child Benefit Supplement

- the Universal Child Care Benefit

4.3 Since July 2018, the government indexed to inflation the maximum benefit amounts payable under the Canada Child Benefit. It also introduced income “thresholds” or levels above which payments would start to be reduced.

4.4 The Canada Revenue Agency administers the Canada Child Benefit. Its responsibilities include determining eligibility and payments to families and communicating with families regarding entitlements.

4.5 Our audit included an examination of measures taken in response to the coronavirus disease (COVID-19) pandemic. In May 2020, the government expanded the program to provide additional income support to families. The benefit amount in that month was increased by up to $300 per child.

4.6 In September 2015, Canada committed to achieving the United Nations’ 2030 Agenda for Sustainable Development. The Canada Child Benefit program supports the goal of no poverty (Goal 1) of the United Nations’ Sustainable Development Goals.

4.7 In the course of our work, we heard that certain vulnerable populations in Canada have difficulty accessing the Canada Child Benefit and similar programs. In the near future, the Office of the Auditor General of Canada is planning to conduct an audit on outreach activities by the Government of Canada to vulnerable populations.

Focus of the audit

4.8 This audit focused on whether the Canada Revenue Agency ensured that Canada Child Benefit recipients were eligible for the benefit and that payments were made in a timely and accurate manner.

4.9 This audit is important because the benefit is intended to help with the cost of raising children under 18 years of age. The Canada Child Benefit is a key public policy tool for reducing poverty and inequality by providing help to low-income families.

4.10 More details about the audit objective, scope, approach, and criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Overall message

4.11 Overall, we found that the Canada Revenue Agency managed the Canada Child Benefit program in a way that ensured accurate and timely payments to millions of eligible families.

4.12 Although eligibility assessment was effective, we identified opportunities for improving program efficiency. For example, we found that payments were sometimes issued on the basis of outdated information. Also, proof of birth was not always required at the time of application.

4.13 In May 2020, the government issued a one-time additional payment of up to $300 per child to help families during the coronavirus disease (COVID-19) pandemic. Close to 265,000 higher-income families not previously entitled under the Canada Child Benefit received payments totalling almost $88 million.

4.14 According to program eligibility conditions, benefit payments are supposed to go to the parent who is the primary caregiver for a child or children, where the parent is not otherwise a shared-custody parent. By law, the primary caregiver is presumed to be the female parent. Given the diversity of families today in Canada, this concept has had an impact on the administration of the program.

Benefit application and payment process

4.15 For eligible families, the Canada Child Benefit program provides a non-taxable monthly payment based on net family incomeDefinition 1. To be eligible (that is, to meet the program conditions), an applicant needs to

- live with a child who is under the age of 18

- have primary responsibility for the care and upbringing of the child

- be a resident of Canada for income tax purposes

- be (or have a spouse or common-law partner who is) a Canadian citizen, a permanent resident, a protected person under the Immigration and Refugee Protection Act, a temporary resident, or an Indigenous person who meets the definition of “Indian” in the Indian Act

4.16 The eligible person should apply for the program when

- a child is born

- a child starts to live with the applicant or returns to live with the applicant after temporarily living with someone else

- the applicant begins or changes a shared custody arrangement

- the applicant gains custody of a child

- the applicant, or his or her spouse or common-law partner, meets the eligibility conditions

4.17 On the basis of factors set out in the Income Tax Regulations, the Canada Revenue Agency defines the primary caregiver as the individual responsible for the care and upbringing of a child, including supervision of the child’s daily activities and needs—for example, arranging medical appointments and organizing child care. If the child lives with the female parent, the Income Tax Act provides that the female parent is presumed to have primary responsibility for the child; this is known as the “female presumption.”

4.18 There are 3 ways to apply for the Canada Child Benefit (Exhibit 4.1):

- automated benefits application: All provinces and the Northwest Territories transmit information from a child’s birth registration form to the agency for use as a benefit application.

- benefits online application: An individual submits an application online through the Canada Revenue Agency’s My Account web portal.

- mail-in application: An individual completes a paper application form and submits it by postal mail.

