2019 Spring Reports of the Auditor General of Canada to the Parliament of Canada Independent Auditor’s ReportReport 3—Taxation of E-Commerce

2019 Spring Reports of the Auditor General of Canada to the Parliament of CanadaReport 3—Taxation of E-Commerce

Independent Auditor’s Report

Introduction

Background

3.1 The retail landscape in Canada is changing. More people are making purchases online. The increase in e-commerce creates challenges for assessing and collecting the goods and services tax (GST) and the harmonized sales tax (HST). This is particularly true for physical products and digital products and services—such as music and videos—that consumers in Canada purchase from foreign vendorsDefinition i.

3.2 E-commerce includes

- physical products purchased online;

- digital products and services purchased and delivered online, such as video streaming; and

- supplies purchased online, such as accommodation sharing (also known as short-term home rentals) and ride sharing.

3.3 The volume of low-value shipments imported by courier into Canada offers some insight into the growth of e-commerce. In the 2017–18 fiscal year, there were 46 million low-value shipments sent by courier from abroad and received in Canada compared with 35 million just five years earlier.

3.4 Statistics Canada reported that for the 12 months ending in June 2018, the total annual spending by Canadians on music and video downloads and streaming services was $2 billion. It also reported that in 2018, accommodation sharing in Canada generated an estimated $2.8 billion in revenues.

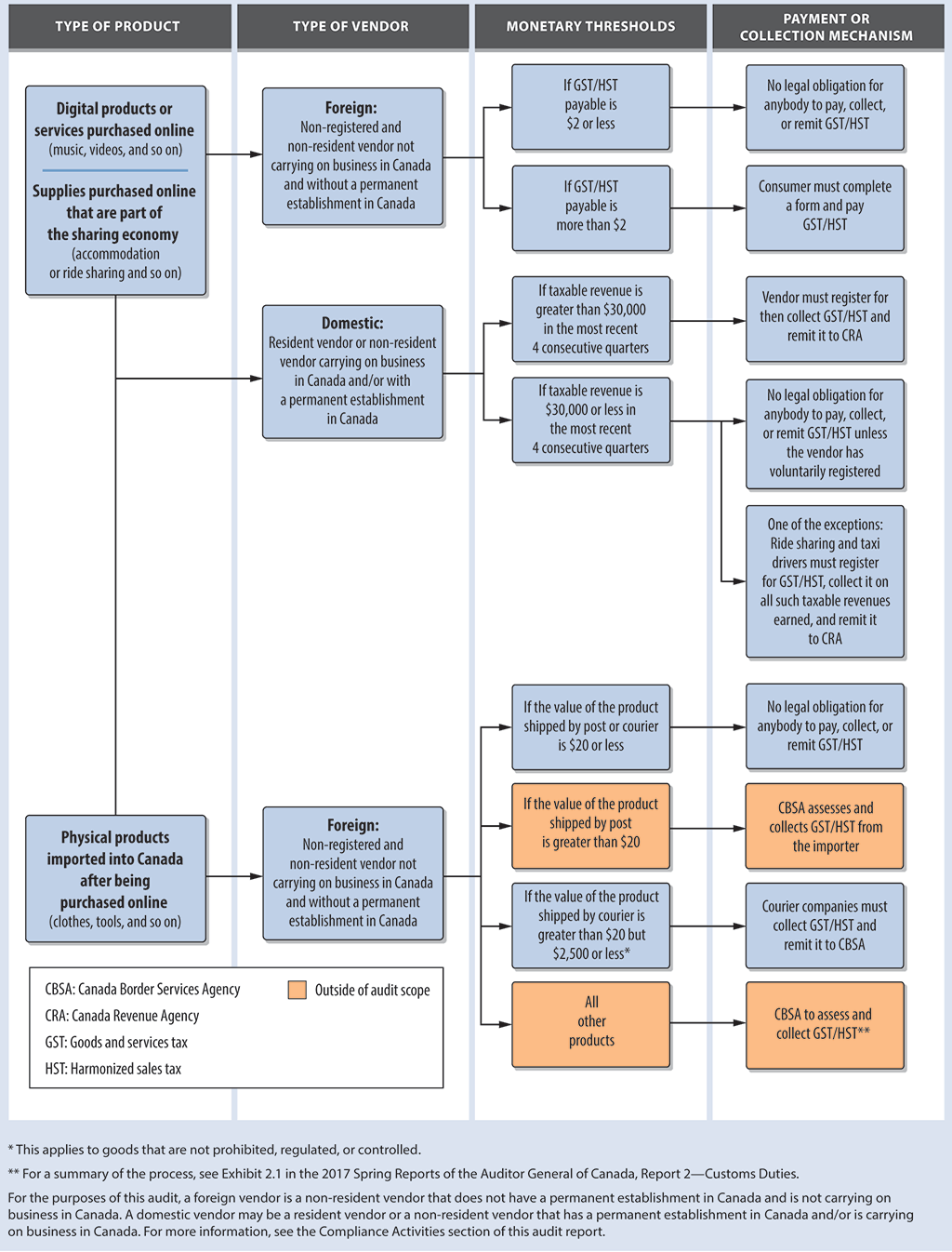

3.5 In Canada, many factors influence an individual’s or a business’s legislative obligations to collect the GST/HST or remit it to the government (Exhibit 3.1).

