Commentary on the 2022–2023 Financial Audits

Below are highlights from our commentary on the 2022–2023 financial audits. For the complete commentary, select Full report.

Results of our 2022–2023 financial audits

The Office of the Auditor General of Canada provided the government with an unmodified audit opinion on its 2022–23 consolidated financial statements, which provides credibility to the government’s financial reporting. Overall, we were satisfied with the credibility of the financial statements prepared by all 69 of the federal government organizations we audited.

The operations of Trans Mountain Corporation depend on external financing

There is a risk that the Trans Mountain Corporation will not be able to fund the remaining costs of the pipeline expansion project and keep operating, as reported in its financial statements.

Since February 2022, the Government of Canada announced it would spend no additional public money on the pipeline. This means the corporation has to secure external financing to continue operating.

COVID-19 benefits programs

Overpayments or ineligible payments

In the 2022 performance audit report Specific COVID‑19 Benefits, we estimated that at least $27.4 billion of payments to recipients should be investigated further through post‑payment verification to confirm eligibility.

The government continued to carry out post-payment verifications of benefit payments in 2023.

Despite this work, we remain concerned that the government may not investigate significant amounts of payments made to ineligible individuals or businesses and therefore may not identify or recover them.

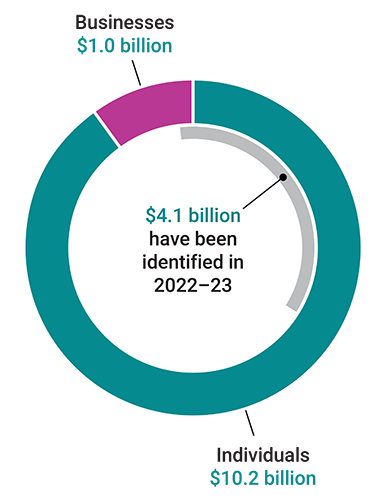

$11.2 billion identified by the government as overpayments or ineligible payments of COVID‑19 benefits since 2020

Text version

This pie chart shows the composition of the $11.2 billion identified by the government as overpayments or ineligible payments of COVID‑19 benefits since 2020. The amounts are shown between businesses and individuals and indicate the amount identified in 2022–2023 as follows:

- $1.0 billion identified by the government as overpayments or ineligible payments of COVID‑19 benefits to businesses

- $10.2 billion identified by the government as overpayments or ineligible payments of COVID‑19 benefits to individuals

- $4.1 billion have been identified in 2022–2023

Repayment of Canada Emergency Business Account loans

This year, the government received repayments from its Canada Emergency Business Account loans and expects to receive additional repayments in coming years. The government had loaned $49 billion through this program. It will forgive up to 33% as an incentive if the recipient repays the required portion of the loan by an established deadline.

At 31 March 2023, approximately $40 billion of the loans were still to be repaid, of which the government expected to forgive nearly $13 billion.

For businesses, this means they will have to repay only $40,000 out of a $60,000 loan.

The Auditor General’s observations on the Government of Canada’s 2022–23 consolidated financial statements

Asset retirement obligations

The government estimated at $12.9 billion the overall cost of retiring these assets.

The Government of Canada owns various assets like buildings, equipment, and vehicles. When it is time to retire or demilitarize some of these assets, the government needs to take action.

The estimated cost of retiring these assets is called an asset retirement obligation and needs to be assessed by the government as part of a new accounting standard that came into effect.

Our audit noted weaknesses in the government’s process for analyzing and determining the amount of its asset retirement obligations, including duplicated efforts and inefficient use of time and resources.

Addressing the weaknesses will increase the accuracy of the amounts reported and provide better data to manage these assets.

Information technology general controls

Our audit noted deficiencies in general controls over key government information technologyIT systems.

IT general controls are controls over access to systems and data, how system changes are managed, and how the system operates.

We found deficiencies in controls over access to key systems that store and process data related to payments, receipts, and accounting records. This increases the risk of fraud or other wrongdoing.

Information technology general controls

| Types of IT general controls | Description |

|---|---|

|

Manage access |

These controls prevent unauthorized users from accessing systems and data. For example, a username and password are required to gain access to a database, or a security badge is required to gain entry to a secure room. |

|

Manage change |

These controls prevent inappropriate changes to IT systems infrastructure. For example, changes prepared by one person must be approved by a separate person before they are implemented. |

|

Manage IT operations |

These controls are routine tasks performed to ensure systems operate as intended. For example, an error message occurs when transaction records are transferred between systems in a way that is incomplete or inaccurate. |