Exhibit 4.1—Benefit applications reached the Canada Revenue Agency through different channels

| Fiscal year | Number of applications received | |||

|---|---|---|---|---|

| Automated benefits applications | Benefits online applications | Mail-in applications | Total applications | |

| 2016–17 | 363,292 | 53,565 | 160,886 | 577,743 |

| 2017–18 | 351,082 | 65,757 | 138,505 | 555,344 |

| 2018–19 | 343,151 | 85,766 | 138,200 | 567,117 |

| 2019–20 | 351,196 | 107,802 | 154,020 | 613,018 |

Source: Information provided by Canada Revenue Agency

4.19 The agency processes applications in 3 tax centres located in Jonquière, Quebec; Sudbury, Ontario; and Winnipeg, Manitoba. The information required to process an application depends on the application method and the time elapsed since the child was born.

4.20 When all the program conditions are met, the amount payable will be calculated on the basis of the net family income reported on the applicant’s income tax return for the previous year, together with the income tax return of the applicant’s spouse or common-law partner, if any. The calculated amount will be paid in equal monthly amounts for a 12-month period from July to June.

4.21 For example, for payments made from July 2020 to June 2021, a recipient will receive monthly payments based on the net family income reported on the 2019 tax return. The higher the net family income, the smaller the benefit amount to be paid to the eligible parent. If one or both of the applicants did not file an income tax return, no payment will be made under the program.

Assessment of Canada Child Benefit eligibility was well managed

4.22 We found that the Canada Revenue Agency had effective systems and processes to assess the eligibility of Canada Child Benefit recipients. However, modifying certain aspects of the requirements and processes would improve the integrity of the program.

4.23 We visited tax centres where the agency processed applications for the program. Although first-level agents were responsible only for data entry and had to work quickly, we witnessed some of these agents taking the initiative to verify the information submitted. In our view, although not always exercised, this additional vigilance had the potential to strengthen the integrity of the program.

4.24 We saw some cases in our sample in which months passed before the agency was informed of a change in situation affecting a beneficiary’s eligibility for the program. We also noted that the agency kept a list of documents that could be provided to support the assessment of a beneficiary’s eligibility, but not all documents suggested were useful for this purpose.

4.25 The analysis supporting this finding discusses the following topics:

- Effective determination of eligibility

- Constraints on eligibility assessment

- Outdated information

- Limited value of some benefit eligibility documentation

4.26 This finding matters because efficient controls over eligibility help protect the integrity of the Canada Child Benefit program. They also reduce the amount of compliance review required and, in some cases, the financial burden on recipients who are later found not to be eligible and who then have to return the benefit amounts already paid to them. If payments are issued to someone who is ineligible or who later becomes ineligible because of a change in circumstances, the cost to the public purse could be as much as $100,000 in payments over time for each child concerned.

4.27 Our recommendation in this area of examination appears at paragraph 4.42.

Effective determination of eligibility

4.28 We found that the Canada Revenue Agency established control mechanisms for validating eligibility, including reviews of compliance and quality assessment.

4.29 We selected a representative sample of benefit applications and cases for the 2019–20 fiscal year. We assessed whether the program’s eligibility conditions had been met and whether they reflected the process described in the program’s operations manual. We found that the agency ensured that benefit recipients met the program’s eligibility criteria.

4.30 We also found that the agency conducted validations to determine eligibility after it began to issue the first payments to a recipient. In some cases, validations were performed at a later date on the basis of risk assessment. This approach was intentional; the agency’s aim was to start payments as soon as possible to help families.

4.31 The approach had the potential to increase the risk of undetected errors in the assessment of eligibility. Nevertheless, for the automated application process, we considered the balance between speed of payment and controls was acceptable. We considered that an application received through the automated benefits application process had a lower risk of errors because the information was provided by a provincial or territorial government.

Constraints on eligibility assessment

4.32 First-level agents at the Canada Revenue Agency were required to complete the initial processing of benefit applications in approximately 5 minutes. In this very limited time, they were expected to enter information from a paper application into an electronic database. The system logic then made the decision whether to approve the application, deny it, or refer the application to a higher level for further assessment.

4.33 We visited tax centres where we observed first-level agents processing applications for the program. Although they were responsible only for data entry and had to work quickly, we witnessed some of these agents taking the initiative to verify the information submitted. Although this vigilance was not performed in every case, it had the potential to identify applications requiring further review.

4.34 In our view, with more time to process benefit applications, first-level agents could better authenticate the information that is provided. For example, they could check whether another child associated with the same parents had been born within the previous 9 months. They could also check the validity of supporting documents, such as a birth certificate from another country, proof of residence in Canada, or a citizenship document. The additional information could improve the validation process.