Exhibit 3.1—Current legislative obligations for the GST/HST in Canada are complex for vendors and consumers

Source: Based on information from the Excise Tax Act and related guidance, publications, and information circulars from the Canada Revenue Agency, including its website, and on information from selected relevant D Memoranda and other information from the Canada Border Services Agency

Exhibit 3.1—text version

This chart shows current legislative obligations for the goods and services tax, or the GST, and the harmonized sales tax, or the HST, in Canada for foreign and domestic vendors and for consumers.

A foreign vendor is a non-resident vendor that does not have a permanent establishment in Canada and is not carrying on business in Canada. A domestic vendor may be a resident vendor or a non-resident vendor that has a permanent establishment in Canada and/or is carrying on business in Canada.

The following monetary thresholds and payment or collection mechanisms apply to a foreign vendor of digital products or services purchased online (music, videos, and so on) or to a foreign vendor of supplies purchased online that are part of the sharing economy (accommodation or ride sharing and so on):

- If the GST/HST payable is $2 or less, then there is no legal obligation for anybody to pay, collect, or remit the GST/HST.

- If the GST/HST payable is more than $2, then the consumer must complete a form and pay the GST/HST.

The following monetary thresholds and payment or collection mechanisms apply to a domestic vendor of digital products or services purchased online (music, videos, and so on); to a domestic vendor of supplies purchased online that are part of the sharing economy (accommodation or ride sharing and so on); or to a domestic vendor of physical products imported into Canada after being purchased online (clothes, tools, and so on):

- If taxable revenue is greater than $30,000 in the most recent 4 consecutive quarters, then the vendor must register for then collect the GST/HST and remit it to the Canada Revenue Agency.

- If taxable revenue is $30,000 or less in the most recent 4 consecutive quarters, then there is no legal obligation for anybody to pay, collect, or remit the GST/HST unless the vendor has voluntarily registered. One of the exceptions is that ride sharing and taxi drivers must register for the GST/HST, collect it on all such taxable revenues earned, and remit it to the Canada Revenue Agency.

The following monetary thresholds and payment or collection mechanisms apply to a foreign vendor of physical products imported into Canada after being purchased online (clothes, tools, and so on):

- If the value of the product shipped by post or courier is $20 or less, then there is no legal obligation for anybody to pay, collect, or remit the GST/HST.

- If the value of the product shipped by post is greater than $20, then the Canada Border Services Agency assesses and collects the GST/HST from the importer. (This monetary threshold and collection mechanism is outside the audit scope.)

- If the value of the product shipped by courier is greater than $20 but $2,500 or less, and the product is not prohibited, regulated, or controlled, then the courier companies must collect the GST/HST and remit it to the Canada Border Services Agency.

- For all other physical products imported into Canada after being purchased online (clothes, tools, and so on), the Canada Border Services Agency is to assess and collect the GST/HST. For a summary of the process, refer to Exhibit 2.1 in the 2017 Spring Reports of the Auditor General of Canada, Report 2—Customs Duties. (This monetary threshold and collection mechanism is outside the audit scope.)

For more information about foreign and domestic vendors, refer to the Compliance Activities section of this audit report.

Source: Based on information from the Excise Tax Act and related guidance, publications, and information circulars from the Canada Revenue Agency, including its website, and on information from selected relevant D Memoranda and other information from the Canada Border Services Agency

3.6 Canada Revenue Agency. The Canada Revenue Agency administers the GST for the Government of Canada and the HST for provinces where applicable. The Agency is responsible for adapting its compliance strategies to detect non-compliance and to enforce deterring measures for e-retailers who should remit the GST/HST under the Excise Tax Act.

3.7 Canada Border Services Agency. The Canada Border Services Agency facilitates and oversees trade across Canada’s border. The Agency is responsible for validating and collecting the sales taxes owed to the Government of Canada on imported low-value shipments sent by courier.

3.8 Department of Finance Canada. The Department of Finance Canada helps the Government of Canada develop and implement tax policies and programs. The Department is responsible for providing advice on measures to enhance the fairness, neutrality, competitiveness, and efficiency of Canada’s sales tax system.

Focus of the audit

3.9 This audit focused on whether, according to their respective roles and responsibilities, the Canada Revenue Agency, the Canada Border Services Agency, and the Department of Finance Canada ensured that the sales tax system for e-commerce was neutral (treated all vendors equally with regard to the GST/HST) and that the GST/HST tax base (everything that is taxable) was protected.

3.10 This audit is important because e-commerce is expanding rapidly. The Canadian sales tax system must keep pace with e-commerce and adapt to the challenges and opportunities it presents. The tax base must be protected so governments can fund vital public services, such as social programs. The Government of Canada must ensure that everyone who should remit sales taxes does so and that the taxes are collected fairly and effectively.

3.11 We did not examine the Canada Border Services Agency’s compliance activities related to commercial and postal imports, nor did we audit the corporate income tax of businesses involved in e-commerce. Moreover, we did not examine the Canada Revenue Agency’s collections processes.

3.12 More details about the audit objective, scope, approach, and criteria are in About the Audit at the end of this report.

Findings, Recommendations, and Responses

Overall message

3.13 Overall, we found that the Canadian sales tax system did not keep pace with the rapidly evolving digital marketplace. On the basis of publicly available data, we estimated losses of $169 million in the GST on foreign digital products and services sold in Canada in 2017. In addition, the federal government could not assess and collect all sales taxes on e-commerce transactions.