Pay administration

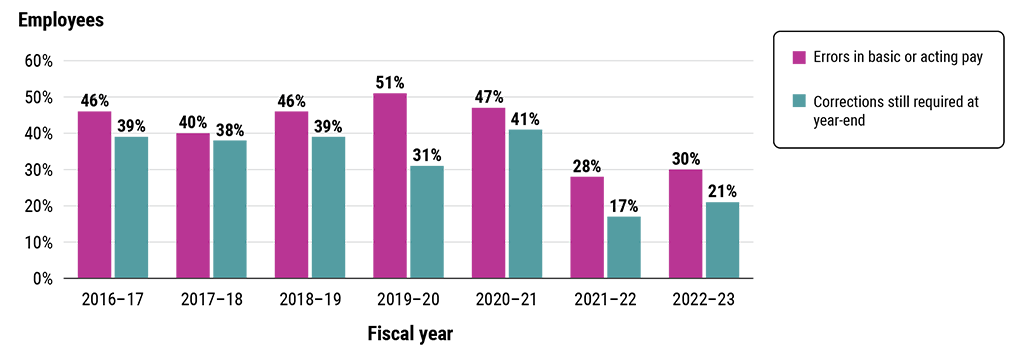

Pay errors continued for many government employees and were more common in 2022–23 than in 2021–22

Percentage of employees in our sample with an error in basic or acting pay

and who were awaiting a correction at year‑end

Source: Based on the Office of the Auditor General’s analysis of a sample of employees’ pay transactions used in the audit of the consolidated financial statements of the Government of Canada for the 7 fiscal years ending March 31 from 2017 to 2023

Text version

This bar chart shows for each fiscal year from 2016–17 to 2022–23 the percentage of employees in our sample with an error in basic or acting pay and who were awaiting a correction at year‑end.

The chart shows that the percentage of employees in our sample who had an error in basic or acting pay during the fiscal year decreased from 46% in 2016–17 to 40% in 2017–18 and then increased to 46% in 2018–19 and to 51% in 2019–20. The percentage then decreased to 47% in 2020–21 and to 28% in 2021–22. In 2022–23 the percentage increased to 30%.

The chart also shows that the percentage of employees in our sample who were awaiting a correction at year-end was steady at either 38% or 39% for the 3 fiscal years from 2016–17 to 2018–19 and then decreased to 31% in 2019–20. The percentage then increased to 41% in 2020–21, decreased to 17% in 2021–22, and increased to 21% in 2022–23.

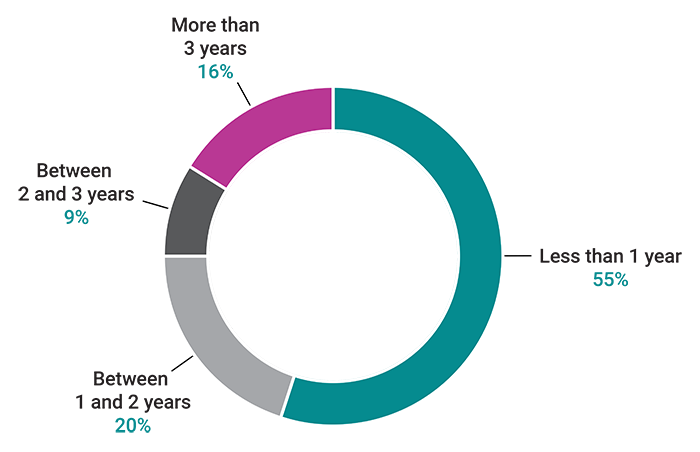

The government continued to address outstanding pay action requests; however, at 31 March 2023, the number of outstanding requests had increased to 405,000 from 310,500 a year earlier. We analyzed how long pay action requests had remained unresolved and found that approximately 65,000 of the requests, or 16%, were outstanding for more than 3 years, which is similar to a year earlier.

Percentage of pay action requests by number of years outstanding as of 31 March 2023

Text version

This pie chart shows the percentage of pay action requests by number of years outstanding as of 31 March 2023. The percentages are shown by years as follows:

- 55% of pay action requests were less than 1 year old

- 20% of pay action requests were between 1 and 2 years old

- 9% of pay action requests were between 2 and 3 years old

- 16% of pay action requests were more than 3 years old

Since our last commentary report, the government has made additional investments, such as funding in Budget 2023 for the pay centre to hire more compensation advisors. Given this, we expect the government to resolve outstanding requests faster and meet the service standards it established.

National defence inventory and asset pooled items

The department is experiencing further delays in completing its 10‑year action plan

For 2 decades, we have raised concerns about National Defence’s ability to properly account for the quantities and values of its inventory.

In our audit this year, we found errors in 17% of the items we sampled, compared with 15% the year before. In our view, these errors indicate weaknesses in the department’s internal controls. The department should address the root causes of discrepancies to improve data quality.

Also, the department has fallen behind schedule to implement a modern scanning and barcoding system. It now projects the system will be fully operational in 2028–29. The implementation of this system represents the last remaining commitment in its long-term inventory management action plan.

Additional insights

Environmental, social, and governance reporting

Some federal organizations, including larger Crown corporations, have increased their environmental, social, and governance reporting, particularly on climate-related financial risks. When such reporting is included in an organization’s annual report, we review the information for coherence with the financial statements we audit.

Our commentary report also provides information on developments in international standards, Canadian legislation, and other guidance that federal organizations could consider in their reporting.

Find out more

Videos