4.35 Agents of all levels sought clarification when an application lacked the required information or contained information that was unclear, but what they were told was often not confirmed through documentation checks. For example, during our visits to the tax centres that processed Canada Child Benefit applications, we observed more senior agents calling applicants to obtain citizenship information and then entering this information in the database without requesting any supporting documentation. In our view, information in the agency’s databases needs to be accurate and supported by evidence so that Canadians maintain their trust in the sound administration of public funds used by this program.

4.36 In some cases, other branches of the agency and other federal departments were likely to have information that could support a benefit application—for example, renewal of a resident card. Access to this information would have enabled agents to assess eligibility with a higher level of confidence.

Outdated information

4.37 We found that the Canada Revenue Agency agents at more senior levels sometimes lacked the latest information when determining eligibility for the program and calculating payments. For example, in the sample we analyzed were instances in which the agency was not informed of changes, including the departure of a recipient from Canada. Payments continued until the agency received an adjustment to the account information or until the parent ceased filing a Canadian income tax return. In these circumstances, an amount would need to be repaid to the government.

4.38 In our opinion, the task of assessing eligibility in such cases was made more difficult because of limited information sharing between the agency and other federal departments. With a better information-sharing process that notified the agency when recipients left the country permanently, the agency would be able to update account information and ensure that the eligibility conditions were met. Another factor with the potential to affect benefit payments was a change in marital status or custody arrangement. The benefit payment would vary according to whether the parents were married, whether they had separated and only 1 parent had custody of the child, or whether they had separated and shared custody of the child on an equal or near-equal basis (Exhibit 4.2). If the information about marital status or custody arrangement was outdated, the payment amount or the recipient could be incorrect.

Exhibit 4.2—A change in marital status or custody arrangement would change the amount of a recipient’s benefit payment

Benefit payment according to marital status of parents with a child under the age of 6—scenarios based on 2019 figures

| Scenario 1: Parents are married |

Scenario 2: Parents have separated and only one parent has sole custody |

Scenario 3: Parents have separated but share custody |

|||

|---|---|---|---|---|---|

| Both parentsNote * | Parent A has sole custody | Parent B has sole custody | Parent A | Parent B | |

| Net family income | $100,000 | $30,000 | $70,000 | $30,000 | $70,000 |

| Monthly benefit payment | 100% of payment = $264.47 |

100% of payment = $563.75 |

100% of payment = $344.47 |

50% of payment = $281.88 |

50% of payment = $172.24 |

| Total yearly payment | $3,173.64 | $6,765.00 | $4,133.64 | $3,382.56 | $2,066.88 |

| $5,449.44 | |||||

Note: If the Canada Revenue Agency was missing up-to-date information about marital status or custody arrangement, it could have made payments for incorrect benefit amounts or paid the incorrect caregiver.

Source: The benefit calculator on the Canada Revenue Agency website

Limited value of some benefit eligibility documentation

4.39 We found that some of the documents from which applicants could choose to provide evidence of their benefit eligibility were of limited value. Also, proof of birth was not required at the time of application for a child under the age of 11 months who had been born in Canada.

4.40 The senior agents at the Canada Revenue Agency assessing eligibility had to exercise judgment with regard to the information provided. For the purpose of assessing eligibility conditions, more precisely who is primarily responsible for the care and upbringing of the child, certain documents that applicants might provide, such as a court order or a separation agreement, may not be sufficient on their own to determine eligibility. For example, for determining which parent had primary responsibility for the care of the child, the documents listed by the agency included

- court order and separation agreement

- registration form or receipt for an extracurricular activity

- any document showing that the child was living with the applicant

4.41 Some of these documents might not reflect the family’s real situation. For instance, proof of a child’s registration for an activity would show who paid for the activity. This document might not demonstrate that the child lived with the parent who paid.

4.42 Recommendation. To improve the administration of the Canada Child Benefit program, the Canada Revenue Agency should

- ensure that the list of documents that applicants can submit are suitable for assessing eligibility

- require valid proof of birth for all applications

- improve receipt of data from other government organizations to obtain greater assurance that the eligibility conditions are met

The agency’s response. Agreed. Given that the Office of the Auditor General of Canada observed instances in which Canada Revenue Agency agents assessed applications where they did not correctly apply the list of acceptable documents in determining eligibility, the agency will provide a reminder to all assessors. In addition, the agency will review the list as well as related training products and revise as necessary.