3.14 We found that existing legislation, combined with the Canada Border Services Agency’s poor data management of low-value shipments imported into Canada by courier companies, placed Canadian businesses at an unfair disadvantage in relation to foreign vendors. According to the Department of Finance Canada, the situation could have encouraged domestic vendors to move their operations abroad and could have discouraged foreign investment in Canada.

3.15 The Canada Border Services Agency was aware that some courier companies were likely not remitting all sales taxes on low-value shipments into Canada. However, we found that the Agency did not step in, despite a significant increase in the volume of shipments declared as low value coming into the country.

3.16 In addition, we found that the Canada Revenue Agency undertook few activities to ensure that e-commerce vendors—including accommodation sharing vendors—registered for, collected, and remitted sales taxes when required. The Agency could not follow Quebec’s and British Columbia’s initiatives to reach out to prominent e-commerce platforms to ask them to voluntarily collect and remit the GST/HST on behalf of vendors on their platforms.

Canadian sales tax system

The Department of Finance Canada conducted sound analyses and identified problems with the sales tax system

3.17 We found that the Department of Finance Canada conducted sound analyses on the implications of e-commerce on GST and HST obligations, including the impact on foreign vendors selling products and services to Canadians and the consequences for domestic vendorsDefinition ii.

3.18 On the basis of publicly available data, we estimated losses to the federal government of $169 million in the GST on foreign digital products and services sold in Canada in 2017. According to the Department of Finance Canada, the sales tax system could have discouraged foreign direct investment in Canada, because foreign vendors could have benefited from not having to collect and remit the GST/HST, while domestic vendors were required to collect and remit those taxes. According to the Department, the sales tax system could have also encouraged domestic vendors to move their operations to other countries to avoid the requirement to collect and remit the GST/HST.

3.19 Our analysis supporting this finding presents what we examined and discusses the following topics:

- Estimate of lost sales tax revenues

- Negative impacts of the non-taxation of imported digital products and services

3.20 This finding matters because with e-commerce rapidly growing, sound analyses are needed to ensure that businesses are treated consistently under the GST/HST framework. It is also important that Canada’s tax base be preserved to ensure that vital public services are funded.

3.21 Many countries have introduced measures to collect sales taxes, when applicable, on imported digital products on the same basis and at the same rates as domestic products and services. These measures ensured tax neutrality (equal treatment of vendors with regard to the GST/HST) and protected the tax base. The Organisation for Economic Co-operation and Development (OECD) indicated that the most effective way to collect sales taxes, such as the GST/HST, on cross-border business-to-consumer purchases was to require the foreign vendor to register for, collect, and remit the tax according to where the product or service is consumed.

3.22 The OECD also recommended limiting the compliance burden on foreign vendors, because they may have sales tax obligations in multiple jurisdictions. According to the OECD, one of the ways to improve the compliance burden is to implement a simplified registration system for vendors. Simplified registration

- requests only necessary information from the registrant,

- allows payment in any major currency,

- removes requirements for tax invoices,

- clearly defines record-keeping requirements,

- makes information on how to register readily available, and

- allows electronic registration.

3.23 In 2018, the OECD surveyed countries with a sales tax to see whether they implemented a simplified registration system for imported business-to-consumer digital products and services. Among the 60 countries that responded, 35 had simplified registration systems for foreign vendors. In addition, for 2 countries, implementation of a simplified registration system was in progress as of March 2018. Sixteen countries used a different mechanism to collect sales taxes, and 5 countries responded “Not Applicable.” Canada was 1 of 2 countries still relying on consumers to voluntarily declare that they owed taxes and to remit them to the government.

3.24 To implement a simplified registration system, other jurisdictions—internationally and in the province of Quebec—adapted their legislation to require foreign businesses to register for, collect, and remit sales taxes regardless of whether they are carrying on business or have a permanent establishment in their jurisdictions.

3.25 The Quebec government estimated that in 2017, it lost a total of $270 million in Quebec sales tax (QST) from vendors that were doing business in the province but were without a physical or significant presence. In 2018, under its QST legislation, the Quebec government implemented a requirement for foreign vendors without a physical or significant presence in Quebec to register for and collect the QST using a simplified registration system. The requirement took effect on 1 January 2019. To encourage compliance, the Quebec government reached agreements with foreign vendors that were selling digital products and services in the province.

3.26 We made no recommendations in this area of examination.

3.27 What we examined. We examined whether the Department of Finance Canada conducted sound analyses to provide advice on the Canadian sales tax system. Such analyses and advice are needed to ensure that businesses are treated equally with regard to the GST/HST on e-commerce transactions, and that the tax base is preserved.

3.28 Estimate of lost sales tax revenues. The Department of Finance Canada calculated the GST tax gap—or the difference between the GST amount that could have been collected and the amount actually collected. However, there was no public report estimating the GST tax gap on e-commerce. On the basis of publicly available data from various sources, we estimated losses to the federal government of $169 million in the GST on foreign digital products and services sold in Canada in 2017.

3.29 Negative impacts of the non-taxation of imported digital products and services. We found that the Department of Finance Canada analyzed the impacts on domestic vendors of the non-taxation of imported digital products and services. To do so, the Department considered international best practices and worked with the Canada Revenue Agency to analyze options for GST/HST administration in Canada. This analysis looked at ways to ensure consistent treatment of domestic and foreign vendors and their obligation to collect the GST/HST.