The agency will conduct a review to determine risks associated with the requirement to provide a valid proof of birth for all applications. The agency will also review the timing of when this documentation should be provided to validate and support the Canada Child Benefit application.

In addition, the agency will engage with its partners with the goal of improving data received to ensure Canada Child Benefit eligibility conditions are met. Lastly, the agency will continue to work with and support the 2 remaining territories in their implementation of the automated benefits application.

Benefit payments were accurate and timely

4.43 We found that the payments made to Canada Child Benefit recipients were accurate. The payments were made in a timely manner according to the service standards established by the Canada Revenue Agency.

4.44 We found that the system could process an automated benefits application in seconds, and a first-level agent could enter data from a paper application within 5 minutes. The service standard for the first payment was 8 weeks for an automated benefits application and a benefits online application and 11 weeks for a mail-in application from the date it was received by the Canada Revenue Agency.

4.45 The analysis supporting this finding discusses the following topics:

4.46 This finding matters because benefit recipients each have the right to be paid the amount to which they are entitled (that is, the correct amount according to the law), as stated in the Taxpayer Bill of Rights. Considering the purpose of the program, it is important that the first payment be made in the shortest possible time frame because families entitled to the benefit need the financial support to raise their children.

4.47 Once the agency determines that a benefit application meets the program’s eligibility conditions, benefit payments are calculated on the basis of net family income, using the formulas set out in the Income Tax Act. Benefit payments are issued around the 20th of each month and a week earlier in December.

4.48 We made no recommendations in this area of examination.

Accurate payments

4.49 We found that the Canada Revenue Agency accurately calculated the amount to which an eligible parent was entitled for the coming year. It did this by determining that a benefit applicant met the program’s eligibility conditions and by referring to the applicant’s income tax return for the previous year. Benefits were calculated for a 12-month period starting in July. Even if someone was found to be eligible for the benefit, net family income would determine how much that person was entitled to receive or whether any payment was to be made. The higher the net family income, the smaller the benefit amount to be paid to the eligible parent. The payment also varied according to the number of children in a family (Exhibit 4.3). This was in addition to variations according to the parents’ marital status and custody arrangement (see Exhibit 4.2).

Exhibit 4.3—Benefit payments varied according to the net family income and the number of children

Benefit payments for a married couple with different incomes and numbers of children under 6 years old

| Net family income | $75,000 | $150,000 | $225,000 | |||

|---|---|---|---|---|---|---|

| Number of children | 1 child | 2 children | 1 child | 2 children | 1 child | 2 children |

| Monthly benefit payment | $331.13 | $681.36 | $131.13 | $325.11 | None | None |

| Total yearly payment | $3,973.56 | $8,176.32 | $1,573.56 | $3,901.32 | None | None |

Source: The benefit calculator on the Canada Revenue Agency website

4.50 If up-to-date information was missing about net family income, number of children, marital status, or custody arrangement, the amount of the payment to a recipient could be affected. The payment might be stopped, or the amount issued might be incorrect—a situation that could require the recipient to repay a substantial amount to the government.

4.51 Payment depends on whether the applicant is eligible for the program and on the established entitlement, which is the correctly calculated amount according to the Income Tax Act. We found that once the agency determined that the eligibility conditions had been met and income tax returns confirmed the net family income, payments would be recalculated yearly and issued until there was a change of situation or the child reached age 18.

4.52 To test the accuracy of payments made to eligible recipients, we selected samples for the period from 1 April 2019 to 31 March 2020. For recipients in our samples, we obtained the net income of the primary caregiver and of that person’s spouse or partner as reported on their income tax returns, as well as the number of their qualified dependants. We then recalculated the payment amount using the formula in subsection 122.61(1) of the Income Tax Act.

4.53 Our recalculation of payments made for the selected samples showed that they were accurate.

4.54 When a child reaches the age of 18, the child’s primary caregiver or the shared-custody parent, as the case may be, is no longer eligible to receive the benefit for that child. In the samples we reviewed, we saw that payments stopped when a child turned 18, which meant that the control regarding a child’s age worked as intended.