3.30 We found that the Department of Finance Canada identified the consequences of not taxing digital products and services imported from foreign vendors, including the following:

- Unfair competition. Unlike Canadian vendors, foreign vendors were not subject to the GST/HST. For example, a video streaming vendor from another country could offer a service that is similar to a Canadian vendor’s without being required to collect and remit the GST/HST from consumers. The result of this taxation inequity could be unfair competition for some vendors located in Canada.

- Impediment to foreign direct investment in Canada. Carrying on business in Canada or having a permanent establishment in Canada requires companies to collect the GST/HST on digital products and services sold. This requirement could result in fewer international companies wanting to invest in Canada, because they are not required to collect and pay the GST/HST if they operate from abroad. Similarly, Canadian businesses could see an incentive to move their operations outside Canada to avoid the requirement to collect and remit the GST/HST on the digital products and services they sell in Canada. This could lead to fewer jobs in Canada if companies choose to operate outside our borders.

Compliance activities

The Canada Revenue Agency had limited authority to assess and collect the GST/HST in e-commerce

3.31 We found that the Canada Revenue Agency identified the digital commerce and the sharing economy, which includes accommodation sharing, as risks in its corporate risk profiles. We found, however, that the Agency had undertaken very few compliance activities to determine whether vendors had to register for the GST/HST. We also found that the Agency did not have the legislative authority to require foreign vendors of physical and digital products to register for, collect, and remit the GST/HST.

3.32 We also found that the Agency lacked the legislative authority or flexibility to implement compliance practices that have been effective in other jurisdictions, such as simplified registration or a direct access to third-party data to detect non-compliance with tax laws. The Agency had not used the limited third-party data it had to conduct compliance activities for the GST/HST as of 27 March 2019.

3.33 Our analysis supporting this finding presents what we examined and discusses the following topics:

- GST/HST compliance on physical products

- GST/HST obligations for digital products

- Practices to facilitate GST/HST compliance

3.34 This finding matters because traditional compliance practices that are allowed under Canada’s current sales tax system may not work to detect and discourage non-compliance with the obligations to collect and remit the GST/HST for some e-commerce vendors, which could lead to lost tax revenues.

3.35 The Canada Revenue Agency administers the GST for the Government of Canada and the HST for provinces where applicable. The Agency is responsible for adapting its compliance practices to detect and discourage non-compliance for e-retailers that should remit the GST/HST under the Excise Tax Act.

3.36 Under the Excise Tax Act, a non-resident vendor is required to register for, collect, and remit the GST/HST if both of the following conditions are met (Exhibit 3.1):

- the vendor is carrying on business in Canada or has a permanent establishment in Canada, and

- the vendor earned more than $30,000 in taxable revenues in the most recent four consecutive quarters.

3.37 The Excise Tax Act does not define “carrying on business.” As a result, the interpretation of “carrying on business” has fallen to Canada Revenue Agency policy and court decisions. The Agency lists a number of factors to determine whether a foreign vendor is carrying on business in Canada for the purposes of the GST/HST, including but not limited to

- place of payment,

- place of delivery,

- location of employees,

- place of manufacturing,

- place of purchase,

- location of assets, and

- place where the service is performed.

3.38 Under the Excise Tax Act, non-resident vendors with a permanent establishment in Canada are deemed to be residents of Canada in respect of their activities carried on through that establishment. If they earned more than $30,000 in worldwide taxable revenues through that establishment in the most recent four consecutive quarters, they are required to register for the GST/HST. Examples of permanent establishments include a facility, a branch, or an office in Canada.

3.39 For physical products imported into Canada and supplied by foreign vendors, the Canada Revenue Agency does not have the legislative authority to require foreign vendors to register for, collect, and remit the GST/HST. It is the Canada Border Services Agency’s responsibility to validate and collect the GST/HST owed to the Government of Canada on imported shipments.

3.40 To enforce Canada’s tax laws, the Canada Revenue Agency undertakes compliance activities. The Agency may

- conduct a thorough audit of the taxpayer’s books and records to ensure the correct amounts were calculated and reported,

- compare information from third parties to determine whether the GST/HST was accurately reported, or

- conduct a more narrow review to validate whether a business should register to collect and remit the GST/HST—or to identify registrants who do not file their GST returns.

3.41 Our recommendations in this area of examination appear at paragraphs 3.54 and 3.55.

3.42 What we examined. We examined whether the Canada Revenue Agency adapted its compliance strategies to ensure that the GST/HST collected from e-commerce could be assessed in a consistent manner.

3.43 GST/HST compliance on physical products. The Canada Revenue Agency had the legislative authority to conduct compliance activities to determine whether vendors of physical products were foreign or domestic and were therefore required to register for the GST/HST. These compliance activities were identified as key controls in the Agency’s corporate risk profiles. We found that, even though the Agency identified digital commerce as a risk in its corporate risk profiles, it had very few compliance activities in this area.

3.44 The Agency told us that it did not track the number of audits it completed of e-commerce vendors. According to its 2018–19 corporate risk profile, the Agency ranked digital commerce in the top three risks in terms of likelihood of occurrence. The Agency had action plans to mitigate the risk that traditional compliance practices may not work to detect and discourage non-compliance with the obligations to collect and remit the GST/HST for some e-commerce vendors.

3.45 GST/HST obligations for digital products. For digital products, such as video streaming services, the Canada Revenue Agency had the legislative authority to conduct compliance activities to determine whether vendors were foreign or domestic. This authority allowed the Agency to determine whether vendors were required to register for the GST/HST. These compliance activities were identified as key controls in the Agency’s corporate risk profile. Although the Agency identified digital commerce as a risk in its corporate risk profiles, we found that it had very few compliance activities to evaluate whether vendors of digital products should register for the GST/HST.