Timely payments

4.55 We found that the Canada Revenue Agency met its timeliness standards for issuing payments under the program. The agency needed around 7 working days to prepare and send payment information to Public Services and Procurement Canada. In turn, that department generally required 2 business days to print cheques and prepare them for mailing. At the request of the Canada Revenue Agency, time was set aside for last-minute corrections to the payments. Any additional time between the printing of the cheques and the payment due date was for mail delivery across Canada; this could take up to 7 days.

4.56 Almost all payments under the program were issued around the 20th of the month and a week earlier in December. If the information did not arrive at the agency in time to meet the cut-off date, the payment would be listed for issuing the following month by Public Services and Procurement Canada. A delay might happen, for example, if the agency was processing a change request or an application for a child not previously covered.

4.57 To allow for all the time factors, the agency’s standards for issuing a first payment were 8 weeks from the date of processing for an automated benefits application and the benefits online application, and 11 weeks for a mail-in application. Agency staff could also issue payments manually in some circumstances.

One-time payment during the coronavirus disease (COVID-19) pandemic

The government used the Canada Child Benefit program to provide support to more families at the beginning of the pandemic

4.58 In March 2020, as part of Canada’s COVID-19 Economic Response Plan, the government announced that the Canada Child Benefit program would issue an additional one-time payment of up to $300 per child, based on a sliding scale of net family income. The program expansion was aligned with a policy change introduced by the government and with legislation amending the Income Tax Act. We found that the formula adopted for the additional payment allowed close to 265,000 higher-income families not previously entitled under the program to benefit from it. Payments to higher-income families amounted to almost $88 million.

4.59 The analysis supporting this finding discusses the following topic:

4.60 This finding matters because under the COVID-19 Economic Response Plan, the government aimed to help families with the high cost of taking care of their children during this challenging period.

4.61 The additional payment to help families during the pandemic was a one-time, non-taxable amount to be added to the Canada Child Benefit program’s May 2020 payment.

4.62 We made no recommendations in this area of examination.

One-time payment issued to families in May 2020

4.63 In March 2020, to allow for the one-time payment of up to $300 per child, Parliament temporarily changed the formula for calculating payments under the program. We found that the modified formula allowed recipients of the additional one-time payment to include families not previously entitled to the benefit because of their higher net family income. Our review of the data showed that close to 265,000 additional families received the May 2020 benefit payment, at a total cost of almost $88 million.

4.64 The agency followed the formula prescribed for the one-time payment, as set out in the March 2020 amendment to the Income Tax Act. The modified formula entitled families with higher net income to receive the one-time payment. For example, before the formula was amended, a family with 1 child under 6 years of age could receive benefits if its net family income did not exceed $195,460. The modified formula raised the maximum to $307,960 for the May 2020 one-time payment (Exhibit 4.4). In the case of a family with 1 child aged between 6 and 18, the modified formula raised the maximum net family income from $163,050 to $275,500 for the May 2020 one-time payment.

Exhibit 4.4—The government raised the maximum net family income allowable for receiving the May 2020 one-time payment during the coronavirus disease (COVID-19) pandemic

Note: Figures are for a family with 1 child under the age of 6.

Source: Canada Revenue Agency’s Canada Child Benefit formula

Exhibit 4.4—text version

This bar chart shows the maximum net family income allowable for a family with 1 child under the age of 6 to receive the Canada Child Benefit.

The formula in the Income Tax Act is used to calculate benefit payments according to net family income. Under the unmodified formula, the maximum net family income allowable in 2019 was $195,460. Under the formula modified for the one-time payment in May 2020 during the pandemic, the maximum net family income allowable was $307,960.

Source: Canada Revenue Agency’s Canada Child Benefit formula

Female presumption

Female presumption presented difficulties for applicants and the agency

4.65 Under the concept of female presumption, the Canada Revenue Agency directed Canada Child Benefit payments to the female partner when the presumption was determined to apply and was not rebutted on the basis of the information provided. We found that, in some samples, because the presumption was applied on the basis of the available information, the parent who in reality had primary responsibility for the care and upbringing of the child did not receive the payment initially. The concept of female presumption influenced the program’s eligibility conditions, which stated that an applicant must have primary responsibility for the care and upbringing of the child for whom the benefit was intended.