3.46 For digital products and services purchased by consumers in Canada from foreign vendors that were not carrying on business in Canada or did not have a permanent establishment in Canada, consumers had to complete a form and remit the applicable GST/HST directly to the Canada Revenue Agency if the taxes owed exceeded $2.00 (Exhibit 3.1). For example, a consumer in Nova Scotia, where there is a 15% HST rate, would have to pay taxes if spending more than $13.33 per month on digital products. This meant that if this consumer had a video streaming subscription for $10.00 per month and a music streaming subscription for $3.50 per month, the consumer was required to complete the form and remit $2.02 of the GST/HST to the Agency every month.

3.47 We found that consumers rarely completed the form and rarely remitted the GST/HST to the Agency. According to Statistics Canada, two thirds of adults in Canada purchased digital products from both foreign and domestic vendors between July 2017 and June 2018. We found, however, that Canadians submitted only 524 GST/HST forms for purchases made from foreign and domestic vendors in the 2017–18 fiscal year.

3.48 This practice of requiring consumers to self-assess the GST/HST is at odds with the recommendation from the Organisation for Economic Co-operation and Development (OECD). The OECD recommends that, when required, digital product vendors collect and remit the sales tax on behalf of consumers in jurisdictions where products and services purchased from foreign vendors are subject to tax.

3.49 Practices to facilitate GST/HST compliance. Although the Agency contributed to the OECD guidelines on sales tax on electronic commerce, it did not have the legislative authority to implement these practices in Canada at the time of our audit. In our view, these practices would facilitate the collection of the GST/HST. Many countries and jurisdictions, such as Quebec, adopted these OECD guidelines and introduced initiatives, such as simplified registration. On the basis of other OECD work, Australia required platforms—if they allowed foreign vendors to sell physical products directly to consumers in Australia—to collect and remit sales taxes.

3.50 In accommodation sharing, the law may require that certain taxpayers in Canada who rent their accommodations on a short-term basis register for, collect, and remit the GST/HST, if applicable (Exhibit 3.1). We found that, although the Canada Revenue Agency identified the sharing economy as a risk in its annual corporate risk profiles, it had no planned compliance activities targeted specifically at the accommodation sharing sector. Statistics Canada reported that this sector generated revenues of $2.8 billion in Canada in 2018, yet we found that the Canada Revenue Agency audited only four property management companies. The goal of the four test audits was to determine the scope of the risk the sharing economy posed. The Agency assessed additional revenues as a result of these four audits. The Agency told us that it may have completed other audits in the accommodation sharing sector, but it did not track this information.

3.51 Some jurisdictions, such as British Columbia, reached an agreement with a major foreign accommodation sharing platform. This agreement allowed the platform, which processes payments, to voluntarily collect the provincial sales tax (PST) and remit it directly to the government. The Canada Revenue Agency did not ask accommodation sharing platforms that process payment transactions to voluntarily collect and remit the GST/HST on behalf of homeowners. The Agency told us that it did not have the legislative authority to require platforms to enter into such agreements.

3.52 We also found that the Canada Revenue Agency had limited authority to collect data from third parties, such as banks and payment processors, compared with tax agencies in other countries. In contrast, more than 30 jurisdictions received third-party data related to value-added or sales tax invoices to complete compliance activities. For example, in the United States, all USamerican payment processors must provide information to the Internal Revenue Service. Payment processors are required to report gross payments to sellers that receive more than US$20,00020 thousand dollars american and more than 200 separate payments in a calendar year.

3.53 In one case, the Canada Revenue Agency had to get a federal court order and needed two years to require a payment processing company to disclose information about business account holders that received or sent a payment through their accounts. We found that the Agency received the data in January 2018. Although the Agency intended to use third-party data to identify non-compliance for the GST/HST on e-commerce, it had not done so as of 27 March 2019. In our view, increased access to third-party information would enable the Canada Revenue Agency to better detect and deter non-compliance.

3.54 Recommendation. Within its legislative authority, the Canada Revenue Agency should expand its compliance activities and leverage available third-party data to enhance its ability to detect and deter non-compliance for the GST/HST in e-commerce, including accommodation sharing.

The Canada Revenue Agency’s response. Agreed. On the basis of the current legislation, the Canada Revenue Agency’s compliance actions to date have been fully satisfactory. The Agency has already identified the e-commerce sector as a risk. Its efforts to address non-compliance in this sector, as supported by educating taxpayers on their GST/HST obligations and conducting test audits, is commensurate with the level of risk of non-compliance and the tax dollars at risk. These efforts allow the Agency to ensure that focus remains on files with the highest risk of non-compliance while promoting a fair tax system for all Canadians. The Office of the Auditor General of Canada estimated losses of $169 million in the GST on foreign digital products and services sold in Canada in 2017. This represents a small fraction of the $4.9 billion in the GST/HST gap that was estimated in 2014 (see the “Tax Gap: A Brief Overview” page on the Agency’s website). Since the Agency expects the scale of e-commerce to continue to grow, the Agency will develop a dedicated compliance strategy to better detect and address non-compliance for the GST/HST in e-commerce and will continue to expand its compliance actions, including the better leveraging of third-party data. The strategy will further support and complement existing compliance efforts undertaken by the Agency to address the non-compliance within the sector.