4.66 The analysis supporting this finding discusses the following topic:

4.67 This finding matters because the concept of female presumption might not reflect today’s reality. Today, families in Canada come in many different forms not envisaged only a short time ago. Laws, procedures, and systems have not always followed course with the changing reality of what constitutes a family.

4.68 After the agency determines the benefit amount and where the applicant is not a shared-custody parent, payments will be issued to the primary caregiver. In deciding who the primary caregiver is, the agency must refer to the Income Tax Act and its regulations. The act states that where the child resides with the female parent, the parent who primarily fulfills the responsibility for the care and upbringing of the child is presumed to be the female parent. The legislation sets out certain circumstances where the presumption does not apply.

4.69 Today, the concept of female presumption is still justified. On average, women in the workforce earn less than men. Most women also perform a disproportionate share of household tasks and child care. Directing benefit payments to the female parent helps with her financial security as the primary caregiver and helps her make her own financial decisions.

4.70 Our recommendation in this area of examination appears at paragraph 4.77.

Difficulties resulting from female presumption

4.71 We found that the Canada Child Benefit program remained bound by the traditional concept of female presumption. This concept appears in the Income Tax Act. Where the presumption is found to apply and is not rebutted, the program directs any payment to a female living with the child or children for whom the payment is made, because she is presumed to be the primary caregiver.

4.72 For a male parent to receive payment, he had to attach a signed letter from the female parent with whom he resided, stating that he is the parent who is primarily responsible for all the children in the home. This is also the case for a male parent when a new female partner lived with him. In the case of a same-sex couple, female presumption does not apply—the agent can assume the applicant is the primary caregiver.

4.73 The female presumption concept made it difficult for the Canada Revenue Agency to treat all applications equally in light of the diversity of families in Canada.

4.74 Our representative sample included cases in which female presumption was applied. In some reconstructed and blended families, it was the new female partner who received benefit payments based on the information available even if she was not, in reality, the primary caregiver. In these instances, we saw convoluted and confusing letters sent by the agency, informing the male partner about who would receive the benefit payment based on the information that the agency had and steps that could be taken to remain the primary caregiver according to the agency.

4.75 In its 2016–17 annual report, the Office of the Taxpayers’ Ombudsman noted complaints from male primary caregivers, maintaining that the female presumption concept had caused them hardship by requiring a male applicant to prove that he was the primary caregiver—a step not required of a female applicant.

4.76 To improve the efficiency of the process, the agency considered possibilities such as sending payments to the parent who applied for the benefit or issuing 2 payments per household for a blended family. As of the completion of our audit, there had been no change to the legislation.

4.77 Recommendation. The female presumption concept is a legislative requirement and only 1 payment per household can be issued under the Income Tax Act. The Canada Revenue Agency should enhance its procedures and communications to mitigate the confusion and sensitivities caused by this concept.

The agency’s response. Agreed. The Canada Revenue Agency follows a People First philosophy. In keeping with this philosophy, the agency will review procedures and communications tools, such as the Canada.ca website, applicable guides, and forms. The review will be to ensure that information is readily available to help everyone understand the steps required for the primary caregiver of a family to receive the Canada Child Benefit.

Conclusion

4.78 We concluded that the Canada Revenue Agency ensured that benefit recipients of the Canada Child Benefit program were eligible, and that payments were made in a timely and accurate manner. The Canada Revenue Agency had effective systems and processes to assess the eligibility of Canada Child Benefit recipients. Our audit also confirmed that benefit amounts were accurate and paid according to the agency’s service standards.

4.79 At the same time, we noted areas where the agency could improve the administration of the program by better managing the information used to assess eligibility and entitlement for the program.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada on the Canada Child Benefit program, administered by the Canada Revenue Agency. Our responsibility was to provide objective information, advice, and assurance to assist Parliament in its scrutiny of the government’s management of resources and programs, and to conclude on whether the Canada Child Benefit program complied in all significant respects with the applicable criteria.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard on Assurance Engagements (CSAE) 3001—Direct Engagements, set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office of the Auditor General of Canada applies the Canadian Standard on Quality Control 1 and, accordingly, maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from entity management:

- confirmation of management’s responsibility for the subject under audit

- acknowledgement of the suitability of the criteria used in the audit

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided

- confirmation that the audit report is factually accurate

Audit objective

The objective of this audit was to determine whether the Canada Revenue Agency ensured that benefit recipients of the Canada Child Benefit program were eligible and that payments were made in a timely and accurate manner.