3.55 Recommendation. The Canada Revenue Agency should implement mechanisms to track, monitor, and report the number of compliance activities it conducts to manage the risk of non-compliance in e-commerce.

The Canada Revenue Agency’s response. Agreed. The Canada Revenue Agency will analyze its tracking and monitoring methodology with respect to the compliance activities it conducts to manage the risk of non-compliance in e-commerce. As similar recommendations were made in the 2018 Fall Reports of the Auditor General of Canada, Report 7—Compliance Activities—Canada Revenue Agency, initiatives being implemented as part of the Agency’s response to those recommendations will align with this current recommendation.

The Canada Border Services Agency could not validate the sales taxes received on imported low-value shipments sent by courier

3.56 We found that the Canada Border Services Agency poorly managed the Courier Low Value Shipment Program data. The Agency relied on the good faith of courier companies to declare and remit the sales taxes they collected from consumers. Even though the Agency had indications that courier companies did not declare the full taxes owing to the government, officials did nothing to resolve the issue. In addition, we found that the Agency could not ensure that the amount of provincial sales taxes and the provincial portion of the HST were accurate.

3.57 Our analysis supporting this finding presents what we examined and discusses the following topics:

- Poor data management of the Courier Low Value Shipment Program

- Warning signs related to incomplete declarations of sales taxes

- Accuracy of provincial sales taxes not validated

3.58 This finding matters because if nothing is done to fix the situation, the sales tax revenues lost on low-value shipments to Canada involving courier companies may grow as the volume of e-commerce increases.

3.59 The Canada Border Services Agency manages the Courier Low Value Shipment Program. Implemented in 1993, its intent was to simplify the process of importing low-value products—not exceeding $2,500—into Canada and to help alleviate the strain on Agency systems by streamlining the processing of shipments from authorized courier companies. Under the program,

- products valued at $20.00 or less were not taxed, and

- only products valued between $20.01 and $2,500.00 were taxed.

3.60 Under the program, the importer or broker is responsible for assessing the sales taxes owing, collecting the revenues owed, and remitting the funds collected to the Canada Border Services Agency.

3.61 Most participating courier companies have their own proprietary systems to track shipments. They include summary information about each shipment in their systems, which can be accessed at each designated Canada Border Services Agency point of entry. This information allows border services officers to manually select shipments for inspection before shipments cross the border.

3.62 In addition, the courier companies provide consolidated accounting information on their shipments every month to the Canada Border Services Agency. This information supports the amounts of sales taxes remitted to the Agency by the participating courier companies.

3.63 Our recommendation in this area of examination appears at paragraph 3.73.

3.64 What we examined. We examined whether the Canada Border Services Agency validated and collected the sales taxes owed to the Government of Canada on imported low-value shipments sent by courier.

3.65 Poor data management of the Courier Low Value Shipment Program. We found that the Canada Border Services Agency poorly managed the Courier Low Value Shipment Program data:

- The Agency required only consolidated summary information about sales taxes paid, even though participating courier companies had detailed information about imported shipments in their own computer systems. With this limited information, it was impossible for the Agency to automatically trace, compare, and validate information to confirm the sales taxes owed and to ensure the courier companies remitted the sales taxes to the government. For example, while processing sales tax refunds when consumers returned physical products to a foreign vendor, the Canada Border Services Agency asked for the document showing the amount of taxes the consumer claimed to have paid to the courier company at the time of importing the goods. However, the Agency could not easily verify that the courier company had accounted for and paid those sales taxes in the first place, because the information was not readily available on the Agency’s system.

- The Agency was unable to easily validate information on shipments, such as value, quantity, and type of product, because it did not require invoices for each transaction. Internationally, requiring e-invoicing is more prevalent as a way to improve compliance with sales tax obligations. International trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership and the Canada–United States–Mexico Agreement, did not limit the Agency’s authority to request invoices for each transaction.

- The Agency reviewed the Courier Low Value Shipment Program in 2009 and determined that it needed an automated system to manage the high volumes of packages that it had to process in short time frames. However, we found that the Agency did not take any action to automate its systems.

- The Agency relied on the good faith of participating courier companies to declare and remit the correct sales taxes due. In addition, we found that the Agency did not have overdue payment reports for the Courier Low Value Shipment Program accounts within its systems.

3.66 Warning signs related to incomplete declarations of sales taxes. Among the 46 million shipments that entered Canada under the Courier Low Value Shipment Program in the 2017–18 fiscal year, 16 million had declared values of $20 or less, which meant there were no taxes to remit (Exhibit 3.1). We found that the number of shipments valued at $20 or less under this program increased by 4 million compared with the 2016–17 fiscal year. The Agency did not conduct any analysis to determine why there was such a large increase in non-taxable shipments.

3.67 In the 2013–14 fiscal year, the Canada Border Services Agency’s border services officers assessed a selection of high-risk shipments. They found that 13,515 shipments were undervalued, and that the real total value of the shipments was $13.5 million, or 17 times larger than the declared value of $800,000.

3.68 Between 2014 and 2018, the Canada Border Services Agency conducted three compliance exercises that randomly sampled shipments in the Courier Low Value Shipment Program. In fall 2016, for example, the Agency analyzed a selection of three couriers’ shipments to determine compliance with the program. It found that the value was inaccurate in 22% of sampled shipments declared as being valued between $20 and $2,500. Although the Agency identified this as a concern, it did not take action. In our opinion, this significant non-compliance rate should have triggered a broad review of the program. In March 2019, at the end of the audit, Agency officials presented us with a basic e-commerce strategy that had been in development since 2016. The purpose of the strategy was to address out-of-date business processes and system capabilities, which contributed to revenue loss. As of 27 March 2019, the Agency had not formally approved this strategy or developed any implementation or business plans.