Scope and approach

The audit of the Canada Child Benefit program focused on the Canada Revenue Agency’s compliance with applicable laws and regulations, the controls in place for the program, and the services offered to Canadians by the Canada Revenue Agency. The scope of the audit included the Benefit Programs Directorate and the Individual Compliance Directorate within the Canada Revenue Agency.

To ensure that eligible recipients received the amount to which they were entitled in a timely manner, the audit team

- identified ways to improve eligibility determination, efficiency, and payment processes

- reviewed available tools for assessing eligibility and processing files

- examined data analysis performed by the agency

- reviewed and assessed selected samples for determining benefit eligibility and payments

- reviewed the agency’s quality assurance practices and results

- reviewed the agency’s performance indicators against its service standards (internal and external)

For our examination, we selected the following samples from the program’s case files:

- representative samples from auto-generated files (applications under the automated benefits application and the benefits online application using My Account) for the 2019–20 fiscal year

- representative sample of closed files for the 2019–20 fiscal year

- targeted sample of May 2020 benefit payments during the coronavirus disease (COVID-19) pandemic that were not for the full amount of $300 per child

We interviewed Canada Revenue Agency employees involved at different levels in the Canada Child Benefit program. We also visited the agency’s tax centres in Jonquière (Quebec), Sudbury (Ontario), and Winnipeg (Manitoba), where we observed agents reviewing and assessing applications.

We did not examine similar provincial or territorial programs, the Canada Child Benefit inquiries line (call centre), objections and appeals related to the program, collection of overpaid benefit amounts, the Child Disability Benefit, or the Children’s Special Allowances.

We also did not examine Government of Canada outreach activities to vulnerable populations because these may be the subject of a separate audit in the near future.

Criteria

We used the following criteria to determine whether the Canada Revenue Agency ensured that benefit recipients of the Canada Child Benefit program were eligible and that payments were made in a timely and accurate manner:

| Criteria | Sources |

|---|---|

|

The Canada Revenue Agency ensures that Canada Child Benefit recipients meet the eligibility criteria. |

|

|

The Canada Revenue Agency ensures that Canada Child Benefit payments made to eligible recipients are accurate and timely. |

|

|

The Canada Revenue Agency service standards in place for eligibility and payments provide an accurate reflection of program performance. |

|

Period covered by the audit

The audit covered the period from 1 April 2019 to 31 March 2020 and the month of May 2020 only for the additional payment during the COVID-19 pandemic. This is the period to which the audit conclusion applies.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 11 January 2021, in Ottawa, Canada.

Audit team

Principal: Philippe Le Goff

Director: Lucie Després

Joyce Baker

Philippe-Antoine Charbonneau

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report, and the numbers in parentheses indicate the location of the related discussion.

Benefit application and payment process

| Recommendation | Response |

|---|---|

|

4.42 To improve the administration of the Canada Child Benefit program, the Canada Revenue Agency should

|

The agency’s response. Agreed. Given that the Office of the Auditor General of Canada observed instances in which Canada Revenue Agency agents assessed applications where they did not correctly apply the list of acceptable documents in determining eligibility, the agency will provide a reminder to all assessors. In addition, the agency will review the list as well as related training products and revise as necessary. The agency will conduct a review to determine risks associated with the requirement to provide a valid proof of birth for all applications. The agency will also review the timing of when this documentation should be provided to validate and support the Canada Child Benefit application. In addition, the agency will engage with its partners with the goal of improving data received to ensure Canada Child Benefit eligibility conditions are met. Lastly, the agency will continue to work with and support the 2 remaining territories in their implementation of the automated benefits application. |

Female presumption

| Recommendation | Response |

|---|---|

|

4.77 The female presumption concept is a legislative requirement and only 1 payment per household can be issued under the Income Tax Act. The Canada Revenue Agency should enhance its procedures and communications to mitigate the confusion and sensitivities caused by this concept. (4.71 to 4.76) |

The agency’s response. Agreed. The Canada Revenue Agency follows a People First philosophy. In keeping with this philosophy, the agency will review procedures and communications tools, such as the Canada.ca website, applicable guides, and forms. The review will be to ensure that information is readily available to help everyone understand the steps required for the primary caregiver of a family to receive the Canada Child Benefit. |