3.69 Accuracy of provincial sales taxes not validated. We found that the Canada Border Services Agency could not determine whether it had collected the right amount of provincial sales taxes on behalf of British Columbia, Manitoba, Quebec, and Saskatchewan, as the Agency did not validate those numbers.

3.70 We also found that, in accordance with the sales tax collection agreements with the provinces, the Agency collected only the GST, and not the provincial sales tax (PST), for courier shipments destined for a province with the PST but imported through a province with the HST.

3.71 The Agency was responsible for validating and collecting the HST on purchases of physical products imported into Canada by consumers living in a province with the HST. Under a mechanism called the revenue allocation framework, the HST on all purchases—domestic and imported—is allocated among the federal government and participating HST provinces. However, the Agency did not validate the accuracy of the total amount of the HST remitted to the government on goods imported using the Courier Low Value Shipment Program. Consequently, the provincial amount of the HST that New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, and Prince Edward Island received may not have been accurate.

3.72 We found that the Agency poorly designed the form used by courier companies to declare and remit the PST and the HST. The form had no specific field to declare the rate and amount of the HST or the PST to remit to the Canada Border Services Agency. There was only a field for the GST. This made it more difficult for the Agency to track and validate provincial sales taxes remitted by courier companies.

3.73 Recommendation. As soon as possible, the Canada Border Services Agency should review the Courier Low Value Shipment Program to improve the validation and collection of the GST, the HST, and the PST. As part of the review, the Agency should

- identify the program variables that should be fully reflected in the Agency’s systems and forms, such as provincial sales taxes;

- ensure that it receives shipment data electronically in advance of the goods arriving at the border to facilitate compliance activities; and

- implement a comprehensive e-commerce strategy to make informed risk assessments and improved revenue collection, and report publicly on its progress.

The Canada Border Services Agency’s response. Agreed. The Canada Border Services Agency will review processes within the Courier Low Value Shipment Program to improve the validation of taxes collected. The Agency will participate in the World Customs Organization Working Group to identify revenue collection models and evaluate other countries’ best practices by September 2019.

The Agency will also further refine its e-commerce strategy to be finalized in 2019 and commit to securing an approved business plan before the end of the 2019–20 fiscal year with implementation timelines. This strategy will focus on trade facilitation, safety, and security as well as revenue collection.

In addition, the Agency will seek authority and funding to regulate shipment data in advance and develop a reconciliation process by December 2019.

Finally, the Agency will renew its focus on compliance activities in the Courier Low Value Shipment Program by proposing an approach on conducting statistically valid courier compliance activities based on courier data to ensure revenue-related requirements are met by March 2020. The Agency will also examine options to further automate the program, including the ability to receive, process, and analyze customs data by March 2023.

Conclusion

3.74 We concluded that the Department of Finance Canada conducted sound analyses related to e-commerce with the aim of ensuring that the sales tax system was neutral and the sales tax base was protected.

3.75 We also concluded that the Canada Revenue Agency was limited by its legislative authority and could not ensure that the sales tax system was applied in a neutral way and that the GST/HST tax base was protected with regard to cross-border e-commerce. In situations in which it had authority, the Agency conducted a limited amount of compliance activities.

3.76 Finally, regarding shipments imported under the Courier Low Value Shipment Program, we concluded that the Canada Border Services Agency could not take the actions necessary to ensure that the sales tax system was neutral and that the GST/HST tax base was protected.

About the Audit

This independent assurance report was prepared by the Office of the Auditor General of Canada on the taxation of e-commerce. Our responsibility was to provide objective information, advice, and assurance to assist Parliament in its scrutiny of the government’s management of resources and programs, and to conclude on whether the taxation of e-commerce complied in all significant respects with the applicable criteria.

All work in this audit was performed to a reasonable level of assurance in accordance with the Canadian Standard for Assurance Engagements (CSAE) 3001—Direct Engagements set out by the Chartered Professional Accountants of Canada (CPA Canada) in the CPA Canada Handbook—Assurance.

The Office applies Canadian Standard on Quality Control 1 and, accordingly, maintains a comprehensive system of quality control, including documented policies and procedures regarding compliance with ethical requirements, professional standards, and applicable legal and regulatory requirements.

In conducting the audit work, we have complied with the independence and other ethical requirements of the relevant rules of professional conduct applicable to the practice of public accounting in Canada, which are founded on fundamental principles of integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

In accordance with our regular audit process, we obtained the following from the Canada Revenue Agency and the Canada Border Services Agency:

- confirmation of management’s responsibility for the subject under audit;

- acknowledgement of the suitability of the criteria used in the audit;

- confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided; and

- confirmation that the audit report is factually accurate.

The Department of Finance Canada did not agree with the terms of the audit, nor did it acknowledge the suitability of the audit criteria. The Department considered that this audit related to policy decisions of the Government of Canada, which the Department considered to be outside the Auditor General’s mandate. We are of the view that the audit criteria were suitable because they were based on accepted practices in many jurisdictions and the work of the Organisation for Economic Co-operation and Development. The Department provided confirmation that all known information that has been requested, or that could affect the findings or audit conclusion, has been provided. The Department provided confirmation that the audit report was factually correct.

Audit objective

The objective of this audit was to determine whether, according to their respective roles and responsibilities, the Canada Revenue Agency, the Canada Border Services Agency, and the Department of Finance Canada, with regard to e-commerce, ensured that the tax system was neutral and that the GST/HST tax base was protected.

Scope and approach

The audit on taxation of e-commerce included the Canada Revenue Agency, the Canada Border Services Agency, and the Department of Finance Canada.

During the audit, we interviewed officials from the Canada Revenue Agency and the Canada Border Services Agency. We also interviewed officials from other levels of government and stakeholders. We visited the Canada Border Services Agency’s Ottawa point of entry to understand how the Courier Low Value Shipment Program works. Finally, we reviewed and analyzed documents provided by the organizations.

Criteria

To determine whether, according to their respective roles and responsibilities, the Canada Revenue Agency, the Canada Border Services Agency, and the Department of Finance Canada, with regard to e-commerce, ensured that the tax system was neutral and that the GST/HST tax base was protected, we used the following criteria:

| Criteria | Sources |

|---|---|

|

The Department of Finance Canada conducts sound analyses to provide advice on the Canadian tax system to ensure equitable treatment of businesses in regard to the GST/HST on e-commerce transactions while preserving the tax base. |

|

|

The Canada Revenue Agency adapts its compliance strategies to enable consistent assessment of the GST/HST in accordance with the current legislative framework and considered best practices to preserve the GST/HST tax base for e-commerce. |

|

|

The Canada Border Services Agency manages the Courier Low Value Shipment Program to ensure the accurate and comprehensive assessment and collection of the GST/HST/PST owed to the government. |

|

Period covered by the audit

The audit covered the period between 1 January 2014 and 15 February 2019. This is the period to which the audit conclusion applies.

Date of the report

We obtained sufficient and appropriate audit evidence on which to base our conclusion on 27 March 2019, in Ottawa, Canada.

Audit team

Principal: Philippe Le Goff

Director: Mathieu Lequain

Manav Kapoor

Rose Pelletier

List of Recommendations

The following table lists the recommendations and responses found in this report. The paragraph number preceding the recommendation indicates the location of the recommendation in the report, and the numbers in parentheses indicate the location of the related discussion.

Compliance activities

| Recommendation | Response |

|---|---|

|

3.54 Within its legislative authority, the Canada Revenue Agency should expand its compliance activities and leverage available third-party data to enhance its ability to detect and deter non-compliance for the GST/HST in e-commerce, including accommodation sharing. (3.31 to 3.53) |

The Canada Revenue Agency’s response. Agreed. On the basis of the current legislation, the Canada Revenue Agency’s compliance actions to date have been fully satisfactory. The Agency has already identified the e-commerce sector as a risk. Its efforts to address non-compliance in this sector, as supported by educating taxpayers on their GST/HST obligations and conducting test audits, is commensurate with the level of risk of non-compliance and the tax dollars at risk. These efforts allow the Agency to ensure that focus remains on files with the highest risk of non-compliance while promoting a fair tax system for all Canadians. The Office of the Auditor General of Canada estimated losses of $169 million in the GST on foreign digital products and services sold in Canada in 2017. This represents a small fraction of the $4.9 billion in the GST/HST gap that was estimated in 2014 (see the “Tax Gap: A Brief Overview” page on the Agency’s website). Since the Agency expects the scale of e-commerce to continue to grow, the Agency will develop a dedicated compliance strategy to better detect and address non-compliance for the GST/HST in e-commerce and will continue to expand its compliance actions, including the better leveraging of third-party data. The strategy will further support and complement existing compliance efforts undertaken by the Agency to address the non-compliance within the sector. |

|

3.55 The Canada Revenue Agency should implement mechanisms to track, monitor, and report the number of compliance activities it conducts to manage the risk of non-compliance in e-commerce. (3.31 to 3.53) |

The Canada Revenue Agency’s response. Agreed. The Canada Revenue Agency will analyze its tracking and monitoring methodology with respect to the compliance activities it conducts to manage the risk of non-compliance in e-commerce. As similar recommendations were made in the 2018 Fall Reports of the Auditor General of Canada, Report 7—Compliance Activities—Canada Revenue Agency, initiatives being implemented as part of the Agency’s response to those recommendations will align with this current recommendation. |

|

3.73 As soon as possible, the Canada Border Services Agency should review the Courier Low Value Shipment Program to improve the validation and collection of the GST, the HST, and the PST. As part of the review, the Agency should

|

The Canada Border Services Agency’s response. Agreed. The Canada Border Services Agency will review processes within the Courier Low Value Shipment Program to improve the validation of taxes collected. The Agency will participate in the World Customs Organization Working Group to identify revenue collection models and evaluate other countries’ best practices by September 2019. The Agency will also further refine its e-commerce strategy to be finalized in 2019 and commit to securing an approved business plan before the end of the 2019–20 fiscal year with implementation timelines. This strategy will focus on trade facilitation, safety, and security as well as revenue collection. In addition, the Agency will seek authority and funding to regulate shipment data in advance and develop a reconciliation process by December 2019. Finally, the Agency will renew its focus on compliance activities in the Courier Low Value Shipment Program by proposing an approach on conducting statistically valid courier compliance activities based on courier data to ensure revenue-related requirements are met by March 2020. The Agency will also examine options to further automate the program, including the ability to receive, process, and analyze customs data by March 2023. |